According to a research report “Off-road Tires Market (By Material: Synthetic Rubber, Natural Rubber, Fabrics & Wire, and Carbon Black; By Tire Height: Below 31 inches, 31-40 inches, 41-45 inches, and Above 45 inches; By Vehicle: 4WD, HDT, SUV, UTV, Dirt Bikes & Quad, and OTR; and By Distribution Channel: Original Equipment Manufacturer (OEM), Secondary/Replacement, and Distributor/Dealer Equipped) – Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2021 – 2030″ published by Precedence Research.

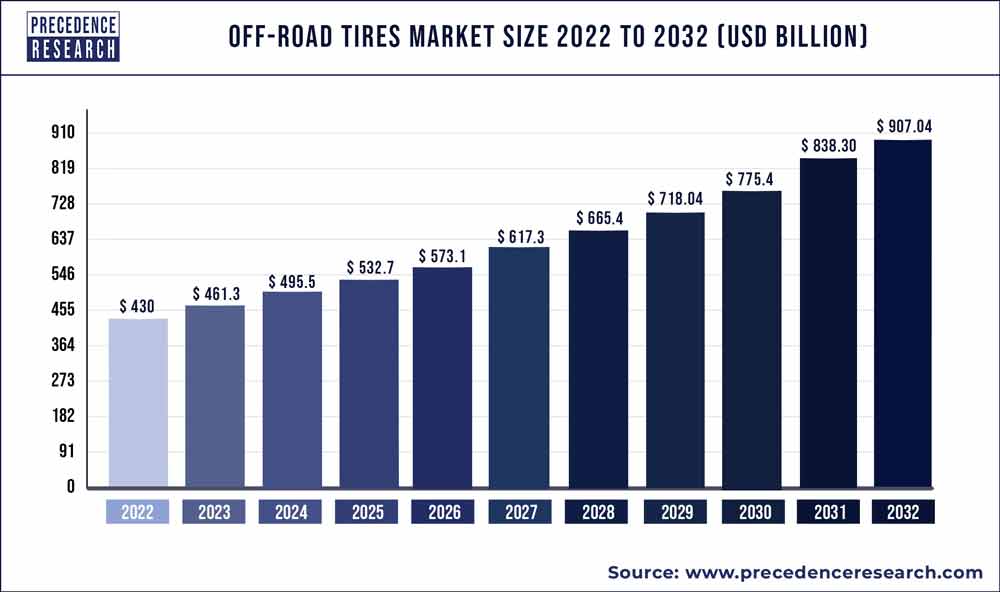

The off-road tires market size is projected to hit from USD 503.23 billion in 2022 to USD 882.2 billion by 2030, growing at a CAGR of 7.3% every year.

The study provides an analysis of the period 2017-2030, wherein 2021 to 2030 is the forecast period and 2021 is considered as the base year.

The off-road tires are a type of vehicle tire with a deep tread pattern to increase friction on uneven surfaces such as mud, dirt, and sand. When it comes to off-road driving, off-road tires are the best option. Off-road tires allow a vehicle to glide over rocks and boulders with ease. The different regional, local, and global service providers in the global off-road tires market are looking to expand their market share. Off-road tires market players are also concentrating on increasing their geographical reach and upgrading their services in order to meet customer requests.

The off-road tires market expansion is being fueled by infrastructure development initiatives and an expanding construction sector. Off-road vehicle demand is being fueled by government investments, particularly in developing countries.

Get a Free Sample Copy of this Report@ https://www.precedenceresearch.com/sample/1499

Table of Contents

Scope of the Off Road Tires Market

| Report Coverage | Details |

| Market Size in 2021 | US$ 469.3 Billion |

| Growth Rate from 2021 to 2030 | 7.3% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | Material, Tires Height, Vehicle, Region |

Market Dynamics

Drivers

Surge in farm mechanization

Off-road machines are used in the farm and agriculture industry to carry out major day-to-day operations. Off-road utility vehicles are used in agricultural operations such as crop plotting and scouting, rock selection, irrigation, and so on. Nowadays, most of the work in the fields is done with this machinery, which necessitates tires replacement at regular intervals, boosting the growth of the global off-road tires market during the forecasting period.

Restraints

Volatility in the prices of raw materials

The raw material of any automotive component is an important factor in determining the component’s price. As a result, changes in the prices of raw materials have an impact on the prices of finished goods. The cost of raw materials varies by country, depending on regulations and season. Rubber is the most common raw material used in the production of off-road tires, followed by steel and fibers. Natural and synthetic rubber are the most essential raw materials, therefore changes in demand and price have a big impact on the cost of off-road tires. Thus, the volatility in the cost of raw materials is the restricting factor for the growth of the off-road tires market.

Opportunities

Rise in sales of off-highway vehicles

The global manufacturing of off-road vehicles is currently undergoing a radical transformation. The increased use of off-road vehicles in military and recreational operations is a major factor driving the growth of the off-road vehicles market. Military operations use off-road trucks to transport cargo, fuel, and ammunition. During wartime, these vehicles are also used to transport heavy-loaded weapons.

Furthermore, advanced technologies such as global positioning system (GPS) on these vehicles, which are used to create field boundaries and mark field lines, allow for less soil compaction and faster planting by plotting the lines. As a result, the rise in sales of off-highway vehicles is creating lucrative opportunities for the growth of the off-road tires market during the forecast period.

Challenges

High research and development costs

Off-road tires are used in a variety of commercial off-road vehicles, including those used in construction, mining, agriculture, and industrial applications. These tires are designed and engineered to work in extreme conditions such as high load-bearing, rough surfaces, various weather conditions, and traction. Material compositions tread patterns, and a variety of other off-road tire parameters vary depending on vehicle type and requirements. Designing, manufacturing, and testing off-road tires entails research and development activities in which tires are developed while taking into account all requirements and standards.

Large special press machines are used in the production of OTR tires, where processes such as vulcanization and curing take place. The cost of raw materials used in the production of OTR tires, as well as the cost of press machines used in the process, is both high. As a result, no key market player can afford to invest heavily in research and development, which is a major challenge for the growth of the off-road tires market.

Read Also: Orthodontics Market Value To Hit US$ 21.5 Billion By 2030

Report Highlights

- Based on the materials, the synthetic rubber segment dominated the global off-road tires market in 2020 with highest market share. Due to its good ageing stability and great abrasion resistance, synthetic rubber is commonly utilized in the off-road tires. It also gives directional stability, rolling resistance, wet traction, speed and run flat capabilities, high fuel efficiency, and weather resistance to the tires, allowing it to perform under difficult situations.

- Asia-Pacific is the largest segment for off-road tires market in terms of region. The increased government investment in construction operations is expected to boost demand for construction vehicles, boosting the off-road tires market across the Asia-Pacific region.

- Europe region is the fastest growing region in the off-road tires market. The surge in demand for off-road tires in the Europe region is due to a number of factors, including increased construction activities, increased industrial development, and an increase in the demand for energy efficient technologies.

Some of the prominent players in the global off-road tires market include:

- Hengfeng Rubber

- Continental AG

- GITI Tire

- Triangle Group

- Nokian Tires

- Toyo Tire

- Michelin

- Hankook

- Yokohama

- Maxxis

Segments Covered in the Report

By Material

- Synthetic Rubber

- Natural Rubber

- Fabrics & Wire

- Carbon Black

By Tire Height

- Below 31 inches

- 31-40 inches

- 41-45 inches

- Above 45 inches

By Vehicle

- 4WD

- HDT

- SUV

- UTV

- Dirt Bikes & Quad

- OTR

By Distribution Channel

- Original Equipment Manufacturer (OEM)

- Secondary/ Replacement

- Distributor/ Dealer Equipped

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Off-road Tires Market

5.1. COVID-19 Landscape: Off-road Tires Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Off-road Tires Market, By Material

8.1. Off-road Tires Market, by Material Type, 2021-2030

8.1.1. Synthetic Rubber

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Natural Rubber

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Fabrics & Wire

8.1.3.1. Market Revenue and Forecast (2019-2030)

8.1.4. Carbon Black

8.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Off-road Tires Market, By Tire Height

9.1. Off-road Tires Market, by Tire Height, 2021-2030

9.1.1. Below 31 inches

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. 31-40 inches

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. 41-45 inches

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Above 45 inches

9.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Off-road Tires Market, By Distribution Channel Type

10.1. Off-road Tires Market, by Distribution Channel Type, 2021-2030

10.1.1. Original Equipment Manufacturer (OEM)

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Secondary/ Replacement

10.1.2.1. Market Revenue and Forecast (2019-2030)

10.1.3. Distributor/ Dealer Equipped

10.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Off-road Tires Market, By Vehicle Type

11.1. Off-road Tires Market, by Vehicle Type, 2021-2030

11.1.1. 4WD

11.1.1.1. Market Revenue and Forecast (2019-2030)

11.1.2. HDT

11.1.2.1. Market Revenue and Forecast (2019-2030)

11.1.3. SUV

11.1.3.1. Market Revenue and Forecast (2019-2030)

11.1.4. UTV

11.1.4.1. Market Revenue and Forecast (2019-2030)

11.1.5. Dirt Bikes & Quad

11.1.5.1. Market Revenue and Forecast (2019-2030)

11.1.6. OTR

11.1.6.1. Market Revenue and Forecast (2019-2030)

Chapter 12. Global Off-road Tires Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Material (2019-2030)

12.1.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.1.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.1.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Material (2019-2030)

12.1.5.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.1.5.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.1.5.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Material (2019-2030)

12.1.6.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.1.6.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.1.6.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Material (2019-2030)

12.2.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.2.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.2.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Material (2019-2030)

12.2.5.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.2.5.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.2.5.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Material (2019-2030)

12.2.6.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.2.6.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.2.6.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Material (2019-2030)

12.2.7.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.2.7.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.2.7.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Material (2019-2030)

12.2.8.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.2.8.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.2.8.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Material (2019-2030)

12.3.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.3.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.3.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Material (2019-2030)

12.3.5.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.3.5.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.3.5.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Material (2019-2030)

12.3.6.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.3.6.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.3.6.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Material (2019-2030)

12.3.7.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.3.7.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.3.7.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Material (2019-2030)

12.3.8.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.3.8.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.3.8.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Material (2019-2030)

12.4.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.4.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.4.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Material (2019-2030)

12.4.5.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.4.5.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.4.5.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Material (2019-2030)

12.4.6.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.4.6.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.4.6.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Material (2019-2030)

12.4.7.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.4.7.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.4.7.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Material (2019-2030)

12.4.8.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.4.8.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.4.8.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Material (2019-2030)

12.5.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.5.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.5.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Material (2019-2030)

12.5.5.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.5.5.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.5.5.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Material (2019-2030)

12.5.6.2. Market Revenue and Forecast, by Tire Height (2019-2030)

12.5.6.3. Market Revenue and Forecast, by Distribution Channel Type (2019-2030)

12.5.6.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

Chapter 13. Company Profiles

13.1. Hengfeng Rubber

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Continental AG

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. GITI Tire

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Triangle Group

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Nokian Tires

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Toyo Tire

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Michelin

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Hankook

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Yokohama

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Maxxis

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1499

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Website: https://www.precedenceresearch.com