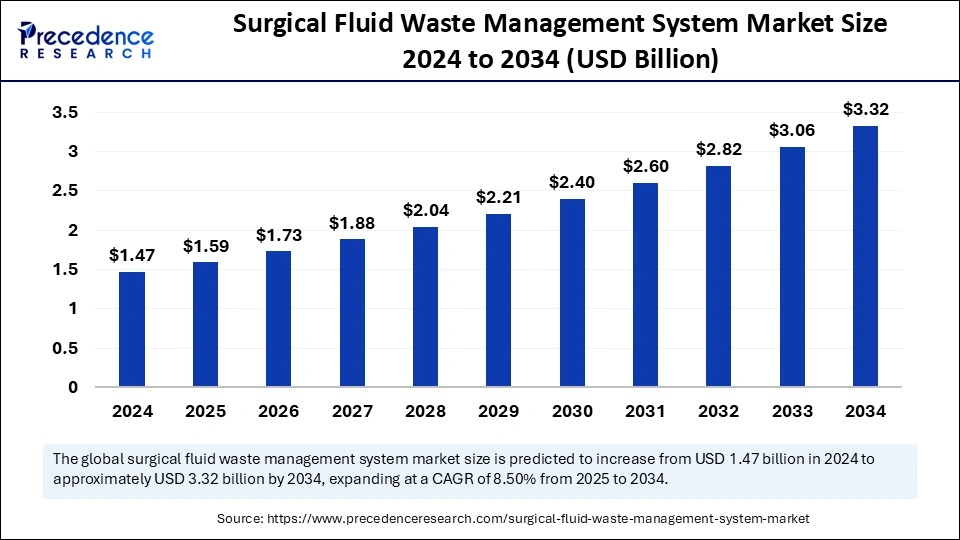

The global surgical fluid waste management system market size was valued at USD 1.47 billion in 2024 and is expected to reach around USD 3.32 billion by 2034, growing at a CAGR of 8.50%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5795

Surgical Fluid Waste Management System Market Key Points

-

North America led the market in 2024, securing a dominant 40% share.

-

The Asia Pacific region is set to witness substantial growth through the forecast period.

-

Mobile-type systems held a commanding 64% share in 2024.

-

Wall-mounted types are projected to gain traction with impressive growth ahead.

-

Laparoscopy emerged as the top application, accounting for 29% of the market in 2024.

-

Arthroscopy is expected to register the highest CAGR moving forward.

-

Hospitals captured the largest end-use share at 52% in 2024.

-

Ambulatory surgical centers are anticipated to expand rapidly through 2034.

Role of AI in the Surgical Fluid Waste Management System Market

Artificial Intelligence (AI) is playing a transformative role in the surgical fluid waste management system market by enhancing efficiency, safety, and automation. These AI-enabled systems bring a new level of intelligence to fluid handling processes during and after surgeries. Through advanced data processing and machine learning, AI improves how surgical waste is collected, monitored, and disposed of, helping to minimize the risks associated with manual handling and exposure to biohazardous materials.

One of the key benefits of AI in this field is its ability to enable real-time monitoring. AI-integrated systems can continuously track parameters such as fluid volume, pressure, and temperature. This smart detection helps prevent overflows, leaks, and cross-contamination during surgeries, ensuring a more sterile and safe operating environment. Additionally, AI systems are capable of identifying anomalies and alerting medical personnel immediately, reducing the chance of equipment failure during critical procedures.

AI also enables predictive maintenance in surgical fluid waste management equipment. By analyzing usage trends and historical performance data, AI systems can predict when maintenance is needed before a breakdown occurs. This not only reduces downtime but also enhances the operational efficiency of healthcare facilities. Furthermore, AI helps optimize inventory management by analyzing consumption patterns, leading to better planning and reduced waste.

Surgical Fluid Waste Management System Market Growth Factors

-

Rising Number of Surgical Procedures

With a global increase in surgical interventions—especially minimally invasive and laparoscopic procedures—there is a growing demand for efficient and safe fluid waste management systems. As healthcare access expands and elective surgeries become more common, the need for proper fluid waste handling is escalating. -

Stringent Health and Safety Regulations

Regulatory bodies worldwide are enforcing strict guidelines regarding infection control and biohazard waste disposal in healthcare settings. These regulations are prompting hospitals and surgical centers to adopt advanced surgical fluid waste management systems that reduce exposure risks and ensure compliance. -

Increasing Focus on Infection Control

Surgical site infections and cross-contamination pose major concerns in operating rooms. Fluid waste management systems help minimize human contact with biohazardous materials, which plays a crucial role in infection prevention—especially in high-risk environments. -

Technological Advancements

Innovations in fluid management systems, such as automation, real-time monitoring, and integration with smart operating rooms, are enhancing the efficiency and appeal of these devices. Features like touch-free operation, AI integration, and mobile units are making them more user-friendly and precise. -

Shift Toward Minimally Invasive Surgeries

The increasing adoption of minimally invasive techniques like laparoscopy and arthroscopy—where large volumes of irrigation fluids are used—drives the need for effective fluid waste collection and disposal systems tailored to these procedures. -

Rising Healthcare Infrastructure Investments

Growing investments in hospital infrastructure, especially in emerging economies, are supporting the adoption of modern medical technologies, including surgical fluid waste management systems. As more ambulatory surgical centers and specialty clinics are established, the market continues to expand. -

Growing Awareness and Training Among Medical Staff

Awareness programs and training sessions on operating room hygiene, waste management protocols, and advanced medical devices are encouraging more hospitals to upgrade their systems for better compliance and patient safety. -

Environmental Sustainability Initiatives

Hospitals are increasingly prioritizing sustainability and waste reduction. Fluid waste management systems that enable safer, cleaner, and more eco-friendly disposal methods align with these green healthcare initiatives.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.32 Billion |

| Market Size in 2025 | USD 1.59 Billion |

| Market Size in 2024 | USD 1.47 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.50% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End use, and Regions |

| Regions Covered North | America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers:

Key drivers include the increasing volume of surgical procedures globally, heightened focus on infection control, and the need to comply with health and environmental safety regulations. Technological advancements are also playing a significant role in encouraging adoption.

Market Opportunities:

Opportunities lie in the integration of AI, automation, and mobile technology to improve fluid waste handling. Emerging markets with expanding healthcare infrastructure offer significant growth potential for manufacturers and suppliers.

Market Challenges:

High initial investment costs, limited awareness in underdeveloped regions, and a lack of trained personnel are major barriers. Smaller hospitals and clinics may be reluctant to upgrade from manual systems due to budget constraints.

Regional Insights:

North America dominates the market due to stringent healthcare regulations and early adoption of advanced technologies. Asia Pacific is expected to witness the fastest growth, driven by expanding healthcare facilities and increased surgical demand in countries like China and India.

Recent Developments

- In March 2025, Predictive Oncology Inc., a leader in AI-driven drug discovery, completed the sale of assets related to its wholly owned subsidiary, Skyline Medical Inc., to DeRoyal Industries Inc., a global manufacturer and supplier of medical products. According to this acquisition, DeRoyal Industries will offer the Streamway® wall suction waste fluid management product line under the DeRoyal brand.

- In December 2024, Intermountain Health, a large clinical research hospital, centralized its IV fluid supply in its pharmacy department and responded to the National Intravenous Fluid Shortage in the Wake of Hurricane Helene by prioritizing fluid distribution for patient care and re-implementing strategies used during Hurricane Maria.

- In March 2023, Amsino was awarded a U.S. national group purchasing agreement for suction and fluid management products, including suction canisters, with Premier, Inc.

Surgical Fluid Waste Management System Market Companies

- Cardinal Health

- Stryker

- Ecolab

- Zimmer Biomet Holdings Inc.

- Medtronic

- Smith+Nephew

- Hologic Inc.

- CONMED Corporation

- IndoSurgicals Private Limited

- Skyline Medical Inc

- Amsino International Inc

Segment Covered in the Report

By Type

- Mobile

- Wall-Mounted

By Application

- Arthroscopy

- Laparoscopy

- Neurology

- Cardiology

- Urology

- Dental

- Gastroenterology

- Others

By End Use

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

Also Read: Medical Digital Imaging System Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/