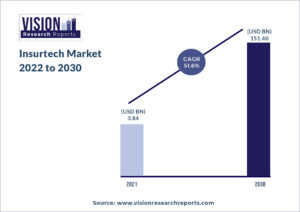

The global insurtech market size was valued at USD 3.84 billion in 2021, and is predicted to be worth around USD 151.40 billion by 2030, registering a CAGR of 51.6% during the forecast period 2022 to 2030.

Download Exclusive Sample of Report@ https://www.visionresearchreports.com/report/sample/39192

Table of Contents

Insurtech Market Growth Factors

The rising awareness about the benefits of insurtech solutions in simplifying the claim process, improving communication, and implementing automation is expected to drive market growth. The increased use of robotic process automation in insurance companies to handle repetitive tasks more accurately, quickly, and accurately compared to humans is also one of the major factors driving the market growth.

The increasing number of insurance claims worldwide is one of the major factors accentuating the market growth. Auto, life, and home are the most common insurance claims secured by people worldwide. According to a 2021 study by the Insurance Barometer, 36% of American respondents planned to purchase life insurance in 2021. Insurance companies are increasingly investing in digital technologies to reduce operational costs and to improve operational efficiency and the entire customer experience.

This trend is expected to favor the growth of the insurtech market. The demand for on-demand insurance is growing among consumers as it enables them to purchase insurance coverage on their smartphones at their convenience.

Report Coverage

| Report Scope | Details |

| Market Size | US$ 151.40 billion by 2030 |

| Growth Rate | CAGR of 51.6% From 2022 to 2030 |

| Largest Market | North America |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Type, Service, Technology, End-use |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Mentioned | Damco Group; DXC Technology Company; Insurance Technology Services; Majesco; Oscar Insurance; Quantemplate; Shift Technology; Trōv, Inc.; Wipro Limited; ZhongAnInsurance |

By Type Analysis

The health segment dominated the market in 2021 and accounted for more than 24.0% share of the global revenue. The increasing demand for digital platforms, which connect exchanges, brokers, providers, and carriers in health insurance, is anticipated to fuel the demand for the health segment.

Life and health insurers are focusing on using advanced analytics to better serve and understand their customers. Numerous health insurance companies are adopting insurtech solutions to streamline claims processing procedures.

The home segment is anticipated to register the highest growth over the forecast period. Numerous home insurance companies are seeking to create innovative products for commercial and residential real estate professionals and their respective tenants and residents.

These companies are adopting insurtech solutions for faster list-to-lease time. These solutions use AI technology to create and deliver personalized insurance policies and efficiently handle claims for customers without needing insurance brokers.

By Service Analysis

The managed services segment held the leading revenue share of more than 42.0% in 2021. Managed services providers can provide insurers a measured gateway to transformation by incorporating expertise and talent with new technologies.

The support and maintenance segment is anticipated to register the highest growth over the forecast period. The growth of the support and maintenance segment can be attributed to the increasing adoption of advanced technologies and distribution channels by insurance companies.

By Technology Analysis

The cloud computing segment led the market with a revenue share of over 24.0% in 2021. Cloud computing has transformed the insurance industry with its resourcefulness, ease of deployment, and flexibility. Widespread acceptance of Bring Your Own Device (BYOD) policies, coupled with the growing amount of data insurance companies collect, is expected to drive the growth. Insurance companies are adopting cloud computing solutions owing to benefits, such as rapid deployment, cost-effectiveness, and scalability.

The blockchain segment is anticipated to register the highest growth over the forecast period. Blockchain technology enables insurance companies to cut down on operational costs and drive operational efficiencies. This technology can be used to drive growth, integrate varied insurtech platforms, and enable new services to come to market, particularly for those who could not access insurance previously.

By End-use Analysis

The BFSI segment dominated the market and accounted for more than 20.0% share of the global revenue in 2021.BFSI businesses are widely adopting insurtech solutions for improving business efficiency. The increase in the number of connected devices in the BFSI sector is leading to the generation of a huge amount of data.

The healthcare segment is expected to register the fastest growth over the forecast period. The rising digitization in the insurance sector is expected to drive the adoption of insurtech solutions in the healthcare industry. The growing number of devices has created a need for effective monitoring, management, and maintenance of data across healthcare organizations.

By Regional Analysis

North America dominated the market for insurtech in 2021 and accounted for more than a 36.0% share of the global revenue. The region is witnessing an increased adoption of insurtech solutions owing to the increasing spending of customers for insurance-related products.

Asia Pacific is anticipated to emerge as the fastest-growing regional market over the forecast period. The region is expected to witness significant growth due to the presence of numerous emerging economies and financial hubs in Singapore, India, and Hong Kong.

Read also @ Skincare Devices Market Size to Reach USD 33.3 Billion by 2030

Major Key Players Covered in The Insurtech Market Report include

- Damco Group

- DXC Technology Company

- Insurance Technology Services

- Majesco

- Oscar Insurance

- Quantemplate

- Shift Technology

- Trōv, Inc.

- Wipro Limited

- ZhongAn Insurance

Insurtech Market Segmentation

- By Type

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

- By Service

- Consulting

- Support & Maintenance

- Managed Services

- By Technology

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

- By End-use

- Automotive

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Transportation

- Others

- Regional

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Asia Pacific

- China

- India

- Japan

- Latin America

- Brazil

- Middle East & Africa

- North America

Table of Contents

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Technology Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Insurtech Market, By Type

7.1. Insurtech Market, by Type, 2021-2030

7.1.1. Auto

7.1.1.1. Market Revenue and Forecast (2019-2030)

7.1.2. Business

7.1.2.1. Market Revenue and Forecast (2019-2030)

7.1.3. Health

7.1.3.1. Market Revenue and Forecast (2019-2030)

7.1.4. Home

7.1.4.1. Market Revenue and Forecast (2019-2030)

7.1.5. Specialty

7.1.5.1. Market Revenue and Forecast (2019-2030)

7.1.6. Travel

7.1.6.1. Market Revenue and Forecast (2019-2030)

Chapter 8. Global Insurtech Market, By Service

8.1. Insurtech Market, by Service, 2021-2030

8.1.1. Consulting

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Support & Maintenance

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Managed Services

8.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Insurtech Market, By Technology

9.1. Insurtech Market, by Technology, 2021-2030

9.1.1. Blockchain

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Cloud Computing

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. IoT

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Machine Learning

9.1.4.1. Market Revenue and Forecast (2019-2030)

9.1.5. Robo Advisory

9.1.5.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Insurtech Market, By End-use

10.1. Insurtech Market, by End-use, 2021-2030

10.1.1. Automotive

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. BFSI

10.1.2.1. Market Revenue and Forecast (2019-2030)

10.1.3. Government

10.1.3.1. Market Revenue and Forecast (2019-2030)

10.1.4. Healthcare

10.1.4.1. Market Revenue and Forecast (2019-2030)

10.1.5. Manufacturing

10.1.5.1. Market Revenue and Forecast (2019-2030)

10.1.6. Retail

10.1.6.1. Market Revenue and Forecast (2019-2030)

10.1.7. Transportation

10.1.7.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Insurtech Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2019-2030)

11.1.2. Market Revenue and Forecast, by Service (2019-2030)

11.1.3. Market Revenue and Forecast, by Technology (2019-2030)

11.1.4. Market Revenue and Forecast, by End-use (2019-2030)

11.1.5. U.S.

11.1.5.1. Market Revenue and Forecast, by Type (2019-2030)

11.1.5.2. Market Revenue and Forecast, by Service (2019-2030)

11.1.5.3. Market Revenue and Forecast, by Technology (2019-2030)

11.1.5.4. Market Revenue and Forecast, by End-use (2019-2030)

11.1.6. Rest of North America

11.1.6.1. Market Revenue and Forecast, by Type (2019-2030)

11.1.6.2. Market Revenue and Forecast, by Service (2019-2030)

11.1.6.3. Market Revenue and Forecast, by Technology (2019-2030)

11.1.6.4. Market Revenue and Forecast, by End-use (2019-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2019-2030)

11.2.2. Market Revenue and Forecast, by Service (2019-2030)

11.2.3. Market Revenue and Forecast, by Technology (2019-2030)

11.2.4. Market Revenue and Forecast, by End-use (2019-2030)

11.2.5. UK

11.2.5.1. Market Revenue and Forecast, by Type (2019-2030)

11.2.5.2. Market Revenue and Forecast, by Service (2019-2030)

11.2.5.3. Market Revenue and Forecast, by Technology (2019-2030)

11.2.5.4. Market Revenue and Forecast, by End-use (2019-2030)

11.2.6. Germany

11.2.6.1. Market Revenue and Forecast, by Type (2019-2030)

11.2.6.2. Market Revenue and Forecast, by Service (2019-2030)

11.2.6.3. Market Revenue and Forecast, by Technology (2019-2030)

11.2.6.4. Market Revenue and Forecast, by End-use (2019-2030)

11.2.7. France

11.2.7.1. Market Revenue and Forecast, by Type (2019-2030)

11.2.7.2. Market Revenue and Forecast, by Service (2019-2030)

11.2.7.3. Market Revenue and Forecast, by Technology (2019-2030)

11.2.7.4. Market Revenue and Forecast, by End-use (2019-2030)

11.2.8. Rest of Europe

11.2.8.1. Market Revenue and Forecast, by Type (2019-2030)

11.2.8.2. Market Revenue and Forecast, by Service (2019-2030)

11.2.8.3. Market Revenue and Forecast, by Technology (2019-2030)

11.2.8.4. Market Revenue and Forecast, by End-use (2019-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2019-2030)

11.3.2. Market Revenue and Forecast, by Service (2019-2030)

11.3.3. Market Revenue and Forecast, by Technology (2019-2030)

11.3.4. Market Revenue and Forecast, by End-use (2019-2030)

11.3.5. India

11.3.5.1. Market Revenue and Forecast, by Type (2019-2030)

11.3.5.2. Market Revenue and Forecast, by Service (2019-2030)

11.3.5.3. Market Revenue and Forecast, by Technology (2019-2030)

11.3.5.4. Market Revenue and Forecast, by End-use (2019-2030)

11.3.6. China

11.3.6.1. Market Revenue and Forecast, by Type (2019-2030)

11.3.6.2. Market Revenue and Forecast, by Service (2019-2030)

11.3.6.3. Market Revenue and Forecast, by Technology (2019-2030)

11.3.6.4. Market Revenue and Forecast, by End-use (2019-2030)

11.3.7. Japan

11.3.7.1. Market Revenue and Forecast, by Type (2019-2030)

11.3.7.2. Market Revenue and Forecast, by Service (2019-2030)

11.3.7.3. Market Revenue and Forecast, by Technology (2019-2030)

11.3.7.4. Market Revenue and Forecast, by End-use (2019-2030)

11.3.8. Rest of APAC

11.3.8.1. Market Revenue and Forecast, by Type (2019-2030)

11.3.8.2. Market Revenue and Forecast, by Service (2019-2030)

11.3.8.3. Market Revenue and Forecast, by Technology (2019-2030)

11.3.8.4. Market Revenue and Forecast, by End-use (2019-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2019-2030)

11.4.2. Market Revenue and Forecast, by Service (2019-2030)

11.4.3. Market Revenue and Forecast, by Technology (2019-2030)

11.4.4. Market Revenue and Forecast, by End-use (2019-2030)

11.4.5. GCC

11.4.5.1. Market Revenue and Forecast, by Type (2019-2030)

11.4.5.2. Market Revenue and Forecast, by Service (2019-2030)

11.4.5.3. Market Revenue and Forecast, by Technology (2019-2030)

11.4.5.4. Market Revenue and Forecast, by End-use (2019-2030)

11.4.6. North Africa

11.4.6.1. Market Revenue and Forecast, by Type (2019-2030)

11.4.6.2. Market Revenue and Forecast, by Service (2019-2030)

11.4.6.3. Market Revenue and Forecast, by Technology (2019-2030)

11.4.6.4. Market Revenue and Forecast, by End-use (2019-2030)

11.4.7. South Africa

11.4.7.1. Market Revenue and Forecast, by Type (2019-2030)

11.4.7.2. Market Revenue and Forecast, by Service (2019-2030)

11.4.7.3. Market Revenue and Forecast, by Technology (2019-2030)

11.4.7.4. Market Revenue and Forecast, by End-use (2019-2030)

11.4.8. Rest of MEA

11.4.8.1. Market Revenue and Forecast, by Type (2019-2030)

11.4.8.2. Market Revenue and Forecast, by Service (2019-2030)

11.4.8.3. Market Revenue and Forecast, by Technology (2019-2030)

11.4.8.4. Market Revenue and Forecast, by End-use (2019-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2019-2030)

11.5.2. Market Revenue and Forecast, by Service (2019-2030)

11.5.3. Market Revenue and Forecast, by Technology (2019-2030)

11.5.4. Market Revenue and Forecast, by End-use (2019-2030)

11.5.5. Brazil

11.5.5.1. Market Revenue and Forecast, by Type (2019-2030)

11.5.5.2. Market Revenue and Forecast, by Service (2019-2030)

11.5.5.3. Market Revenue and Forecast, by Technology (2019-2030)

11.5.5.4. Market Revenue and Forecast, by End-use (2019-2030)

11.5.6. Rest of LATAM

11.5.6.1. Market Revenue and Forecast, by Type (2019-2030)

11.5.6.2. Market Revenue and Forecast, by Service (2019-2030)

11.5.6.3. Market Revenue and Forecast, by Technology (2019-2030)

11.5.6.4. Market Revenue and Forecast, by End-use (2019-2030)

Chapter 12. Company Profiles

12.1. Damco Group

12.1.1. Company Overview

12.1.2. Type Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. DXC Technology Company

12.2.1. Company Overview

12.2.2. Type Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Insurance Technology Services

12.3.1. Company Overview

12.3.2. Type Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Majesco

12.4.1. Company Overview

12.4.2. Type Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Oscar Insurance

12.5.1. Company Overview

12.5.2. Type Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Quantemplate

12.6.1. Company Overview

12.6.2. Type Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Shift Technology

12.7.1. Company Overview

12.7.2. Type Offerings

12.7.3. Financial PerServiceance

12.7.4. Recent Initiatives

12.8. Trōv, Inc.

12.8.1. Company Overview

12.8.2. Type Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Wipro Limited

12.9.1. Company Overview

12.9.2. Type Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. ZhongAn Insurance

12.10.1. Company Overview

12.10.2. Type Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Buy this Research Report study@ https://www.visionresearchreports.com/report/cart/39192

Contact Us:

Vision Research Reports

Call: +1 9197 992 333