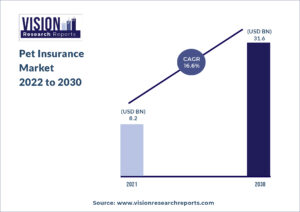

The global pet insurance market size was valued at USD 8.2 billion in 2021, and is predicted to be worth around USD 31.6 billion by 2030, registering a CAGR of 16.6% during the forecast period 2022 to 2030.

Download Exclusive Sample of Report@ https://www.visionresearchreports.com/report/sample/39180

Table of Contents

Pet Insurance Market Growth Factors

The key factors driving the market growth include the rising number of pets across the globe, high veterinary care costs, and the need to reduce financial risk. As per the Pet Food Manufacturers Association, about 59% of households had pets in the U.K. in 2021. Dogs were the most popular at about 33%, followed by cats at 27%. Other pets include rabbits, indoor birds, guinea pigs, tortoises and turtles, horses, and others.

Rapidly growing consumer awareness, underpenetrated market, and product acceptance have benefited the market. According to Petplan, in the U.S., the average cost of an unexpected visit to the veterinarian was around USD 800-1,500 in 2018. This burden could be eased with an insurance plan in place. Moreover, untapped opportunities in developed and developing economies are anticipated to provide lucrative growth to this market in the coming years.

Growing pet population, adoption of pet insurance in underpenetrated markets, increasing veterinary care costs, initiatives by key companies, and humanization of pets are some of the key drivers of this market. In 2020, Trupanion reported that over 800,000 pets were insured under the company’s policies across key markets in the U.S., Canada, and Australia.

Report Coverage

| Report Scope | Details |

| Market Size | US$ 31.6 billion by 2030 |

| Growth Rate | CAGR of 16.6% From 2022 to 2030 |

| Largest Market | Europe |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Coverage Type, Animal Type, Sales Channel |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Mentioned | Trupanion, Inc.; Deutsche Familienversicherung AG (DFV); Petplan (Allianz); Animal Friends Insurance Services Limited; Figo Pet Insurance, LLC; Direct Line; Nationwide Mutual Insurance Company; Embrace Pet Insurance Agency, LLC; AnicomInsurance; ipet Insurance Co., Ltd |

By Coverage Type Analysis

The accident and illness segment dominated the market and accounted for the largest revenue share of 84.0% in 2021. It is also estimated to witness the fastest CAGR in the coming years. The key factors contributing to this growth include high veterinary treatment and diagnostic costs, a rise in the companion animal population, and an increase in awareness about pet insurance.

The others segment, on the other hand, comprising of liability insurance policies among others, is projected to see a higher uptake in Europe. This is due to countries such as Germany making it mandatory for pet owners to have dog liability insurance.

By Animal Type Analysis

The dogs segment dominated the market and accounted for the largest revenue share of more than 50% in 2021. The segment comprising horses, small mammals, etc. is expected to grow at the fastest CAGR of more than 17% over the forecast period.

As per FEDIAF, around 88.0 million households across the European Union owned at least one pet in 2020. The number of pets was estimated to be 110 million cats, 89 million dogs, 51 million birds, 29 million small mammals, and 9 million reptiles.

By Sales Channel Analysis

The direct sales segment dominated the market and held the largest revenue share of over 34.0% in 2021. This is attributable to the high usage of direct sales strategies by key pet insurance providers.

Deutsche Familienversicherung AG, for instance, reported that direct sales contributed to 87.3% of the company’s new business during HY2020. The company also reported a 21.4% increase in online sales compared to HY 2019.

The others segment comprising animal care centers, vet clinics, and more are anticipated to register the fastest growth of over 17.0% during the forecast period. This is due to an increasing number of companies onboarding veterinary care providers and pet stores as a means to reach consumers or pet parents.

By Regional Analysis

Europe dominated the pet insurance market and held the largest revenue share of over 43.0%. This is owing to the growing adoption of pet insurance, rising pet ownership, and the presence of key companies. According to the Department of Clinical Veterinary Science and the Pet Food Institute, 23.0% of pets in the U.K. and 30.0% of pets in Sweden were covered by pet insurance policies by 2017 and this penetration was anticipated to increase over time.

In North America, the market for pet insurance held the second-largest revenue share as of 2021. However, only 1-2% of the pets in the U.S. are insured thus presenting lucrative growth opportunities. Asia Pacific region is estimated to grow the fastest at a rate of over 18%.

Read also @ Insilico Clinical Trials Market is Anticipated to Grow US$ 5.0 Bn By 2030

Major Key Players Covered in The Pet Insurance Market Report include

- Trupanion, Inc.

- Deutsche Familienversicherung AG (DFV)

- Petplan (Allianz)

- Animal Friends Insurance Services Limited

- Figo Pet Insurance, LLC

- Direct Line

- Nationwide Mutual Insurance Company

- Embrace Pet Insurance Agency, LLC

- Anicom Insurance

- ipet Insurance Co., Ltd.

Pet Insurance Market Segmentation

- By Coverage Type

- Accident & Illness

- Accident only

- Others

- By Animal Type

- Dogs

- Cats

- Others

- By Sales Channel

- Agency

- Broker

- Direct

- Bancassurance

- Others

- Regional

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Netherlands

- Sweden

- Norway

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- Israel

- North America

Table of Contents

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Pet Insurance Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. MarPet Insurance Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Pet Insurance Market, By Coverage Type

7.1. Pet Insurance Market, by Coverage Type, 2021-2030

7.1.1. Accident & Illness

7.1.1.1. Market Revenue and Forecast (2019-2030)

7.1.2. Accident only

7.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 8. Global Pet Insurance Market, By Animal Type

8.1. Pet Insurance Market, by Animal Type, 2021-2030

8.1.1. Dogs

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Cats

8.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Pet Insurance Market, By Sales Channel

9.1. Pet Insurance Market, by Sales Channel, 2021-2030

9.1.1. Agency

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Broker

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Direct

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Bancassurance

9.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Pet Insurance Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.1.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.1.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.1.4. U.S.

10.1.4.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.1.4.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.1.4.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.1.5. Rest of North America

10.1.5.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.1.5.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.1.5.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.2.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.2.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.2.4. UK

10.2.4.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.2.4.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.2.4.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.2.5. Germany

10.2.5.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.2.5.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.2.5.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.2.6. France

10.2.6.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.2.6.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.2.6.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.2.7. Rest of Europe

10.2.7.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.2.7.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.2.7.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.3.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.3.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.3.4. India

10.3.4.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.3.4.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.3.4.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.3.5. China

10.3.5.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.3.5.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.3.5.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.3.6. Japan

10.3.6.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.3.6.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.3.6.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.3.7. Rest of APAC

10.3.7.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.3.7.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.3.7.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.4.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.4.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.4.4. GCC

10.4.4.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.4.4.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.4.4.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.4.5. North Africa

10.4.5.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.4.5.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.4.5.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.4.6. South Africa

10.4.6.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.4.6.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.4.6.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.4.7. Rest of MEA

10.4.7.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.4.7.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.4.7.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.5.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.5.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.5.4. Brazil

10.5.4.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.5.4.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.5.4.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

10.5.5. Rest of LATAM

10.5.5.1. Market Revenue and Forecast, by Coverage Type (2019-2030)

10.5.5.2. Market Revenue and Forecast, by Animal Type (2019-2030)

10.5.5.3. Market Revenue and Forecast, by Sales Channel (2019-2030)

Chapter 11. Company Profiles

11.1. Trupanion, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Deutsche Familienversicherung AG (DFV)

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Petplan (Allianz)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Animal Friends Insurance Services Limited

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Figo Pet Insurance, LLC

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Direct Line

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Nationwide Mutual Insurance Company

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Embrace Pet Insurance Agency, LLC

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Anicom Insurance

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. ipet Insurance Co., Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

Glossary of Terms

Buy this Research Report study@ https://www.visionresearchreports.com/report/cart/39180

Contact Us:

Vision Research Reports

Call: +1 9197 992 333