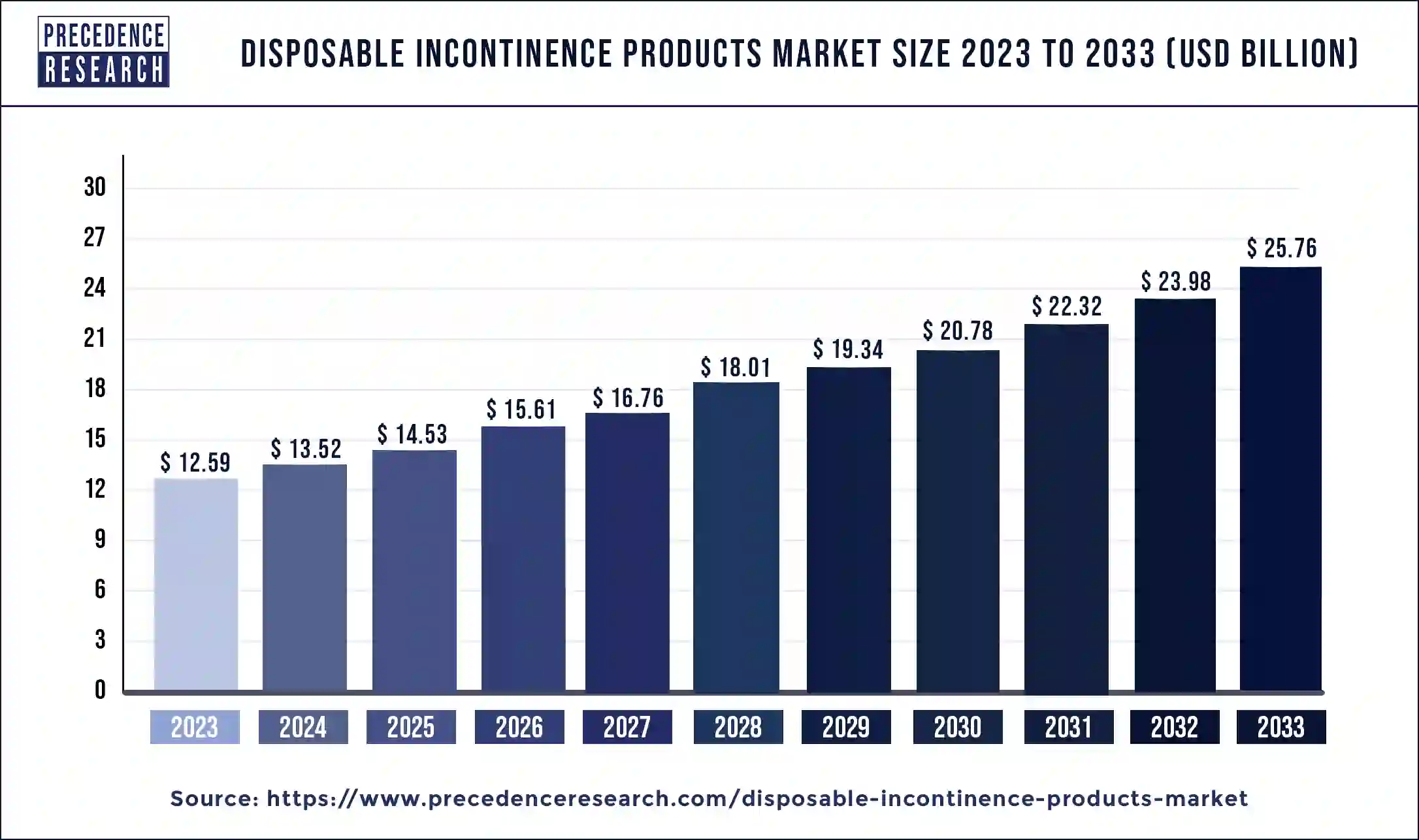

The global disposable incontinence products market size was estimated at USD 12.59 billion in 2023 and is projected to reach USD 25.76 billion by 2033, growing at a CAGR of 7.42% from 2024 to 2033.

Key Points

- Europe dominated the market with the largest share of 35% in 2023.

- By product, the protective incontinence garments segment has held the largest market share of 85% in 2023.

- By application, the fecal incontinence segment has contributed more than 25% of market share in 2023.

- By incontinence type, the mixed segment dominated the market with the largest share in 2023.

- By disease, the chronic disease segment has accounted for more than 26% of the market share in 2023.

- By material, the cotton fabrics segment dominated the market’s largest revenue share in 2023.

- By gender, the female segment dominated the disposable incontinence products market in 2023.

- By age, the 60 to 79 years segment dominated the market in 2023.

- By distribution channel, the retail stores segment dominated the market in 2023.

- By end-use, the ambulatory surgical centers segment held the largest share of the market in 2023.

The disposable incontinence products market is experiencing robust growth globally due to the increasing prevalence of urinary incontinence, fecal incontinence, and other bladder control issues among the aging population. Disposable incontinence products, including adult diapers, absorbent pads, and protective underwear, provide effective solutions for managing urinary and fecal leakage, maintaining hygiene, and improving quality of life for individuals with incontinence issues. With the rising awareness about incontinence management and the growing acceptance of disposable products, the market for disposable incontinence products is expected to witness continued expansion in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/3980

Growth Factors:

Several factors drive the growth of the disposable incontinence products market. One key driver is the increasing prevalence of urinary incontinence and fecal incontinence, particularly among the elderly population. Age-related changes, chronic health conditions, and neurological disorders contribute to bladder control issues, leading to a growing demand for effective incontinence management solutions. Disposable incontinence products offer convenience, discretion, and comfort, making them preferred choices for individuals seeking reliable containment and protection against leakage.

Moreover, changing lifestyles, urbanization, and increasing healthcare awareness contribute to market growth. Busy lifestyles, sedentary habits, and dietary factors contribute to the prevalence of incontinence issues across diverse demographic groups. As individuals become more aware of available treatment options and management strategies, the demand for disposable incontinence products is expected to rise. Additionally, the availability of a wide range of product options, including gender-specific designs, sizes, and absorbency levels, caters to diverse consumer preferences and contributes to market expansion.

Furthermore, advancements in product design, material technologies, and manufacturing processes enhance the performance and comfort of disposable incontinence products. Innovations such as super-absorbent polymers, odor-control technologies, and breathable materials improve product efficacy, skin health, and user comfort. Manufacturers focus on developing products that offer superior leakage protection, skin-friendly features, and discreet packaging, driving consumer satisfaction and brand loyalty.

Region Insights:

The disposable incontinence products market exhibits strong regional dynamics, with North America, Europe, Asia-Pacific, and other regions representing key growth markets. North America dominates the market, driven by the high prevalence of incontinence disorders, aging demographics, and favorable reimbursement policies. The region’s advanced healthcare infrastructure, robust distribution networks, and widespread availability of disposable incontinence products contribute to market leadership.

In Europe, increasing awareness about incontinence management, aging populations, and government initiatives to promote home healthcare drive market growth. Countries such as the United Kingdom, Germany, and France are witnessing growing demand for disposable incontinence products, supported by reimbursement schemes and community-based care services. Moreover, the availability of premium-quality products and eco-friendly options caters to environmentally conscious consumers, further fueling market expansion.

Asia-Pacific emerges as a rapidly growing market for disposable incontinence products, driven by the aging population, increasing healthcare expenditure, and improving awareness about incontinence management. Countries such as Japan, China, and South Korea witness significant market growth, supported by rising disposable incomes and changing consumer preferences. Moreover, strategic partnerships between multinational manufacturers and local distributors facilitate product penetration and market expansion in Asia-Pacific markets.

Disposable Incontinence Products Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.42% |

| Global Market Size in 2023 | USD 12.59 Billion |

| Global Market Size by 2033 | USD 25.76 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Application, By Incontinence Type, By Disease, By Material, By Gender, By Distribution Channel, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Disposable Incontinence Products Market Dynamics

Drivers:

Several drivers contribute to the adoption and utilization of disposable incontinence products. One primary driver is the aging population demographics, with the elderly population being more prone to incontinence issues due to age-related changes in bladder function and muscle control. As the global population continues to age, the prevalence of incontinence disorders is expected to rise, driving demand for effective containment and management solutions such as disposable incontinence products.

Additionally, the growing emphasis on maintaining dignity, independence, and quality of life among individuals with incontinence issues drives market growth. Disposable incontinence products offer discreet and reliable solutions for managing urinary and fecal leakage, allowing users to engage in daily activities with confidence and comfort. The availability of gender-specific designs, discreet packaging, and odor-control features enhances product acceptance and adherence to treatment regimens.

Furthermore, increasing healthcare awareness and the destigmatization of incontinence contribute to market expansion. Healthcare providers, patient advocacy groups, and educational campaigns play a crucial role in raising awareness about incontinence management, treatment options, and available support resources. As individuals become more informed about their condition and available products, the demand for disposable incontinence products is expected to grow, driving market adoption and penetration.

Opportunities:

The disposable incontinence products market presents numerous opportunities for innovation and expansion. One significant opportunity lies in the development of eco-friendly and sustainable product alternatives. With increasing environmental consciousness and regulatory pressure to reduce plastic waste, manufacturers are exploring biodegradable materials, compostable designs, and recycling initiatives to minimize the environmental impact of disposable incontinence products. Eco-friendly options cater to environmentally conscious consumers and address sustainability concerns, driving market differentiation and brand loyalty.

Moreover, the expansion of product portfolios to include specialized products for specific user needs and preferences presents growth opportunities. Tailored solutions for different incontinence severity levels, body sizes, and lifestyles cater to diverse consumer segments and enhance market competitiveness. Additionally, innovations in product design, such as discreet packaging, skin-friendly materials, and easy-to-use features, improve user experience and promote product adoption among individuals with incontinence issues.

Furthermore, digital health technologies and connectivity solutions offer opportunities for enhancing product functionality and user engagement. Smart incontinence products equipped with sensors, mobile apps, and remote monitoring capabilities enable real-time tracking of bladder activity, leakage episodes, and usage patterns. Data-driven insights and personalized recommendations empower users to better manage their condition, optimize product usage, and seek timely medical intervention when needed. Moreover, connectivity features enable caregivers and healthcare providers to remotely monitor patients’ incontinence status and provide personalized support and interventions, enhancing overall patient care and outcomes.

Challenges:

Despite the promising growth prospects, the disposable incontinence products market faces several challenges that could impact market expansion. One such challenge is the stigma and embarrassment associated with incontinence, which may hinder individuals from seeking help or using disposable products. Addressing social taboos, promoting open communication about incontinence, and raising awareness about available management options are essential for reducing stigma and increasing product acceptance.

Additionally, cost considerations and affordability constraints pose challenges to market access and adoption, particularly in low- and middle-income countries. Disposable incontinence products can impose a financial burden on individuals with limited resources, leading to challenges in accessing essential care and supplies. Moreover, disparities in reimbursement policies and insurance coverage for incontinence products contribute to inequities in access to quality care and management options, particularly for vulnerable populations.

Moreover, regulatory compliance and quality standards pose challenges to manufacturers and distributors operating in the disposable incontinence products market. Strict regulations governing product safety, performance, and labeling require companies to adhere to rigorous testing, certification, and documentation requirements. Ensuring compliance with regulatory standards across different geographic regions and markets adds complexity and costs to product development and market entry strategies.

Read Also: Cold Chain Monitoring Market Size to Rise USD 229.61 Bn by 2033

Recent Developments

- In September 2022, Attindas Hygiene Partners proudly presents its cutting-edge, new adults disposable incontinence underwear line in North America. The latest product, which is invisible beneath clothes and offers 100% leak-free protection, uses Maxi Comfort ultrasonic bonding tech to create a more elastic material that can fit a variety of body shapes. The product comes in three skin-friendly, cottony-soft colors for both men and women.

Disposable Incontinence Products Market Companies

- Essity AB

- Kimberly-Clark Corporation

- Coloplast Ltd.

- Unicharm Corporation

- Paul Hartmann AG

- Ontex

- First Quality Enterprises

- Medline Industries Inc.

Segments Covered in the Report

By Product

- Protective Incontinence Garments

- Disposable Adult Diaper

- Disposable Protective Underwear

- Cloth Adult Diaper

- Disposable Pads and Liners

- Male Guards

- Bladder Control Pads

- Incontinence Liners

- Belted and Beltless Under Garments

- Disposable Under Pads

- Urine Bag

- Leg Urine Bag

- Bedside Urine Bag

- Urinary Catheter

- Indwelling (Foley) Catheter

- Intermittent Catheter

- External Catheter

By Application

- Urine Incontinence

- Fecal Incontinence

- Dual Incontinence

By Incontinence Type

- Stress

- Urge

- Mixed

- Others

By Disease

- Feminine Health

- Pregnancy and Childbirth

- Menopause

- Hysterectomy

- Others

- Chronic Disease

- Benign Prostatic Hyperplasia

- Bladder Cancer

- Mental Disorders

- Others

By Material

- Plastic

- Cotton Fabrics

- Super Absorbents

- Latex

- Others

By Gender

- Male

- Female

By Age

- Below 20 years

- 20 to 39 years

- 40 to 59 years

- 60 to 79 years

- 80+ years

By Distribution Channel

- Retail Stores

- E-commerce

By End-use

- Hospital

- Ambulatory Surgical Centers

- Nursing Facilities

- Long term Care Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/