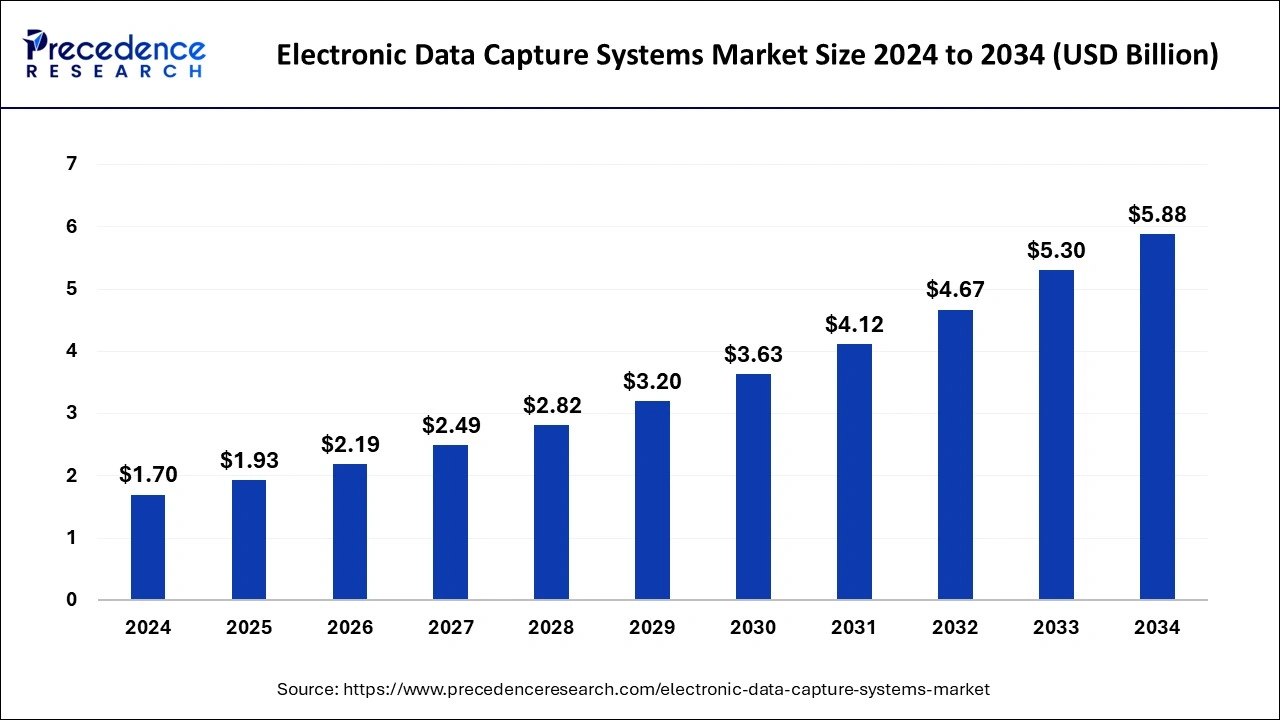

The global electronic data capture systems market size was estimated at USD 1.50 billion in 2023 and is predicted to rake around USD 5.30 billion by 2033, growing at a CAGR of 13.45% from 2024 to 2033.

Key Takeaways

- The North America electronic data capture systems market size reached USD 770 million in 2023 and is projected to hit around USD 2,700 million by 2033.

- North America dominated the electronic data capture systems market in 2023 with a market share of 51%.

- By the development phase, the Phase III segment has accounted largest market share of 50.8% in 2023.

- By end user, the CROs segment held the dominating share of around 36% in 2023.

- By end user, the hospitals or healthcare providers segment is showcasing a lucrative growth during the forecast period.

- By delivery mode segment, the web and cloud-based systems segment dominated the market and held the largest share in 2023.

- Based on component, the highest share was captured by the services segment of the electronic data capture systems market and thus dominated the market on a global scale.

- The software segment of component is expected to witness a significant growth rate during the forecast period.

Electronic data capture (EDC) systems are advanced software solutions that enable the collection, management, and analysis of data from clinical trials, medical research, and other healthcare-related studies. These systems replace traditional paper-based methods of data collection, providing streamlined and efficient processes that enhance data accuracy and speed up the research process. EDC systems have become an essential component of clinical research and are increasingly being adopted across various industries for their ability to support real-time data access and secure storage.

Get a Sample: https://www.precedenceresearch.com/sample/4090

Growth Factors

Several factors drive the growth of the electronic data capture systems market:

- Increasing Demand for Clinical Research: The rising prevalence of chronic diseases and the need for innovative treatments have fueled the demand for clinical research, which in turn drives the adoption of EDC systems.

- Advancements in Healthcare Technology: As healthcare technology evolves, the need for efficient data management solutions increases. EDC systems are becoming more sophisticated, allowing for better data integration, interoperability, and data analytics capabilities.

- Regulatory Compliance: Stringent regulations governing the healthcare industry necessitate accurate and reliable data capture and storage methods. EDC systems ensure compliance with these regulations by providing secure data handling and audit trails.

- Cost-Effectiveness: EDC systems offer cost savings by reducing the time and resources required for data collection, management, and analysis. This cost-effectiveness appeals to organizations looking to streamline their operations.

- Increased Adoption of Cloud-Based Solutions: The rise of cloud computing has made EDC systems more accessible and scalable, allowing organizations to store and manage data securely and efficiently.

Region Insights

- North America: The North American region dominates the EDC systems market due to its advanced healthcare infrastructure, significant investments in research and development, and the presence of key market players. The region’s strict regulatory environment also encourages the adoption of EDC systems to ensure compliance.

- Europe: Europe is another major market for EDC systems, driven by the increasing focus on clinical research and a strong emphasis on patient safety and data security. The region’s regulatory landscape also supports the growth of the market.

- Asia-Pacific: The Asia-Pacific region is expected to experience significant growth in the EDC systems market due to the rising number of clinical trials, increasing healthcare expenditure, and growing awareness of advanced data capture solutions.

- Latin America: Latin America is witnessing a growing interest in EDC systems as the region’s healthcare sector modernizes and the demand for efficient data management solutions increases.

- Middle East and Africa: The Middle East and Africa region is gradually adopting EDC systems, driven by improving healthcare infrastructure and the need for advanced data management solutions.

Electronic Data Capture Systems Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 13.45% |

| Global Market Size in 2023 | USD 1.50 Billion |

| Global Market Size in 2024 | USD 1.70 Billion |

| Global Market Size by 2033 | USD 5.30 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Delivery Mode, By Component, By Development Phase, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Electronic Data Capture Systems Market Dynamics

Drivers

- Improved Data Accuracy and Efficiency: EDC systems streamline data collection and management processes, reducing the potential for human error and increasing data accuracy.

- Regulatory Compliance and Audit Trails: EDC systems offer secure data handling and comprehensive audit trails, ensuring compliance with regulatory requirements and standards.

- Real-Time Data Access and Monitoring: Researchers can access and monitor data in real-time, enabling faster decision-making and more efficient study management.

- Integration with Other Systems: EDC systems can integrate with other software solutions such as electronic health records (EHRs) and laboratory information management systems (LIMS), providing a comprehensive view of the data.

- Increased Adoption of Telemedicine: The growth of telemedicine has led to a higher demand for secure and efficient data capture systems that can support remote monitoring and data management.

Challenges

- Data Security and Privacy Concerns: Ensuring data security and patient privacy is a significant challenge for EDC systems, as breaches can lead to regulatory penalties and damage to reputation.

- High Implementation Costs: The initial investment in EDC systems, including software, hardware, and training, can be high, especially for smaller organizations.

- Integration and Compatibility Issues: Integrating EDC systems with existing software and ensuring compatibility across different platforms can be challenging.

- Lack of Standardization: The lack of standardization in EDC systems can lead to interoperability issues and hinder data sharing across different systems.

- Resistance to Change: Some organizations may resist transitioning from traditional paper-based methods to electronic systems due to a lack of familiarity with the technology or concerns about its reliability.

Opportunities

- Technological Advancements: Continued advancements in technology, such as artificial intelligence and machine learning, present opportunities for EDC systems to become even more efficient and sophisticated.

- Emerging Markets: The growing healthcare infrastructure in emerging markets offers opportunities for EDC system providers to expand their presence and tap into new customer bases.

- Customization and Scalability: EDC systems can be customized and scaled according to the needs of different organizations, allowing providers to cater to a wide range of clients.

- Partnerships and Collaborations: Collaborations between EDC system providers and other healthcare technology companies can lead to the development of integrated solutions that offer enhanced data management capabilities.

- Remote Monitoring and Telemedicine: As remote monitoring and telemedicine continue to gain popularity, there is an opportunity for EDC systems to support these trends by providing secure and efficient data capture and management solutions.

Read Also: Battery Binders Market Size to Rake USD 8.20 Billion by 2033

Recent Developments

- In March 2024, Veeva Systems Inc. VEEV recently announced that Veeva Vault EDC has powered more than 1,000 study starts. Per management, this reflects increased adoption of Vault EDC, which is enabling companies to establish two contract research organizations (CROs) standardizing Vault EDC.

- In September 2023- Medidata a Dassault Systeme’s company, was rated the pharmaceutical industry’s preferred provider of electronic data capture (EDC) solutions in a new report by Industry Standard Research. This report also identified Medidata’s EDC system as the No. 1 most recently used EDC system across the industry.

Electronic Data Capture Systems Market Companies

- Calyx

- Castor

- Open Clinica, LLC

- IBM

- IQVIA Inc.

- Medidata Solutions, Inc.

- Oracle

- DATATRAK International, Inc.

- Clario

- Veeva Systems

Segments Covered in the Report

By Delivery Mode

- On-premises

- Web & Cloud-based

By Component

- Software

- Services

By Development Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By End-user

- Hospitals/Healthcare Providers

- CROs

- Pharmaceutical and Biotechnology Firms

- Medical Device Firms

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/