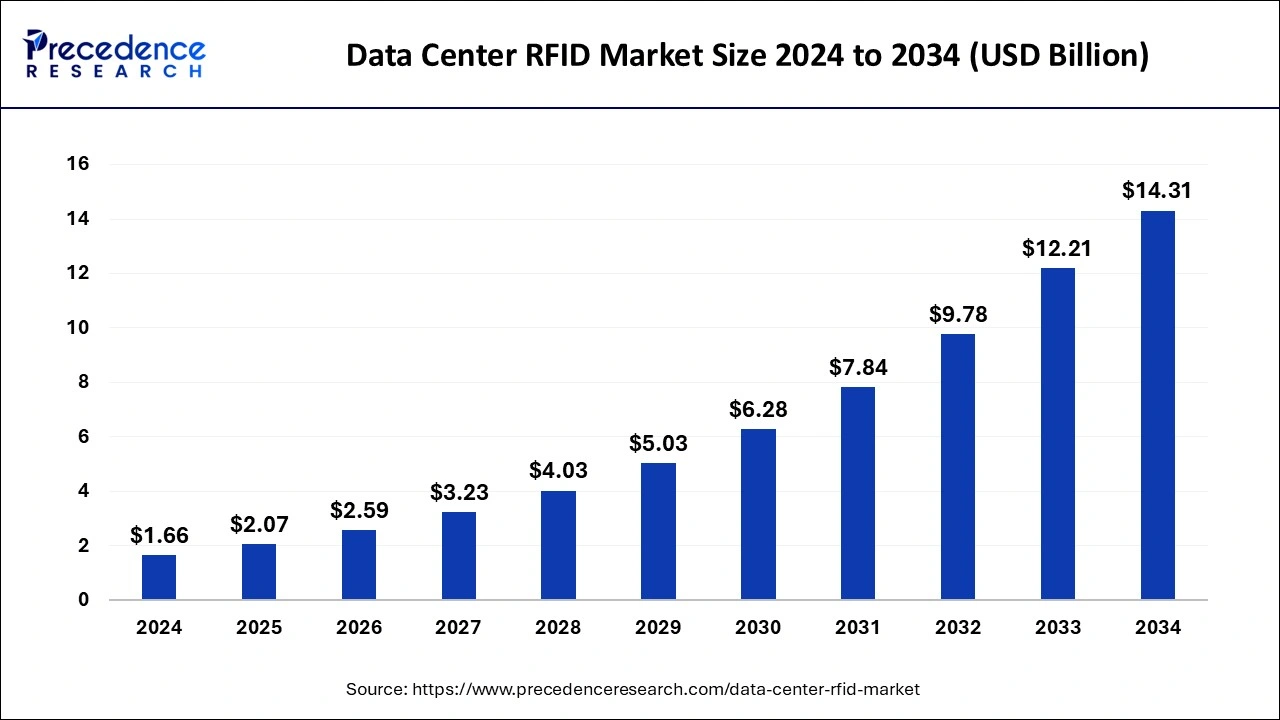

The global data center RFID market size was calculated at USD 1.33 billion in 2023 and is predicted to rise around USD 12.21 billion by 2033, expanding at a CAGR of 24.82% from 2024 to 2033.

Key Points

- The North America data center RFID market size accounted for USD 510 million in 2023 and is expected to attain around USD 4,640 million by 2033.

- North America has generated more than 38% of market share in 2023.

- Asia Pacific emerges as a rapidly growing region in the global market.

- By component, the hardware segment held the largest share of 73% in 2023.

- By component, the services segment is anticipated to register rapid growth in the upcoming years.

- By hardware, the readers segment has accounted for the highest market share of 62% in 2023.

- By hardware, the antenna segment is expected to witness a rapid CAGR over the forecasted years.

- By tags, the passive tags segment has held the major market share of 72% in 2023.

- By tags, the active tags segment is anticipated to gain a notable share of the market during the foreseen period.

- By tag frequency, the UFH segment has contributed the biggest market share of 71% in 2023.

- By tag frequency, the HF tags frequency segment is anticipated to witness the fastest growth in the upcoming years.

- By reader type, the handheld segment has held the largest market share of 62% in 2023.

- By reader type, the fixed reader type segment is expected to showcase the fastest CAGR over the foreseen years.

- By application, the asset tracking and management segment has captured more than 39% of market share in 2023.

- By application, the lifecycle management segment is projected to grow rapidly in the forecasted years.

The data center RFID (Radio Frequency Identification) market is experiencing robust growth driven by the increasing adoption of RFID technology in data centers for asset tracking, inventory management, and security enhancement. RFID systems use radio waves to identify and track tagged objects wirelessly, offering real-time visibility and automation capabilities critical for efficient data center operations. As the demand for scalable and secure data storage solutions rises, data center operators are leveraging RFID technology to optimize resource utilization and streamline workflows.

Get a Sample: https://www.precedenceresearch.com/sample/4253

Growth Factors

Several factors contribute to the growth of the data center RFID market. One key driver is the growing complexity of data center operations and the need for accurate asset tracking. RFID systems enable data center managers to monitor the location and status of equipment and assets in real-time, reducing manual efforts and minimizing the risk of errors. Furthermore, increasing concerns about data security and compliance have propelled the adoption of RFID-based solutions for access control and physical security within data centers, enhancing overall safety and regulatory compliance.

Region Insights

The adoption of RFID technology in data centers varies by region, influenced by factors such as technological advancements, regulatory frameworks, and market maturity. North America and Europe have emerged as key regions for data center RFID solutions, driven by a high concentration of data centers and stringent regulatory requirements related to data protection and security. In Asia Pacific, rapid urbanization and digitalization are fueling the demand for advanced data center infrastructure, creating opportunities for RFID technology providers to expand their presence in emerging markets.’

Data Center RFID Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 24.82% |

| Data Center RFID Market Size in 2023 | USD 1.33 Billion |

| Data Center RFID Market Size in 2024 | USD 1.66 Billion |

| Data Center RFID Market Size by 2033 | USD 12.21 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Hardware, By Tags, By Tag Frequency, By Reader, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Data Center RFID Market Dynamics

Drivers

Several drivers are propelling the growth of the data center RFID market. One significant driver is the increasing need for data center automation and efficiency. RFID technology enables automated asset management and inventory control, reducing operational costs and minimizing downtime associated with manual tracking processes. Moreover, the rising adoption of cloud computing and edge computing technologies necessitates agile and scalable data center solutions, where RFID plays a crucial role in optimizing resource allocation and capacity planning.

Opportunities

The data center RFID market presents numerous opportunities for innovation and collaboration across the industry ecosystem. One key opportunity lies in the development of integrated RFID solutions that combine asset tracking with other data center management functions such as environmental monitoring and energy optimization. Partnerships between RFID technology providers, data center operators, and hardware manufacturers can accelerate the deployment of RFID-enabled data center infrastructure, driving efficiency and scalability. Additionally, the integration of AI (Artificial Intelligence) and analytics with RFID data can unlock new insights and predictive capabilities for data center management.

Challenges

Despite its growth trajectory, the data center RFID market faces certain challenges. Interoperability issues between different RFID systems and legacy infrastructure can hinder seamless integration and scalability. Concerns related to data privacy and security require robust encryption and authentication mechanisms to protect RFID data from unauthorized access. Moreover, the upfront investment and deployment costs associated with RFID technology may pose barriers for small to mid-sized data centers, necessitating cost-effective solutions and flexible deployment models.

Data Center RFID Market Recent Developments

- In March 2023, Zebra Technologies and MASS group announced their integration with newer additions of fixed readers-FX9600 and FX7500, respectively. The capability of integration of both fixed and handled hardware solutions will enable the MASS group to offer and fulfill clients’ demands extensively with a spectrum of solutions, which will eventually lead to strengthening their position in the market.

- In May 2022, Vizinex RFID was acquired by HID Global. This acquisition made the HID portfolio globally appealing in the rapidly expanding RFID tag market. Standard and high-quality tags provided by Vizinex RFID enable consumers to save money and increase their efficiency by improving the tracking system, security, and authentication process. These customized tags hold a promising specialty of integration into the various range of product designs, making them more compatible with respect to the ever-evolving market’s attention.

Data Center RFID Market Companies

- Alien Technology

- AVERY DENNISON CORPORATION

- Confidex

- Detego

- GAO Group

- HID Global

- Honeywell International Inc.

- Impinj, Inc.

- MOJIX

- Nedap

- NXP Semiconductors

- SATO Holdings Corporation

- Semiconductor Components Industries, LLC

- ThingMagic

- Zebra Technologies Corp.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Hardware

- Tags

- Reader

- Printer

- Antenna

- Others

By Tags

- Active

- Passive

By Tag Frequency

- LHF

- HF

- UHF

By Reader

- Fixed

- Handheld

By Application

- Asset Tracking and Management

- IT Asset Management

- Lifecycle Management

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/