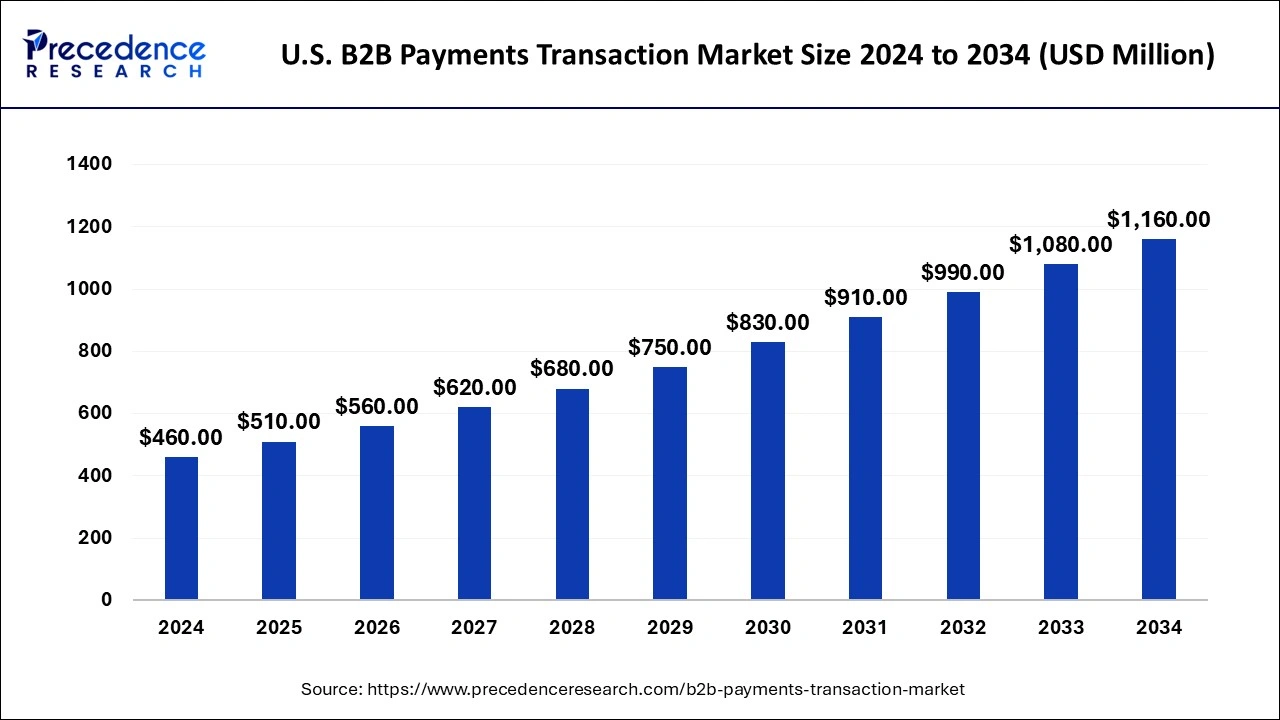

The U.S. B2B payments transaction market size reached USD 410 billion in 2023 and is predicted to be worth around USD 1,080 billion by 2033, growing at a CAGR of 9.95% from 2024 to 2033.

Key Points

- By payment type, the domestic payment dominated the market with the largest share in 2023.

- By payment mode, the ACH segment dominated the U.S. B2B payments transaction market with the largest share in 2023.

- By enterprise size, the large enterprise segment dominated the market in 2023.

- By industry, manufacturing segment dominated the market with the highest market share in 2023.

- By industry, the BFSI was the second largest segment while it held a considerable share of the market in 2023.

The U.S. B2B payments transaction market encompasses the exchange of payments between businesses for goods and services. This market segment plays a crucial role in the economy by facilitating transactions between businesses of all sizes across various industries. Traditionally, B2B payments have involved methods such as checks, wire transfers, and Automated Clearing House (ACH) payments. However, the market is evolving rapidly with the adoption of digital solutions, including electronic invoicing, virtual cards, and payment platforms, aimed at improving efficiency and reducing costs.

Get a Sample: https://www.precedenceresearch.com/sample/4292

Growth Factors

Several key factors are driving the growth of the U.S. B2B payments transaction market. One significant factor is the increasing adoption of electronic payment methods by businesses seeking to streamline processes and enhance security. The shift towards cloud-based financial technology (fintech) solutions has also contributed to market expansion, enabling faster and more transparent payment processing. Additionally, regulatory initiatives aimed at promoting electronic payments and reducing reliance on paper-based transactions are fueling market growth.

Region Insights:

The U.S. B2B payments transaction market is highly dynamic and regionally diverse. Different regions within the U.S. exhibit varying levels of adoption of digital payment technologies and preferences for specific payment methods. Urban areas and tech-forward regions tend to lead in the adoption of innovative payment solutions, while rural and less digitally connected areas may experience slower adoption rates.

U.S. B2B Payments Transaction Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9.95% |

| U.S. B2B Payments Transaction Market Size in 2023 | USD 410 Billion |

| U.S. B2B Payments Transaction Market Size in 2024 | USD 460 Billion |

| U.S. B2B Payments Transaction Market Size by 2033 | USD 1,080 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Payment, By Payment Mode, By Enterprise Size, and By Industry |

U.S. B2B Payments Transaction Market Dynamics

Drivers:

Several drivers are propelling the growth of the U.S. B2B payments transaction market. Enhanced security features offered by digital payment solutions are encouraging businesses to transition away from traditional payment methods. Moreover, the demand for real-time payment processing and improved cash flow management is driving businesses to adopt faster and more efficient payment technologies. Additionally, the proliferation of e-commerce and online marketplaces is increasing the need for seamless B2B payment solutions.

Opportunities:

The U.S. B2B payments transaction market presents numerous opportunities for innovation and market expansion. The integration of artificial intelligence (AI) and machine learning (ML) technologies into payment platforms offers opportunities for automated reconciliation and fraud detection. Moreover, partnerships between fintech companies and traditional financial institutions are creating new avenues for offering comprehensive B2B payment solutions tailored to specific industry needs.

Challenges:

Despite its growth prospects, the U.S. B2B payments transaction market faces several challenges. One major hurdle is the resistance to change among businesses accustomed to traditional payment methods. Overcoming interoperability issues between different payment systems and ensuring regulatory compliance also pose challenges. Additionally, concerns related to data privacy and cybersecurity remain significant barriers to the widespread adoption of digital B2B payment solutions.

Read Also: Smart Display Market Size to Rise USD 51.47 Billion by 2033

U.S. B2B Payments Transaction Market Recent Developments

- In April 2024, Paystand, a blockchain-enabled B2B payments network, acquired Teampay, a management software provider for increasing the B2B payments services. The transaction will work on the B2B payments powerhouse aiming to revolutionalize payement by increasing fastest, largest, and the most cost-efficient B2B payment network.

- In April 2024, Airwallex, a global leader in the financial and payment platform for new-age businesses announced the launch of payment acceptance solutions in US. The launch is offered to the merchant in US to accept the payments from the domestic and international customers.

- In April 2024, FedNow is work as a revolutionary force in real-time payments marking a significant shift from the traditional Automated Clearing House (ACH) system. A shit is the banking revolution provide the instant transaction process that meets the demand of the modern financial transaction.

U.S. B2B Payments Transaction Market Companies

- American Express

- Bank of America Corporation

- MasterCard

- Citigroup Inc

- PayPal Holdings Inc

- Block Inc

- Payoneer Inc

Segments Covered in the Report

By Payment Type

- Domestic Payments

- Cross-border Payments

By Payment Mode

- Cheque And Cash

- Ach

- Card

- Wire And Others

By Enterprise Size

- Large Enterprises

- Smes

- Small Businesses

By Industry

- BFSI

- Manufacturing

- Businesses and Professional Services

- IT and Telecom

- Energy and Utilities

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/