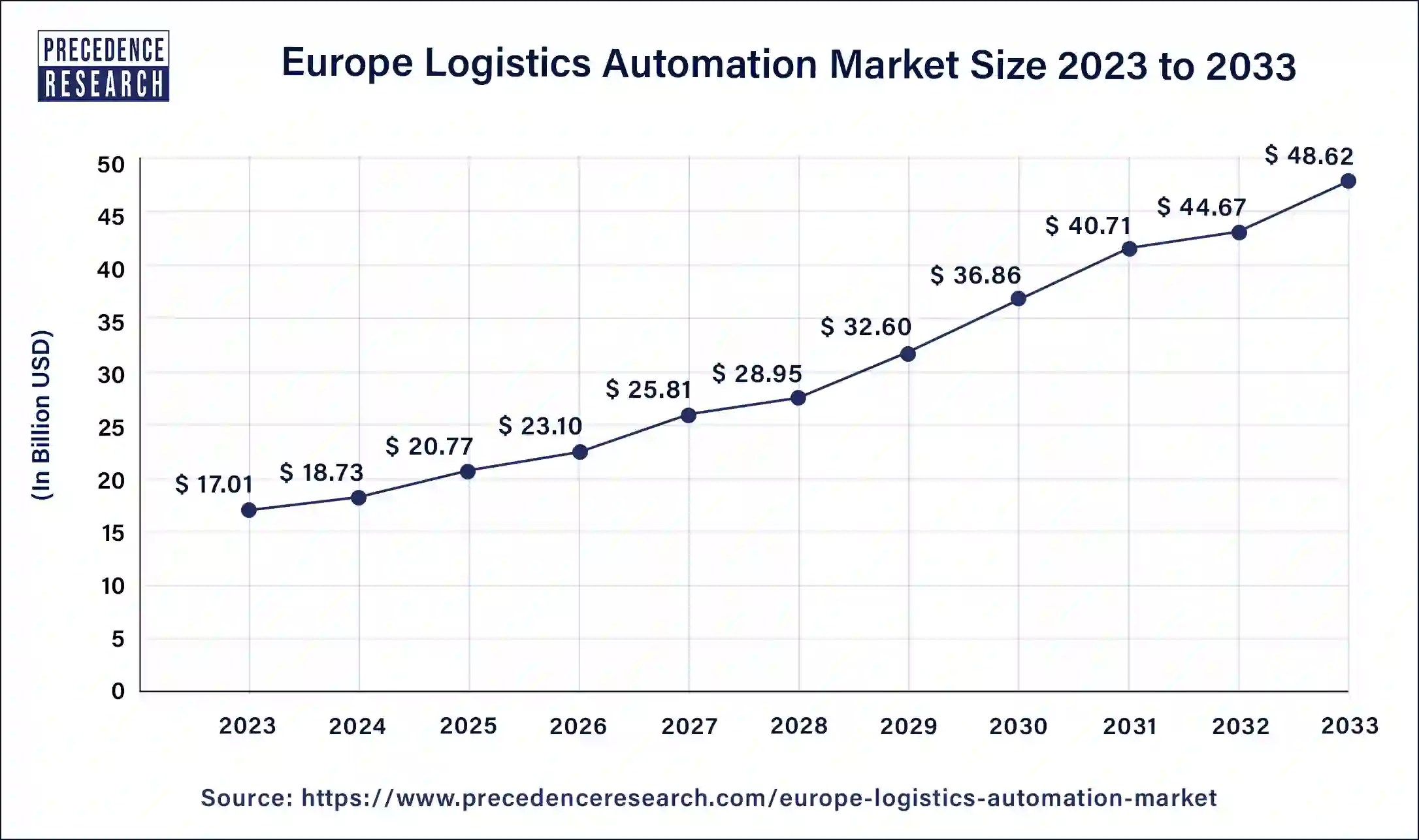

The Europe logistics automation market size was estimated at USD 17.01 billion in 2023 and is projected to rise around USD 48.62 billion by 2033, growing at a CAGR of 11.18% from 2024 to 2033.

Key Points

- By type, the production logistics segment dominated the market with the largest revenue share of 50.26% in 2023.

- By type, the sales logistics segment was the second largest with 27.50% revenue share in 2023.

- By component, the hardware has held the biggest revenue share of 55.69% in 2023.

- By component, the software segment is observed to be the fastest growing in the revenue during the forecast period.

- By organization size, the large enterprises segment has contributed the major revenue share of 65.72% in 2023.

- By mode of freight transport, the road segment led market with the highest revenue share of 55.04% in 2023.

- By mode of freight transport, the sea segment is observed to be the fastest growing in the revenue during the forecast period.

- By application, the transportation management segment has held the major revenue share of 69.82% in 2023.

- By end-user, the automotive segment led the market with the major revenue share of 30.56% in 2023.

- By end-user, the retail and e-commerce segment is observed to grow at a significant rate in the revenue during the forecast period.

The Europe logistics automation market is experiencing significant growth due to the increasing adoption of advanced technologies in supply chain management. Logistics automation involves the use of automated machinery, software, and control systems to improve the efficiency and accuracy of logistics operations. This market encompasses various solutions including automated storage and retrieval systems (AS/RS), warehouse management systems (WMS), transportation management systems (TMS), and robotic systems. These technologies are being integrated into logistics operations to streamline processes, reduce human error, and enhance overall operational efficiency.

Get a Sample: https://www.precedenceresearch.com/sample/4365

Table of Contents

Growth Factors

Several factors are driving the growth of the logistics automation market in Europe. One of the primary factors is the increasing demand for efficient and cost-effective logistics solutions driven by the rise of e-commerce. The surge in online shopping has led to a higher volume of shipments, necessitating more efficient handling and delivery processes. Additionally, advancements in technology such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning are enabling the development of more sophisticated automation solutions. Government initiatives and policies promoting the modernization of infrastructure and adoption of smart technologies are also contributing to market growth.

Region Insights

The logistics automation market in Europe shows varied dynamics across different regions. Western Europe, including countries like Germany, France, and the UK, leads the market due to their advanced industrial infrastructure and high adoption rate of automation technologies. Germany, being a hub for automotive and manufacturing industries, has a significant demand for logistics automation to streamline operations. Eastern Europe is also witnessing growth, albeit at a slower pace, driven by improving economic conditions and increasing foreign investments in logistics and warehousing sectors. Nordic countries are leveraging their technological advancements to integrate more sustainable and efficient logistics solutions.

Europe Logistics Automation Market Scope

| Report Coverage | Details |

| Europe Logistics Automation Market Size in 2023 | USD 17.01 Billion |

| Europe Logistics Automation Market Size in 2024 | USD 18.73 Billion |

| Europe Logistics Automation Market Size by 2033 | USD 48.62 Billion |

| Europe Logistics Automation Market Growth Rate | CAGR of 11.18% from 2024 to 2033 |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Component, Organization Size, Mode of Freight Transport, Application, and End-user |

Europe Logistics Automation Market Dynamics

Drivers

Key drivers of the logistics automation market in Europe include the growing need for operational efficiency and cost reduction. Businesses are increasingly focusing on minimizing operational costs while maximizing output, and automation provides a viable solution to achieve these objectives. The rise in consumer expectations for faster and more reliable deliveries is pushing logistics providers to adopt automation technologies. Furthermore, the increasing complexity of supply chains, with multiple touchpoints and processes, necessitates the use of advanced automation systems to ensure smooth operations.

Opportunities

The Europe logistics automation market presents numerous opportunities for growth. The integration of AI and machine learning in logistics operations offers potential for significant advancements in predictive analytics, route optimization, and demand forecasting. The growing emphasis on sustainability and green logistics is opening avenues for the development of energy-efficient automated systems. Moreover, the increasing collaboration between technology providers and logistics companies is expected to lead to the creation of innovative solutions tailored to specific industry needs.

Challenges

Despite the promising growth prospects, the logistics automation market in Europe faces several challenges. High initial costs associated with the implementation of automation technologies can be a significant barrier for small and medium-sized enterprises (SMEs). There is also a need for skilled personnel to manage and maintain automated systems, which can be a constraint given the current skills gap in the market. Additionally, concerns related to cybersecurity and data privacy with the adoption of connected and automated systems need to be addressed to ensure secure operations.

Read Also: Commodity Services Market Size to Attain USD 7.58 Billion by 2033

Europe Logistics Automation Market Recent Developments

- In March 2024, Leading European consultant and Oracle business partner Flo Group, which specializes in international supply chain logistics, was purchased by Accenture. Through this acquisition, Accenture’s Oracle capabilities in Europe will be further enhanced, enabling clients to create supply chains that are more resilient, flexible, and end-to-end visible. The transaction’s financial details were kept a secret.

- In January 2024, ABB declared that it has decided to buy Meshmind, one of the largest software service providers, to increase its capacity for AI, Industrial IoT, and machine vision research and development. With this acquisition, ABB will create a new global R&D hub combining software expertise, artificial intelligence (AI), and technical ability to hasten the creation of cutting-edge automation solutions inside its Machine Automation division (B&R).

- In August 2023, A payment module developed by LogiNext assists businesses in choosing providers and handle payments. Through rate charts facilitated by automation and artificial intelligence (AI), the new module makes it easier to select carrier partners by comparing the costs of various carriers and drivers.

Europe Logistics Automation Market Companies

- E&K Automation

- Jungheinrich

- Knapp

- SSI Schaefer

- Swisslog

- System Logistics

- TGW Logistics Group

- SAP

Segments Covered in the Report

By Type

- Sales Logistics

- Production Logistics

- Recovery Logistics

By Component

- Hardware

- Software

- Services

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Mode of Freight Transport

- Air

- Road

- Sea

By Application

- Transportation Management

- Warehouse and Storage Management

By End-user

- Manufacturing

- Healthcare and Pharmaceuticals

- Fast Moving Consumer Goods

- Retail and E-commerce

- Automotive

- Others

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/