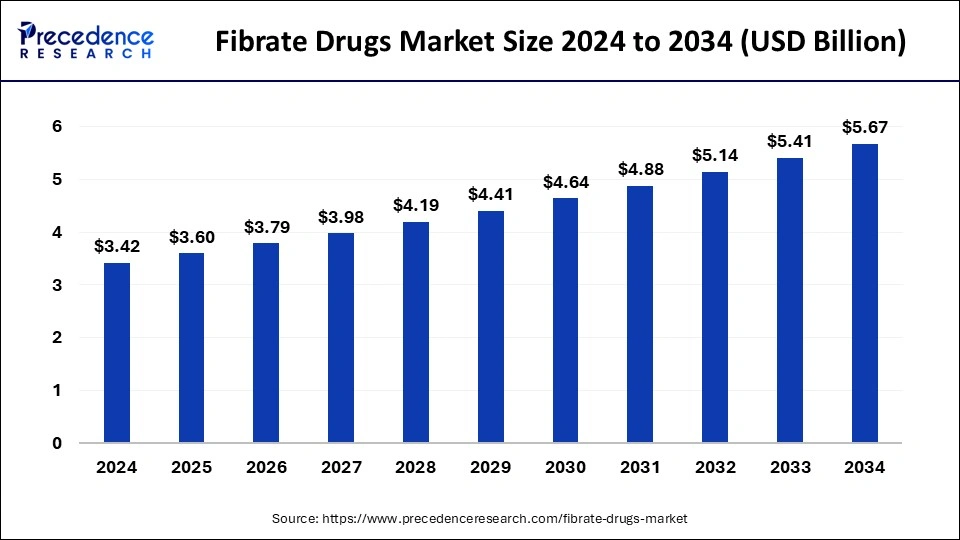

The global fibrate drugs market size was valued at USD 3.25 billion in 2023 and is predicted to reach around USD 5.41 billion by 2033, at a CAGR of 5.22% from 2024 to 2033.

Fibrate Drugs Market Key Points

- North America dominated the global fibrate drugs market with the highest revenue share of 39% in 2023.

- Europe is poised to show the fastest growth in the market during the projected period.

- By product, the branded segment has generated more than 67% of revenue share in 2023.

- By drug, the clofibrate segment dominated the market in 2023 and is anticipated to grow at the fastest rate during the forecast period.

- By distribution channel, the hospital & retail pharmacy segment led the market with a major revenue share of 40% in 2023.

- By distribution channel, the online pharmacy segment is expected to show the fastest growth in the market over the forecast period.

The Fibrate Drugs Market encompasses pharmaceuticals designed to lower lipid levels, particularly triglycerides and cholesterol, thereby reducing the risk of cardiovascular diseases (CVDs). Fibrates work by activating peroxisome proliferator-activated receptors (PPARs) in the liver and other tissues, which regulate lipid metabolism and promote the breakdown of triglycerides. These drugs are prescribed either alone or in combination with statins, another class of lipid-lowering medications, depending on the patient’s lipid profile and cardiovascular risk factors.

Globally, the market for fibrate drugs has been expanding steadily, driven by increasing incidences of lifestyle-related diseases such as obesity, diabetes, and hypertension, which are significant risk factors for dyslipidemia and CVDs. The market is characterized by several established and emerging players offering a range of products with varying mechanisms of action and formulations to cater to diverse patient needs.

Regional Insights

North America dominates the global Fibrate Drugs Market, primarily due to high healthcare expenditure, advanced healthcare infrastructure, and a large patient population suffering from obesity-related dyslipidemia. The United States, in particular, accounts for a substantial share of the market, supported by extensive research and development activities and robust healthcare reimbursement policies. Europe is another key region in the fibrate drugs sector, driven by a significant prevalence of cardiovascular diseases and a growing geriatric population prone to dyslipidemia. Countries like Germany, France, and the UK lead in terms of market size and adoption of advanced lipid-lowering therapies. Regulatory support and emphasis on preventive healthcare measures further bolster market growth in this region.

The Asia-Pacific region presents lucrative growth opportunities for fibrate drug manufacturers, attributed to rising healthcare expenditure, increasing awareness about cardiovascular health, and a growing middle-class population with changing dietary habits. Countries such as China, India, and Japan are expected to witness robust market expansion owing to improving healthcare infrastructure and rising disposable incomes.

Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 5.41 Billion |

| Market Size in 2023 | USD 3.25 Billion |

| Market Size in 2024 | USD 3.42 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 5.22% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Drug Type, Product Type, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Fibrate Drugs Market Dynamics

Drivers of Growth

Increasing Prevalence of Cardiovascular Diseases: The rising incidence of cardiovascular diseases globally, driven by sedentary lifestyles, unhealthy dietary habits, and aging populations, remains a primary driver for the fibrate drugs market. Fibrates play a crucial role in managing lipid disorders, thereby reducing the risk of heart attacks and strokes.

Advancements in Drug Formulations: Continuous innovations in drug delivery systems and formulations have enhanced the efficacy and safety profiles of fibrate medications. Newer formulations with improved bioavailability and reduced side effects are gaining traction among healthcare providers and patients alike.

Growing Geriatric Population: The demographic shift towards an aging population, particularly in developed regions, increases the demand for lipid-lowering therapies. Older adults are more susceptible to dyslipidemia and cardiovascular ailments, driving the adoption of fibrate drugs as part of comprehensive treatment regimens.

Opportunities

Expansion in Emerging Markets: Untapped potential in emerging economies presents substantial growth opportunities for fibrate drug manufacturers. Rising healthcare expenditure, improving healthcare infrastructure, and increasing awareness about cardiovascular health create a favorable environment for market expansion.

Pipeline Development and Research Initiatives: Ongoing research and development activities aimed at developing novel fibrate formulations and exploring new therapeutic indications offer promising growth prospects. Investments in clinical trials and collaborations with academic institutions drive innovation within the market.

Challenges

Generic Competition: Patent expirations and subsequent entry of generic alternatives pose a challenge to market incumbents, leading to pricing pressures and revenue erosion. Strategies such as product differentiation and lifecycle management are crucial to mitigate the impact of generic competition.

Adverse Effects and Safety Concerns: Despite their efficacy, fibrate drugs are associated with potential side effects such as gastrointestinal disturbances and liver function abnormalities. Ensuring patient safety and addressing adverse event profiles remain critical concerns for healthcare providers and regulatory authorities.

Read Also: Biological Buffers Market Size to Rise USD 1,549.96 Mn by 2033

Recent Developments

- In October 2022, United Therapeutics Corporation announced the EXPEDITE study of Remodulin induction prior to Orenitram therapy’s top line. Teprostinil exposure is increased when organigram and the CYP2C8 enzyme inhibitor gemfibrozil are taken together.

- In February 2022, the Food and Drug Administration (FDA) expanded approval of empagliflozin (Jardiance) for use in adults with heart failure (HF), regardless of ejection fraction, to reduce the risk of cardiovascular death and HF hospitalization.

- In May 2022, Amgen reported positive data from the Phase 2 OCEAN(a)-DOSE clinical study evaluating olpasiran (formerly AMG 890) in 281 adult patients with lipoprotein(a), or Lp(a), levels greater than 150 nmol/L. disclosed evidence of atherosclerotic cardiovascular disease (ASCVD).

Fibrate Drugs Market Companies

- Teva Pharmaceutical Industries

- Pfizer Inc.

- Mylan N.V.

- Sanofi SA

- Novartis AG

- GlaxoSmithKline plc

- Sun Pharmaceutical Industries Inc.

- Macleods Pharmaceuticals Limited

- Aurobindo Pharma

- Abbott

Segments Covered in the Report

By Drug Type

- Clofibrate

- Gemfibrozil

- Fenofibrate

- Others

By Product Type

- Branded

- Generics

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/