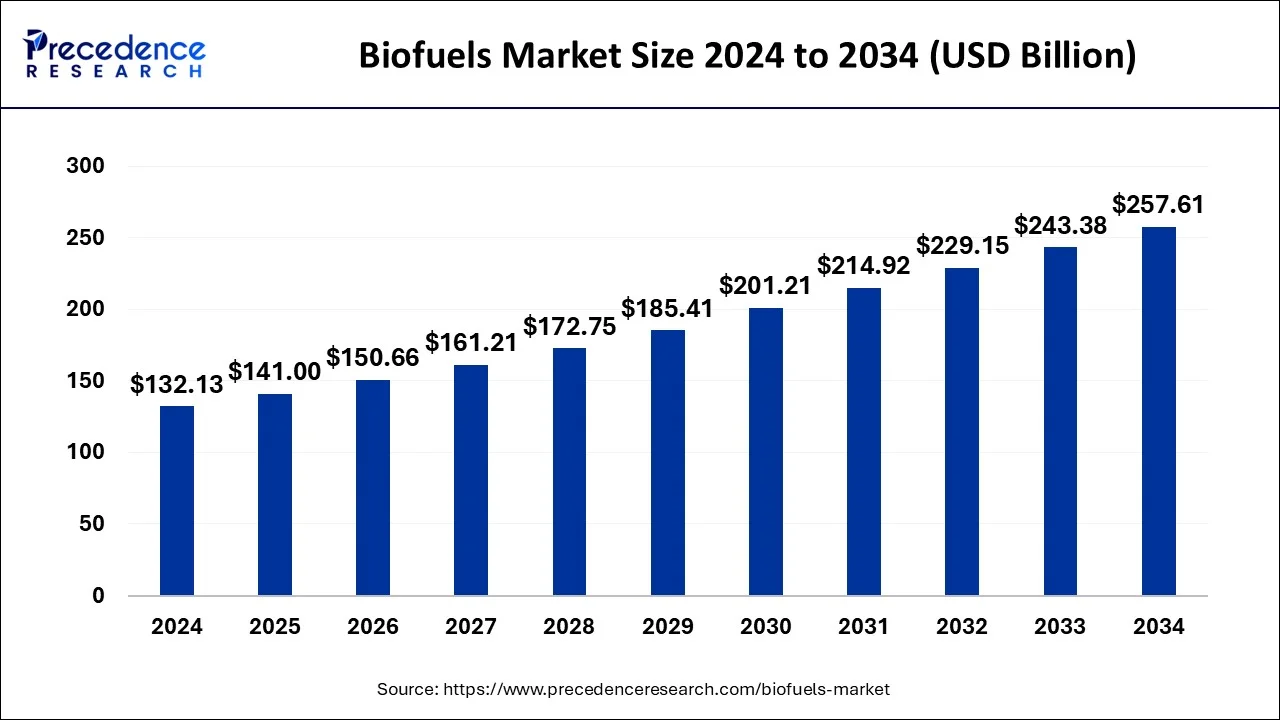

The global biofuels market size was valued at USD 123.97 billion in 2023 and is projected to cross USD 257.61 billion by 2034. It is growing at a CAGR of 6.9% from 2024 to 2034.

The need for clean fuels, particularly in road transportation, has increased with the growing focus on reducing greenhouse gas emissions. However, biofuels have become a favorable substitute for fossil fuels. They are produced from renewable organic materials and have the ability to reduce carbon emissions to some extent, thus contributing to sustainability goals. Stringent government regulations to reduce carbon emissions and the rising awareness about the negative impact of conventional fuels on the environment have led to increased production of biofuels, thus contributing to the growth of the market.

Immediate Delivery Available | Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1187

Key Insights

- North America has accounted largest revenue share of around 40.49% in 2023.

- Based on fuel type, the bioethanol segment has accounted highest revenue share of 72.15% in 2023.

- Based on feedstock, the vegetable oil segment has garnered revenue share of 27.76% in 2023.

Biofuels Market Regional Stance

North America dominated the biofuels market with the largest share in 2023 due to the advent of more rigorous sustainability regulations, the availability of advanced biofuel production processes, and the high conversion of waste to biofuel. Advanced biofuels like renewable diesel and cellulosic ethanol are gaining immense popularity due to their high energy density and lower emissions. The transformation of biofuels from waste products also addresses waste management concerns and fosters a circular economy. Moreover, rising government initiatives to boost domestic biofuel production and the rising consumption of biofuels in countries like the U.S. and Canada contribute to market growth in North America.

According to a report, the U.S. Department of Agriculture (USDA) invested over US$ 600 million in clean energy projects through the Rural Energy for America Program (REAP) and over US$ 180 million in domestic biofuel projects to increase the availability of biofuels across the country.

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. This is mainly due to the rising usage of sustainable fuels in the region. Countries such as China, Japan, Singapore, and South Korea are leading in adopting biofuels in marine transportation. Moreover, increasing investments in renewable energy projects and research contribute to market expansion. Nevertheless, major technological innovations and an increase in awareness about the drawbacks of conventional fuels on the environment are boosting the demand for biofuels.

Fuel Type Insights

The ethanol segment dominated the biofuels market in 2023. Ethanol is a sustainable fuel that reduces pollution, burns clean, and is produced from easily replenishable raw material resources such as sugarcane and beetroot. It has an octane index of 113, making it ideal for high compression engines. Ethanol, which is also used in gasoline engines as a fuel and props to antifreeze gasoline lines, effectively prevents problems during winter seasons while keeping the fuel system clear. It is also an important constituent in gasoline blended with ethanol, as well as E85, E15, and direct methanol fuel cells DEFCs due to its range of low toxicity and economic effects. Ethanol is also found in flexible fuel vehicles and direct-ethanol fuel cells because they are less expensive.

Biofuels Market, By Fuel Type, 2020-2023 (USD Billion)

| Fuel Type | 2020 | 2021 | 2022 | 2023 |

| Biodiesel | 34.57 | 30.63 | 30.63 | 34.53 |

| Bioethanol | 86.04 | 79.32 | 79.32 | 89.45 |

The biodiesel fuel segment is anticipated to expand at the highest CAGR throughout the forecast period due to the decreasing usage of petroleum diesel. Biodiesel is a renewable, biodegradable fuel that can be used for numerous purposes, and it is used in fuel for transportation, heating, electricity generation, or as a solvent. Biodiesel reduces greenhouse gas emissions and lessens reliance on imported oil. They have lower toxicity than fossil fuels. These fuels have lower engine wear and a high cetane number for more power and capacity. Biodiesel fuel is more energy efficient and safer than usual diesel. Hence, this is a viable substitute for petroleum diesel.

Feedstock Insights

The vegetable oil segment is projected to dominate the biofuels market in the coming years. This is primarily due to its lower toxicity compared to other fuels, such as ethanol, gasoline, and methanol, making them suitable for biofuels. It is widely used to produce biodiesel. Vegetable oil has a much higher flash point, reducing the risk of accidental ignition. In addition, feedstock like waste cooking oil is easily available and cheaper, reducing the production cost of biodiesel.

The jatropha segment is expected to grow at the fastest rate during the forecast period. Jatropha is considered a sustainable and low-cost source of biodiesel, as it can be grown on degraded land. It possesses good fuel properties. Jatropha oil can be easily converted into biodiesel for diesel engine vehicles. Jatropha seeds contain the highest oil content, leading to the highest biodiesel yield.

Biofuels Market Revenue, By Feedstock, 2020-2023 (USD Billion)

| Feedstock | 2020 | 2021 | 2022 | 2023 |

| Coarse Grains | 33.85 | 30.64 | 32.21 | 34.03 |

| Non-agri Feedstock | 10.07 | 9.33 | 10.03 | 10.84 |

| Biomass | 7.63 | 7.05 | 7.58 | 8.18 |

| Vegetable oil | 33.82 | 30.73 | 32.44 | 34.42 |

| Sugar crop | 20.59 | 18.72 | 19.77 | 20.98 |

| Jatropha | 2.30 | 2.34 | 2.74 | 3.19 |

| Others | 12.36 | 11.16 | 11.70 | 12.34 |

Market Dynamics

Driver

High oil prices and government initiatives to drive the market

The demand for alternative fuels is increasing worldwide due to the rising oil prices. However, biofuels are the most efficient alternative to oil and other fossil fuels. They can be produced locally. Moreover, governments in various countries are focusing on curbing carbon emissions. Thus, they are implementing several standards to reduce fossil fuel use. These factors collectively boost the demand for biofuels to reduce reliance on oil or other fossil fuels.

Restraint

Excessive use of land for biofuel production hampering the market

Biofuel production leads to excessive use of agricultural lands, causing natural lands, such as grassland and forests, to be converted into farming for growing maize and soybeans. The impact of the Renewable Fuel Standard resulted in 26% more conversion of natural land to cropland in 2022 than ever before. In the past few years, large areas of natural land have been converted to cropland to support biofuel production. This destroys forests and grassland, further breaking ecosystems.

Opportunity

Technological advancements in manufacturing biofuels offer growth opportunity in the biofuels market

Advances in efficiency and technology in biofuel manufacturing are likely to reduce costs. Tropical regions with long agricultural seasons, higher biofuel output, and lower fuel and input costs are best for biofuel production. The global biofuels market depends on factors such as elevated crude oil prices and skyrocketing feedstock prices. Advanced technologies will play a key role in increasing the production of biofuels since they can be used to recover cellulose materials and thereby increase the biofuels yields per acre, thus reducing the space required.

Recent Developments

- In September 2024, Rio Tinto to develop Pongamia seed farms in Australia as part of a new biofuels pilot to explore the potential of Pongamia seed oil as a feedstock for renewable diesel.

- In September 2024, AM Green Technology and Solutions BV entered into the biofuels market by signing binding agreement to acquire Chempolis Oy and Fortum 3 BV.

Key Players Operating in the Biofuels Market

- BTG International Ltd

- Renewable Energy Group, Inc.

- Abengoa Bioenergy S.A.

- Cargill

- DowDuPont, Inc.

- Wilmar International Ltd

- POET, LLC

- Archer Daniels Midland Company

- VERBIO Vereinigte BioEnergie AG

- My Eco Energy

- China Clean Energy Inc.

Segments Covered in the Report

By Fuel Type

- Biodiesel

- Ethanol

By Feedstock

- Coarse Grain

- Non-agri Feedstock

- Biomass

- Vegetable Oil

- Sugar Crop

- Jatropha

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research Report@https://www.precedenceresearch.com/checkout/1187

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344