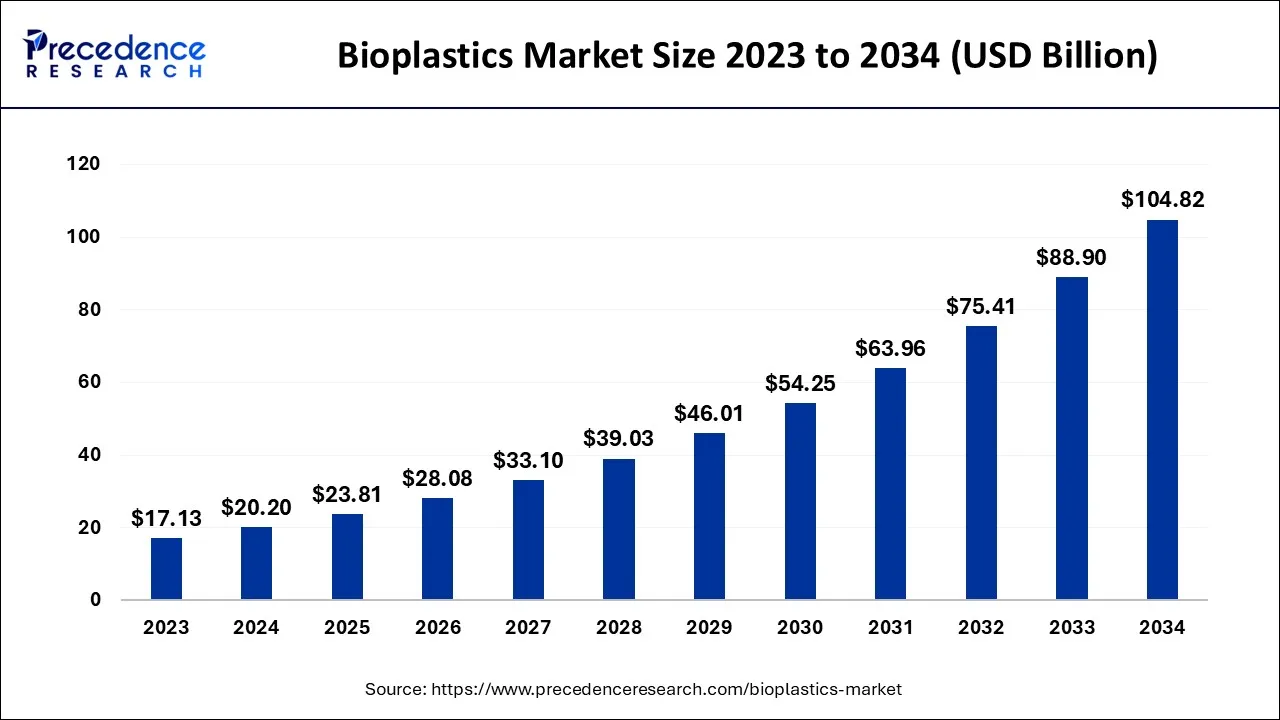

The global bioplastics market size Cross USD 104.82 billion by 2034, increasing from USD 17.13 billion in 2023. It is growing at a CAGR of 17.9% from 2024 and 2034.

Plastic is one of the most used petroleum derivatives. It takes more than 1000 years to decompose, leading to environmental pollution. However, bioplastics are eco-friendly and biodegradable materials that are derived from renewable sources, and they do not cause pollution and are flexible. They are already in use in the textile and healthcare industries. Polyhydroxyalkanoate (PHA) is gaining immense popularity in the U.S. and Europe. This bioplastic material is obtained from vegetables by fermenting them.

Key Insights

- Asia Pacific region has accounted highest revenue share of around 41% in 2023.

- The biodegradable segment has captured revenue share of 52.75% in 2023.

- The non-biodegradable segment is expanding at the CAGR of 16.8% from 2024 and 2034.

- The polylactic acid segment has held revenue share of 40.80% in 2023.

- The packaging application has accounted revenue share of 49.08% in 2023.

- The polybutylene succinate (PBS) segment is expanding at a CAGR of 19% from 2024 to 2034.

| Coverage of the Report | Details | |

| Bioplastics Market in 2023 | USD 17.13 Billion | |

| Bioplastics Market by 2033 | USD 88.90 Billion | |

| Bioplastics Market CAGR | 17.9% | |

| Bioplastics Market Segmentation | Product, Application, Region | |

| Bioplastics Market Companies | TEIJIN LIMITED, TORAY INDUSTRIES, INC., Toyota Tsusho Corporation, Avantium, PTT MCC Biochem Co., Ltd., An Phat Holdings, NatureWorks LLC, SABIC, BASF SE, Futerro, Trinseo S.A., Braskem, Total Corbion PLAIR, SUPLA (JIANGSU SUPLA BIOPLASTICS CO., LTD.), Solvay | |

Asia Pacific dominated the bioplastics market in 2023

Asia Pacific dominated the bioplastics market with the largest share in 2023 which is 41%. This is mainly due to the rapid expansion of the packaging industry in countries like China, India, Japan, and South Korea. The governments in these countries are also imposing strict regulations to reduce the use of plastic. Apart from this, these countries have set their sustainability goals. This encourages consumers and various industries to transition toward bio-based plastics. In addition, several regional players are making efforts to boost the production of bioplastics, thus contributing to the regional market growth.

- In August 2024, Nagase, a leading Japanese trading company, and TotalEnergies Corbion partnered to distribute Luminy PLA, a bioplastic-based material, in Japan, aiming to meet the country’s carbon neutrality goal by 2050.

- In June 2024, Uttar Pradesh’s government announced a plan to build a bioplastic park in Lakhimpur Kheri, covering 1000 hectares and aiming for an investment of around Rs 2 billion, amid environmental concerns over petroleum-based plastics.

Regional Insights

| Region Covered | Market Share 2023 (%) | |

| North America | 41 | % |

| Europe | 20 | % |

| Asia Pacific | 29 | % |

| Latin America | 6 | % |

| MEA | 4 | % |

Product Insights

The biodegradable segment held the largest share of the bioplastics market in 2023. Biodegradable bioplastics are a type of plastic that does not leave any harmful residue, as organisms can decompose it into water, carbon dioxide, and biomass. Biodegradable plastic materials are derived from natural renewable resources such as maize, beetroot, sugarcane, corn, or yeast – one microbial resource type. Common uses for bioplastics include food wrap, agricultural films or sheeting, and sanitary items. Biodegradable plastics have many advantages because they help reduce environmental pollution, have a small carbon footprint, and are usable in many compost systems. They are safe for the environment and biodegrade quickly.

- In September 2024, Pierre Fabre joins Sorbonne University in the bioplastic project which focuses on the cultivation of microalgae to absorb atmospheric carbon dioxide and convert it into a useful industrial material.

- In July 2024, researchers in Virginia Tech are developing biodegradable bioplastics from food waste to reduce plastic pollution and promote sustainability, addressing concerns of greenhouse gas emissions and economic losses associated with food waste.

- In November 2023, AgroRenew LLC announced a plan to invest US$ 83 million to build a processing facility to convert food waste into eco-friendly bioplastics.

| Product Covered | Market Share 2023 (%) | |

| Biodegradable | 52.75 | % |

| Non-biodegradable | 47.25 | % |

Application Insights

The packaging segment dominated the bioplastics market with the largest share of 49.08% in 2023. This is due to the rising need for sustainable packaging solutions in various industries. Bioplastics emerged as a sustainable alternative to traditional plastics. Their excellent flexibility, durability, barrier, and heat resistance properties help maintain the freshness of packaged goods for a long period. Biodegradable plastics and thermoplastic polyester coatings are usually found in bags, films, and containers. With the rising demand for packaged food, the demand for bioplastics is rising, contributing to segmental growth.

- In November 2023, the NENU2PHAR project developed sustainable packaging plastics from aquatic origin.

Market Dynamics

Driver

Development of advanced materials to drive the growth of the bioplastics market

The rising development of advanced materials is expected to drive the market in the coming years. Production of bio-based, biodegradable plastics has increased as a result of the innovation of new biopolymers such as polylactic acid (PLA) and polyhydroxyalkanoates (PHAs). These biopolymers are derived from natural resources and are known for their excellent physical and mechanical properties. Their high performance and excellent barrier properties make them a better alternative to polystyrene (PS), polypropylene (PP), and acrylonitrile butadiene styrene (ABS) in demanding applications.

- In September 2024, Ningbo Homelink Eco-iTech and animer Scientific are launching home-compostable extrusion-coated biopolymers, made with Danimer’s signature polyhydroxyalkanoate (PHA) Nodax, to replace traditional polyethylene coatings in paper cups.

Restraint

High production cost to hamper the market growth

The high costs associated with sourcing and processing renewable feedstocks hamper market growth. Producing bioplastics requires specialized manufacturing processes, which contribute to their high cost. Furthermore, the limited availability of raw materials makes it difficult for manufacturers to choose materials that precisely match their needs, restraining the market.

Opportunity

Research to improve properties of bioplastics offers immense opportunities

The increased manufacturing and subsequent use of plastics has resulted in the saturation of plastic debris, which threatens the health of people and the environment. Some solutions include recycling, composting, burning, and landfilling plastic waste. However, these all have a lot of ecological drawbacks. Biodegradable plastics (BPs) growth from bio-based resources seems to be required to attain sustainable development targets. BPs have been utilized in various sectors, including food packages, fertilizer containers, 3D printing materials, fishing nets, and medical device implants. There is a need for continued research and development to improve the properties and performance of bioplastics, which may result in even more durable, heat-resistant, and mechanically strong bioplastics, thus increasing their area of applications as well as contributing to the global green economy.

Recent Developments in the Bioplastics Market

- In October 2024, Balrampur Chini Mills, one of the top sugar producers in India, announced plans to set up a bioplastic plant worth ₹2,000 crore by 2026.

- In September 2024, CSIRO and Murdoch University launched the Bioplastics Innovation Hub to develop 100% compostable plastic for sustainable packaging solutions, accelerating the development of eco-friendly packaging.

- In July 2024, Emirates Biotech and SS Royal Kit Emirates Investment entered into a partnership to create a sustainable, circular PLA bioplastics industry in the Middle East, Africa, and India.

- In December 2023, Swiss technology company Sulzer introduced CAPSULTM, an end-to-end licensed technology for continuous manufacturing of polycaprolactone (PCL), a biodegradable polyester used in various industries.

Bioplastics Market Companies

- TEIJIN LIMITED

- TORAY INDUSTRIES, INC.

- Toyota Tsusho Corporation

- Avantium

- PTT MCC Biochem Co., Ltd.

- An Phat Holdings

- NatureWorks LLC

- SABIC

- BASF SE

- Futerro

- Trinseo S.A.

- Braskem

- Total Corbion PLAIR

- SUPLA (JIANGSU SUPLA BIOPLASTICS CO., LTD.)

- Solvay

Segments covered in the report

By Product

- Biodegradable

- Polylactic Acid

- Polybutylene Adipate Terephthalate (PBAT)

- Polybutylene Succinate (PBS)

- Starch blends

- Others

- Non-biodegradable

- Polyethylene

- Polyethylene Terephthalate

- Polytrimethylene Terephthalate

- Polyamide

- Others

By Application

- Packaging

- Rigid Packaging

- Bottle & Jar

- Trays

- Others

- Flexible Packaging

- Pouches

- Shopping/Waste Bags

- Others

- Rigid Packaging

- Consumer goods

- Agriculture

- Automotive & Transportation

- Textile

- Building & Construction

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@https://www.precedenceresearch.com/checkout/2148

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344