The global stationery products market size reached USD 5.60 billion in 2024 and is predicted to be Surpass around USD 10.64 billion by 2034, growing at a CAGR of 6.62% from 2024 to 2034

Key Points

- Asia Pacific dominated the stationery products market with the largest market share of 34% in 2023.

- North America is expected to show the fastest growth in the market over the forecast period.

- By product, the paper-based segment accounted for the highest market share of 31% in 2023.

- By product, the ink-based segment is anticipated to grow at the fastest rate in the market over the forecast period.

- By application, the educational institutes segment generated the biggest market share of 48% in 2023.

- By application, the corporate segment is anticipated to grow at a significant rate in the market over the projected period.

The stationery products market encompasses a wide range of items used for personal, educational, and professional purposes. This includes paper, writing instruments (pens, pencils), office supplies (binders, folders, desk organizers), art supplies, and educational tools. The market is driven by the growing demand for both traditional stationery items and innovative, eco-friendly alternatives. The rise of remote work and e-learning has also contributed to an increase in demand for office and school-related products. As of recent years, the market has been experiencing growth with a shift toward personalized and premium products, especially in the online retail sector.

Sample: https://www.precedenceresearch.com/sample/5221

Market Scope

| Report Coverage | Details |

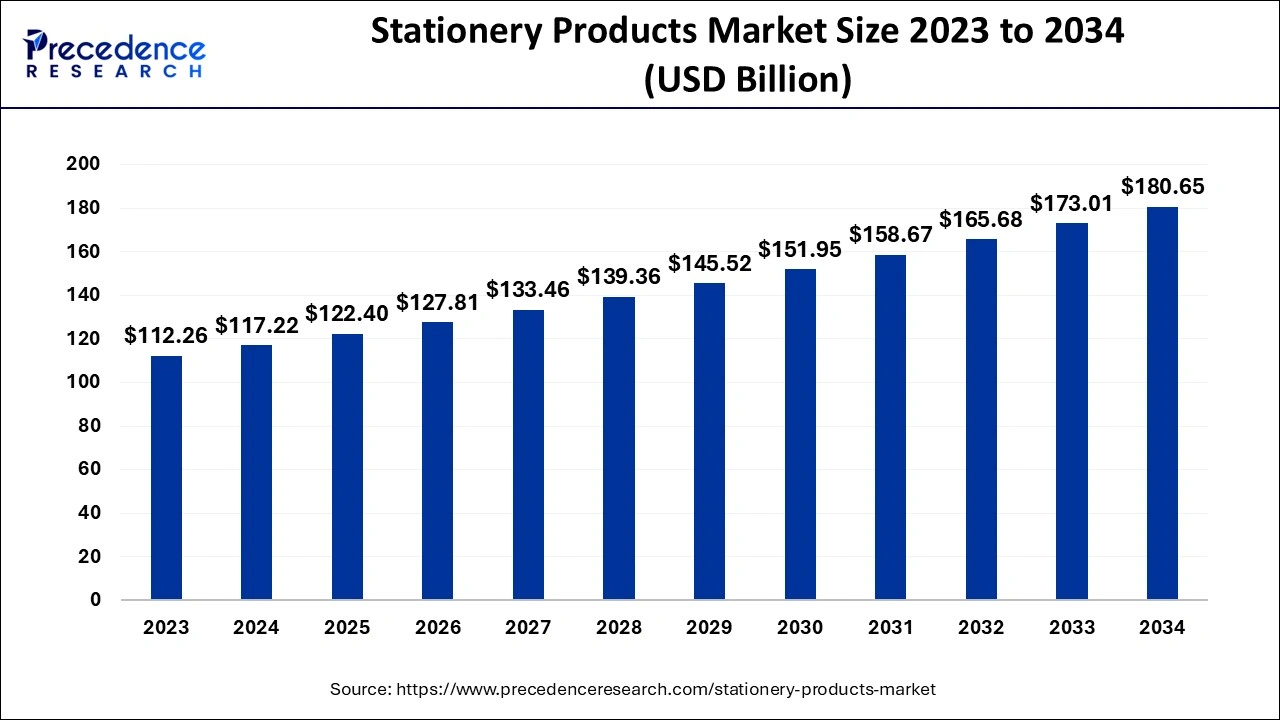

| Market Size by 2034 | USD 180.65 Billion |

| Market Size in 2024 | USD 117.22 Billion |

| Market Size in 2025 | USD 122.40 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.42% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Drivers of the Stationery Products Market

Several key drivers are fueling the growth of the stationery products market. First, the increasing number of students and the expansion of the education sector globally lead to greater demand for educational supplies. Second, the growing trend of remote working and learning increases the consumption of office supplies and writing materials. Third, the rising awareness of environmental sustainability has driven the demand for eco-friendly products, such as recycled paper and biodegradable pens. Additionally, technological advancements have enabled the development of innovative stationery, such as multifunctional pens, digital writing pads, and customized stationery products that appeal to both businesses and individuals.

Opportunities in the Stationery Products Market

There are numerous opportunities within the stationery market, particularly in the realm of customization and sustainability. The demand for personalized stationery, including custom notebooks, planners, and gifts, has seen significant growth, especially with the rise of online marketplaces. Furthermore, brands focusing on environmentally sustainable products, such as bamboo pens, recycled paper, and non-toxic paints, are finding a growing customer base. With the expansion of e-commerce, companies can reach global markets more effectively, providing opportunities for growth, especially in emerging markets where education and office infrastructure are rapidly developing. There is also room for growth in specialized sectors like stationery for artists, designers, and other creative professionals, which presents opportunities for niche product development.

Challenges in the Stationery Products Market

The stationery market faces several challenges, including the increasing reliance on digital devices and the decline in traditional paper-based activities. As more people shift to digital communication and work, the demand for paper and traditional writing instruments has been impacted. Additionally, there is significant price competition, especially from low-cost manufacturers, which puts pressure on product margins. The cost of raw materials, particularly paper, has fluctuated, affecting production costs and leading to pricing challenges for manufacturers. Another challenge lies in maintaining sustainability without compromising product quality, as sourcing eco-friendly materials can sometimes increase production costs. Finally, supply chain disruptions, particularly for international companies, can affect the availability and cost of products.

Regional Insights

The stationery products market is widely distributed across regions, with North America and Europe being significant markets due to the established education systems and high office supply consumption. However, Asia-Pacific, particularly China and India, represents a rapidly expanding region driven by increasing educational institutions and a growing middle class that demands stationery for both professional and personal use. In Latin America and the Middle East, there is a growing demand for stationery products, driven by the rise in educational investment and e-commerce platforms making products more accessible. Africa’s stationery market is also expanding, although at a slower pace, with growth expected in the coming years due to rising literacy rates and educational improvements.

Read Also: Sterilization Services Market Size to Surpass USD 10.64 Bn By 2034

Stationery Products Market Companies

- ACCO Brands Corporation

- Adveo Group International SA

- BIC Group

- Canon Inc.

- Crayola, LLC

- Dixon Ticonderoga Company

- Faber-Castell AG

- Herlitz PBS AG

- Kokuyo Co., Ltd.

- Mitsubishi Pencil Co., Ltd.

- Navneet Education Limited

- Newell Brands Inc.

- Pilot Corporation

- Pentel Co., Ltd.

- Schneider Schreibgeräte GmbH

- Shachihata Inc.

- Société BIC SA

- Staples, Inc.

- Tombow Pencil Co., Ltd.

- Zebra Pen Corporation

Recent News

- In June 2023, Anthropologie, a retail firm, created Papier, an online stationery brand based in the United Kingdom. Papier is launching a limited-edition line of stationery products in-store.

- In March 2023, Elmer’s, a renowned brand for crafting glue used in schools and homes, introduced a new product in its activity collection called Elmer’s Squishies. This creative DIY kit is specially created to stimulate children’s imagination, allowing them to create their personalized squishy toys.

- In August 2022, William Penn, an Indian premium writing instruments and lifestyle accessories company, acquired Sheaffer, the 110-year-old iconic American manufacturer of writing instruments, particularly known for its luxury fountain pens.

- In February 2023, The Chinese government declared that it will be decreasing the subsidies given to the paper industry. This might have an impact on the worldwide market and is anticipated to drive up paper costs in China.

Latest Announcements by Market Leaders

- In September 2024, Linc Limited and Mitsubishi Pencil Company Limited, Japan, announced a strategic Joint Venture in India. This business venture aims to launch an innovative Japanese technology to the Indian market, driving the production of high-quality yet affordable writing instruments, tailored specifically for Indian consumers.

- In September 2023, the crayon maker, a subsidiary of Hallmark Cards, announced the launch of Crayola Flowers, an online flower shop selling bright bouquets and boxed flowers. It will also double as a fundraising platform, with 10%-50% of every direct sale donated to a participating charity or entity chosen by the customer.

Segments Covered in the Report

By Product

- Paper based

- Ink based

- Art based

- Others

By Application Channel

- Educational Institutes

- Corporates

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa