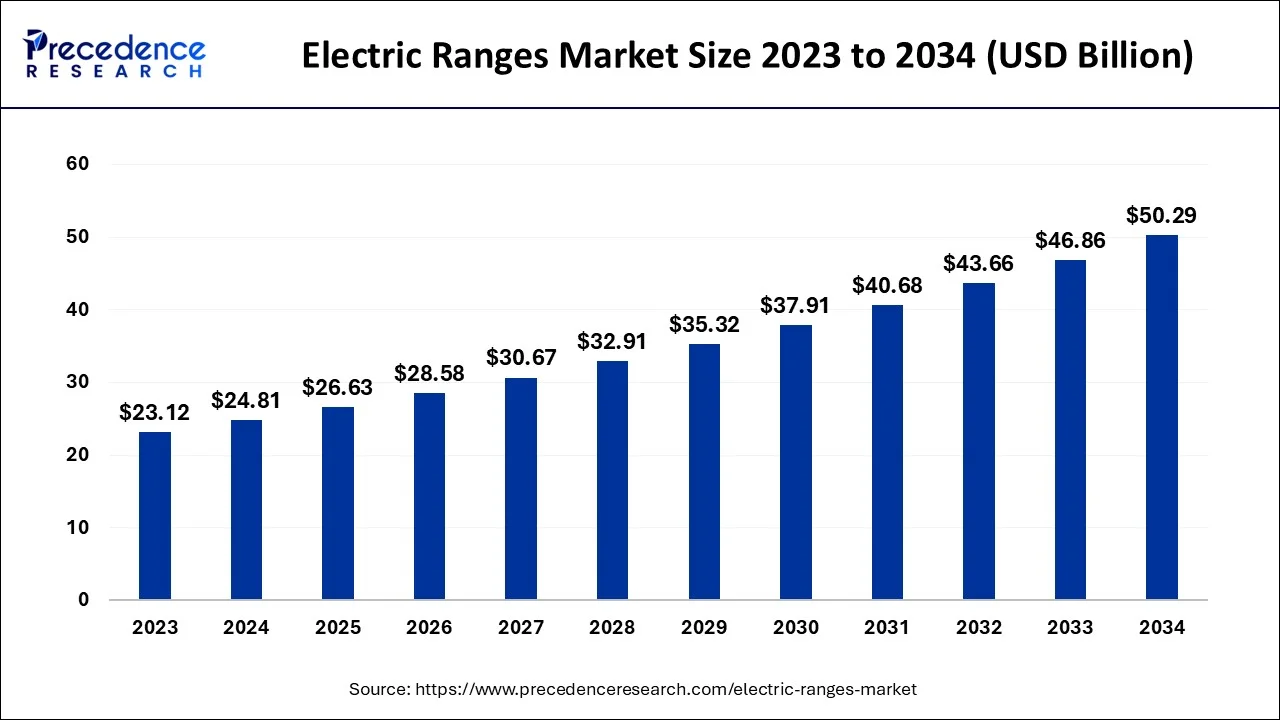

The global electric ranges market size reached USD 24.81 billion in 2024 and is predicted to be Surpass around USD 50.29 billion by 2034, growing at a CAGR of 7.32% from 2024 to 2034

Key Points

- North America dominated the electric ranges market with the largest market share of 38% in 2023.

- Asia Pacific is expected to grow at a fastest CAGR of 8.21% during the studied period.

- By product, the freestanding electric ranges segment accounted for the highest market share of 63% in 2023.

- By product, the slide-in electric ranges segment is expected to grow at the fastest CAGR of 8.21% over the forecast period.

- By application, the residential segment contributed the biggest market share of 81% in 2023.

- By application, the commercial segment is predicted to grow at a solid CAGR of 8.12% over the projected period.

- By distribution channel, the mass retailer-driven sales segment generated the biggest market share of 47% in 2023.

- By distribution channel, the online sales segment is anticipated to expand at the fastest CAGR of 9.03% during the forecast period.

The global electric ranges market is experiencing steady growth, driven by rising consumer demand for energy-efficient and technologically advanced cooking appliances. Electric ranges, which use electricity as their primary energy source, are increasingly preferred for their safety, ease of use, and consistent heating capabilities. The market is being fueled by the shift toward electric appliances as more households and businesses seek sustainable, efficient cooking solutions. Smart electric ranges, equipped with Wi-Fi, touchscreen controls, and voice assistant integration, are particularly popular in developed markets, while developing regions are seeing growth from affordable models with basic functionalities. Major players are focusing on expanding their product portfolios with innovative features, catering to a range of consumer needs and preferences.

Sample: https://www.precedenceresearch.com/sample/5218

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 50.29 Billion |

| Market Size in 2024 | USD 24.81 Billion |

| Market Size in 2025 | USD 26.63 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Drivers

Several key factors are driving the growth of the electric ranges market. First, growing awareness and adoption of energy-efficient appliances are encouraging consumers to invest in electric ranges over gas alternatives. This shift is supported by the increasing environmental consciousness and desire to reduce carbon footprints. Additionally, rising urbanization and disposable incomes, especially in emerging economies, have bolstered demand as more households are able to afford electric kitchen appliances. Government regulations promoting energy-efficient devices and incentives to replace outdated kitchen appliances are also helping accelerate market growth. The popularity of induction-based electric ranges, which offer faster heating and safety benefits, further drives the market, particularly among eco-conscious consumers.

Market Opportunities

The electric ranges market offers several opportunities for growth, particularly in the areas of innovation and product diversification. Expanding consumer interest in smart home technologies provides an opportunity for companies to introduce connected electric ranges that integrate with home automation systems. Moreover, increased demand for modular kitchens and compact living spaces opens the door for electric range manufacturers to develop more compact, versatile models tailored for smaller households. In developing regions, where gas infrastructure is limited, the market has a strong potential for growth as electric ranges become more affordable and accessible. Further, partnerships between appliance manufacturers and energy providers to promote electric ranges as part of energy-saving programs can also boost market penetration.

Market Challenges

Despite growth prospects, the electric ranges market faces several challenges. High electricity costs in certain regions deter some consumers, especially those in areas where gas is more economically viable. Additionally, the upfront cost of electric ranges, particularly for high-tech models with advanced features, can be prohibitive for lower-income households. The perception of electric ranges as slower compared to gas ranges in certain cooking styles remains a barrier in traditional markets where gas stoves have long been the norm. Additionally, in regions with inconsistent electricity supply, electric ranges may not be practical, limiting market growth in these areas. Competition from alternative cooking technologies, such as hybrid and solar-powered cookers, also presents a challenge.

Regional Insights

Regionally, North America and Europe lead the electric ranges market due to high consumer demand for advanced appliances and supportive government regulations. The mature markets in these regions are primarily driven by innovations in smart electric ranges and demand for induction technology. In Asia-Pacific, rapid urbanization and rising disposable incomes in countries like China, India, and Japan are fueling market growth, although gas appliances still hold significant market share. Latin America and the Middle East & Africa are emerging markets, with increasing adoption as infrastructure and affordability improve. However, inconsistent electricity access in some parts of these regions limits the market’s reach. The market’s growth prospects in each region depend on infrastructure, consumer preferences, and economic development.

Read Also: Liquid Packaging Carton Market Size to Worth USD 49.17 Bn By 2034

Electric Ranges Market Companies

- Whirlpool Corporation

- Samsung Electronics Co. Ltd.

- LG Electronics Inc.

- General Electric (GE Appliances)

- Bosch (BSH Hausgerte GmbH)

- Frigidaire

- Haier Group Corporation

- Miele & Cie. KG

- Brown Stove Works, INC.

- Rangaire

Recent News

- In March 2024, GE Appliances launched a new range lineup featuring 36 models, including the top-tier GE 30″ Slide-In Electric Convection Range with No Preheat Air Fry and the EasyWash Oven Tray, created for faster cooking and easier cleaning.

- In January 2023, Sharp Home Electronics showcased new 30″ slide-in electric ranges and smart combi appliances at the 2023 Kitchen & Bath Industry Show (KBIS) in Las Vegas.

- In October 2023, Usha International, a prominent player in the consumer durables segment in India, launched a selection of five innovative kitchen appliances as part of its latest premium iChef range.

Segments Covered in the Report

By Product

- Freestanding electric ranges

- Slide-in electric ranges

- Drop-in electric ranges

By Application

- Residential

- Commercial

By Distribution Channel

- Mass retailers

- Electronic & appliance stores

- Online/e-commerce

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa