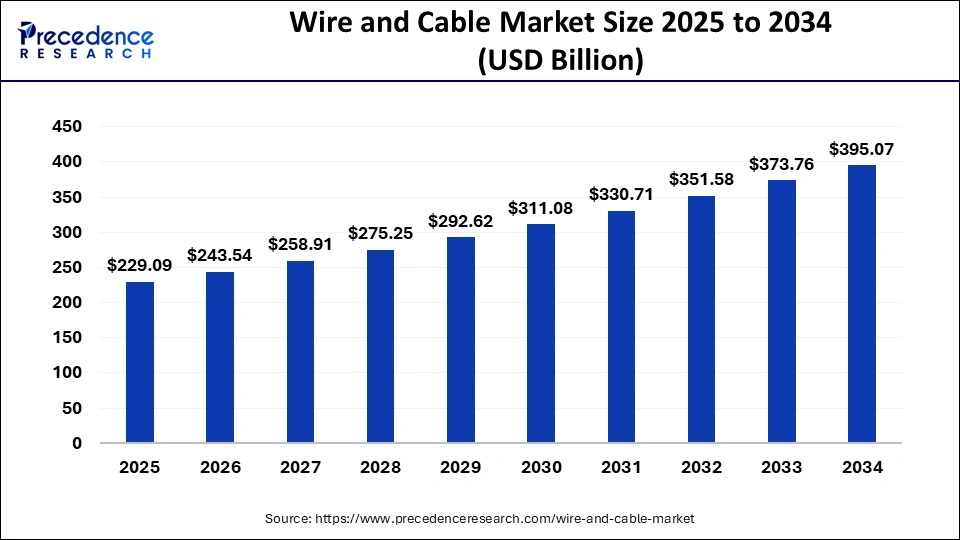

The wire and cable market size is calculated at USD 215.49 billion in 2024 and is expected to reach around USD 395.07 billion by 2034, with a notable CAGR of 6.20%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1070

Key Insights

- In 2024, Asia Pacific held a revenue share of approximately 38% in the market.

- The low voltage segment recorded the highest revenue share of over 44% in 2024.

- The overhead installation segment accounted for more than 65% of total revenue in 2024.

- The energy and power segment contributed to 38% of the market revenue in 2024.

- The building and construction segment is projected to grow at a CAGR of 4.9% from 2025 to 2034.

Market Dynamics

Drivers

The growing demand for electricity due to rapid industrialization and urbanization is a major driver for the wire and cable market. The expansion of smart grids and renewable energy projects is also fueling the need for advanced cabling solutions. Increasing investments in infrastructure development, including power distribution networks, telecom expansion, and transportation projects, further contribute to market growth. The adoption of fiber optic cables in telecommunication and data transmission sectors is another key factor propelling the industry forward.

Opportunities

The rising focus on sustainable and energy-efficient solutions presents significant opportunities in the wire and cable market. The growing adoption of electric vehicles (EVs) is driving the demand for high-performance charging cables. Additionally, the increasing penetration of 5G technology and smart city initiatives worldwide is expected to create lucrative business prospects. Emerging economies are heavily investing in modernizing their electrical infrastructure, which provides new avenues for market expansion.

Challenges

Fluctuations in raw material prices, particularly copper and aluminum, pose a significant challenge for manufacturers. Strict regulatory standards and safety compliance requirements add to operational costs. The market also faces competition from low-cost alternatives, affecting profit margins. Additionally, the installation and maintenance of high-performance cables require skilled labor, which can be a limiting factor in developing regions.

Regional Insights

Asia Pacific dominates the wire and cable market, driven by high investments in power infrastructure and rapid industrial growth. North America is witnessing steady growth due to the expansion of telecom networks and smart grid projects. Europe is focusing on sustainability and energy efficiency, encouraging the adoption of advanced cabling solutions. Meanwhile, the Middle East and Africa are experiencing growth with the increasing demand for power distribution networks and renewable energy installations.

Wire and Cable Market Companies

- Hengtong Optic-Electric Co Ltd.

- Prysmian Group

- Sumitomo Electric Industries, Ltd.,

- Furukawa Electric Co., Ltd.

- Leoni AG

- Jiagnan Group

- General Cable Corporation

- LS Cable & System Ltd

- TPC Wire & Cable Corp

- Southwire Company, LLC

- Polycab Wires Private Limited

- Nexans S.A.

- Hitachi Metals Ltd

- Far East Cable Co., Ltd.

Recent Development

- In January 2023, In compliance with new High Voltage Direct Current (HVDC) recommendations, SuperGrid Institute and Nexans completed a temporary overvoltage test on a 525kV DC cable design. The SuperGrid Institute’s High Voltage testing equipment was used to conduct numerous damped oscillating voltage trials on the Nexans-produced and -installed DC cable system.

- In January 2023, The Voluntary Protection Programs (VPP) Star site designation for Southwire’s El Paso, Texas, facility has been renewed by the Occupational Health and Safety Administration (OSHA).

- In July 2022, the domestic creation, production, and marketing of a liquid-cooled (LC) ultra-fast charging cable were all disclosed by LS Cable & System (LS C&S).

- In May 2022, six new products will be released in Q2 2022, according to Belden Inc., a top provider of specialist networking solutions worldwide. These products will give clients additional integration options, safer ways to transport power over long distances, and quick lead times.

Segments Covered in the Report

By Type

- Medium and High Voltage (MV & HV)

- Low Voltage (LV)

- Optical Fiber Cable

By Material

- Aluminum

- Copper

- Glass

By Installation

- Overhead

- Underground

By Application

- Data Transmission

- Building

- Power Transmission

- Transport

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/