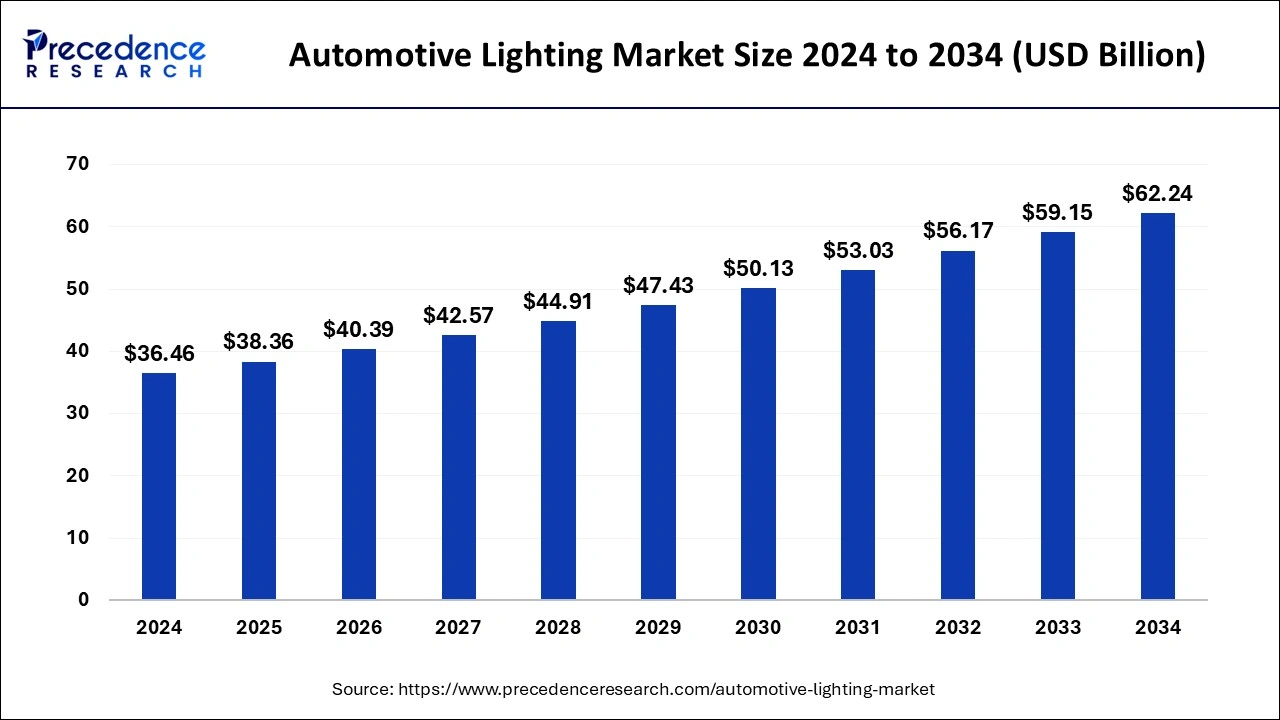

The global automotive lighting market size is estimated to reach around USD 62.24 billion by 2034 increasing from USD 36.46 billion in 2024, with a CAGR of 5.49%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1079

Key Insights

- In 2024, Asia Pacific dominated the market, securing the largest share of 40.11%.

- The halogen segment recorded the highest market share by technology in 2024.

- The Light Emitting Diode (LED) segment is projected to grow at the highest CAGR during the forecast period.

- Among applications, the front/headlamps segment is expected to witness the fastest CAGR over the projected period.

Market Dynamics

Drivers

The automotive lighting market is primarily driven by the increasing demand for advanced and energy-efficient lighting solutions. With the growing adoption of LED technology, vehicles now feature better illumination, longer lifespan, and improved energy efficiency compared to traditional halogen and xenon lights. Additionally, the rise of autonomous and electric vehicles is boosting the need for smart lighting systems, enhancing safety and aesthetics. Stringent government regulations on road safety and vehicle visibility are also pushing automakers to incorporate advanced lighting technologies in their models.

Opportunities

The increasing focus on vehicle aesthetics and customization is creating new opportunities for the automotive lighting industry. Manufacturers are investing in adaptive lighting, dynamic turn signals, and ambient lighting to enhance vehicle appeal and functionality. The integration of AI and IoT in lighting systems, enabling real-time adjustments based on driving conditions, is another emerging trend. Moreover, the rising sales of electric vehicles (EVs) globally provide a lucrative market for innovative lighting solutions tailored to energy-efficient vehicles.

Challenges

Despite its growth, the market faces challenges such as high production costs for advanced lighting technologies like OLEDs and laser lights. The complexity of integrating smart lighting systems with vehicle electronics can also lead to higher maintenance costs. Additionally, fluctuations in raw material prices and supply chain disruptions, particularly for semiconductor components, pose a threat to market stability. The presence of counterfeit and low-quality lighting products in emerging markets further challenges established manufacturers.

Regional Outlook

Asia Pacific dominates the automotive lighting market due to the high production of vehicles, growing demand for luxury cars, and technological advancements in countries like China, Japan, and South Korea. North America is experiencing steady growth, driven by strong demand for premium vehicles equipped with advanced lighting features. Europe remains a key player, benefiting from stringent safety regulations and the presence of major automotive manufacturers. Meanwhile, the Middle East & Africa and Latin America are witnessing gradual growth, fueled by increasing vehicle adoption and improving infrastructure.

Automotive Lighting Market Companies

- DENSO Corporation

- HellaKGaAHueck& Co.

- Hyundai Mobis

- Valeo

- Koito Manufacturing Co. Ltd.

- OsramLicht AG

- Koninklijke Philips N.V.

- Stanley Electric Co. Ltd.

- ROBERT BOSCH GmbH

- ZizalaLichtsysteme GmbH

Recent Developments

- In June 2024, Melexis launched their MLX81123 IC. This will extend their LIN RGB family that offers small SOIC8 and DFN-8 3mm x 3mm package. The miniaturization of this LED drive will offer ambient lighting in different locations inside the vehicle.

- In March 2024, Marelli, a well-known supplier of automotive developed a unique automotive lighting domain control unit platform in China. This platform is designed in a particular way to help manage the front lights and rear lights as well as introduced 360° lighting features in a vehicle.

- In April 2023, Continental AG introduced their automotive lighting product called NightViu, especially designed for construction and off-road vehicles. The company launched a portfolio of 16 products under the product line of NightViu; designed to suit specific requirements for construction, mining, and off-road equipment applications.

Segments Covered in the Report

By Technology

- LED

- Halogen

- Xenon/HID

By Product Sale

- Aftermarket Products

- Original Equipment Manufacturers (OEMs)

By Vehicle Type

- ICE

- Commercial Vehicle

- Passenger Vehicle

- Electric Vehicle

- Hybrid Electric Vehicle (HEV)

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

By Application

- Front/Headlamps

- Side

- Rear Lighting

- Interior Lighting

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/