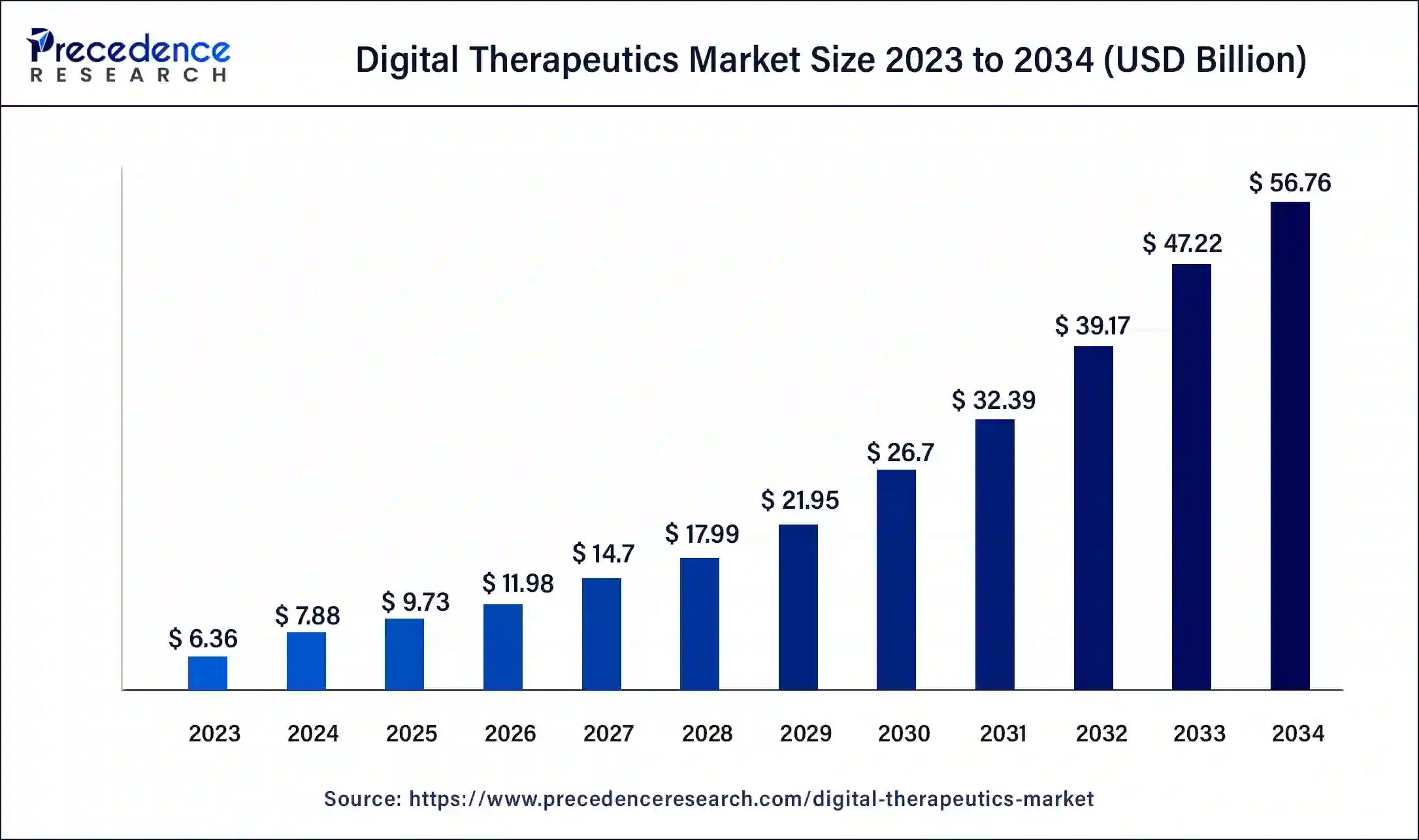

The global digital therapeutics market is calculated at USD 7.88 billion in 2024 and is expected to attain around USD 56.76 billion by 2034, at a CAGR of 21.83%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1128

Key Points

- North America led the market in 2023 with a dominant share of 44.03%.

- The devices segment accounted for the majority of the market, capturing 87.38% of the share.

- In terms of sales channels, the B2B segment dominated with a 65.29% share.

- Among applications, the diabetes segment held the highest share at 26.46%.

Market Scope

| Report Scope | Details |

| Market Size in 2023 | USD 6.36 Billion |

| Market Size in 2024 | USD 7.88 Billion |

| Market Size by 2034 | USD 56.76 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 21.83% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Application, and By Sales Channel |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read Also: https://www.dailytechbulletin.com/printed-and-flexible-sensors-market/

Market Dynamics

Market Drivers

The digital therapeutics market is expanding due to the rising demand for cost-effective and efficient healthcare solutions. An increasing number of patients suffering from chronic illnesses, along with the shift towards patient-centric care, is accelerating adoption.

Advancements in cloud computing, artificial intelligence, and mobile health applications are enhancing the accessibility and functionality of digital therapeutics. Additionally, favorable regulatory frameworks and increased funding from governments and private investors are driving innovation in this space.

Opportunities

The emergence of value-based healthcare models is creating new growth opportunities for digital therapeutics. The rising preference for remote healthcare solutions and digital treatment options is leading to increased collaborations between tech companies and healthcare providers.

The expansion of digital therapeutics into mental health, neurology, and respiratory care presents significant market potential. Furthermore, the increasing integration of digital therapeutics with electronic health records (EHR) and hospital management systems is expected to boost adoption.

Challenges

One of the major challenges in the digital therapeutics market is the resistance from traditional healthcare providers who are hesitant to integrate digital solutions into their practice. The lack of standardized regulations across different countries complicates the approval and commercialization of digital therapeutics.

Concerns over cybersecurity and data breaches also pose significant risks to patient confidentiality. Additionally, many developing nations face challenges related to infrastructure, internet connectivity, and digital literacy, which hinder the widespread adoption of digital therapeutics.

Regional Insights

North America remains the leading market for digital therapeutics, driven by high healthcare expenditure, robust technology adoption, and strong support from regulatory agencies. Europe follows closely, with increasing investments in digital healthcare and a growing focus on preventive care.

The Asia-Pacific region is experiencing rapid growth due to expanding internet access, a rising elderly population, and increased government support for digital health initiatives. Latin America and the Middle East & Africa are still in the early stages of digital therapeutics adoption, with gradual advancements being made in healthcare digitization.

Digital Therapeutics Market Companies

- Fitbit Health Solutions

- 2MORROW, Inc.

- Medtronic Plc.

- Livongo Health, Inc.

- Pear Therapeutics, Inc.

- Omada Health, Inc.

- Resmed, Inc. (Propeller Health)

- Proteus Digital Health, Inc.

- Welldoc, Inc.

- Voluntis, Inc.

- Canary Health Inc.

- Noom, Inc.

- Mango Health Inc.

- Dthera Sciences

Recent Developments

- In September 2023, Fitbit introduced Fitbit Charge 6 to track heart rate during workouts.

- In September 2023, 2Morrow and FIT HR entered into a partnership to bring evidence-based digital wellness solutions to more than 120 local and national small to midsize organizations.

Segments Covered in the Report

By Product

- Device

- Software

By Sales Channel

- Business-to-Consumer (B2C)

- Caregiver

- Patient

- Business-to-Business (B2B)

- Healthcare Provider

- Employer

- Others

By Application

- Obesity

- Diabetes

- Central Nervous System (CNS) Disease

- Gastrointestinal Disorder (GID)

- Cardiovascular Disease (CVD)

- Smoking Cessation

- Respiratory Disease

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- MEA

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/