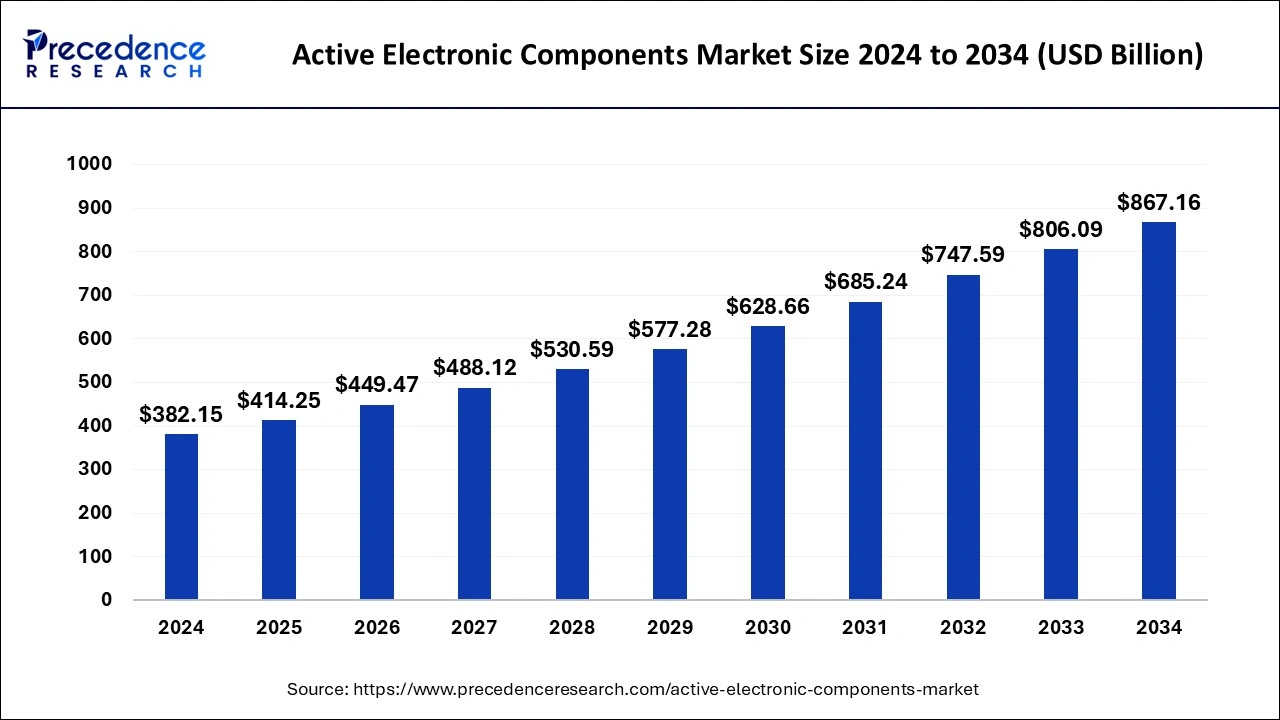

The active electronic components market size was evaluated at USD 382.15 billion in 2024 and is predicted to be surge around USD 867.16 billion by 2034 with a CAGR of 8.53%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1017

Market Key Takeaways

- Asia Pacific generated the highest revenue share, exceeding 38% in 2024.

- The semiconductor segment led the market, contributing over 58% of the revenue in 2024.

- The consumer electronics sector emerged as the dominant end-user in 2024.

- The consumer electronics segment accounted for a 32% revenue share in 2024.

Market Overview

The active electronic components market is experiencing significant growth due to increasing demand for advanced electronic devices. These components, including semiconductors, transistors, diodes, and integrated circuits, play a crucial role in various industries such as consumer electronics, automotive, telecommunications, and healthcare. Rapid technological advancements and the rise of smart devices are further fueling market expansion.

Drivers

The growing adoption of IoT devices, artificial intelligence, and 5G technology is a key driver of market growth. Rising consumer demand for smartphones, laptops, and wearable devices is also contributing to increased production of active electronic components. Additionally, advancements in automotive electronics, such as electric vehicles and autonomous driving systems, are further propelling market demand.

Opportunities

The increasing shift toward renewable energy sources creates new opportunities for active electronic components in solar panels and energy storage systems. The expansion of smart cities and industrial automation also presents a lucrative market for electronic components. Moreover, innovations in semiconductor manufacturing and miniaturization of components are expected to drive future market growth.

Challenges

Despite growth prospects, the market faces challenges such as supply chain disruptions and fluctuating raw material prices. The complexity of semiconductor manufacturing and the high cost of research and development can also hinder market expansion. Additionally, concerns regarding electronic waste management and environmental impact pose regulatory challenges.

Regional Insights

Asia Pacific dominates the active electronic components market due to the presence of key manufacturers and high demand for consumer electronics in countries like China, Japan, and South Korea. North America follows closely, driven by technological advancements and strong demand for automotive and industrial electronics. Europe is also a significant market, with increasing investments in electric vehicles and renewable energy projects. Other regions, including the Middle East and Latin America, are witnessing steady growth due to rising digitalization and infrastructure development.

Active Electronic Components Market Companies

- Infineon Technologies AG

- Fairchild Semiconductor International, Inc.

- Maxim Integrated Products Inc.

- Texas Instruments, Inc.

- Analog Devices, Inc.

- ST Microelectronics NV

- Diotec Semiconductor AG

- ON Semiconductor

- Toshiba Corporation

- NXP Semiconductors NV

- Everlight Electronics Co., Ltd.

- Vishay Intertechnology, Inc.

- Renesas Electric Corporation

- Panasonic Corporation

Recent Developments

- In January 2023, The HiRel DC-DC converter business of Infineon, comprising its hybrid and custom board-based power products, has been definitively agreed to be acquired by Micross Components, Inc. (“Micross”), according to an announcement from Infineon Technologies AG. This sale will allow Infineon to decrease its emphasis on companies that need more specialized product offerings for the high-reliability market and increase investments, and its attention on core semiconductor advancements for that market.

- In December 2022, In western Japan’s Hyogo Prefecture, Toshiba revealed that it is going to build a new manufacturing facility for power semiconductors at the Himeji Operations. Production is expected to begin in the spring of 2025 once construction begins in 2024. In comparison to fiscal 2022, the project will almost treble Toshiba’s Himeji manufacturing capabilities for automotive power semiconductors.Infineon Technologies AG announced in July 2016 that it would acquire Cree Inc.’s R.F. power and Wolf speed Power divisions. Infineon was able to strengthen its position in the semiconductor business as a result of the agreement.

- NXP Semiconductors N.V. announced the SR100T, a secure fine-ranging chipset, in September 2019. This chipset is primarily developed to deliver very accurate positioning performance for next-generation Ultra-Wide Band (UWB)-enabled mobile devices.

- Infineon Technologies AG purchased Cypress Semiconductor Corp. in June 2019 to expand its product portfolio and market position.

- In December 2022, Texas Instruments, a market pioneer in high-voltage semiconductor products, revealed that the newest 65-W laptop power adapter, Le Petit, by Chicony Power will be powered by TI’s integrated gallium nitride (GaN) technology. Chicony Power and TI worked together to develop a design that reduced the size of Chicony’s energy converter by 50% and increased efficiency by up to 94% while utilizing TI’s LMG2610 half-bridge GaN FET with an integrated gate driver.

Segments Covered in the Report

By Product

- Semiconductor Devices

- Transistors

- Diodes

- Optoelectronic Components

- Integrated Circuits

- Display Devices

- Cathode-ray Tubes

- Microwave Tubes

- X-ray Tubes

- Triodes

- Photoelectric Tubes

- Optoelectronic

- Vacuum Tubes

- Others

By End User

- Consumer electronics

- Healthcare

- Automotives

- Aerospace and defense

- Information Technology

- Others

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/