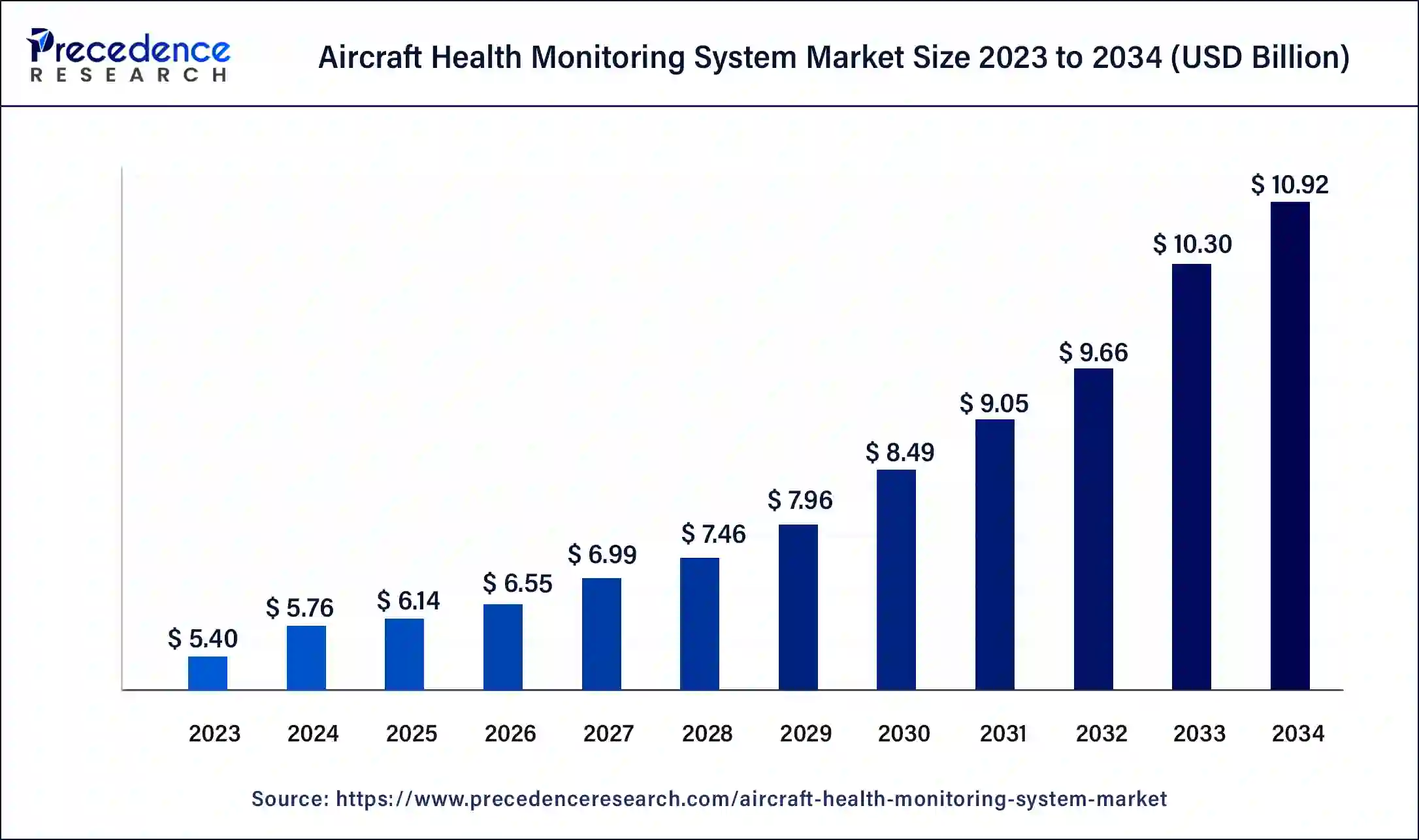

The global aircraft health monitoring system market size was estimated at USD 5.40 billion in 2023 and is projected to reach around USD 10.30 billion by 2033, growing at a CAGR of 6.67% from 2024 to 2033.

Key Points

- North America is expected to lead the global aircraft health monitoring system market in 2023 with revenue share of 34%.

- Asia Pacific is witnessing notable growth during the forecast period 2024 to 2033.

- By Fit, the line fit segment has captured highest revenue share of around 85% in 2023.

- By system, the software segment has dominated the market in 2023 with revenue share of 51% in 2023.

- By platform, the narrow body aircraft segment has dominated the market in 2023 with revenue share of 33.8%.

The Aircraft Health Monitoring System (AHMS) market plays a pivotal role in the aviation industry by providing real-time monitoring and diagnostics of aircraft components and systems. AHMS technologies enable proactive maintenance, enhance safety, and reduce operational costs for airlines and aircraft operators. This market overview will delve into the current trends, growth drivers, challenges, and future outlook of the AHMS market.

Get a Sample: https://www.precedenceresearch.com/sample/4060

Trends:

Several trends are shaping the AHMS market. Firstly, there’s a growing adoption of predictive maintenance solutions powered by advanced data analytics and machine learning algorithms. Airlines are increasingly leveraging predictive maintenance to anticipate component failures, optimize maintenance schedules, and minimize aircraft downtime.

Secondly, there’s a rising demand for integrated AHMS solutions that can monitor multiple aircraft systems and components simultaneously. Integrated AHMS platforms offer comprehensive monitoring capabilities, streamline data management, and improve operational efficiency for airlines and maintenance providers.

Furthermore, there’s a shift towards cloud-based AHMS solutions that offer scalability, flexibility, and remote accessibility. Cloud-based AHMS platforms enable real-time data analysis, predictive modeling, and collaborative decision-making among stakeholders across the aviation ecosystem.

Aircraft Health Monitoring System Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.67% |

| Global Market Size in 2023 | USD 5.40 Billion |

| Global Market Size in 2024 | USD 5.76 Billion |

| Global Market Size by 2033 | USD 10.30 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Platform, By Fit, By System, and By Operation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Aircraft Health Monitoring System Market Dynamics

Growth Drivers:

The AHMS market is driven by several factors. Firstly, stringent regulatory requirements mandating the implementation of aircraft health monitoring systems to enhance safety and reliability are driving market growth. Regulatory bodies such as the Federal Aviation Administration (FAA) and the European Aviation Safety Agency (EASA) require airlines to implement AHMS technologies to comply with airworthiness standards.

Secondly, the growing emphasis on operational efficiency and cost reduction is fueling the adoption of AHMS solutions. Airlines are under pressure to optimize maintenance processes, minimize unscheduled maintenance events, and maximize aircraft utilization to remain competitive in the market.

Moreover, the increasing complexity of modern aircraft systems and the proliferation of data-driven technologies are driving demand for AHMS solutions. Aircraft manufacturers and operators are investing in advanced monitoring and diagnostic capabilities to effectively manage the health and performance of critical components such as engines, avionics, and airframe structures.

Challenges:

Despite the promising growth prospects, the AHMS market faces several challenges. Firstly, there are interoperability issues associated with integrating AHMS solutions with existing aircraft systems and data infrastructure. Ensuring seamless communication and compatibility between different AHMS components and aircraft platforms remains a significant challenge for manufacturers and operators.

Secondly, concerns related to data security, privacy, and regulatory compliance pose challenges for the adoption of cloud-based AHMS solutions. Airlines and maintenance providers must implement robust cybersecurity measures to protect sensitive aircraft data and comply with data protection regulations such as the General Data Protection Regulation (GDPR).

Furthermore, the high initial investment required for deploying AHMS technologies and the complexity of transitioning from traditional maintenance practices to predictive maintenance models represent barriers to adoption for some stakeholders in the aviation industry.

Future Outlook:

Despite the challenges, the AHMS market is poised for significant growth in the coming years. Technological advancements in sensor technology, data analytics, and artificial intelligence will drive innovation and enable the development of more sophisticated AHMS solutions capable of predictive maintenance, prognostics, and health management.

Moreover, the increasing focus on sustainability and environmental performance is expected to drive demand for AHMS solutions that optimize fuel efficiency, reduce emissions, and minimize environmental impact.

Read Also: Space Technology Market Size to Rake USD 916.85 Bn by 2033

Recent Developments

- In June 2023, GE Engine Services LLC (General Electric Company) was selected by Korea Aerospace Industries (KAI) to supply health and usage monitoring systems (HUMS).

- In July 2022, Curtiss-Wright Corporation was awarded a contract by Airbus to provide custom actuation technology. This technology offers improved reliability over legacy systems and incorporates health monitoring functions.

- In April 2022, Lufthansa Technik announced that it had recently enhanced its AVIATAR digital platform with various new digital fleet management applications for the Boeing 737 NG (Next Generation), which are now available to 737 operators around the world.

- In March 2022, Indigo announced that it had become the 55th airline to adopt Skywise Health Monitoring (SHM) as its future fleet performance tool.

Aircraft Health Monitoring System Market Companies

- Airbus SE

- Curtiss-Wright Corporation

- FLYHT Aerospace Solutions Ltd.

- GE Engine Services LLC (General Electric Company)

- Honeywell Aerospace

- Meggitt Plc

- Rolls-Royce Plc

- Safran

- SITA N.V.

- The Boeing Company

Segments Covered in the Report

By Platform

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Aircraft

- Business Jet

- Helicopter

- Fighter Jet

By Fit

- Line Fit

- Retrofit

By System

- Hardware

- Software

- Services

By Operation

- Real-time

- Non-real-time

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/