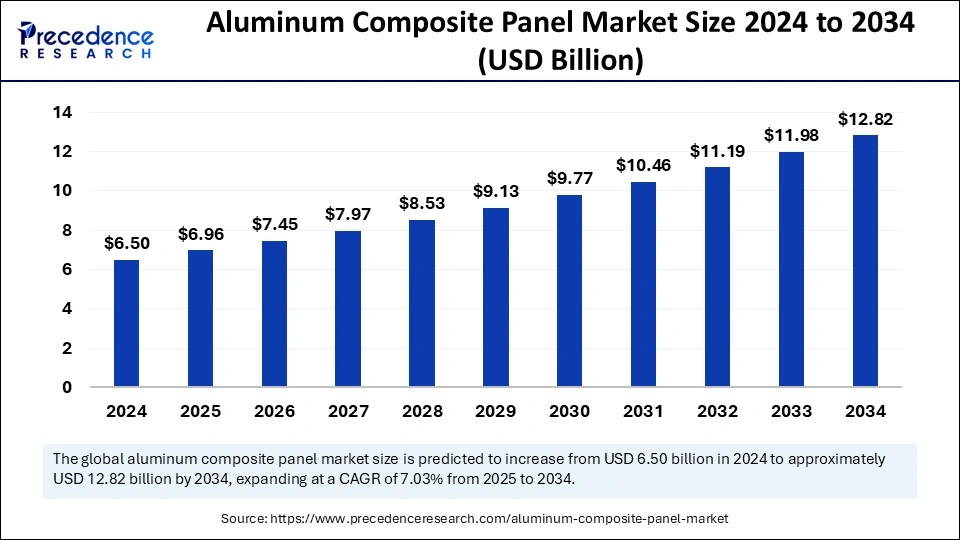

The global aluminum composite panel market size was estimated at USD 6.50 billion in 2024 and is expected to reach around USD 12.82 billion by 2034, growing at a CAGR of 7.03%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5819

Aluminum Composite Panel Market Key Points

-

In 2024, Asia Pacific led the global market, accounting for 41% of the total market share.

-

North America is forecasted to register the fastest growth in the coming years.

-

Europe is expected to expand at a notable CAGR during the forecast timeframe.

-

The polyvinylidene fluoride product segment dominated with a 37% share in 2024.

-

The laminating coating segment is likely to grow at a CAGR of 6.44% through the forecast period.

-

Construction remained the top application, securing 55% of the market share in 2024.

-

The advertising boards segment is anticipated to grow steadily at a CAGR of 6.54%.

Role of AI in Aluminum Composite Panel Industry

Artificial Intelligence (AI) is playing a transformative role in enhancing the efficiency and quality control of aluminum composite panel manufacturing. Through machine learning and automation, AI enables real-time monitoring of production lines, helping manufacturers detect surface defects, inconsistencies in coating, and structural flaws early in the process significantly reducing waste and ensuring consistent product quality.

Additionally, AI-driven data analytics support demand forecasting and inventory management, allowing manufacturers to optimize resource allocation and minimize production downtime. In design and R&D, AI helps simulate material behaviors under various environmental conditions, speeding up innovation in developing fire-resistant, lightweight, and sustainable ACPs. Overall, AI contributes to smarter manufacturing, improved product performance, and cost savings across the ACP value chain.

Aluminum Composite Panel (ACP) Market Growth Factors

1. Expansion in the Construction Industry

The surge in global construction activities, particularly in emerging economies, is a primary driver for ACP demand. ACPs are favored for their lightweight, durability, and aesthetic versatility, making them ideal for modern architectural designs. Their applications in exterior cladding, roofing, and interior decoration contribute significantly to market growth.

2. Urbanization and Infrastructure Development

Rapid urbanization and the development of infrastructure projects worldwide have increased the demand for ACPs. These panels are utilized in various applications, including transportation and signage, due to their adaptability and ease of installation.

3. Emphasis on Energy Efficiency and Sustainability

With growing environmental concerns, there is a heightened focus on energy-efficient and sustainable building materials. ACPs contribute to this trend by offering thermal insulation and reducing energy consumption in buildings. Their recyclability and low maintenance further enhance their appeal in green construction practices.

4. Technological Advancements and Product Innovation

Continuous advancements in ACP technology, such as the development of fire-resistant and antibacterial panels, have expanded their application scope. Innovations in coating technologies, like PVDF and PE coatings, have improved the durability and weather resistance of ACPs, making them suitable for diverse environments.

5. Growth in Advertising and Signage Applications

The advertising industry’s expansion has led to increased use of ACPs in signage and display applications. Their smooth surface, printability, and resistance to environmental factors make them an ideal choice for outdoor advertising boards and displays.

Market Overview

The aluminum composite panel market is expanding steadily, fueled by rising demand from the construction, automotive, and signage industries. Known for being lightweight, cost-effective, and offering aesthetic appeal, ACPs are widely used for cladding, facades, and interior design. Their durability, easy installation, and low maintenance make them highly desirable in both commercial and residential projects.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.82 Billion |

| Market Size in 2025 | USD 6.96 Billion |

| Market Size in 2024 | USD 6.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.03% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Key drivers include growing global construction activities, especially in rapidly developing countries, and continuous technological advancements. Innovations in coating technologies such as PVDF have improved weather resistance, fire safety, and thermal insulation. Rising urbanization and infrastructure investments are also pushing market growth.

Opportunities

There is significant opportunity in the growing demand for sustainable and energy-efficient construction materials. Eco-conscious design trends and green building certifications are encouraging developers to opt for recyclable materials like ACPs. Additionally, anti-bacterial and fire-retardant variants are opening new doors in healthcare and high-rise buildings.

Challenges

The market faces challenges including fluctuating aluminum prices and environmental concerns regarding plastic core materials. Regulatory compliance with strict fire safety standards is also a concern for manufacturers. Furthermore, intense competition from alternative materials can impact market share.

Regional Insights

Asia Pacific dominated the market in 2024, capturing over 41% of global revenue, thanks to robust construction activity in countries like China and India. North America is forecasted to grow at the fastest pace due to a focus on energy-efficient buildings, while Europe will grow steadily, driven by sustainability policies and innovation

Recent Developments

- In February 2025, Viva ACP announced Bricklyn as the latest addition to their Santa Fe series, and Vive ACP is Asia’s largest aluminum composite panel manufacturer. Bricklyn was inspired by combining themes of modern design elements with the durability of real brick to provide a heritage loSok with modern technology.

- In November 2024, ALUCOBOND, the renowned Swiss-based 3A Composites brand, released “ALUCODUAL,” which entered the market as an innovation within its high-quality aluminum composite material offerings. The new ALUCODUAL product focuses on architectural applications because it targets scenarios needing advanced technological cladding solutions with exceptional design and performance capabilities.

- In June 2023, the new aluminum composite panels manufacturing plant of Alumaze opened its doors to operations in Visakhapatnam. Pawan Hirawat expressed that Alumaze established itself through 50 crore capital to produce ACP sheets at the Ravada hamlet of Bhogapuram in the Vizianagaram district.

Aluminum Composite Panel Market Companies

- 3A Composites GmbH

- Alcoa Corporation

- Alpolic Materials

- A strong Enterprises

- Alubond U.S.A.

- Aludecor Lamination Pvt. Ltd.

- Alumax Industrial Co., Ltd.

- Arconic Corporation

- Changshu Kaidi Decoration Co., Ltd.

- Fairfield Metal LLC

- Guangzhou Xinghe Co., Ltd.

- Jyi Shyang Industrial Co., Ltd.

- Mitsubishi Chemical Corporation

- Shanghai Huayuan Co., Ltd.

- Yaret Industrial Group Co., Ltd.

Segments Covered in the Report

By product

- PVDF

- Polyester

- Laminating coating

- Oxide film

- Others

By application

- Construction

- Automotive

- Cars

- Doors

- Hoods

- Wings

- Side panels

- Others

- Commercial vehicle

- Trailers

- Cars

- Advertising boards

- Railways

- Others

By region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Also Read: Magnesium Stearate Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/