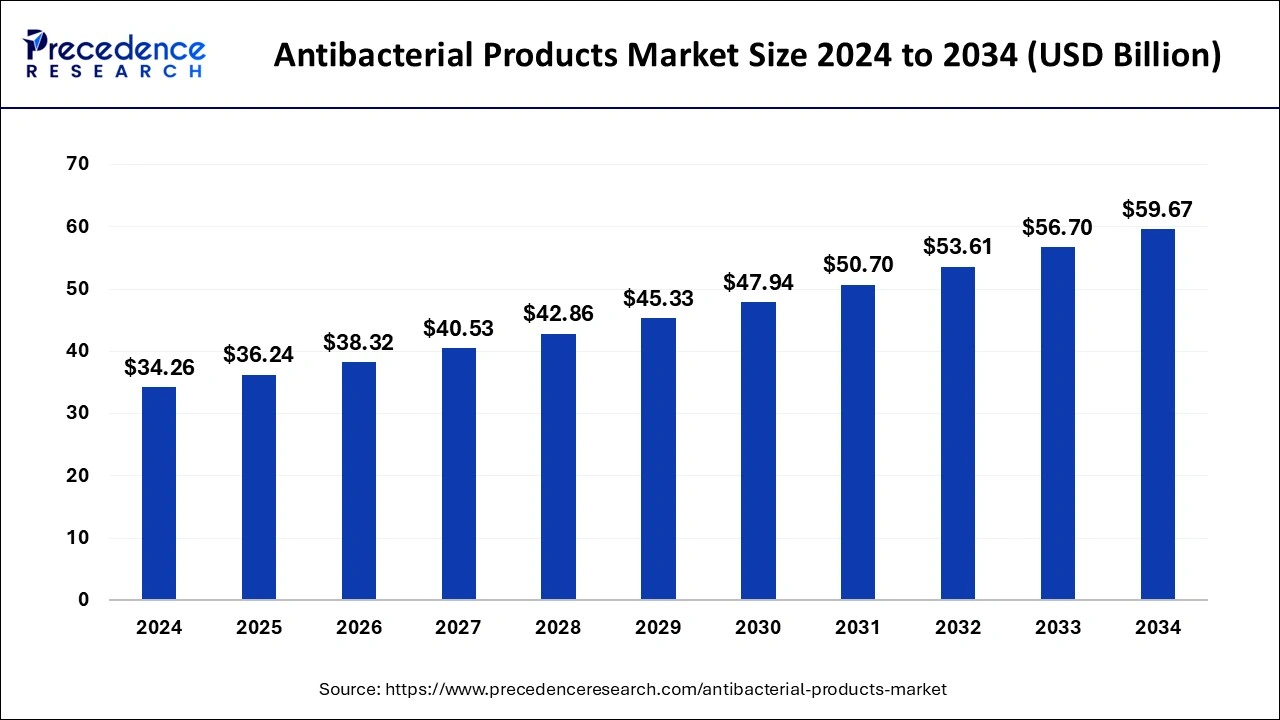

The global antibacterial products market size was estimated at USD 32.40 billion in 2023 and is projected to attain around USD 56.70 billion by 2033, growing at a CAGR of 5.75% from 2024 to 2033.

Key Points

- Asia Pacific dominated the global antibacterial products market in 2023 with a revenue share of 48%.

- By Product, the hand soap segment dominated the global antibacterial products market with the largest share of around 38% in 2023.

- By Product, the hand sanitizers segment held the second position while showing a notable rate of growth during the forecast period.

- By Distribution channel, the hypermarkets and supermarkets segment dominated the market with a revenue share of 47.5% in 2023.

- By distribution channel, the online platforms segment has held a 24% revenue share in 2023.

The global antibacterial products market encompasses a wide range of goods designed to prevent or eliminate harmful bacteria. These products play a crucial role in maintaining public health, hygiene, and safety across various industries and settings. The market for antibacterial products has witnessed significant growth in recent years, driven by increasing awareness of infectious diseases, rising concerns about antimicrobial resistance, and a growing emphasis on cleanliness and sanitation. Understanding the key trends, growth factors, challenges, and opportunities within the antibacterial products market is essential for stakeholders to make informed decisions and capitalize on emerging market dynamics.

Get a Sample: https://www.precedenceresearch.com/sample/4064

Trends:

Several notable trends are shaping the antibacterial products market. One prominent trend is the growing demand for natural and eco-friendly antibacterial solutions. Consumers are increasingly seeking products formulated with plant-based ingredients or organic compounds, driven by concerns about the environmental impact of traditional antibacterial agents and chemicals.

Another trend is the expansion of antibacterial product offerings across various industries, including healthcare, personal care, household cleaning, and food processing. Manufacturers are innovating to develop specialized antibacterial formulations tailored to specific applications and consumer preferences, driving product differentiation and market growth.

Furthermore, the rise of antimicrobial stewardship programs and regulatory initiatives aimed at curbing antimicrobial resistance is influencing the development and marketing of antibacterial products. Companies are under increasing pressure to demonstrate the safety, efficacy, and responsible use of antibacterial agents to comply with regulations and address public health concerns.

Antibacterial Products Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.75% |

| Global Market Size in 2023 | USD 32.40 Billion |

| Global Market Size in 2024 | USD 34.26 Billion |

| Global Market Size by 2033 | USD 56.70 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growth Factors:

Several factors contribute to the growth of the antibacterial products market. The primary driver is the increasing prevalence of infectious diseases and healthcare-associated infections (HAIs). Rising incidences of bacterial infections, coupled with growing awareness of the importance of infection prevention and control, are driving demand for antibacterial products in healthcare facilities, households, and public spaces.

Additionally, changing consumer lifestyles and hygiene habits, especially in the wake of the COVID-19 pandemic, have accelerated the adoption of antibacterial products. Heightened awareness of hand hygiene, surface disinfection, and personal protection measures has led to increased demand for antibacterial soaps, hand sanitizers, disinfectants, and antimicrobial textiles.

Moreover, advancements in antibacterial technology and product innovation are fueling market growth. Manufacturers are investing in research and development to create novel antibacterial formulations with enhanced efficacy, longer-lasting protection, and reduced environmental impact. Technological innovations such as nanotechnology, antimicrobial coatings, and UV-C disinfection are driving product differentiation and market competitiveness.

Challenges:

Despite the growth opportunities, the antibacterial products market faces several challenges. One challenge is the emergence of antimicrobial resistance (AMR), which poses a significant threat to public health and healthcare systems worldwide. Prolonged and indiscriminate use of antibacterial agents can contribute to the development of resistant bacteria, rendering existing treatments ineffective and limiting treatment options for infectious diseases.

Another challenge is regulatory scrutiny and compliance requirements governing the use of antibacterial ingredients. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Chemicals Agency (ECHA) closely monitor the safety, efficacy, and environmental impact of antibacterial products, imposing stringent regulations and restrictions on certain ingredients and formulations.

Furthermore, consumer skepticism and misinformation surrounding antibacterial products present challenges for manufacturers and marketers. There is a perception among some consumers that antibacterial agents may contribute to antibiotic resistance or have adverse health effects, leading to reluctance or skepticism towards using antibacterial products.

Opportunities:

Despite the challenges, the antibacterial products market presents significant opportunities for growth and innovation. One opportunity lies in the development of next-generation antibacterial agents and technologies with broader spectrum activity, lower toxicity, and reduced potential for inducing resistance. Investment in research and development aimed at discovering novel antimicrobial compounds and mechanisms of action can drive innovation and address unmet needs in infection prevention and control.

Moreover, the expansion of the antibacterial products market into new applications and end-user segments offers opportunities for market players to diversify their product portfolios and capture untapped market potential. For example, the use of antibacterial coatings in healthcare facilities, food processing plants, and public transportation systems can help reduce the risk of microbial contamination and transmission.

Furthermore, partnerships and collaborations between industry stakeholders, academia, and government agencies can facilitate knowledge sharing, technology transfer, and regulatory harmonization efforts. By working together, stakeholders can accelerate the development and commercialization of safe, effective, and sustainable antibacterial products while addressing public health challenges associated with antimicrobial resistance and infectious diseases.

Read also: Protein A Resins Market Size to Rake USD 2.60 Billion By 2033

Recent Developments

- In 2022, a Russia-based pharmaceutical manufacturing group acquired a medicine brand to increase the production of medicines related to antibacterial products.

- In 2021, NSG Group launched antibacterial glass to maintain hygiene when people touch the glass. The innovation covers a large portion of users and it provides glass cover for smartphones and other electronic devices.

- In 2021, Medimix launched their antibacterial hand sanitizer gels for convenient use. The product includes glycerin, aloe vera gel and other basil products.

- In 2021, ITC an India-based manufacturing company launched a Savlon moisturizing sanitizer. The product contains five ingredients which help to kill germs without the use of any soap or water.

Antibacterial Products Market Companies

- Reckitt Benckiser Group Plc

- Unilever

- Johnson & Johnson

- Farouk Systems

- Guardpack

- Nice-pak Products Inc

- GOJO Industries, Inc

- The Himalaya Drug Company

- Rockline Industries

- Sebapharma GmbG& Co. KG

- Bielenda

- fco Lp

- Colgate- Palmolive Company

- Henkel Corporation

Segments Covered in the Report

By Product

- Body Moisturizer

- Hand Cream and Lotion

- Facial Cleansers

- Hand Soap

- Hand Sanitizer

- Body Wash

By Distribution Channel

- Hypermarkets and supermarkets

- Pharmacy and Drug Stores

- Specialty Stores

- Online

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/