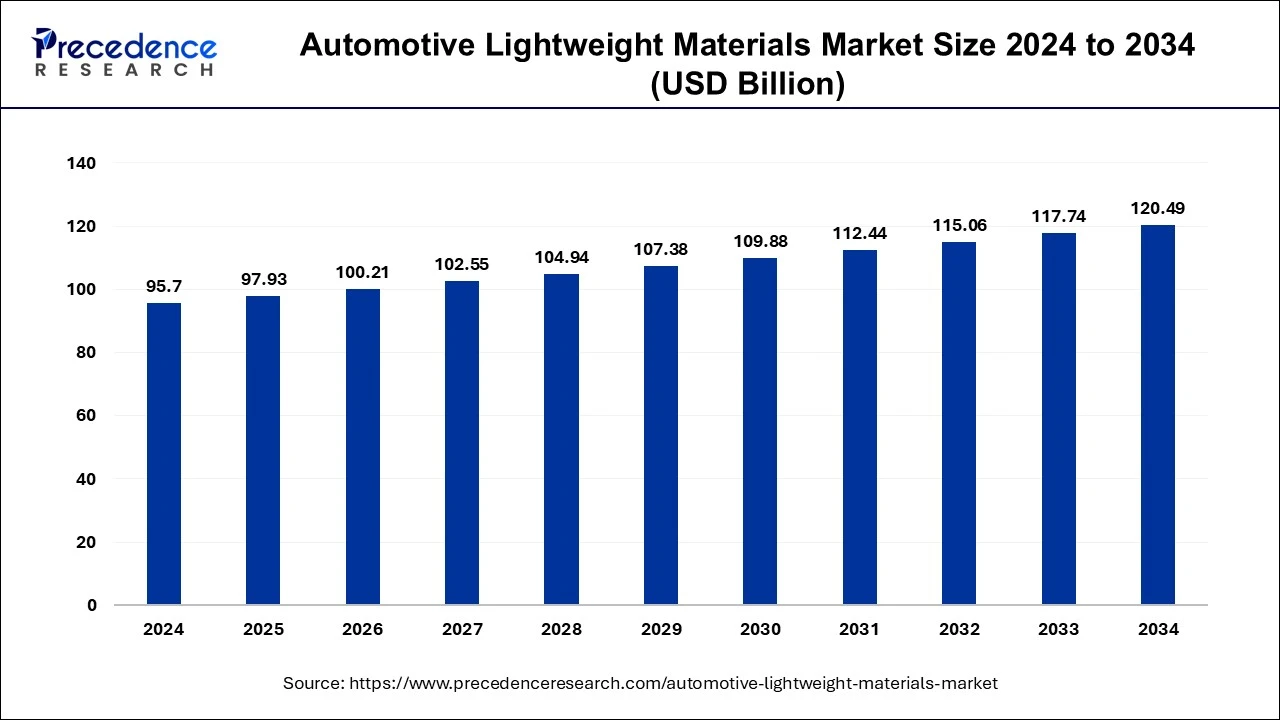

The global automotive lightweight materials market size is projected to reach around USD 120.49 billion by 2034 from USD 95.7 billion in 2024 with a CAGR of 2.33%.

Key Points

- In 2024, Europe led the global automotive lightweight market with a dominant market share of 36.52%.

- The automotive lightweight materials market in Germany is experiencing a strong CAGR of 6.99% over the forecast period.

- North America is anticipated to grow at a steady CAGR of 4.96% throughout the forecast period.

- The composites segment accounted for the highest market share of 66% in 2024 by material type.

- The plastics segment is expected to expand at a CAGR of 3.83% during the forecast period.

- By application, the body in white (BiW) segment held the largest market share of 26% in 2024.

- The closures segment is projected to grow at a CAGR of 2.6% over the forecast period.

- The passenger cars segment dominated the market in 2024, holding an 83% share by end use.

- The light commercial vehicles (LCVs) segment is growing at a CAGR of 3.3% over the forecast period.

Market Dynamics

Drivers

The automotive lightweight materials market is driven by the increasing demand for fuel-efficient and high-performance vehicles. Stringent government regulations regarding carbon emissions and fuel economy are pushing automakers to adopt lightweight materials such as composites, aluminum, and high-strength steel. Additionally, the rising production of electric vehicles (EVs) is fueling the demand for lightweight materials to enhance battery efficiency and driving range.

Opportunities

The growing advancements in material science and manufacturing techniques are opening new opportunities for market expansion. The increasing use of recycled and bio-based materials in automotive components is gaining traction, driven by sustainability concerns. Furthermore, the rising adoption of electric and hybrid vehicles is expected to create new demand for lightweight materials that optimize vehicle efficiency without compromising structural integrity.

Challenges

Despite the benefits, the high cost of advanced lightweight materials remains a major challenge, particularly in cost-sensitive markets. The complexities in manufacturing and integrating lightweight materials into existing vehicle designs can also hinder adoption. Moreover, supply chain disruptions and fluctuations in raw material prices pose risks to market growth.

Regional Insights

Europe leads the automotive lightweight materials market due to stringent emission regulations and a strong presence of automotive manufacturers investing in lightweight solutions. North America is also a key market, driven by government policies and consumer demand for fuel-efficient vehicles. The Asia-Pacific region is expected to witness rapid growth, driven by rising vehicle production, urbanization, and increasing investments in electric mobility.

Automotive Lightweight Materials Market Companies

- Henkel AG & Co.

- DuPont

- NovaCentrix

- KGaA

- Intrinsiq Materials, Inc.

- Creative Materials Inc.

- Vorbeck Materials Corporation, Inc

- Johnson Matthey PLC

- Heraeus Holding GmbH

- Applied Ink Solutions

Recent Developments

- In April 2024, Hyundai and Toray, carbon fiber specialist collaborated to develop lightweight and high strength materials. This partnership aims to develops durable materials that are sustainable with joint research and development activities to improve performance of EV batteries and motors.

- In April 2024, LyondellBasell and ASIN signed an agreement for the development of innovative lightweight plastics.

- In May 2024, Covestro and Arecesso’s Arfinio Technology received accolades with innovation award at German Innovation Award 2024. This is a technology that will help produce lightweight, recyclable, and replaceable solid surface materials.

Segments Covered in the Report

By Vehicle

- Passenger Vehicles

- Heavy Commercial Vehicles [HCVs]

- Light Commercial Vehicles [LCVs]

By Material

- High-strength Steel [HSS]

- Metal Alloys

- Polymers

- Composites

By Application

- Exterior

- Interior

- Powertrain

- Structural

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World