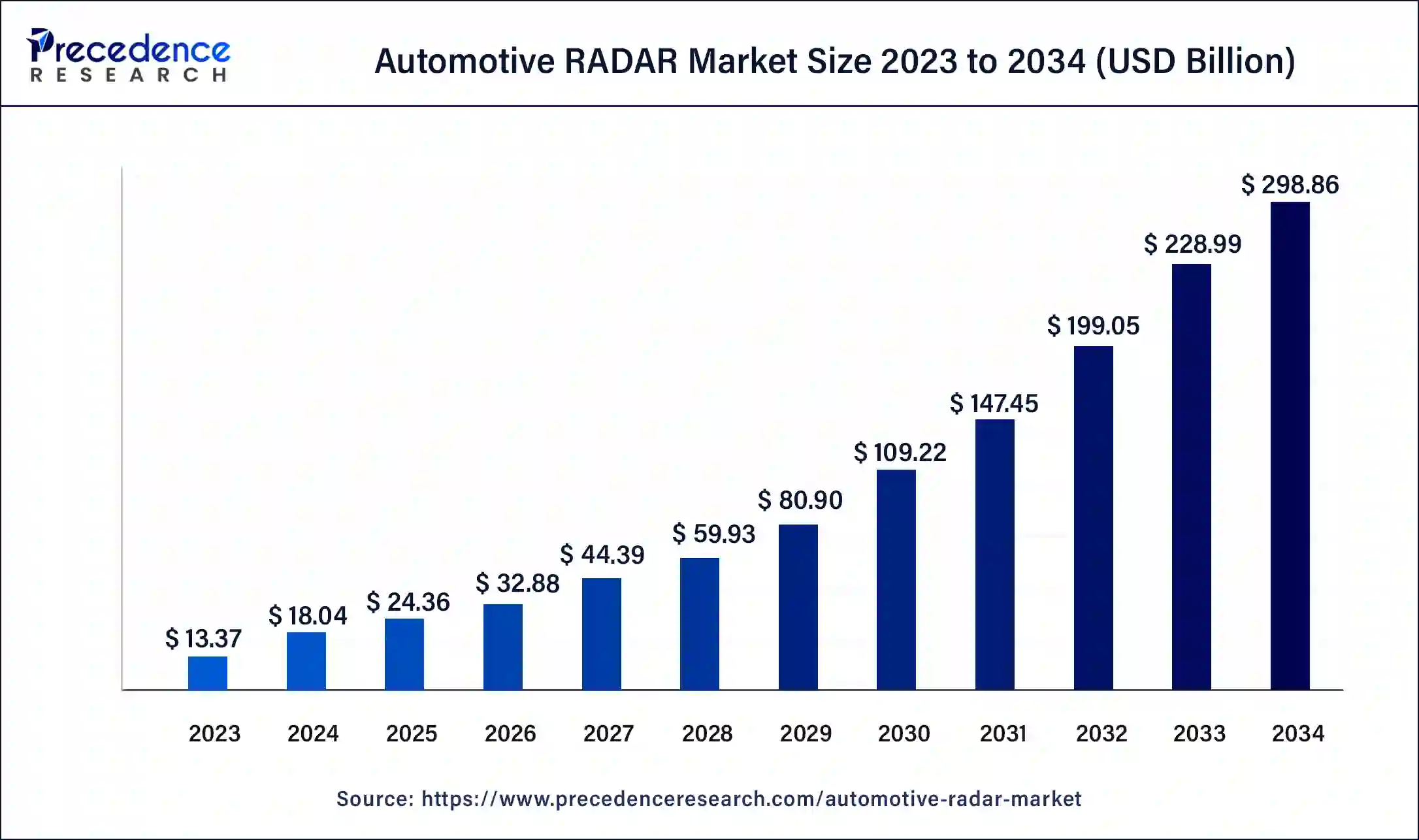

The global automotive RADAR market size is valued at USD 18.04 billion in 2024 and is projected to attain around USD 298.86 billion by 2034, with a CAGR of 32.4%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1034

Market Key Takeaways

- Asia Pacific dominated the global market in 2023, holding the highest market share.

- Europe is anticipated to grow at the fastest CAGR during the forecast period.

- The Short & Medium Range RADAR (S&MRR) segment recorded the largest market share in 2023.

- The intelligent park assist segment accounted for over 52% of the revenue share in 2023.

- The adaptive cruise control (ACC) segment is projected to grow at the fastest CAGR over the forecast period.

AI-Driven Innovation in Automotive RADAR Market

AI is playing a crucial role in optimizing automotive RADAR by enabling more precise and intelligent sensing. Advanced algorithms enhance RADAR’s ability to differentiate between static and moving objects, minimizing errors in detection. The combination of AI with RADAR technology is accelerating the development of self-driving cars, improving navigation, and enhancing overall vehicle safety.

Market Drivers

The increasing demand for advanced driver assistance systems (ADAS) and safety features is a major driver of the automotive RADAR market. Stringent government regulations mandating safety technologies, along with growing consumer awareness regarding vehicle safety, are fueling market growth. The rising adoption of autonomous and semi-autonomous vehicles is further accelerating the demand for RADAR-based sensing technologies.

Opportunities

Technological advancements in millimeter-wave RADAR and artificial intelligence-driven sensing solutions present significant opportunities for market growth. Expanding electric vehicle (EV) adoption and the development of smart transportation infrastructure create new avenues for RADAR applications. Moreover, increasing investments in connected car technology and vehicle-to-everything (V2X) communication further enhance market potential.

Challenges

High costs associated with RADAR system integration and calibration pose a challenge to widespread adoption. Technical limitations, such as signal interference and difficulties in detecting small or stationary objects, can affect RADAR system efficiency. Additionally, competition from alternative sensing technologies like LiDAR and ultrasonic sensors adds complexity to market expansion.

Regional Insights

The Asia Pacific region dominates the market due to rapid automotive industry expansion, government safety regulations, and growing consumer demand for advanced vehicles. North America is also witnessing strong growth, driven by increasing investments in autonomous driving technologies. Meanwhile, Europe benefits from strict safety mandates and the presence of key automotive manufacturers, boosting RADAR system adoption.

Automotive RADAR Market Companies

- Continental AG

- Autoliv Inc.

- DENSO Corporation

- Delphi Automotive Company

- NXP Semiconductors

- Texas Instruments

- Robert Bosch GmbH

- ZF Friedrichshafen

- Valeo

- Analog

Segments Covered in the Report

By Frequency

- 24 GHz

- 77 GHz

- 79GHz

By Range

- Short & Medium Range RADAR (S&MRR)

- Long Range RADAR (LRR)

By Vehicle Type

- Commercial Vehicle

- Passenger Vehicle

By Application

- Autonomous Emergency Braking (AEB)

- Adaptive Cruise Control (ACC)

- Forward Collision Warning System

- Intelligent Park Assist

- Blind Spot Detection (BSD)

- Others ADAS Applications

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/