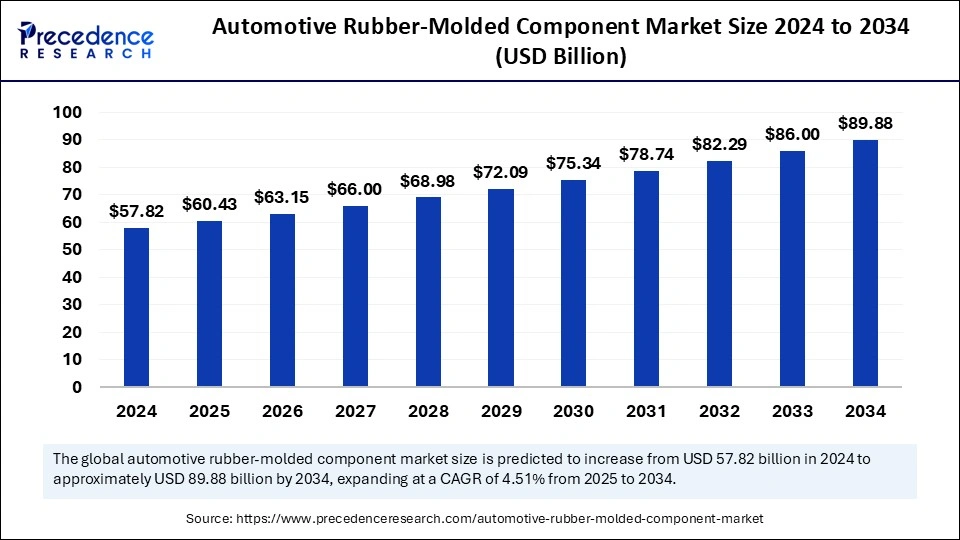

The global automotive rubber-molded component market size was valued at USD 57.82 billion in 2024 and is expected to reach around USD 89.88 billion by 2034, growing at a CAGR of 4.51% from 2025 to 2034.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/5738

Automotive Rubber-Molded Component Market Key Points

-

Asia Pacific emerged as the market leader in 2024, holding the highest share.

-

North America is expected to experience substantial growth throughout the forecast period.

-

Among materials, EPDM (ethylene propylene diene monomer) dominated the market in 2024.

-

The SBR (styrene-butadiene rubber) segment is set to expand significantly in the coming years.

-

By component, seals accounted for the largest market share in 2024.

-

The gaskets segment is projected to witness considerable growth over the forecast period.

-

Passenger cars led the market in 2024 based on vehicle type.

-

The commercial vehicles segment is expected to register notable growth during the study period.

AI’s Role in Advancing the Automotive Rubber-Molded Component Market

-

AI-powered predictive analytics optimize raw material usage, reducing waste and enhancing cost efficiency.

-

Machine learning algorithms improve manufacturing precision, ensuring consistent quality and durability.

-

AI-driven automation accelerates production, minimizing manual errors and improving scalability.

-

Advanced AI-based inspection systems detect defects in rubber-molded components with high accuracy.

-

AI enhances supply chain management by predicting demand and optimizing inventory levels.

Automotive Rubber-Molded Component Market Overview

The automotive rubber-molded component market is experiencing steady growth due to rising vehicle production and increasing demand for durable, high-performance components. These components play a crucial role in ensuring vehicle safety, efficiency, and durability. Advances in rubber compounds, coupled with innovations in manufacturing technologies, are driving the market forward. Additionally, the push for lightweight materials in vehicles to enhance fuel efficiency is boosting the demand for rubber-molded components.

Also Read: Rail Glazing Market

Automotive Rubber-Molded Component Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 89.88 Billion |

| Market Size in 2025 | USD 60.43 Billion |

| Market Size in 2024 | USD 57.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.51% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Component Type, Vehicle Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Automotive Rubber-Molded Component Market Dynamics

Market Drivers

Key drivers fueling the market include the expansion of the automotive industry, stringent emission regulations, and the growing adoption of electric vehicles (EVs). The demand for high-performance sealing solutions, vibration dampeners, and weatherproofing components has surged due to advancements in vehicle design and increasing safety concerns. Moreover, the integration of AI and automation in manufacturing processes has improved product quality and efficiency, further accelerating market growth.

Opportunities

The shift toward electric and hybrid vehicles presents significant opportunities for the automotive rubber-molded component market. Manufacturers are developing innovative rubber materials that can withstand high temperatures and electrical insulation requirements. Additionally, the rising focus on sustainable and recyclable rubber products is opening new growth avenues. Expanding markets in developing regions, where automotive production is increasing, also present lucrative prospects for industry players.

Challenges

Despite growth opportunities, the industry faces several challenges. Fluctuating raw material prices and supply chain disruptions impact production costs and profit margins. The industry also needs to address concerns regarding the environmental impact of rubber waste and develop sustainable solutions. Furthermore, competition from alternative materials such as advanced polymers may pose a challenge to market expansion.

Regional Insights

The Asia Pacific region dominates the market due to its strong automotive manufacturing base in countries like China, Japan, and India. The region benefits from high vehicle production rates and increasing investments in electric mobility. North America is witnessing steady growth, driven by advancements in automotive technology and a strong focus on sustainability. Europe is also a key player, supported by stringent regulations on emissions and safety standards, which drive the demand for high-quality rubber components.

Automotive Rubber-Molded Component Market Recent Developments

- In December 2024, Pricol, an automotive components maker, announced its plan to acquire Sundaram Auto Components’ injection molding business for Rs 215 crore. The company stated that it is acquiring its wholly-owned subsidiary, Pricol Precision Products Pvt Ltd.

- In June 2024, Celanese announced the expansion of its portfolio of materials for automotive boots and bellows. New solutions include multiple sustainable materials and a new grade suitable for injection molding of these parts. New materials aimed at achieving performance requirements while reducing the carbon footprint.

Automotive Rubber-Molded Component Market Companies

- NOK Corporation

- Trelleborg AB

- AB SKF

- Continental AG

- Federal-Mogul Corporation

- ALP Group

- Bohra Rubber Pvt. Ltd

- Cooper-Standard Automotive

- DANA Holding Corporation

- Freudenberg and Co. Kg

- Hebei Shinda Seal Group

- Hutchinson SA

- Steele Rubber Products

- Sumitomo Riko Co. Ltd

- Jayem Auto Industries Pvt Ltd

- Bony Polymers Pvt Ltd

Segments Covered in the Report

By Material Type

- Ethylene Propylene Diene Monomer (EPDM)

- Natural Rubber (NR)

- Styrene-butadiene Rubber (SBR)

- Others

By Component Type

- Seals

- Gaskets

- Hoses

- Weather-strips

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)