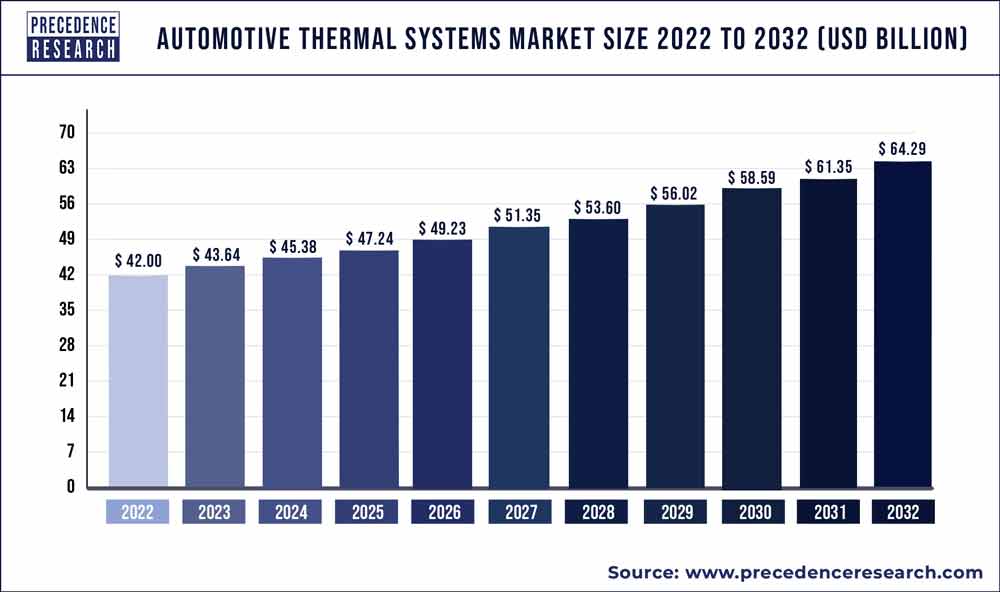

According to a research report “Automotive Thermal Systems Market (By Component: Compressor, Heating Ventilation Air Conditioning (HVAC), Powertrain Cooling, Fluid Transport; By Vehicle Type: Passenger Vehicles and Commercial Vehicles; By Application: Front & Rear A/C, Engine and Transmission, Seat, Battery, Motor, Waste Heat Recovery, and Power Electronics) – Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2021 – 2030″ published by Precedence Research, the automotive thermal systems market is projected to grow from USD 34.71 billion in 2022 and is forecasted to reach USD 47.3 billion by 2030; it is expected to grow at a CAGR of 3.9% from 2021 to 2030.

The study provides an analysis of the period 2017-2030, wherein 2021 to 2030 is the forecast period and 2021 is considered as the base year.

The market for automotive thermal system is expected to increase significantly during the forecast period. Several factors, including strict pollution restrictions and emission norms, as well as rising global warming, have contributed to the increase in demand for automotive thermal system in the market.

One of the primary drivers driving the automotive thermal system market expansion is the growing demand to reduce carbon emissions produced by internal combustion engines in automobiles, as well as rigorous emission regulatory frameworks enforced by government agencies in developing regions. Aside from that, the automotive thermal system industry is being boosted by the increasing use of innovative Heating Ventilation Air Conditioning (HVAC) systems that are less harmful to the environment.

Get a Free Sample Copy of this Report with Global Industry Analysis @ https://www.precedenceresearch.com/sample/1520

Table of Contents

Report Highlights

- Based on the vehicle type, the passenger vehicle segment dominated the global automotive thermal system market in 2020 with highest market share. The increased per capita income and higher standard of living are two significant reasons driving passenger vehicle sales in many countries. The automotive thermal system market is also likely to be driven by a growing desire for luxury and comfort, as well as demand for advanced amenities such as rear A/C, ventilated seats, and heated steering.

Market Estimations Y-O-Y:

-

Market Size Was Valued In 2021: US$ 33.43 Billion

-

Market Size Is Projected to Grow By 2022: US$ 34.71 Billion

-

Market Size Is Projected to Grow By 2023: US$ 36.05 Billion

-

Market Size Is Projected to Grow By 2024: US$ 37.45 Billion

-

Market Size Is Projected to Grow By 2025: US$ 38.91 Billion

-

Market Size Is Projected to Grow By 2026: US$ 40.44 Billion

-

Market Size Is Projected to Grow By 2027: US$ 42.03 Billion

-

Market Size Is Projected to Grow By 2028: US$ 43.69 Billion

-

Market Size Is Projected to Grow By 2029: US$ 45.43 Billion

-

Market Size Is Projected to Grow By 2030: US$ 47.3 Billion

-

Compound Annual Growth Rate (CAGR) from 2022 to 2030: 3.9 percent

Market Dynamics

Drivers

Surge in demand for electric vehicles

The major market players have been compelled to provide electric vehicles all over the world due to the factors such as rising demand for low-emission commuting and governments supporting long-range, zero emission vehicles through subsidies and tax rebates. As a result, there is an increasing demand for electric vehicles in the market. The cost of batteries is predicted to decrease as the demand for electric vehicles is expected to grow.

This is driving the growth of the battery electric vehicles in the market. The battery electric vehicles require power electronics, battery cooling, and electric motor cooling. By successfully utilizing waste heat, thermal system plays a vital role in boosting driving time and performance. As a result, the surge in demand for electric vehicles is driving the growth of the global automotive thermal system market.

Restraints

Lack of standardization and high cost of manufacturing

The local or regional market players must adhere to the regulating body’s emission regulations. However, because emission regulations differ by region, a lack of standardization can make it difficult to export thermal systems. The manufacturers are unable to get raw materials or inventory due to lack of standardization, which hampered the export sector. This also leads to the high cost of manufacturing. As a result, the lack of standardization and high cost of manufacturing is restricting the growth of global automotive thermal system market during the forecast period.

Opportunities

Increasing government regulations

Controlling greenhouse gas emissions from automobiles has become a serious concern as the global vehicle fleet grows. The government regulatory frameworks have controlled gasoline Sulphur content limits and required fuel economy standards to combat the exponential consequence of emissions. By utilizing waste heat and controlling the vehicle’s heating and cooling systems properly, advancements in automotive thermal system technology can minimize carbon dioxide reduction and enhance automobile efficiency. Thus, the increasing government regulations against toxic gases emissions are creating lucrative opportunities for the growth of the automotive thermal system market during the forecast period.

Challenges

High cost of technology

The original equipment manufacturers (OEMs) have implemented innovative and advanced technology to attain to intended outcomes as a result of the establishment of rigorous pollution. In addition, the rising demand for in-vehicle comfort characteristics on interior comfort thermal systems. The cost of thermal system can be compared to overall amount of carbon dioxide reduction accomplished by these technologies to determine its performance. The cost for upgradation and modification of automotive thermal systems required high capital investments. Thus, the high cost of technology is a major challenge for the growth of the automotive thermal system market during the forecast period.

Scope of the Automotive Thermal Systems Market

| Report Coverage | Details |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Segments Covered | Component, Vehicle, Application, Region |

Regional Snapshot

Asia-Pacific is the largest segment for automotive thermal system market in terms of region. In recent years, the Asia-Pacific region has grown as a production hub for automobiles and automotive. The original equipment manufacturers (OEMs) have increased vehicle production in the region due to changing consumer demands, rising per capita income of the middle-class population, and cost benefits.

Europe region is the fastest growing region in the automotive thermal system market. The introduction of strict emission standards by various European Union countries is likely to boost the sales of automobiles, resulting in the growth of the automotive thermal system market in the Europe region.

Read Also: Central Nervous System Therapeutic Market to Reach US$ 209.2 Billion by 2030

Some of the prominent players in the global automotive thermal systems market include:

- Denso Corporation

- Mahle GmbH

- Gentherm Inc.

- Valeo

- Grayson Thermal Systems

- Borgwarner Inc.

- General Motors Company

- Lennox International Inc.

- Modine Manufacturing Company Inc.

- Visteon Corporation

Segments Covered in the Report

By Component

- Compressor

- Heating Ventilation Air Conditioning (HVAC)

- Powertrain Cooling

- Fluid Transport

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Application

- Front and Rear A/C

- Engine and transmission

- Seat

- Battery

- Motor

- Waste Heat Recovery

- Power Electronics

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- spain

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Why should you invest in this report?

If you are aiming to enter the global automotive thermal systems market, this report is a comprehensive guide that provides crystal clear insights into this niche market. All the major application areas for automotive thermal systems are covered in this report and information is given on the important regions of the world where this market is likely to boom during the forecast period of 2022-2030 so that you can plan your strategies to enter this market accordingly.

Besides, through this report, you can have a complete grasp of the level of competition you will be facing in this hugely competitive market and if you are an established player in this market already, this report will help you gauge the strategies that your competitors have adopted to stay as market leaders in this market. For new entrants to this market, the voluminous data provided in this report is invaluable.

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Thermal Systems Market

5.1. COVID-19 Landscape: Automotive Thermal Systems Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Thermal Systems Market, By Component

8.1. Automotive Thermal Systems Market, by Component Type, 2021-2030

8.1.1. Compressor

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Heating Ventilation Air Conditioning (HVAC)

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Powertrain Cooling

8.1.3.1. Market Revenue and Forecast (2019-2030)

8.1.4. Fluid Transport

8.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Automotive Thermal Systems Market, By Application

9.1. Automotive Thermal Systems Market, by Application, 2021-2030

9.1.1. Front and Rear A/C

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Engine and transmission

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Seat

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Battery

9.1.4.1. Market Revenue and Forecast (2019-2030)

9.1.5. Motor

9.1.5.1. Market Revenue and Forecast (2019-2030)

9.1.6. Waste Heat Recovery

9.1.6.1. Market Revenue and Forecast (2019-2030)

9.1.7. Power Electronics

9.1.7.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Automotive Thermal Systems Market, By Vehicle

10.1. Automotive Thermal Systems Market, by Vehicle, 2021-2030

10.1.1. Passenger Vehicles

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Commercial Vehicles

10.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Automotive Thermal Systems Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component (2019-2030)

11.1.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component (2019-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.4.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component (2019-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.5.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component (2019-2030)

11.2.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component (2019-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.4.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component (2019-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.5.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component (2019-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.6.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component (2019-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.7.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component (2019-2030)

11.3.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component (2019-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.4.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component (2019-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.5.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component (2019-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.6.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component (2019-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.7.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component (2019-2030)

11.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component (2019-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.4.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component (2019-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.5.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component (2019-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.6.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component (2019-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.7.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component (2019-2030)

11.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component (2019-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.4.3. Market Revenue and Forecast, by Vehicle (2019-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component (2019-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.5.3. Market Revenue and Forecast, by Vehicle (2019-2030)

Chapter 12. Company Profiles

12.1. Denso Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Mahle GmbH

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Gentherm Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Valeo

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Grayson Thermal Systems

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Borgwarner Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. General Motors Company

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Lennox International Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Modine Manufacturing Company Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Visteon Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1520

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Website: https://www.precedenceresearch.com