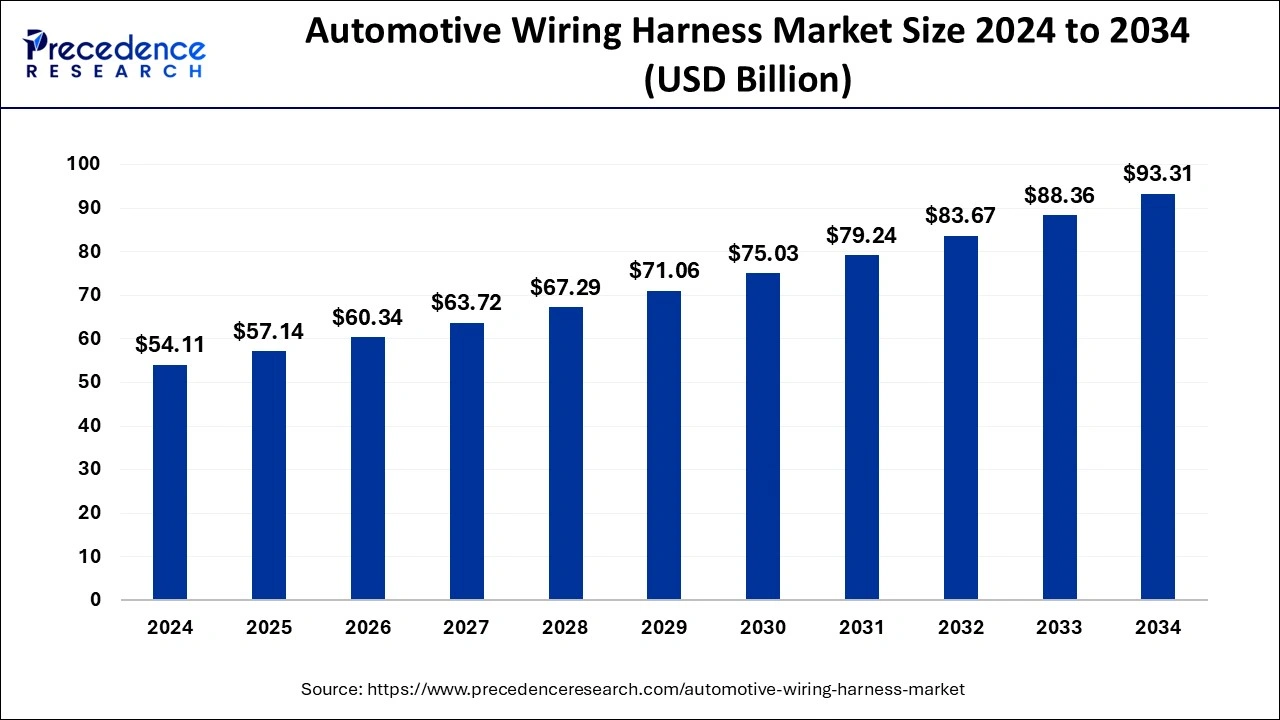

The automotive wiring harness market size was valued at USD 54.11 billion in 2024 and is projected to hit around USD 93.31 billion by 2034 with a CAGR of 5.60%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1008

Market Key Takeaways

- In 2024, Asia Pacific led the global automotive wiring harness market, accounting for 48% of the total share.

- The copper segment dominated by material type, contributing 65% of the market share.

- ICE vehicles held the largest share by propulsion, making up 82% of the market.

- Among vehicle types, passenger cars generated the highest market share at 58%.

- Low voltage systems remained the most prevalent, securing 85% of the market share.

Automotive Wiring Harness Market Overview

The automotive wiring harness market plays a crucial role in modern vehicle manufacturing, serving as the backbone for electrical and electronic systems in automobiles. A wiring harness is an assembly of wires, connectors, and terminals that transmit power and signals throughout a vehicle, enabling the functioning of lighting, infotainment, sensors, engine components, and safety systems. The market is growing steadily due to the rising adoption of advanced technologies in vehicles, including electric vehicles (EVs), autonomous driving systems, and connected car features. As vehicle electrification and automation gain momentum, the demand for sophisticated and lightweight wiring harnesses is increasing.

Market Drivers

The key driver of the automotive wiring harness market is the growing production and sales of vehicles worldwide, particularly electric and hybrid vehicles that require advanced electrical systems. The increasing integration of safety and convenience features such as Advanced Driver Assistance Systems (ADAS), infotainment, and electronic control units (ECUs) has further boosted demand. Additionally, stringent government regulations on vehicle safety and fuel efficiency are pushing automakers to adopt lightweight wiring harness solutions to reduce vehicle weight and enhance fuel efficiency. Advancements in high-voltage wiring for EVs and the adoption of smart wiring harnesses with data transmission capabilities are also key drivers.

Market Opportunities

The shift towards electric and autonomous vehicles presents significant opportunities for the automotive wiring harness market. As EV adoption rises, high-voltage wiring systems are becoming essential, driving innovation in thermal and electrical management solutions. The growing trend of connected vehicles and Internet of Things (IoT) integration in automobiles is also expected to create new opportunities, as smart wiring harnesses enable seamless communication between various vehicle components. Additionally, the development of lightweight and eco-friendly wiring materials, such as aluminum-based harnesses, presents a promising avenue for market growth. The expansion of automotive manufacturing in emerging economies also offers new investment opportunities for wiring harness suppliers.

Market Challenges

Despite strong growth prospects, the automotive wiring harness market faces several challenges. The complexity of modern vehicle electrical architectures increases design and manufacturing costs, requiring significant investments in R&D. Fluctuations in raw material prices, particularly copper and aluminum, impact production costs and profit margins. Additionally, the risk of wiring failures and short circuits, which can lead to safety issues, poses a challenge for manufacturers to ensure high reliability and durability. The increasing demand for wireless technologies in vehicles may also impact traditional wiring harness demand in the long run. Furthermore, the COVID-19 pandemic and supply chain disruptions have exposed vulnerabilities in sourcing raw materials and components, affecting production timelines.

Regional Insights

- North America: The U.S. and Canada are witnessing strong demand for automotive wiring harnesses due to the rapid adoption of EVs, connected vehicles, and autonomous driving technologies. The presence of major automakers and technology firms investing in advanced vehicle electronics supports market growth.

- Europe: Countries like Germany, France, and the UK are at the forefront of automotive electrification and ADAS deployment, creating a high demand for sophisticated wiring harnesses. The European Union’s strict emission regulations are pushing automakers to develop lightweight and high-performance electrical systems.

- Asia-Pacific: The region dominates the automotive wiring harness market, with China, Japan, and India being major manufacturing hubs. The growth of EV production in China and the increasing localization of auto component manufacturing in India are key drivers. Japan’s technological advancements in automotive electronics and hybrid vehicles also contribute to market expansion.

- Rest of the World: Latin America, the Middle East, and Africa are experiencing gradual market growth due to the expansion of the automotive sector and foreign investments. However, infrastructure limitations and economic uncertainties remain challenges in these regions.

Automotive Wiring Harness Market Companies

- Sumitomo Electric Industries, Ltd.

- Delphi Automotive LLP

- Furukawa Electric Co. Ltd

- Lear Corporation

- THB Group

- Yura Corporation

- Leoni Ag

- SPARK MINDA

- Yazaki Corporation

- Fujikura Ltd.

- QINGDAO SANYUAN GROUP

- SamvardhanaMotherson Group

- NexansAutoelectric

- PKC Group

Latest Announcements by Industry Leaders

- In June 2023, Private investment firm Auxo Investment Partners declared that it had acquired SOS Manufacturing, a producer of specialized wire harnesses, cable assemblies, and complete box builds for users in the computing, electronics, aerospace, appliance, agricultural, automotive, and food processing industries.

Recent Developments

- In October 2024, Japanese automotive wiring producer Sumitomo Electric is set to launch operations at its latest plant backed by €22 million in investments.

Segments Covered

By Type

- Engine Harness

- Dashboard/ Cabin Harness

- Battery Wiring Harness

- Chassis Wiring Harness

- Body & Lighting Harness

- HVAC Wiring Harness

- Seat Wiring Harness

- Door Wiring Harness

- Sunroof Wiring Harness

By Material

- Metallic

- Aluminum

- Copper

- Other Metals

- Optical Fiber

- Plastic Optical Fiber

- Glass Optical Fiber

By Propulsion

- IC Engine Vehicle

- Electric Vehicle

By Transmission

- Electric Wiring

- Data Transmission

- <150 Mbps

- 150 Mbps to 1 Gbp

- >1 Gbps

By Vehicle

- Commercial Vehicle

- Passenger Vehicle

By Voltage

- Low Voltage

- High Voltage

By Sales Channel

- OEM

- Aftermarket

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/automotive-wiring-harness-market