Table of Contents

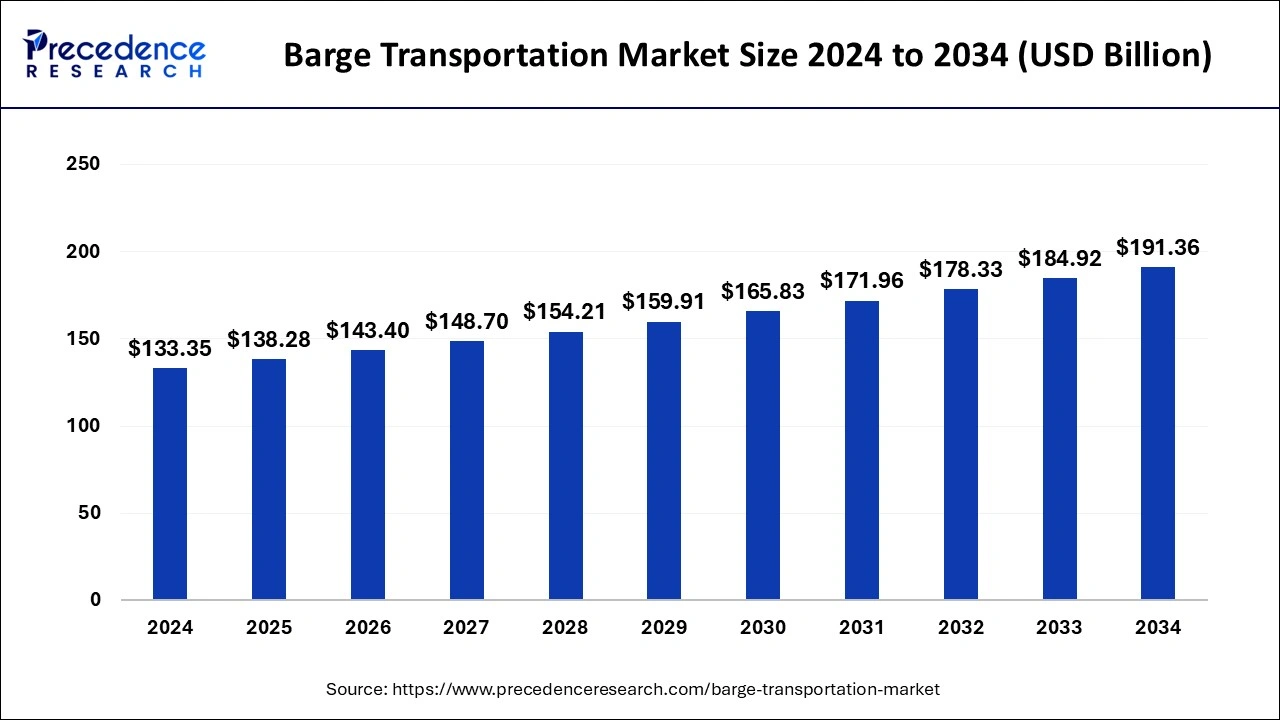

The global barge transportation market size was calculated at USD 133.35 billion in 2024 and is predicted to soar around USD 191.36 billion by 2034 with a CAGR of 3.68%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1043

Key Insights

- In 2024, Europe dominated the global market, accounting for 72% of the total market share.

- The tank segment within the barge fleet category contributed over 25% of the revenue share in 2024.

- The dry cargo product segment held the largest share of the market in 2024.

AI’s Impact on Barge Transportation Market

Optimized Route Planning and Fuel Efficiency

- AI-driven predictive analytics help optimize navigation, reducing fuel consumption and operational costs.

- Smart route planning minimizes delays and enhances overall efficiency in barge transportation.

Enhanced Cargo Tracking and Fleet Management

- AI-powered automation improves real-time cargo monitoring, ensuring better security and compliance.

- IoT and AI-driven sensors enhance fleet management by reducing errors and improving logistics efficiency.

Predictive Maintenance and Cost Reduction

- AI integration in predictive maintenance reduces downtime and extends the lifespan of barge fleets.

- Machine learning algorithms help forecast demand, improving fleet utilization and cost management.

Barge Transportation Market Overview and Key Factors

Overview

The barge transportation market plays a vital role in global logistics, offering a cost-effective and environmentally friendly mode of transporting bulk goods, including dry cargo, liquid cargo, and heavy equipment. It is widely used across industries such as agriculture, construction, and petroleum. The market is driven by increasing trade activities, rising demand for fuel-efficient transport, and advancements in fleet management technology.

Market Drivers

Several factors contribute to the growth of the barge transportation market. The demand for inland and coastal transportation has surged due to its low-cost advantage compared to rail and road transport. Additionally, stringent environmental regulations promoting fuel efficiency and reduced carbon emissions have increased the adoption of barges. Technological innovations, including automation and AI-driven route optimization, further enhance operational efficiency.

Opportunities

There are significant opportunities in the market, especially with the integration of digital tracking systems and smart fleet management solutions. The growing focus on sustainable transportation has led to increased investments in alternative fuel-powered barges. Emerging economies present untapped potential as governments invest in inland waterway infrastructure to enhance trade routes.

Challenges

Despite its advantages, the market faces several challenges, including high maintenance costs, aging fleet infrastructure, and limited waterway connectivity in certain regions. Weather-related disruptions and fluctuating fuel prices also impact the industry’s growth. Additionally, competition from rail and trucking services poses a challenge, requiring continuous innovation to remain competitive.

Regional Insights

Europe leads the global barge transportation market due to its extensive inland waterways and strong trade network. North America follows closely, driven by increased petroleum and agricultural cargo movement. Asia-Pacific is witnessing rapid growth due to rising industrialization, particularly in China and India. However, infrastructure limitations in developing regions present both challenges and opportunities for market expansion.

Barge Transportation Market Companies

- SEACOR Holdings

- American Commercial Barge Line (ACBL)

- Ingram Marine Group

- Campbell Transportation Company

- Kirby Corporation

- APL Logistics

- Crowley Maritime Corporation

Industry Leader Announcement

- In October 2024, Tobias Martin Bartz, CEO of the Rhenus Group, a leading transportation company in Europe, announced a plan to ramp up operations in India. The company is set to invest about USD 100 million into the country’s inland waterways in 2025. The German company, operating in India in a joint venture with Mumbai-based Western Arya Group, is expected to operate 10 barges on Indian waters to ship cargo.

Recent Developments

- In January 2025, the Inland Waterways Development Council (IWDC), the apex body for policy deliberation on the inland waterways network in India, announced investments of more than Rs 50,000 crore over the next 5 years. The announcements to boost infrastructure along national waterways (NWs) were made at the second meeting of IWDC, organized by the Inland Waterways Authority of India (IWAI), at Kaziranga. They include a series of new initiatives across 21 Inland Waterways, worth more than Rs 1,400 crore.

- In June 2023, Cargill partnered with KOTUG International to deploy Kotug’s zero emission E-Pusher and E-Barges to Cargill’s cocoa factory in Zaandam, the Netherlands. These fully electrified pusher and barges eliminate both emissions and noise pollution.

Segments Covered in the Report

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2020 to 2032. This report includes market segmentation and its revenue estimation by classifying on the basis of barge fleet, product, application, and region:

By Barge Fleet

- Covered

- Open

- Tank

By Product

- Liquid Cargo

- Dry Cargo

- Gaseous Cargo

By Application

- Agricultural Products

- Coal & Crude Petroleum

- Metal Ores

- Coke & Refined Petroleum Products

- Food Products

- Secondary Raw Materials & Wastes

- Beverages & Tobacco

- Rubber & Plastic

- Chemicals

- Nuclear Fuel

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/