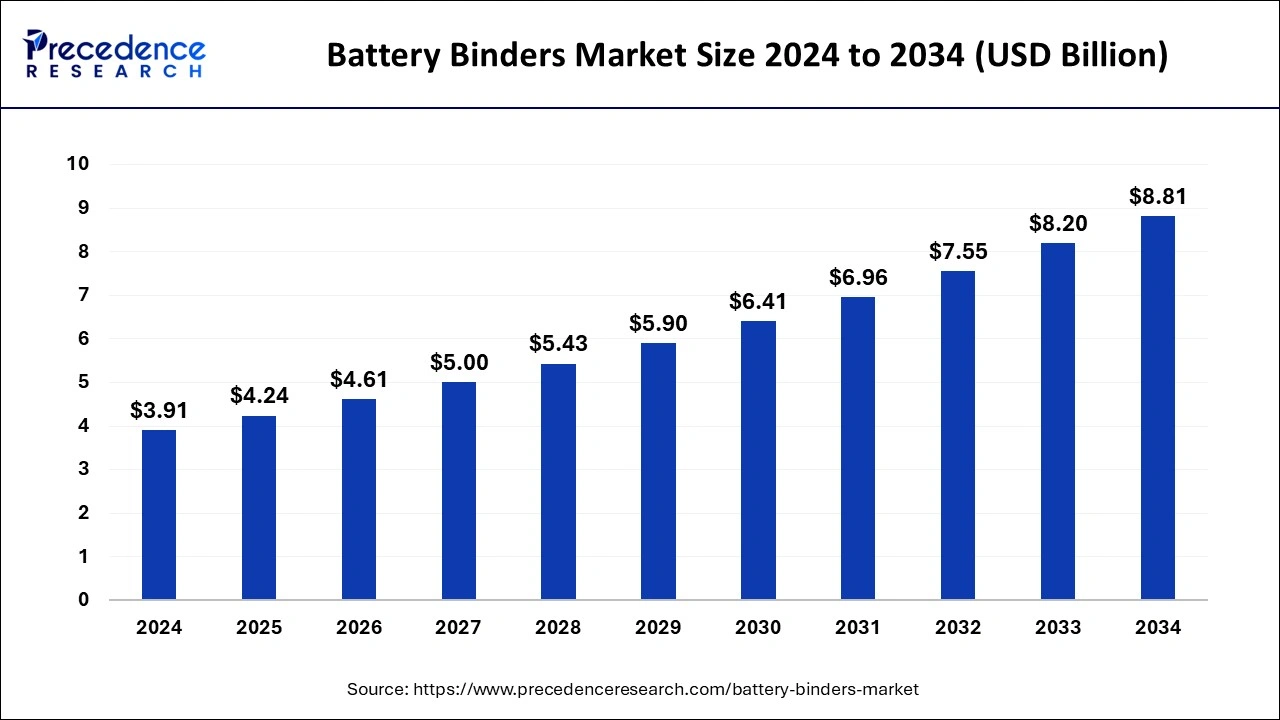

The global battery binders market size was estimated at USD 3.60 billion in 2023 and is projected to rake around USD 8.20 billion by 2033, growing at a CAGR of 8.58% from 2024 to 2033.

Key Points

- Asia Pacific dominated the battery binders market with the largest share of 40% in 2023.

- North America is observed to grow at a significant rate during the forecast period.

- By application, the electric vehicles segment has accounted market share of around 33% in 2023.

- By type, the polyvinylidene fluoride segment held the largest share in battery binders market and expected to hold largest share during forecast period.

- By end-use, the automotive segment held a notable share of the market in 2023.

The battery binders market is an essential component of the growing battery industry. Battery binders play a crucial role in the manufacturing and performance of various types of batteries, including lithium-ion, lead-acid, and other advanced energy storage solutions. These binders are used to hold active materials together in electrodes, ensuring proper conductivity and stability within the battery cell. The market for battery binders is expanding rapidly as the demand for batteries increases, driven by the widespread adoption of electric vehicles, renewable energy storage systems, and portable electronic devices.

Get a Sample: https://www.precedenceresearch.com/sample/4089

Growth Factors

The growth of the battery binders market is influenced by several factors:

- Rising Demand for Electric Vehicles (EVs): As the world transitions to cleaner transportation options, the demand for electric vehicles continues to surge. This has led to increased production of lithium-ion batteries, thereby driving the demand for battery binders.

- Expansion of Renewable Energy Storage Systems: The integration of renewable energy sources such as solar and wind power into power grids necessitates the use of energy storage systems. Batteries play a critical role in these systems, boosting the demand for battery binders.

- Technological Advancements: Ongoing research and development in battery technology have led to improvements in binder materials, resulting in enhanced battery performance, longer lifespan, and increased energy density.

- Increasing Demand for Portable Electronics: The proliferation of smartphones, tablets, laptops, and wearable devices has led to a steady demand for high-performance batteries, thereby driving the need for advanced battery binders.

- Government Initiatives and Regulations: Governments worldwide are promoting the adoption of electric vehicles and renewable energy through incentives and regulations. This indirectly boosts the demand for batteries and, consequently, battery binders.

Region Insights

The battery binders market exhibits varying trends across different regions:

- North America: The region is witnessing significant growth due to the increasing adoption of electric vehicles and renewable energy projects. The presence of major battery manufacturers and technological advancements in the region further drive market growth.

- Europe: Europe is a key market for battery binders, thanks to its strong focus on sustainability and renewable energy adoption. Government initiatives to promote electric vehicles and energy storage systems also contribute to market growth.

- Asia-Pacific: This region dominates the battery binders market due to the rapid expansion of electric vehicle production and the presence of major battery manufacturers in countries like China, Japan, and South Korea. The growing demand for consumer electronics also fuels market growth.

- Latin America: The region is experiencing gradual growth in the battery binders market, driven by increasing investments in renewable energy projects and the rising adoption of electric vehicles.

- Middle East & Africa: The market in this region is emerging, with potential for growth due to increasing investments in renewable energy and infrastructure projects.

Battery Binders Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.58% |

| Global Market Size in 2023 | USD 3.60 Billion |

| Global Market Size in 2024 | USD 3.91 Billion |

| Global Market Size by 2033 | USD 8.20 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Application, By Battery Type, and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Battery Binders Market Dynamics

Drivers

Key drivers of the battery binders market include:

- Growing Adoption of Electric Vehicles: The shift towards electric vehicles is a major driver, as it leads to increased production of high-capacity batteries that require advanced binders.

- Increasing Renewable Energy Projects: As countries aim to reduce carbon emissions, renewable energy projects are gaining traction. This increases the demand for energy storage systems, driving the need for battery binders.

- Technological Innovations: Continuous improvements in battery technology enhance the performance and lifespan of batteries, leading to greater demand for efficient battery binders.

- Rising Consumer Demand for Portable Electronics: The steady demand for smartphones, laptops, and other portable devices requires efficient and high-capacity batteries, boosting the need for battery binders.

- Government Support: Policies and incentives aimed at promoting electric vehicles and renewable energy projects indirectly support the growth of the battery binders market.

Challenges

The battery binders market faces several challenges:

- Supply Chain Disruptions: The COVID-19 pandemic highlighted vulnerabilities in global supply chains, impacting the availability of raw materials and components.

- Environmental Concerns: The production of battery materials, including binders, can have negative environmental impacts. Ensuring sustainable sourcing and production is a challenge for the industry.

- Stringent Regulations: Increasingly strict regulations on emissions and waste management in the battery manufacturing process may pose challenges for binder manufacturers.

- Competition from Alternative Technologies: Advances in alternative energy storage technologies, such as solid-state batteries, could potentially challenge the demand for conventional battery binders.

- Price Fluctuations: The cost of raw materials used in battery binder production can fluctuate due to market conditions, affecting profitability.

Opportunities

Despite challenges, the battery binders market presents numerous opportunities:

- Innovative Binder Materials: Research into advanced materials, such as silicon-based or graphene-based binders, can lead to improved battery performance and open new market opportunities.

- Sustainable Production Methods: Developing environmentally friendly and sustainable production methods can help companies stay ahead in the market and meet regulatory requirements.

- Growing Demand in Emerging Markets: As emerging markets such as India and Southeast Asia continue to grow, the demand for electric vehicles and renewable energy storage systems will rise, creating opportunities for battery binders.

- Battery Recycling Initiatives: As the need for battery recycling increases, there may be opportunities for binder manufacturers to innovate in materials and processes that facilitate recycling.

- Partnerships and Collaborations: Collaborations between binder manufacturers and battery producers can lead to advancements in binder technology, driving market growth.

Read Also: Pupillometer Market Size to Rake USD 723.70 Million by 2033

Recent Developments

- In May 2023, For Li-ion cell producers, Ionic Mineral Technologies, a developer of cutting-edge materials for silicon anode batteries, introduced its Generation 1 Ionisil nano-silicon product. (Previous article.) High energy density and quick charging capabilities are provided by this drop-in lithium-ion battery solution, which makes it appropriate for usage in electric vehicles (EVs) and other applications that call for high-performance batteries.

Battery Binders Market Companies

- Arkema

- Solvay

- LG Chem

- ENEOS Corporation

- Zeon Corporation

Segment Covered in the Report

By Type

- Polymethyl Methacrylate

- Polyvinylidene Fluoride

- Carboxymethyl Cellulose

- Styrene Butadiene Copolymer

- Others

By Application

- Electric Vehicle

- Portable Electronics

- Grid Energy Storage System

- Industrial

- Others

By Battery Type

- Lead Acid

- Nickel Cadmium

- Lithium-ion

- Others

By End Use

- Automotive

- Electronics

- Power Grid

- Consumer Goods

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/