According to a research report “Biofuels Market Size, Share & Growth Analysis Report, By Fuel Type (Biodiesel and Ethanol), By Feedstock (Coarse Grain, Sugar Crop, Vegetable Oil, Jatropha, Molasses) – Global Industry Analysis, Trends, Revenue, Segment Forecasts, Regional Outlook 2021 – 2030″ published by Precedence Research.

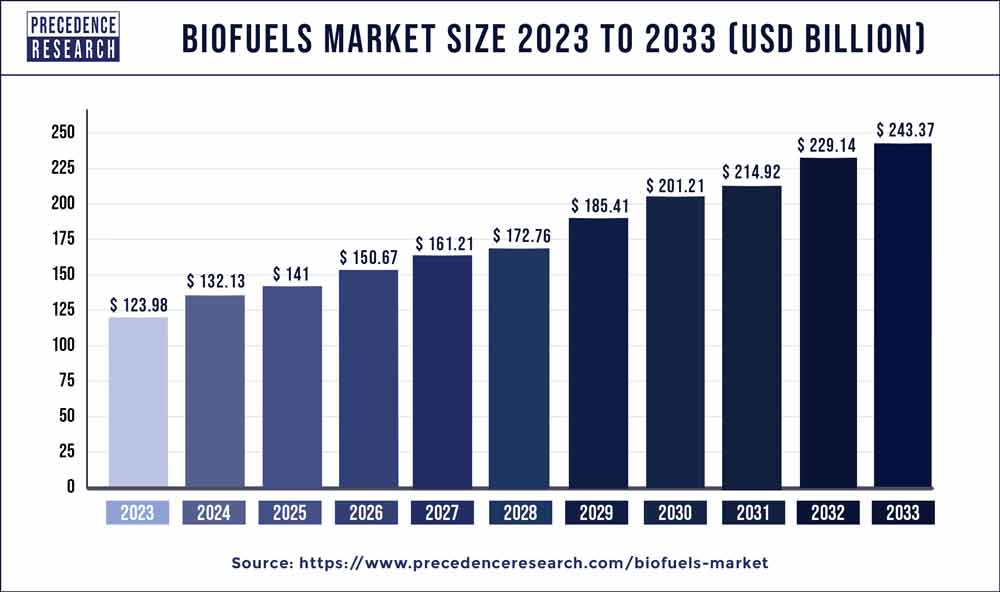

The biofuels market size is projected to hit from USD 116.46 billion in 2022 to USD 201.21 billion by 2030, growing at a CAGR of 8.3% every year.

The study provides an analysis of the period 2017-2030, wherein 2021 to 2030 is the forecast period and 2021 is considered as the base year.

The transportation fuels generated from biomass resources, such as ethanol and biomass-based diesel, are known as biofuels. These fuels are typically mixed with petroleum fuels, but they can also be used independently. In addition, advanced liquid biofuels made from biomass waste, waste fats, and oil are a potential solution for decarbonizing energy sectors in industries like shipping, aviation, and freight at a low cost.

Get a Free Sample Copy of this Report@ https://www.precedenceresearch.com/sample/1187

The rising demand for sustainable and reliable energy, as well as growing focus on environmentally acceptable clean energy sources, are likely to drive biofuel demand around the world. The government regulations for biofuel combining in vehicle fuels, as well as increased government support for environmentally friendly power options, will combine to increase global biofuel use and keeps the biofuels market growing at rapid pace during the projection period.

Furthermore, large scale biofuel production from different types of plants and crops may result in a scarcity of food commodities manufactured from the crops and plants. It has the potential to alter food prices and raises concerns about the food security. In some regions or nations around the world, this factor will stifle the biofuels market expansion in the predicted period.

In the United States, China, and Brazil, major blending regulations that drive global demand for biofuels have been established. By 2020-2022, these countries aim to achieve a 15-27 percent biofuels-to-conventional-fuel blend, which is likely to drive worldwide demand in their respective regions.

Table of Contents

Report Scope of the Biofuels Market

| Report Highlights | Details |

| Market Size | USD 201.21 Billion by 2030 |

| Growth Rate | CAGR of 8.3% from 2021 to 2030 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | Fuel Type, Feedstock Type, Regional Type |

Biofuels Market Regional Snapshot

Asia-Pacific region is the fastest growing region in the biofuels market. The introduction and increased adoption of biofuel-friendly laws and regulations in emerging countries of Asia-Pacific region, is expected to increase demand for biofuels, particularly in the transportation sector, where they will be blended with conventional fossil fuels. Although the biofuels business in Asia Pacific is still in its infancy, there is significant potential for growth, as seen by companies like NESTE spending $1.4 billion in a bio refinery in Singapore in 2019.

Several governments in the region have shown their support for the industry by establishing a favorable regulatory environment. India and China are currently leading the pack in terms of manufacturing, research, and innovation investments. The need to minimize its reliance on oil and energy exports is one of the most important market factors. Currently, ethanol is the most extensively manufactured biofuel in the region, owing to the ease with which fuel companies can generate it from sugarcane waste, which is abundant in the country.

Report Highlights

Based on fuel type, the bioethanol segment accounted largest market share 71.3% in the global biofuels market in 2020. As bioethanol is made entirely of biological sources, it produces cleaner emissions when it is burned (carbon dioxide, steam, and heat). Plants take carbon dioxide and use it to help them grow by processing it through photosynthesis. Because of this creation and energy combustion cycle, bioethanol has the potential to be a carbon-neutral fuel. It also helps to enhance air quality by reducing carbon monoxide emissions from aging automobile engines.

Another significant advantage of bioethanol is the ease with which it can be integrated into the existing road transportation fuel system – bioethanol may be blended with conventional fuels (up to 15%) without requiring engine modifications. Bioethanol can be used as a substitute for gasoline in gasoline engines. It can be combined with gasoline in almost any proportion. The majority of existing petrol engines run on bioethanol-petroleum mixtures of up to 15%.

Based on feedstock, the coarse grains segment accounted largest market share 28.1% in the global biofuels market in 2020. Cereal grains other than wheat and rice, as well as those used primarily for animal feed or brewing, are referred to as coarse grains. These grains are warm-season cereals that are used for food, feed, and fodder in different parts of the world. These are primarily farmed in Asia and Africa’s semi-arid tropical regions, under rain-fed farming techniques with few external inputs and low grain yields (typically less than 1 tonne/ha).

Biofuel Market Share, By Feedstock, 2020

| Feedstock Segment | 2020 (%) | |

| Coarse Grains | 28.1 | % |

| Vegetable oil | 28 | % |

| Sugar crop | 17.1 | % |

| Others | 10.2 | % |

| Non-agri Feedstock | 8.3 | % |

| Biomass | 6.3 | % |

| Jatropha | 1.9 | % |

Coarse grains are the main feedstock for producing bioethanol. The decline in road transport due to strict lockdowns during the COVID-19 pandemic has resulted in affecting the demand for coarse grains in biofuels. The market witnessed a significant drop in 2020 and the market is expected to regain as the lockdown on transport is lifted.

Post-2020, the global demand for biofuels is expected to increase. The growing demand for ethanol as a fuel blend to reduce GHG emissions and adhere to the UNCCC to control climate change is expected to drive market growth. Furthermore, the price of coarse grains has a steady year-on-year variation as compared to other feedstock. Thus, the demand for coarse grains is expected to remain steady over the forecast period.

Covid 19 Impact

Since the emergence of COVID-19 in late 2019 in China and its rapid spread around the world, demand for crude oil has fallen precipitously due to a drop in economic activity, resulting in a significant drop in crude oil prices. Furthermore, rivalry among big oil producers has pushed crude oil prices even lower.

As shown below, Brent crude oil fell from USD 59.27 per barrel in January 2019 to USD 23.34 per barrel in April 2020. On the other hand, Dubai Fateh crude oil dropped from USD 58.96 per barrel in January 2019 to USD 23.27 per barrel in April 2020. Similarly, West Texas Intermediate crude oil prices declined from USD 51.52 per barrel in January 2019 to USD 16.52 per barrel in April 2020.

The significant drop in ethanol prices decreased ethanol producers’ profit margins. The average return above variable expenses for Iowa ethanol producers fell from nearly 35 cents per gallon in late November 2019 to -7 cents per gallon on March 27, 2020, according to daily statistics from Iowa State University’s Center for Agricultural and Rural Development (CARD). COVID-19 has several negative consequences for ethanol producers, not the least of which is a decrease in profitability per gallon of ethanol produced.

Due to the 10% mix regulation, reductions in economic activity due to social distancing and required shelter in place rules have had a detrimental impact on demand for gasoline and thus ethanol. Currently, around 96 percent of the US population is subjected to various mandatory restrictions to prevent the spread of COVID-19.

As a result of the lack of profitability in ethanol production combined with lower gasoline demand, ethanol producers are likely to reduce output levels or, in some circumstances, shut down their operations. Because ethanol (and DDGS) accounts for a big amount of maize produced in the United States (approximately 38%), a lack of ethanol demand will result in a significant drop in corn demand.

Due to the slowdown in economic activity induced by the spread of COVID-19, demand for distillate fuel oil (diesel fuels and fuel oils) has also decreased in recent months. According to data released by the EIA, usage of these fuels decreased by 11.3% in the first two months of 2020 compared to the same period in 2019. Diesel fuel costs have fallen as a result of lower crude oil prices and lower demand for diesel fuel. For example, in the last week of March 2020, the retail diesel price fell from around USD 3.05 per gallon in January 2020 to USD 2.56 per gallon.

As a result, the price of biodiesel dropped dramatically from over USD 1,050 per metric tonne in early January 2020 to USD 735 per metric tonne by the end of March 2020. Weaker demand for diesel may result in lower demand for biodiesel, which will diminish demand for biodiesel feedstock. Soybean oil has the biggest market share in the United States of these feedstocks. As a result, any significant drop in biodiesel demand will also affect demand for soybeans.

Biofuels Market Dynamics

Drivers – Reduces greenhouse gases

According to some research studies, biofuels can reduce greenhouse gas emissions by up to 65%. When fossil fuels are burned, enormous volumes of greenhouse gases, such as carbon dioxide, are released into the atmosphere. These greenhouse gases trap sunlight, causing global warming. Furthermore, burning coal and oil raises the temperature and contributes to global warming. Biofuels are being used by people all around the world to lessen the impact of greenhouse gases. As a result, the reduction of greenhouse gases is fueling the growth of the biofuels market during the forecast period.

Read Also: Automated Guided Vehicle Market is Likely to Cross $ 6.23 Billion by 2030

Restraints – High cost of production

Despite all of the disadvantages of biofuels, they are currently relatively costly to produce. Biofuel production currently has a low level of interest and capital investment, but it can meet demand in the future. If demand rises, boosting supply will be a lengthy and costly process. Biofuels are still being held back by this disadvantage. As a result, the high cost of production is hindering the growth of the biofuels market during the forecast period.

Opportunities – Use of biofuels in vehicles’ engine

Biofuels can easily be adapted to conventional engine designs and function under most adverse situations. It has a high cetane number and improved lubrication. The engine’s durability improves when biodiesel is utilized as a highly flammable fuel. There is no need to convert the engine.

This allows the engine to function for longer periods of time, requiring less maintenance and lowering overall pollution check expenses. Biofuel-powered engines emit fewer pollutants than conventional diesel engines. Thus, the use of biofuels in vehicles’ engine is creating lucrative opportunities for the growth of the biofuels market during the forecast period.

Challenges – Industrial pollution

When burned, biofuels have a lower carbon footprint than traditional fuels. However, the method through which they are made compensates for this. A lot of water and oil are required for production. Substantial-scale biofuel manufacturing plants are known to produce large amounts of pollution and cause small-scale water pollution.

Unless more efficient production methods are implemented, overall carbon emissions will not be significantly reduced. It also increases nitrogen oxides levels in the atmosphere. This also leads to global warming in the environment. As a result, the industrial production caused by production of biofuels is a major challenge for the growth of the biofuels market during the forecast period.

Top Players contending in the Market:

The companies focusing on research and development are expected to lead the global biofuels market. Leading competitors contending in global biofuels market are as follows:

- BTG International Ltd

- Renewable Energy Group, Inc.

- Abengoa Bioenergy S.A.

- Cargill

- DowDuPont, Inc.

- Wilmar International Ltd

- POET, LLC

- Archer Daniels Midland Company

- VERBIO Vereinigte BioEnergie AG

- My Eco Energy

- China Clean Energy Inc.

Major Market Segments Covered:

By Fuel Type

- Biodiesel

- Ethanol

By Feedstock

- Coarse Grain

- Non-agri Feedstock

- Biomass

- Vegetable Oil

- Sugar Crop

- Jatropha

- Others

By Geography

-

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- North America

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions& Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Biofuels Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

Chapter 5. COVID 19 Impact on Biofuels Market

5.1. Covid-19: Biofuels Industry Impact

5.2. Biofuels Business Impact Assessment: Covid-19

5.2.1. Services Challenges/Disruption

5.2.2. Market Trends and Biofuels Opportunities in the COVID-19 Landscape for Major Markets

5.3. Strategic Measures against Covid-19

5.3.1. Government Support and Initiative to Combat Covid-19

5.3.2. Proposal for Biofuels Market Players to deal with Covid-19 Pandemic Scenario

Chapter 6. Biofuels Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.1.1. Growing demand as environment-friendly fuel in road transportation

6.1.1.2. Abundant availability of bioethanol blends and its extended use

6.1.2. Market Restraints

6.1.2.1. Uncertain feed stock prices and yield

6.1.3. Market Opportunities

6.1.3.1. Emergence of new feedstocks

Chapter 7. Global Biofuels Market: Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.1.1. Biofuels Market Revenue by Market Players (2016 -2019)

7.1.1.2. Biofuels Market Revenue Market Share by Market Players (2016 -2019)

7.1.2. Key Organic/Inorganic Strategies Adopted by Players

7.1.2.1. Product Portfolio Expansion, Geographic Expansion, Fuel Type Innovation

7.1.2.2. Merger and Acquisition, Collaboration and Partnerships

7.1.3. Market Players Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of End-users

Chapter 8. Global Biofuels Market, By Fuel Type

8.1. Biofuels Market, by Fuel Type, 2016-2027

8.1.1. Biodiesel

8.1.1.1. Market Revenue and Forecast (2016-2027)

8.1.2. Ethanol

8.1.2.1. Market Revenue and Forecast (2016-2027)

Chapter 9. Global Biofuels Market, By Feedstock

9.1. Biofuels Market, by Feedstock, 2016-2027

9.1.1. Coarse Grain

9.1.1.1. Market Revenue and Forecast (2016-2027)

9.1.2. Sugar Crop

9.1.2.1. Market Revenue and Forecast (2016-2027)

9.1.3. Vegetable Oil

9.1.3.1. Market Revenue and Forecast (2016-2027)

9.1.4. Jatropha

9.1.4.1. Market Revenue and Forecast (2016-2027)

9.1.5. Molasses

9.1.5.1. Market Revenue and Forecast (2016-2027)

Chapter 10. Global Biofuels Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue Forecast by Fuel Type(2016-2027)

10.1.2. Market Revenue Forecast by Feedstock (2016-2027)

10.1.3. U.S

10.1.3.1. Market Revenue Forecast (2016-2027)

10.1.4. Canada

10.1.4.1. Market Revenue Forecast (2016-2027)

10.2. Europe

10.2.1. Market Revenue Forecast by Fuel Type (2016-2027)

10.2.2. Market Revenue Forecast by Feedstock (2016-2027)

10.2.3. UK

10.2.3.1. Market Revenue Forecast (2016-2027)

10.2.4. Germany

10.2.4.1. Market Revenue Forecast (2016-2027)

10.2.5. France

10.2.5.1. Market Revenue Forecast (2016-2027)

10.2.6. Rest of EU

10.2.6.1. Market Revenue Forecast (2016-2027)

10.3. Asia Pacific (APAC)

10.3.1. Market Revenue Forecast by Fuel Type (2016-2027)

10.3.2. Market Revenue Forecast by Feedstock (2016-2027)

10.3.3. China

10.3.3.1. Market Revenue Forecast (2016-2027)

10.3.4. India

10.3.4.1. Market Revenue Forecast (2016-2027)

10.3.5. Japan

10.3.5.1. Market Revenue Forecast (2016-2027)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue Forecast (2016-2027)

10.4. LATAM

10.4.1. Market Revenue Forecast by Fuel Type (2016-2027)

10.4.2. Market Revenue Forecast by Feedstock (2016-2027)

10.4.3. Brazil

10.4.3.1. Market Revenue Forecast (2016-2027)

10.4.4. Rest of LATAM

10.4.4.1. Market Revenue Forecast (2016-2027)

10.5. Middle East and Africa (MEA)

10.5.1. Market Revenue Forecast by Fuel Type (2016-2027)

10.5.2. Market Revenue Forecast by Feedstock (2016-2027)

10.5.3. GCC

10.5.3.1. Market Revenue Forecast (2016-2027)

10.5.4. North Africa

10.5.4.1. Market Revenue Forecast (2016-2027)

10.5.5. South Africa

10.5.5.1. Market Revenue Forecast (2016-2027)

10.5.6. Rest of MEA

10.5.6.1. Market Revenue Forecast (2016-2027)

Chapter 11. Company Profiles

11.1. Abengoa Bioenergy S.A.

11.1.1. Company Overview, Business Information, Regional Presence

11.1.2. Product Portfolio Analysis

11.1.2.1. Product Details, Specification, Feedstock

11.1.3. Revenue, Price, and Gross Margin (2015-2020)

11.1.4. Recent Developments and Strategies

11.2. Cargill

11.2.1. Company Overview, Business Information, Regional Presence

11.2.2. Product Portfolio Analysis

11.2.2.1. Product Details, Specification, Feedstock

11.2.3. Revenue, Price, and Gross Margin (2015-2020)

11.2.4. Recent Developments and Strategies

11.3. DowDuPont, Inc.

11.3.1. Company Overview, Business Information, Regional Presence

11.3.2. Product Portfolio Analysis

11.3.2.1. Product Details, Specification, Feedstock

11.3.3. Revenue, Price, and Gross Margin (2015-2020)

11.3.4. Recent Developments and Strategies

11.4. BTG International Ltd.

11.4.1. Company Overview, Business Information, Regional Presence

11.4.2. Product Portfolio Analysis

11.4.2.1. Product Details, Specification, Feedstock

11.4.3. Revenue, Price, and Gross Margin (2015-2020)

11.4.4. Recent Developments and Strategies

11.5. Renewable Energy Group, Inc.

11.5.1. Company Overview, Business Information, Regional Presence

11.5.2. Product Portfolio Analysis

11.5.2.1. Product Details, Specification, Feedstock

11.5.3. Revenue, Price, and Gross Margin (2015-2020)

11.5.4. Recent Developments and Strategies

11.6. Wilmar International Ltd

11.6.1. Company Overview, Business Information, Regional Presence

11.6.2. Product Portfolio Analysis

11.6.2.1. Product Details, Specification, Feedstock

11.6.3. Revenue, Price, and Gross Margin (2015-2020)

11.6.4. Recent Developments and Strategies

11.7. POET, LLC

11.7.1. Company Overview, Business Information, Regional Presence

11.7.2. Product Portfolio Analysis

11.7.2.1. Product Details, Specification, Feedstock

11.7.3. Revenue, Price, and Gross Margin (2015-2020)

11.7.4. Recent Developments and Strategies

11.8. Archer Daniels Midland Company

11.8.1. Company Overview, Business Information, Regional Presence

11.8.2. Product Portfolio Analysis

11.8.2.1. Product Details, Specification, Feedstock

11.8.3. Revenue, Price, and Gross Margin (2015-2020)

11.8.4. Recent Developments and Strategies

11.9. VERBIO VereinigteBioEnergie AG

11.9.1. Company Overview, Business Information, Regional Presence

11.9.2. Product Portfolio Analysis

11.9.2.1. Product Details, Specification, Feedstock

11.9.3. Revenue, Price, and Gross Margin (2015-2020)

11.9.4. Recent Developments and Strategies

11.10. My Eco Energy

11.10.1. Company Overview, Business Information, Regional Presence

11.10.2. Product Portfolio Analysis

11.10.2.1. Product Details, Specification, Feedstock

11.10.3. Revenue, Price, and Gross Margin (2015-2020)

11.10.4. Recent Developments and Strategies

11.11. China Clean Energy Inc.

11.11.1. Company Overview, Business Information, Regional Presence

11.11.2. Product Portfolio Analysis

11.11.2.1. Product Details, Specification, Feedstock

11.11.3. Revenue, Price, and Gross Margin (2015-2020)

11.11.4. Recent Developments and Strategies

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1187

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Website: https://www.precedenceresearch.com