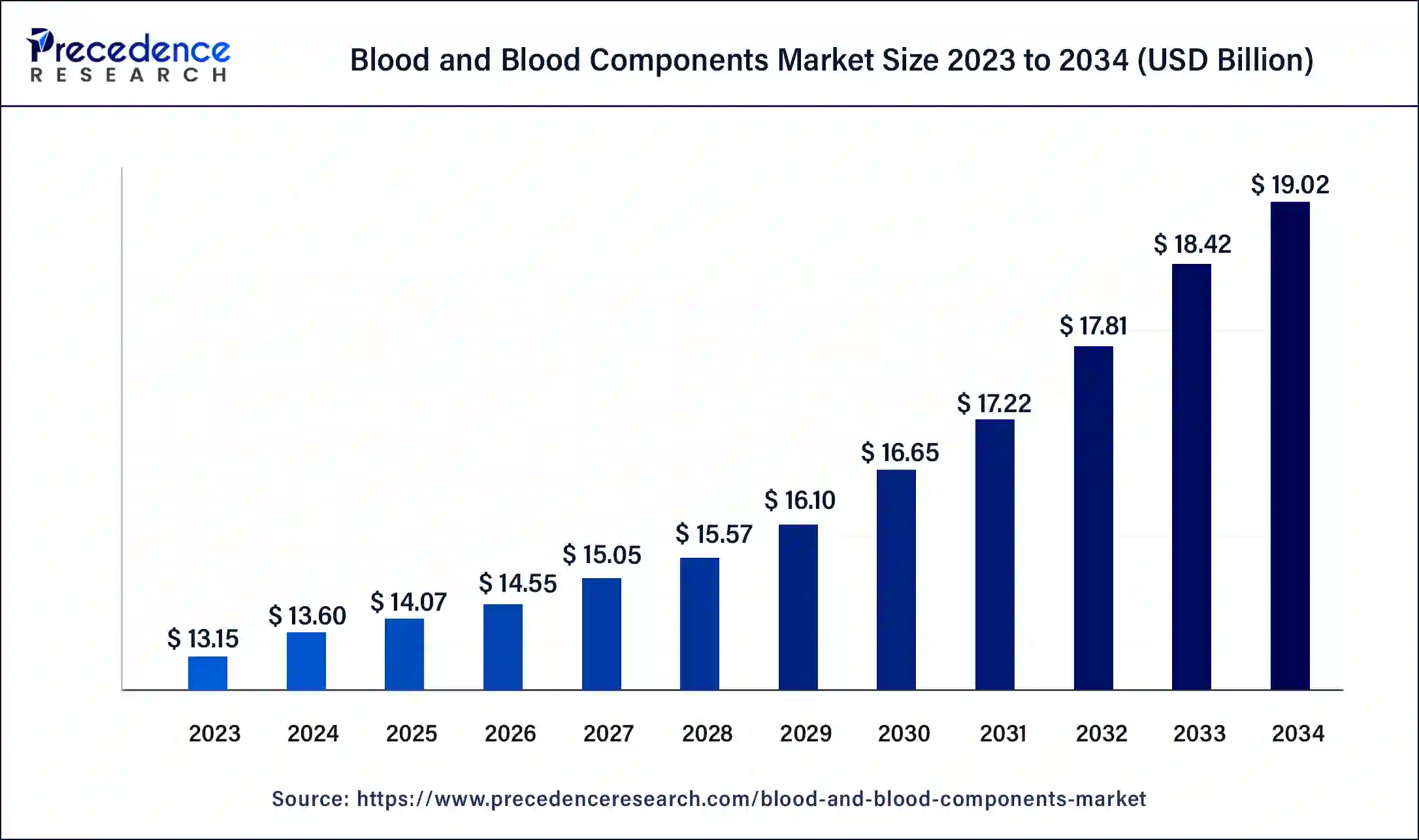

The global blood and blood components market size was estimated at USD 13.15 billion in 2023 and is projected to rise to around USD 18.42 billion by 2033, growing at a CAGR of 3.43% from 2024 to 2033.

Key Points

- Europe dominated the market with the largest revenue share of 35% in 2023.

- North America is expected to gain a significant share of the market during the forecast period.

- By product, the blood components segment held the largest revenue share in 2023.

- By product, the whole blood segment is expected to witness the fastest growth in the market during the forecast period.

- By end use, the hospitals segment dominated the market in 2023.

- By end use, the ambulatory surgical centers segment is expected to grow rapidly in the market during the forecast period.

- By application, the cancer treatment segment held a significant share of the market in 2023.

- By application, the anemia segment is expected to grow rapidly during the forecast period.

The Blood and Blood Components Market encompasses the collection, processing, storage, distribution, and sale of whole blood and its various components, including red blood cells, white blood cells, plasma, and platelets. These components are essential for a range of medical treatments and procedures, such as surgeries, trauma care, and the treatment of chronic illnesses like anemia and hemophilia. The market is characterized by a network of blood banks, hospitals, and diagnostic laboratories, all working to ensure the availability and safety of blood supplies. With advancements in medical technology and a growing awareness of the importance of blood donation, this market is poised for significant growth.

Get a Sample: https://www.precedenceresearch.com/sample/4355

Growth Factors

Several factors contribute to the growth of the Blood and Blood Components Market. The increasing incidence of chronic diseases and the rising number of surgical procedures are major drivers. Technological advancements in blood collection and storage techniques have improved the efficiency and safety of blood transfusions. Moreover, the growing awareness about the importance of blood donation and the establishment of various government and non-government initiatives to encourage donation are boosting the supply of blood and its components. Additionally, the aging global population, which is more susceptible to diseases requiring blood transfusions, further fuels market growth.

Region Insights

Regionally, the Blood and Blood Components Market exhibits diverse trends. North America holds a significant share of the market due to its well-established healthcare infrastructure, high awareness levels, and strong regulatory frameworks. Europe follows closely, benefiting from advanced healthcare systems and substantial government support. In Asia-Pacific, the market is expanding rapidly, driven by increasing healthcare expenditures, a rising prevalence of chronic diseases, and improving healthcare facilities. Emerging economies in Latin America and Africa are also seeing growth, albeit at a slower pace, due to improving healthcare access and rising awareness about blood donation.

Blood and Blood Components Market Scope

| Report Coverage | Details |

| Blood and Blood Components Market Size in 2023 | USD 13.15 Billion |

| Blood and Blood Components Market Size in 2024 | USD 13.60 Billion |

| Blood and Blood Components Market Size by 2033 | USD 18.42 Billion |

| Blood and Blood Components Market Growth Rate | CAGR of 3.43% from 2024 to 2033 |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, End-use, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Blood and Blood Components Market Dynamics

Drivers

The primary drivers of the Blood and Blood Components Market include the growing prevalence of chronic diseases such as cancer and cardiovascular disorders, which require frequent blood transfusions. Additionally, advancements in medical technology, such as improved blood storage solutions and automated blood collection systems, enhance the efficiency and safety of blood transfusions. Increased government funding and support for blood donation campaigns also play a crucial role in driving market growth. Furthermore, the expanding healthcare infrastructure in developing countries is facilitating better blood collection and distribution networks.

Opportunities

The Blood and Blood Components Market presents several opportunities for growth and innovation. The development of new technologies for blood collection, processing, and storage can significantly improve the safety and availability of blood supplies. Increasing investment in research and development can lead to the discovery of synthetic blood substitutes, which could address shortages and reduce dependency on donors. Expanding awareness campaigns and education programs can enhance donor participation rates. Additionally, partnerships between public and private sectors can foster advancements in blood banking services and infrastructure.

Challenges

Despite the growth potential, the Blood and Blood Components Market faces several challenges. One of the primary issues is the risk of transfusion-transmitted infections, which necessitates stringent screening and testing protocols. There is also a significant challenge in maintaining an adequate and stable blood supply, as donation rates can fluctuate due to various factors, including donor eligibility and seasonal trends. The high cost associated with blood collection, testing, and storage can also be a barrier, particularly in low-income regions. Furthermore, logistical challenges in the distribution and transportation of blood components, especially in remote areas, can impede market growth.

Read Also: Corrugated Boxes Market Size to Rise USD 92.30 Bn by 2033

Blood and Blood Components Market Recent Developments

- In January 2024, Today, Inspira Technologies OXY B.H.N Ltd., a leader in life support technology with the goal of replacing conventional mechanical ventilators, announced its intention to provide a single-use, disposable blood oxygenation kit (the “Kit”) for its INSPIRA ART medical device series.

- In January 2024, in a race with Apple Inc. and other electronic behemoths, Samsung Electronics Co. is pursuing the development of continuous blood pressure monitoring and noninvasive glucose monitoring. The company has high aspirations for the healthcare industry.

Blood and Blood Components Market Companies

- European Blood Alliance

- Australian Red Cross

- Indian Red Cross

- American Association of Blood Banks

- South African National Blood Service

Segment Covered in the Report

By Product

- Whole Blood

- Blood Components

By End-use

- Hospitals

- Ambulatory Surgical Centers

By Application

- Anemia

- Trauma & Surgery

- Cancer Treatment

- Bleeding Disorders

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/