According to a research report “Blood Pressure Monitoring Devices Market (By Product: Digital Blood Pressure Monitor, Sphygmomanometer, Ambulatory Blood Pressure Monitor, Instruments and Accessories, and Transducers; By End-use: Ambulatory Surgical Centers & Clinics, Hospitals, and Home Healthcare) – Global Market Size, Trends Analysis, Segment Forecasts, Regional Outlook 2022 – 2027″ published by Precedence Research.

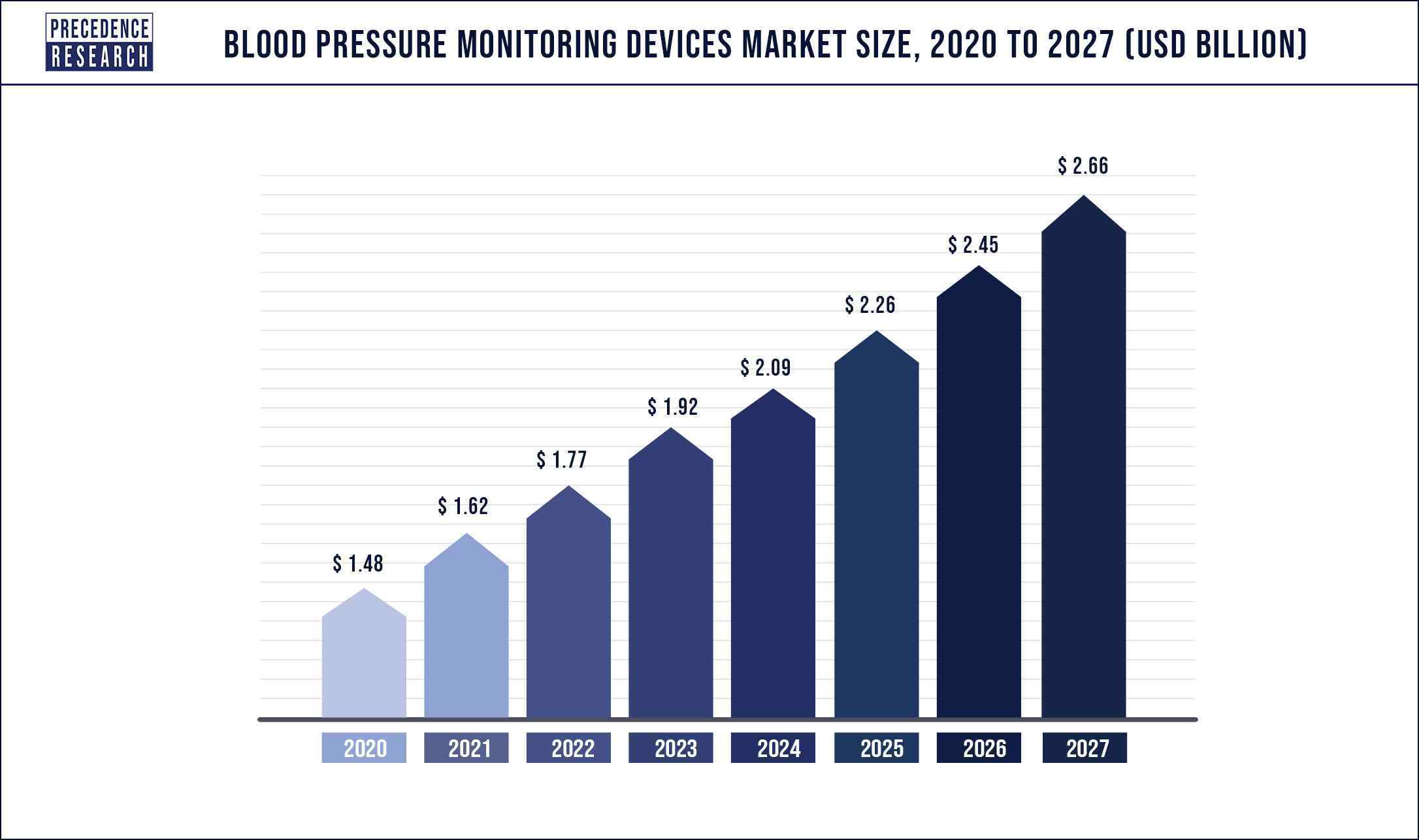

The blood pressure monitoring devices market size is projected to hit from USD 1.77 billion in 2022 to USD 2.66 billion by 2030, growing at a CAGR of 8.56% every year.

The study provides an analysis of the period 2017-2027, wherein 2022 to 2027 is the forecast period and 2021 is considered as the base year.

The pulse within the arteries is measured using blood pressure monitoring devices. In the measurement and monitoring of hypertension, blood pressure monitoring devices play a critical role. The pulse-checking devices are quite accurate, allowing doctors and healthcare professionals to provide patients with appropriate treatment.

Due to the rising number of cases of high blood pressure around the world, the market for blood pressure monitoring devices is booming. The blood pressure monitoring devices market has been accelerated by the expanding geriatric population. The blood pressure monitoring devices market has been pushed by the rising incidence of kidney and heart diseases.

Get a Free Sample Copy of this Report@ https://www.precedenceresearch.com/sample/1090

The blood pressure monitoring devices market will grow during the forecast period as the incidence of hypertension rises as a result of changing lifestyles. The need for blood pressure monitoring devices is quite high, due to the growing senior population and the rising risk of chronic ailments across the global population as a result of hectic lifestyles and rising obesity.

Due to the huge number of market players, the blood pressure monitoring devices market is fragmented and competitive. The major blood pressure monitoring devices market players are currently concentrating their efforts on expanding their businesses in order to strengthen their market positions.

Table of Contents

Report Scope of the Blood Pressure Monitoring Devices Market

| Report Highlights | Details |

| Market Size | USD 2.66 Billion by 2027 |

| Growth Rate | CAGR of 8.56% from 2022 to 2027 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2021 |

| Forecast Period | 2022 to 2027 |

| Segments Covered | Product Type, End User Type, Region Type |

COVID-19 Landscape

The demand for blood pressure monitors in China, Europe, and Asia remained strong in fiscal 2019. Meanwhile, demand in Japan slowed due to a rise in the consumption tax and other factors, while demand in North America fell due to trade tensions between the US and China. COVID-19 had a global impact in the fourth quarter.

The global demand for blood pressure monitors and thermometers increased in 2020, as a result of the growing requirement for health management to combat COVID-19’s effects. Furthermore, in light of the limits on non-essential travel outside the home, sales through online channels grew notably.

New challenges arose as a result of the COVID-19 epidemic, hastening the global adoption of telemedicine. Patients with hypertension, diabetes, or other chronic ailments, on the other hand, must attend hospitals or clinics frequently and receive ongoing care.

OMRON is working on a remote patient monitoring service that will allow patients to take their vital signs at home using our blood pressure monitor, ECG monitor, and/or body composition monitor with scale, and communicate the information with their doctors and nurses in real-time.

This allows individuals to receive proper guidance from their physicians without having to leave their homes or attend a hospital. The company is focusing on proposing novel telemedicine approaches that are adaptable to the approaching “new normal.”

Read Also: Skilled Nursing Facility Market Size to Hit US$ 592.10 Bn by 2030 – Daily Tech Bulletin

Market Dynamics

Drivers

Shift in consumer preferences

The governments of many countries are enforcing restrictions due to pandemic in various places and postponing elective surgery. Also, in the era of community transmission, patients are more drawn towards home care equipment, and a shift from hospital care to home settings is noted.

The digital blood pressure monitoring devices are examples of these kind of devices. They have ability to precisely measure body temperature, blood pressure, and cardiac problems. As a result, the shift in consumer preference of using blood pressure monitoring devices at home is driving the market growth during the forecast period.

Restraints

High cost of blood pressure monitoring devices

The use of blood pressure monitoring devices is quite limited in many poor or underdeveloped nations. Aside from that, the massive costs of the blood pressure monitoring devices are preventing these countries from adopting new and advanced technology. Thus, the high cost of blood pressure monitoring devices is limiting the market growth during the forecast period.

Opportunities

Rising prevalence of chronic disorders

The chronic disorders such as hypertension are becoming more common around the world. Furthermore, the governments of various nations, as well as private healthcare organizations, are constantly promoting hypertension management awareness. This is leading to a rise in self-diagnosis and routine checkups among the general public, which is driving the demand for blood pressure monitoring devices in the market.

As a result, the rising prevalence of chronic disorders is creating lucrative opportunities for the growth of the blood pressure monitoring devices market during the forecast period.

Challenges

Shortage of skilled technicians

The scarcity of skilled professionals or technicians is huge challenge for the growth of the blood pressure monitoring devices market. The highly skilled technicians provide instant solutions. They are capable of resolving issues related to technology. Thus, the shortage of skilled technicians is hindering the market growth for blood pressure monitoring devices over the forecast period.

Report Highlights

Based on the product, the digital blood pressure monitor segment dominated the global blood pressure monitoring devices market in 2020 with highest market share 35.3%. RPM stands for remote patient monitoring, which is the measurement and analysis of a patient’s health metrics such as vital signs, heart rate, blood glucose, temperature, and medication adherence without the patient being physically present in a clinical setting or with a healthcare practitioner.

Wearables that continuously monitor health in a non-invasive, discrete, and seamless manner, while being both convenient and comfortable for the user, are currently moving away from the more dated ideas of wearables as connected blood pressure cuffs or heart rate monitors, and toward wearables that are continuously monitoring health in a non-invasive, discrete, and seamless manner, are currently moving away from the more dated ideas of wearables as connected blood pressure cuffs or heart rate monitors.

Unnecessary trips to healthcare facilities will be eliminated as patients and caregivers are allowed to offer care at home, substantiating a decentralized healthcare model and improving resource allocation in hospitals and clinics.

The sphygmomanometers demand is predicted to grow as a result of technological improvements and new product releases around the world. Sphygmomanometers are devices that measure blood pressure, especially in arteries. A mercury column and a gauge with a dial face are the two types of sphygmomanometers. The most common sphygmomanometer in use today is a gauge attached to a rubber cuff placed around the upper arm and inflated to restrict the arteries.

Based on the end use, the hospitals segment dominated the global blood pressure monitoring devices market in 2020 with highest market share 60.6%. The desire for quick, cost-effective, and accurate diagnostic tools for better health outcomes drive the use of blood pressure monitoring devices in the hospitals.

Regional Snapshot

North America region accounted largest revenue share with 38% in 2020. In the future years, increased investments in the development of precise and effective blood pressure monitors are likely to contribute to the North America blood pressure monitoring devices market growth. Major factors fueling the expansion of remote patient monitoring in the region include the region’s rapidly rising senior population, high prevalence of chronic illnesses, and quick acceptance of telemedicine services in the United States and Canada.

The recent COVID-19 pandemic has sparked a surge in demand for remote patient monitoring devices. For example, the United States had more than 1.8 million coronavirus infections and about 105,000 deaths as of June 2020, whereas Canada had 93,000 cases and approximately 7,400 deaths owing to coronavirus.

The region’s high frequency of infectious diseases has fueled demand for teleconsultation. Remote patient monitoring may be a particularly effective and valuable method of treatment as our healthcare system strives to combat COVID-19. During a pandemic like COVID-19, clinicians can use remote patient monitoring devices to track blood pressure, heart rate, temperature, pulmonary function, and other pertinent physiology for changes in a patient’s condition and symptom development.

According to the Population Reference Bureau, the number of individuals aged 65 and above is projected to nearly double from 52 million in 2018 to 95 million by 2060. The surging geriatric population is susceptible to diabetes, and chronic disorders. Thus, there is high demand for portable and wireless gadgets both among patients and caregivers. Moreover, the region also houses some of the largest market participants, hence giving early bird advantage to North America.

Blood Pressure Monitoring Devices Market Share, By Region, 2020 (%)

| Region | 2020 (%) | |

| North America | 38 | % |

| Europe | 28 | % |

| Asia Pacific | 21.1 | % |

| MEA | 5.2 | % |

| Latin America | 7.7 | % |

Asia-Pacific is the fastest growing region in the blood pressure monitoring devices market. This is attributed to the presence of untapped markets, rising consumer awareness levels, increased research and development investments, and rising hypertension incidences, the Asia-Pacific is predicted to develop at a quick rate over the projection period.

The rapid improvement of healthcare facilities, as well as the rising number of untreated and undiagnosed instances of blood pressure, is driving the Asia-Pacific blood pressure monitoring devices market growth.

Key Companies & Market Share Insights

The global blood pressure monitoring devices market witnesses intense competition because of price sensitivity. Merger & acquisitions, collaborative, strategic alliances, and partnership are the key strategies adopted by the market players to sustain in the competition.

Certain of the noticeable performers in the blood pressure monitoring devices market as follows:

- Koninklijke Philips N.V.

- General Electric Company

- A & D Company, Limited

- SunTech Medical, Inc.

- Welch Allyn

- American Diagnostic Corporation

- Briggs Healthcare

- Withings

- Spacelabs Healthcare

- GF HEALTH PRODUCTS, INC.

- Kaz, A Helen of Troy Company

- Rossmax International Limited

- Microlife Corporation

Segments Covered in the Report

This research study comprises complete assessment of the market by means of far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers classification of marketplace into impending and niche sectors. Further, this research study calculates market size and its development drift at global, regional, and country from 2016 to 2027. This report contains market breakdown and its revenue estimation by classifying it on the basis ofproduct, end-use, and region:

By Product

- Digital Blood Pressure Monitor

- Wrist

- Arm

- Finger

- Sphygmomanometer

- Ambulatory Blood Pressure Monitor

- Instruments & Accessories

- Blood pressure cuffs

- Reusable

- Disposable

- Others

- Blood pressure cuffs

- Transducers

- Reusable

- Disposable

By End-User

- Ambulatory Surgical Centers & Clinics

- Hospitals

- Home Healthcare

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Blood Pressure Monitoring Devices Market, By Product

7.1. Blood Pressure Monitoring Devices Market, by Product Type, 2020-2027

7.1.1. Digital Blood Pressure Monitor (Wrist, Arm, Finger)

7.1.1.1. Market Revenue and Forecast (2016-2027)

7.1.2. Sphygmomanometer

7.1.2.1. Market Revenue and Forecast (2016-2027)

7.1.3. Ambulatory Blood Pressure Monitor

7.1.3.1. Market Revenue and Forecast (2016-2027)

7.1.4. Instruments & Accessories

7.1.4.1. Market Revenue and Forecast (2016-2027)

7.1.5. Transducers

Chapter 8. Global Blood Pressure Monitoring Devices Market, By End-Use

8.1. Blood Pressure Monitoring Devices Market, by End-Use, 2020-2027

8.1.1. Ambulatory Surgical Centers & Clinics

8.1.1.1. Market Revenue and Forecast (2016-2027)

8.1.2. Hospitals

8.1.2.1. Market Revenue and Forecast (2016-2027)

8.1.3. Home Healthcare

8.1.3.1. Market Revenue and Forecast (2016-2027)

Chapter 9. Global Blood Pressure Monitoring Devices Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Product (2016-2027)

9.1.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.1.3. U.S.

9.1.3.1. Market Revenue and Forecast, by Product (2016-2027)

9.1.3.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.1.4. Rest of North America

9.1.4.1. Market Revenue and Forecast, by Product (2016-2027)

9.1.4.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Product (2016-2027)

9.2.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.2.3. UK

9.2.3.1. Market Revenue and Forecast, by Product (2016-2027)

9.2.3.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.2.4. Germany

9.2.4.1. Market Revenue and Forecast, by Product (2016-2027)

9.2.4.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.2.5. France

9.2.5.1. Market Revenue and Forecast, by Product (2016-2027)

9.2.5.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.2.6. Rest of Europe

9.2.6.1. Market Revenue and Forecast, by Product (2016-2027)

9.2.6.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Product (2016-2027)

9.3.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.3.3. India

9.3.3.1. Market Revenue and Forecast, by Product (2016-2027)

9.3.3.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.3.4. China

9.3.4.1. Market Revenue and Forecast, by Product (2016-2027)

9.3.4.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.3.5. Japan

9.3.5.1. Market Revenue and Forecast, by Product (2016-2027)

9.3.5.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.3.6. Rest of APAC

9.3.6.1. Market Revenue and Forecast, by Product (2016-2027)

9.3.6.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Product (2016-2027)

9.4.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.4.3. GCC

9.4.3.1. Market Revenue and Forecast, by Product (2016-2027)

9.4.3.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.4.4. North Africa

9.4.4.1. Market Revenue and Forecast, by Product (2016-2027)

9.4.4.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.4.5. South Africa

9.4.5.1. Market Revenue and Forecast, by Product (2016-2027)

9.4.5.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.4.6. Rest of MEA

9.4.6.1. Market Revenue and Forecast, by Product (2016-2027)

9.4.6.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Product (2016-2027)

9.5.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.5.3. Brazil

9.5.3.1. Market Revenue and Forecast, by Product (2016-2027)

9.5.3.2. Market Revenue and Forecast, by End-Use (2016-2027)

9.5.4. Rest of LATAM

9.5.4.1. Market Revenue and Forecast, by Product (2016-2027)

9.5.4.2. Market Revenue and Forecast, by End-Use (2016-2027)

Chapter 10. Company Profiles

10.1. Koninklijke Philips N.V.

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. General Electric Company

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. A & D Company, Limited

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. SunTech Medical, Inc.

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Welch Allyn

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. American Diagnostic Corporation

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Briggs Healthcare

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Withings

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. Spacelabs Healthcare

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. GF HEALTH PRODUCTS, INC.

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

10.11. Kaz, A Helen of Troy Company

10.11.1. Company Overview

10.11.2. Product Offerings

10.11.3. Financial Performance

10.11.4. Recent Initiatives

10.12. Rossmax International Limited

10.12.1. Company Overview

10.12.2. Product Offerings

10.12.3. Financial Performance

10.12.4. Recent Initiatives

10.13. Microlife Corporation

10.13.1. Company Overview

10.13.2. Product Offerings

10.13.3. Financial Performance

10.13.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1090

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Website: https://www.precedenceresearch.com