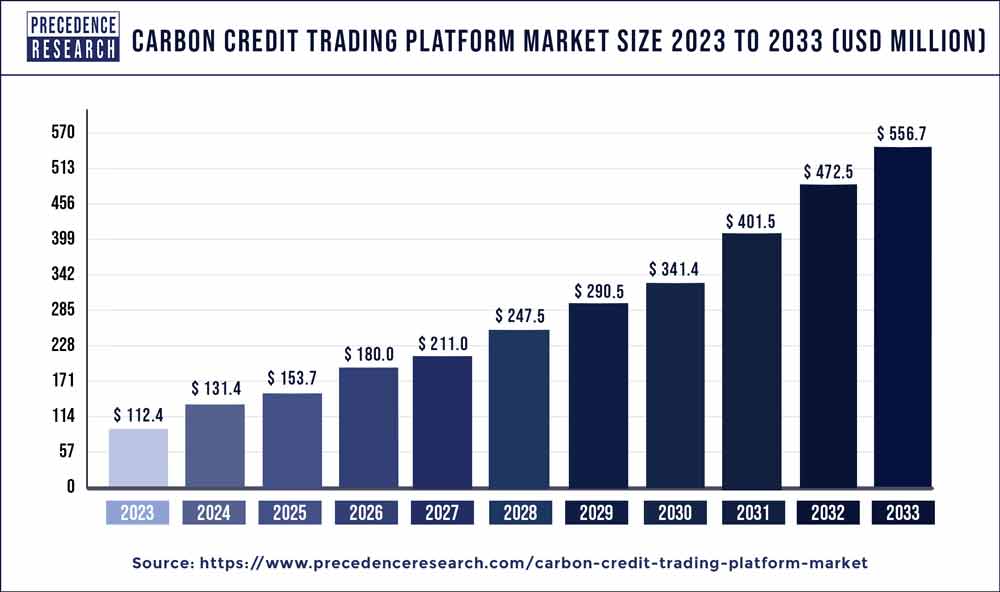

The global carbon credit trading platform market size was estimated to be around US$ 112.4 million in 2023 and is projected to reach US$ 556.7 million by 2033, indicating a CAGR of 17.40% from 2024 to 2033.

Key Takeaways

- Europe contributed 40% of market share in 2023.

- North America is estimated to expand the fastest CAGR between 2024 and 2033.

- By type, the voluntary segment has held the largest market share of 55% in 2023.

- By type, the compliance segment is anticipated to grow at a remarkable CAGR of 18.7% between 2024 and 2033.

- By system type, the cap trade segment generated over 57% of market share in 2023.

- By system type, the baseline and credit segment is expected to expand at the fastest CAGR over the projected period.

- By end-use, the utilities segment generated over 26% of market share in 2023.

- By end-use, the aviation segment is expected to expand at the fastest CAGR over the projected period.

The Carbon Credit Trading Platform Market is a dynamic sector that facilitates the buying and selling of carbon credits to mitigate the impact of greenhouse gas emissions. With the pressing global need to address climate change, carbon credit trading has emerged as a pivotal mechanism to incentivize businesses and organizations to reduce their carbon footprint. This market operates on the principles of emissions trading, providing a platform for entities to trade carbon credits as a means of achieving environmental sustainability.

Get a Sample: https://www.precedenceresearch.com/sample/3733

Growth Factors

The market’s growth is propelled by the increasing awareness of climate change and the need for sustainable business practices. Governments and international agreements advocating for emissions reduction have spurred the demand for carbon credits. Additionally, corporate initiatives to achieve carbon neutrality and the implementation of stringent environmental regulations contribute significantly to the market’s expansion. The rise of innovative technologies, such as blockchain, is streamlining the trading process and enhancing transparency, further fueling market growth.

Carbon Credit Trading Platform Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 17.40% |

| Global Market Size in 2023 | USD 112.4 Million |

| Global Market Size by 2033 | USD 556.7 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By System Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Automotive Glass Market Size to Reach USD 50.25 Billion by 2033

Opportunities

The Carbon Credit Trading Platform Market presents numerous opportunities for investors and stakeholders. The growing trend of ESG (Environmental, Social, and Governance) investing has created a substantial market for carbon credits, attracting funds towards sustainable projects. Advancements in verification methodologies and the standardization of carbon credits create opportunities for the market to become more accessible and efficient. Collaboration between governments and private enterprises can unlock new avenues for scalable, impactful projects that generate carbon credits.

Challenges

Despite its growth, the Carbon Credit Trading Platform Market faces several challenges. One major hurdle is the lack of a universal framework and standardized regulations, leading to variations in credit quality and pricing. The potential for fraudulent practices in carbon credit projects poses a reputational risk to the market. Additionally, the reliance on voluntary participation rather than mandatory regulations in some regions can limit the overall effectiveness of carbon credit trading in achieving significant emissions reductions.

Reasons to Purchase this Report:

- Comprehensive market segmentation analysis incorporating qualitative and quantitative research, considering the impact of economic and policy factors.

- In-depth regional and country-level analysis, examining the demand and supply dynamics that influence market growth.

- Market size in USD million and volume in million units provided for each segment and sub-segment.

- Detailed competitive landscape, including market share of major players, recent projects, and strategies implemented over the past five years.

- Comprehensive company profiles encompassing product offerings, key financial information, recent developments, SWOT analysis, and employed strategies by major market players.

Carbon Credit Trading Platform Market Companies

- AirCarbon Exchange (ACX)

- CarbonX

- CTX (Climate Trade)

- CBL Markets

- Markit (now IHS Markit)

- APX, Inc.

- Climex

- Carbon Trade Exchange (CTX)

- Karbone

- Redshaw Advisors

- EEX Group

- ClearBlue Markets

- ClimateCare

- South Pole

- Bluesource

Segments Covered in the Report

By Type

- Voluntary

- Compliance

By System Type

- Cap and Trade

- Baseline and Credit

By End-use

- Industrial

- Utilities

- Energy

- Petrochemical

- Aviation

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Carbon Credit Trading Platform Market

5.1. COVID-19 Landscape: Carbon Credit Trading Platform Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Carbon Credit Trading Platform Market, By Type

8.1. Carbon Credit Trading Platform Market, by Type, 2024-2033

8.1.1 Voluntary

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Compliance

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Carbon Credit Trading Platform Market, By System Type

9.1. Carbon Credit Trading Platform Market, by System Type, 2024-2033

9.1.1. Cap and Trade

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Baseline and Credit

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Carbon Credit Trading Platform Market, By End-use

10.1. Carbon Credit Trading Platform Market, by End-use, 2024-2033

10.1.1. Industrial

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Utilities

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Energy

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Petrochemical

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Aviation

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Carbon Credit Trading Platform Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by System Type (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by System Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by System Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by System Type (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by System Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by System Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by System Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by System Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by System Type (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by System Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by System Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by System Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by System Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by System Type (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by System Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by System Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by System Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by System Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by System Type (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by System Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by System Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. AirCarbon Exchange (ACX)

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. CarbonX

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. CTX (Climate Trade)

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. CBL Markets

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Markit (now IHS Markit)

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. APX, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Climex

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Carbon Trade Exchange (CTX)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Karbone

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Redshaw Advisors

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/