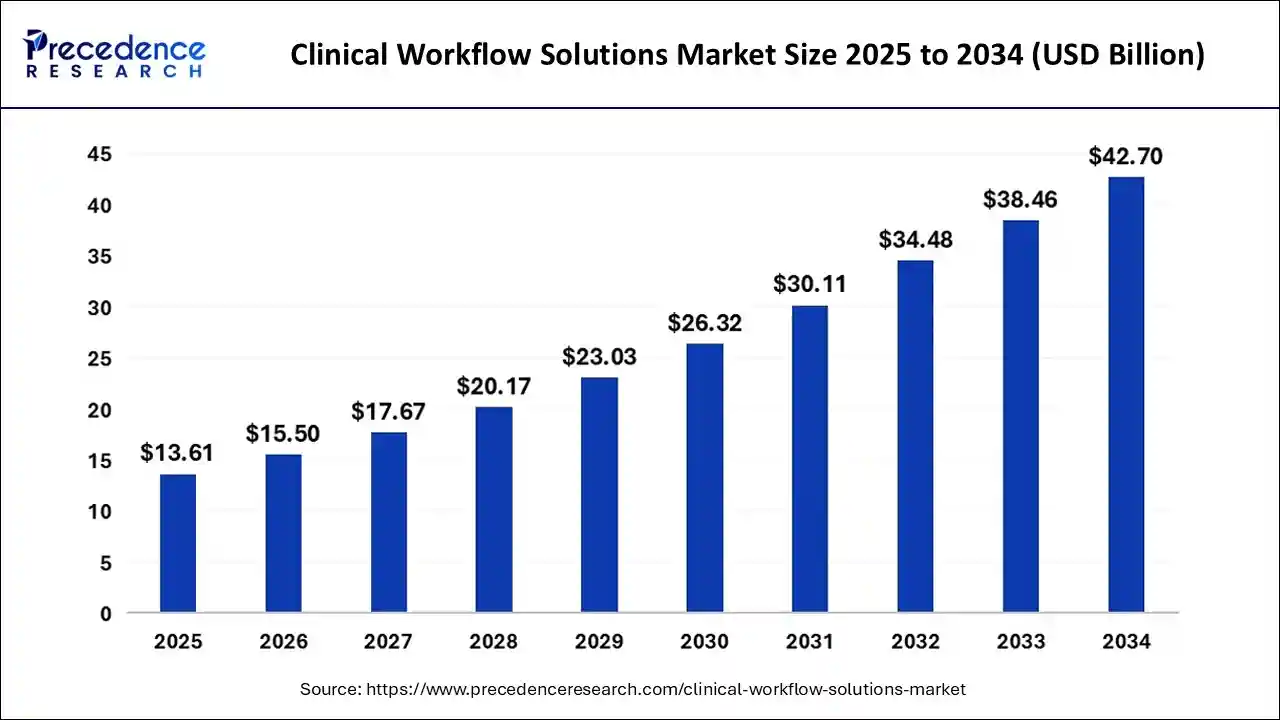

The global clinical workflow solutions market size is predicted to surge around USD 42.7 billion by 2034 from USD 11.96 billion in 2024, with a CAGR of 13.57%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1104

Key Points

- In 2024, North America led the market, generating more than 41.55% of total revenue.

- The data integration solutions segment captured a revenue share exceeding 26.4% by type.

- The hospitals segment emerged as the dominant end-user, accounting for 46% of the market share.

Market Dynamics

Drivers

The increasing demand for efficient healthcare services is a major driver for the clinical workflow solutions market. As patient volumes grow, healthcare providers are seeking advanced digital solutions to streamline workflows, reduce administrative burdens, and improve patient care coordination.

The rapid adoption of electronic health records (EHR) and hospital information systems (HIS) has also fueled market growth. Additionally, government initiatives promoting digital healthcare and interoperability among healthcare IT systems are encouraging the adoption of clinical workflow solutions.

Opportunities

The integration of artificial intelligence (AI) and machine learning (ML) in workflow solutions is creating significant opportunities for market expansion. AI-powered analytics help in predictive decision-making, early diagnosis, and personalized treatment planning.

The rise of telehealth and remote patient monitoring has further increased the need for efficient workflow management tools. Moreover, emerging markets in Asia-Pacific and Latin America present immense growth potential, as healthcare providers in these regions are increasingly investing in digital transformation to enhance patient outcomes.

Challenges

One of the major challenges in the market is the high cost of implementing clinical workflow solutions, which can be a barrier for small and mid-sized healthcare facilities. Additionally, interoperability issues between different healthcare IT systems can lead to inefficiencies and data silos, affecting seamless workflow integration.

Data privacy and security concerns, particularly compliance with regulations like HIPAA and GDPR, also pose significant hurdles for widespread adoption. Resistance from healthcare professionals to adopt new technologies due to workflow disruptions further limits market growth.

Regional Analysis

North America holds the largest share of the clinical workflow solutions market due to strong regulatory support, high adoption rates of EHRs, and the presence of leading healthcare IT companies. Europe follows closely, driven by initiatives promoting digital healthcare transformation.

The Asia-Pacific region is expected to witness the highest growth due to increasing investments in healthcare infrastructure and the growing adoption of advanced technologies. Latin America and the Middle East & Africa are also emerging as potential markets, supported by healthcare modernization efforts and rising awareness of workflow automation benefits.

Clinical Workflow Solutions Market Companies

- Cerner Corporation

- Allscripts Healthcare Solutions, Inc.

- NXGN Management, LLC

- Koninklijke Philips N.V.

- McKesson Corporation

- Hill-Rom Services Inc.

- General Electric

- Cisco

- Stanly Healthcare

- ASCOM

- Vocera Communications

- athenahealth, Inc.

Latest Announcements

- In March 2024, Royal Philips collaborated with Amazon Web Services (AWS) to address the growing need for secure, scalable digital pathology solutions in the cloud. Tehsin Syed, GM of Health AI at Amazon Web Services, said, “Healthcare organizations benefit when clinical workflow leadership is combined with scalable cloud infrastructure. By building cloud-native enterprise pathology solutions on services like AWS Health Imaging and Amazon Bedrock, Philips is offering their customers the best of both worlds.”

Recent Developments

- In December 2024, the All India Institute of Medical Sciences (AIIMS) signed a MoU (Memorandum of Understanding) with Wipro GE Healthcare. Under this MoU, Wipro GE Healthcare will focus on the development of intelligent systems and workflow solutions tailored to the identified areas in healthcare.

- In October 2024, Emtelligent, a leading company engaged in the development of clinical-grade medical AI software, announced the launch of its emtelligent Clinical Workflow. This AI-driven clinical review tool transforms the way healthcare professionals review medical records.

Segments Covered in the Report

This research study comprises complete assessment of the market by means of far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers classification of marketplace into impending and niche sectors. Further, this research study calculates market size and its development drift at global, regional, and country from 2025 to 2034. This report contains market breakdown and its revenue estimation by classifying it on the basis oftype, end-use, and region:

By Type

- Real-Time Communication Solutions

- Unified Communication

- Nurse Call Alert Systems

- Data Integration Solutions

- Medical Image Integration

- EMR Integration

- Workflow Automation Solutions

- Nursing & Staff Scheduling Solutions

- Patient Flow Management Solutions

- Enterprise Reporting & Analytics Solutions

- Care Collaboration Solutions

- Rounding Solutions

- Perinatal Care Management

- Medication Administration

- Other Care Collaboration Solutions

By End-User

- Ambulatory Care Centers

- Long-term Care Facilities

- Hospitals

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/