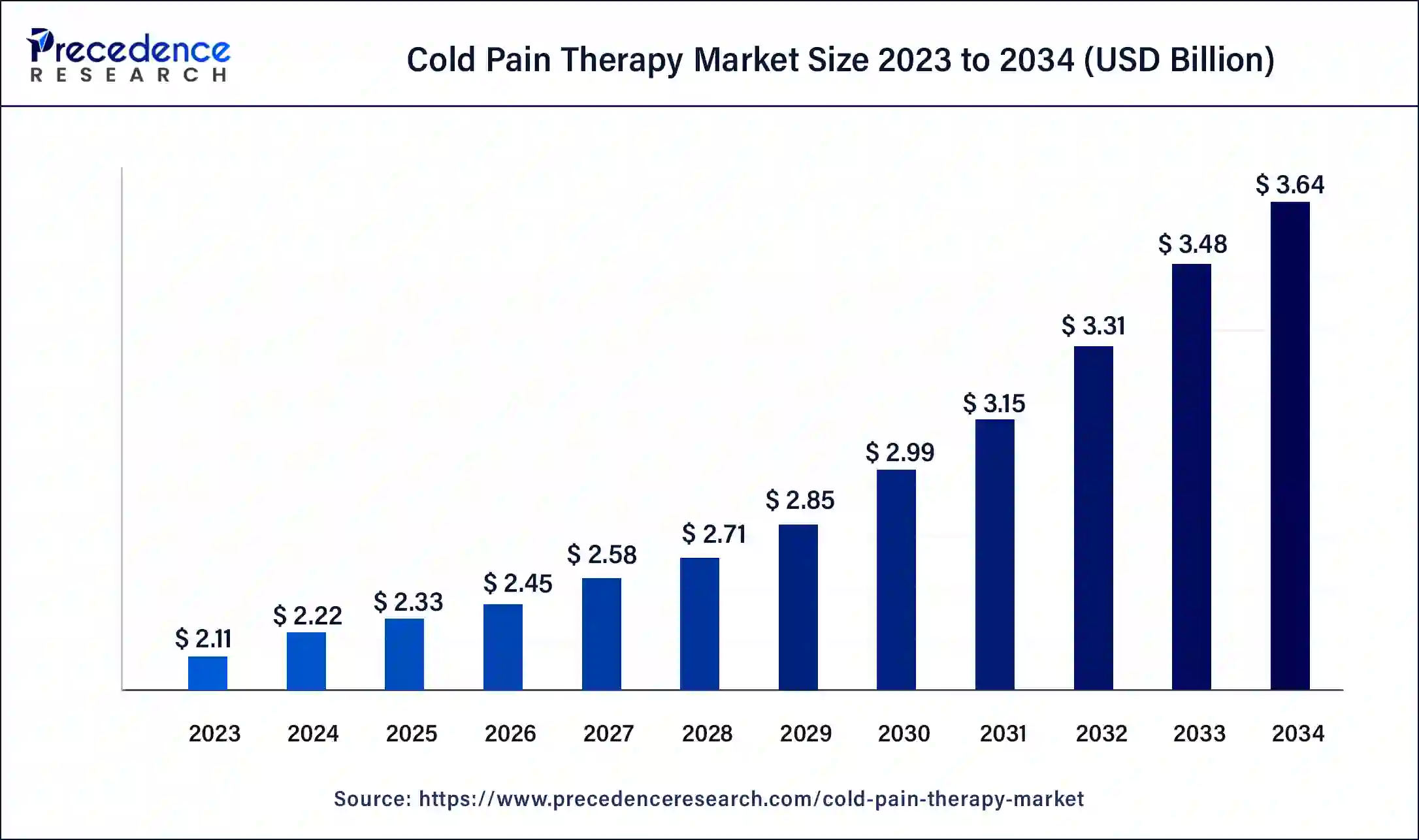

The global cold pain therapy market size was estimated at USD 2.11 billion in 2023 and is projected to rise around USD 3.48 billion by 2033, growing at a CAGR of 5.12% from 2024 to 2033.

Key Points

- The North America cold pain therapy market size accounted for USD 870 million in 2023 and is expected to attain around USD 1,440 million by 2033, poised to grow at a CAGR of 5.16% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 41% in 2023.

- Asia Pacific is expected to hold the fastest-growing market during the forecast period.

- By product, the OTC segment has held the biggest revenue share of 64% in 2023.

- By product, the prescription segment is expected to grow at the fastest rate in the market during the forecast period.

- By application, the musculoskeletal disorders segment has contributed more than 40% in 2023.

- By application, the post-trauma therapy segment is expected to expand notably in the market over the projected period.

- By distribution channel, the retail pharmacies segment led the global market in 2023.

- By distribution channel, the hospital pharmacies segment is expected to grow rapidly in the market during the forecast period.

The cold pain therapy market is a segment within the broader medical devices industry focused on providing relief from pain through the application of cold therapy. This therapy involves the use of cold packs, wraps, and devices to alleviate pain, reduce inflammation, and promote healing for various injuries and medical conditions. It is widely used in sports medicine, post-operative care, and treatment of chronic conditions such as arthritis.

Get a Sample: https://www.precedenceresearch.com/sample/4358

Growth Factors

The cold pain therapy market has witnessed significant growth in recent years due to several key factors. Firstly, an increasing prevalence of sports injuries and orthopedic conditions has boosted the demand for effective pain management solutions. Additionally, growing awareness among healthcare professionals and patients about the benefits of cold therapy has driven adoption rates. Technological advancements in cold therapy devices, such as the development of portable and wearable options, have also contributed to market growth.

Region Insights

The cold pain therapy market exhibits regional variations in terms of market size, adoption rates, and regulatory landscape. North America holds the largest market share, driven by a high prevalence of musculoskeletal injuries, a well-established healthcare infrastructure, and robust reimbursement policies. Europe follows closely, with a growing emphasis on sports medicine and rehabilitation driving market expansion. The Asia-Pacific region is poised for rapid growth, fueled by increasing healthcare expenditure, rising awareness about cold therapy benefits, and a growing aging population.

Cold Pain Therapy Market Scope

| Report Coverage | Details |

| Cold Pain Therapy Market Size in 2023 | USD 2.11 Billion |

| Cold Pain Therapy Market Size in 2024 | USD 2.22 Billion |

| Cold Pain Therapy Market Size by 2033 | USD 3.48 Billion |

| Cold Pain Therapy Market Growth Rate | CAGR of 5.12% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Distribution Channel, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cold Pain Therapy Market Dynamics

Drivers

Several factors are driving the growth of the cold pain therapy market. These include the increasing incidence of sports injuries and orthopedic conditions, rising demand for non-invasive pain management solutions, and expanding applications of cold therapy beyond traditional sports medicine to include post-operative care and chronic pain management. Furthermore, favorable reimbursement policies in many countries are incentivizing healthcare providers to recommend cold therapy to patients.

Opportunities

The cold pain therapy market presents several opportunities for expansion and innovation. There is a growing demand for advanced cold therapy devices that offer improved efficacy, ease of use, and portability. Expansion into emerging markets, such as Asia-Pacific and Latin America, offers significant growth opportunities due to rising healthcare expenditure and increasing awareness about the benefits of cold therapy. Additionally, partnerships and collaborations between medical device manufacturers and healthcare providers can help drive market penetration and product development.

Challenges

Despite the favorable growth prospects, the cold pain therapy market faces certain challenges. These include regulatory hurdles associated with the approval and commercialization of cold therapy devices, particularly in regions with stringent medical device regulations. Competition from alternative pain management modalities, such as heat therapy and pharmaceuticals, poses a challenge to market growth. Moreover, limited reimbursement coverage for cold therapy products in some regions may hinder adoption rates among patients and healthcare providers.

Read Also: Personal Mobility Devices Market Size, Share, Report by 2033

Cold Pain Therapy Market Recent Developments

- In October 2023, IBM and the EY announced the release of EY.ai Workforce, a cutting-edge HR solution that makes it easier for businesses to incorporate artificial intelligence (AI) into their essential HR business operations. This is a critical next step in the firms’ partnership and a major turning point in the way AI is being used to boost productivity in the HR department.

- In October 2023, Hyloris Pharmaceuticals, a Belgian firm, said that the U.S. health authorities had approved its new tab medication for post-operative pain. The company anticipates launching the non-opioid treatment in the United States by early next year. Branded as Maxigesic IV, the injectable medication was authorized for use in hospitals following surgery or in cases where patients are unable to take oral medication.

Cold Pain Therapy Market Companies

- Romsons Sustaining the Life Force

- 3M

- DJO, LLC.

- Hot and Cold Company

- Polar Products Inc.

- Medline Industries, Inc.

- Hisamitsu Pharmaceutical Co., Inc.

- Sanofi

Segment Covered in the Report

By Product

- OTC Products

- Prescription Products

By Distribution Channel

- Hospitals Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Application

- Musculoskeletal Disorders

- Post-Operative Therapy

- Sports Injuries

- Post-trauma Therapy

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/