Table of Contents

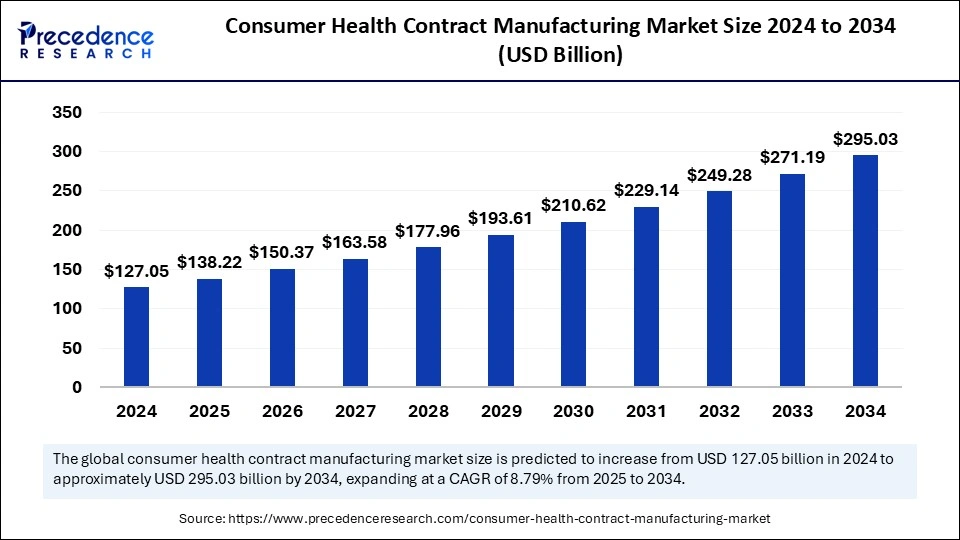

The global consumer health contract manufacturing market size was valued at USD 127.05 billion in 2024 and is expected to reach around USD 295.03 billion by 2034, growing at a CAGR of 8.79%.

Consumer Health Contract Manufacturing Market Key Points

-

North America led the market, capturing over 34% of the total market share in 2024.

-

The Asia Pacific region is expected to witness the fastest CAGR growth in the forecast period.

-

The over-the-counter (OTC) drugs segment emerged as the dominant product category, holding a 35% share in 2024.

-

The nutritional supplements segment is anticipated to expand at a strong CAGR of 9.4% in the coming years.

-

Among services, the API manufacturing segment maintained its leading position in 2024.

-

The pharmaceutical & biopharmaceutical sector remained the largest end-use segment in 2024.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5739

Impact of AI on the Consumer Health Contract Manufacturing Market

1. Enhancing Production Efficiency and Automation

AI is revolutionizing the consumer health contract manufacturing market by streamlining production processes and optimizing operational efficiency. AI-driven automation reduces human intervention, minimizing errors and improving production speed. Smart manufacturing techniques, such as predictive maintenance and robotic process automation, enhance efficiency, reduce downtime, and improve overall yield in pharmaceutical and supplement manufacturing.

2. Accelerating Drug Development and Formulation

AI-powered algorithms assist in drug formulation and development by analyzing vast datasets, identifying patterns, and predicting optimal ingredient combinations. This leads to faster research and development (R&D) cycles, reducing the time required to bring new consumer health products to market. AI also helps in formulating personalized healthcare solutions by assessing consumer trends and individual health data.

3. Quality Control and Compliance Monitoring

AI plays a crucial role in ensuring product quality and regulatory compliance. AI-driven inspection systems detect defects in packaging, labeling, and product composition with high precision. Machine learning models analyze real-time data from manufacturing lines to ensure adherence to Good Manufacturing Practices (GMP) and regulatory requirements, reducing the risk of non-compliance and product recalls.

4. Optimizing Supply Chain and Demand Forecasting

AI-driven predictive analytics enhances supply chain management by improving demand forecasting and inventory management. AI models analyze consumer behavior, historical sales data, and external factors to predict demand fluctuations, helping manufacturers optimize production schedules and reduce excess inventory or shortages. Additionally, AI-powered logistics solutions improve transportation and distribution efficiency.

5. Personalized Consumer Health Products

AI is driving the trend of personalized health solutions by analyzing consumer preferences, genetic data, and lifestyle choices. Contract manufacturers use AI-powered insights to develop tailored vitamins, supplements, and healthcare products, catering to individual health needs. This shift toward customization is expected to boost consumer engagement and brand loyalty.

6. Advancing Smart Packaging and Traceability

AI-powered smart packaging solutions enhance product safety and authenticity by incorporating features like QR codes, NFC chips, and blockchain-based traceability. Consumers can scan packaging to verify product authenticity, track manufacturing details, and receive personalized health recommendations. AI-driven monitoring systems also detect counterfeit products, ensuring consumer safety.

7. Cost Reduction and Waste Minimization

AI-driven optimization techniques help contract manufacturers reduce costs by minimizing raw material waste, optimizing resource allocation, and improving energy efficiency. AI-powered simulations and digital twins enable manufacturers to test production scenarios before implementation, reducing trial-and-error costs.

8. AI in Consumer Insights and Market Trends

AI-driven analytics platforms analyze market trends, social media data, and consumer feedback to provide manufacturers with real-time insights. This helps contract manufacturers understand shifting consumer preferences, emerging health trends, and competitor strategies, enabling them to develop products that align with market demand.

Also Read: Therapeutic Hypothermia Systems Market

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 295.03 Billion |

| Market Size in 2025 | USD 138.22 Billion |

| Market Size in 2024 | USD 127.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.79% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Service, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Drivers

The rising demand for consumer health products, fueled by increasing health awareness and self-medication trends, is a major driver for the market. The expansion of e-commerce and digital healthcare platforms has made it easier for consumers to access a wide range of OTC drugs and supplements. Additionally, stringent regulations governing drug manufacturing are prompting pharmaceutical firms to partner with contract manufacturers who specialize in compliance and quality control. The growing trend of personalized health and wellness solutions is also boosting demand for specialized contract manufacturing services.

Opportunities in the Market

Technological advancements in AI, automation, and data-driven manufacturing are creating new opportunities in the sector. AI-powered predictive analytics is improving production efficiency, while innovations in biologics and personalized medicine open new avenues for contract manufacturers. The increasing adoption of plant-based and organic health products presents further growth opportunities. Emerging markets, particularly in Asia-Pacific and Latin America, offer potential for expansion due to rising healthcare investments and increasing consumer spending on health products.

Challenges in the Market

Despite its growth, the market faces challenges such as stringent regulatory requirements, supply chain disruptions, and high competition among contract manufacturers. Ensuring consistent product quality, managing production costs, and addressing sustainability concerns are also significant hurdles. Additionally, geopolitical uncertainties and fluctuating raw material prices can impact supply chain stability and profitability.

Regional Outlook

North America holds a significant share of the consumer health contract manufacturing market, driven by a well-established healthcare sector, strong R&D investments, and high consumer demand for dietary supplements and OTC drugs. Europe follows closely, with stringent regulatory frameworks ensuring high-quality production standards. The Asia-Pacific region is projected to witness the fastest growth, supported by increasing government initiatives, rising health awareness, and cost-effective manufacturing capabilities. Latin America and the Middle East & Africa are also emerging as promising markets due to their expanding healthcare infrastructure.

Consumer Health Contract Manufacturing Market Companies

- Lonza

- Recipharm AB

- Piramal Consumer Products

- Scapa Healthcare

- Catalent, Inc

- SCN BestCo

- Aenova Group

- Ventiz Healthcare

- Bionova

- Aurohealth

- Siegrified AG

- Thermo Fisher Scientific Inc

- Famar

- Sirio Pharma Co., Ltd

- Tishcon Corporation

- Vit-Best Nutrition Inc

Recent Developments

- In October 2024, Samsung Biologics, a global contract development and manufacturing organization (CDMO), signed a USD 1.24 billion contract manufacturing deal with an Asia-based pharmaceutical company to bring effective, high-quality biopharmaceuticals to the market.

- In October 2023, Lallemand Health Solutions announced the launch of a new contract manufacturing and development platform, Expert’Biome CDMO. This new platform enables the company to support partners in developing next-generation strains by offering services like research and development, bioprocess scaling, drug manufacturing, and other production steps.

Segments Covered in the Report

By Product

- Over-the-counter (OTC) Drugs

- Nutritional Supplements

- Personal Care Products

- Medical Devices

- Others

By Service

- API Manufacturing

- Finished Dose Manufacturing

- Medical Device Manufacturing

- Packaging & Labelling

- Others

By End-use

- Pharmaceutical & Biopharmaceutical Companies

- Nutraceutical Companies

- Cosmeceutical Companies

- Medical Device Companies

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/