Table of Contents

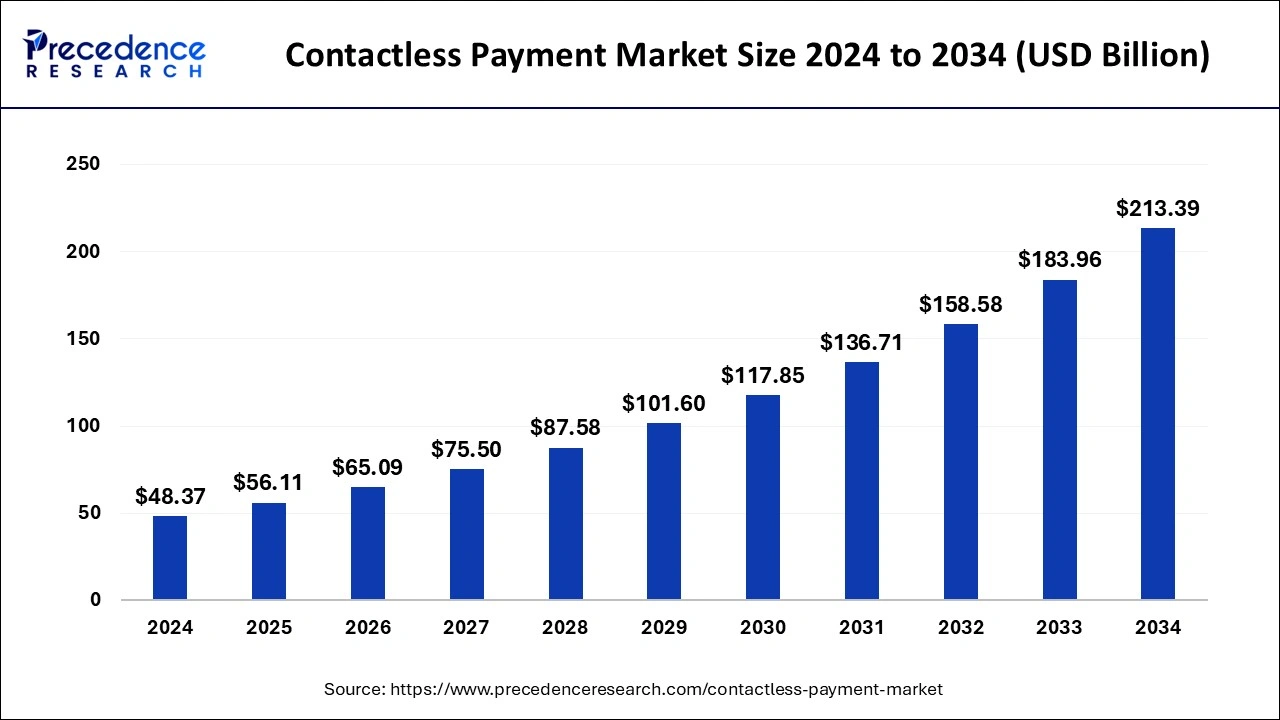

The contactless payment market size was evaluated at USD 48.37 billion in 2024 and is projected to surpass around USD 213.39 billion by 2034 with a CAGR of 16%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1044

Key Takeaways

- In 2024, North America dominated the global market, holding the largest market share.

- The payment terminal solution segment accounted for over 40% of the total revenue share.

- The retail segment contributed more than 60% of the revenue share by application.

- The smartphones and wearables segment generated over 60% of the revenue share by device.

AI Transforming the Contactless Payment Market

- AI enhances fraud detection by identifying suspicious transactions in real time.

- Machine learning algorithms optimize transaction speed and accuracy, improving user experience.

- AI-driven analytics help businesses personalize offers and loyalty programs based on consumer behavior.

Contactless Payment Market Overview

The contactless payment market has witnessed significant growth in recent years, driven by the increasing demand for fast, secure, and convenient payment solutions. With the widespread adoption of smartphones, wearable devices, and contactless-enabled cards, digital transactions have become more seamless than ever. The COVID-19 pandemic accelerated the shift towards contactless payments as consumers and businesses sought hygienic and touch-free transaction methods. Advancements in near-field communication (NFC) and radio frequency identification (RFID) technologies have further enhanced the adoption of contactless payment solutions across various industries, including retail, hospitality, and transportation.

Market Dynamics

Market Drivers

The growing preference for cashless transactions is one of the major drivers of the contactless payment market. Rising consumer awareness about digital payment security and the convenience of tap-and-go transactions have fueled market expansion. Governments and financial institutions are also promoting digital payments by implementing favorable regulations and initiatives. The increasing penetration of smartphones and the expansion of mobile payment apps have contributed to market growth. Additionally, the integration of artificial intelligence and blockchain in payment processing has improved security and efficiency, encouraging more users to adopt contactless solutions.

Opportunities

The rapid development of smart cities and the expansion of the e-commerce industry present lucrative opportunities for the contactless payment market. The adoption of digital wallets and wearable payment devices is expected to rise, creating new revenue streams for technology providers. Emerging markets in Asia-Pacific, Latin America, and Africa offer vast potential due to increasing internet penetration and digital payment infrastructure development. Furthermore, partnerships between financial institutions and technology firms are likely to enhance innovation and drive market growth.

Challenges

Despite its rapid expansion, the contactless payment market faces challenges such as cybersecurity threats, fraud risks, and high initial implementation costs. Concerns regarding data privacy and security breaches have raised apprehensions among consumers and businesses. Additionally, some regions still lack the necessary infrastructure to support widespread adoption. The need for continuous technological advancements to combat evolving cyber threats remains a key challenge for the industry.

Regional Insights

North America and Europe lead the contactless payment market due to their advanced digital payment ecosystems and high consumer adoption rates. Countries such as the United States, Canada, the United Kingdom, and Germany have well-established infrastructure supporting contactless transactions. The Asia-Pacific region is witnessing rapid growth, driven by the increasing adoption of mobile payments in countries like China, India, and Japan. The Middle East and Africa, along with Latin America, are emerging markets with strong potential, as governments and businesses invest in digital payment infrastructure.

Contactless Payment Market Companies

- Verifone

- Ingenico Group SA

- Gemalto

- Visa Inc.

- Giesecke & Devrient GmbH

- Heartland Payment Systems, Inc.

- Thales Group

- Wirecard AG

- On Track Innovations Ltd.

- IDEMIA

Recent Developments:

- In August 2024, Mastercard collaborated with boAt, India’s leading wearables brand, to enable contactless payments on boAt’s payment-enabled smartwatches. This collaboration enables Mastercard cardholders to make convenient and secure transactions using the boat’s wearable devices by offering key features such as Tap-and-Pay functionality and enhanced security.

- In September 2024, NMI, a global leader in embedded payments, partnered with INIT, a leading supplier of public transit ticketing solutions, to implement a cutting-edge payment processing solution for the San Diego Metropolitan Transit System (MTS). This collaboration showcases a new “Tap-on/Tap-off” model that enhances both convenience and security for daily commuters on MTS buses and trolleys.

- In January 2025, Mollie, a leading provider of financial services in Europe, introduced Apple’s Tap to Pay on iPhone for its customers in Austria, Italy, and the U.K. This allows businesses of all sizes to use the Mollie app on iPhone to accept contactless payments without the need for additional hardware.

Segments Covered in the Report

By Solution

- Security and Fraud Management

- Payment Terminal Solution

- Transaction Management

- Hosted Point-of-Sales

- Analytics

By Application

- Government

- Healthcare

- Retail

- Transportation

- Hospitality

By Device

- Point-of-Sales Terminals

- Smartphones & Wearables

- Smart Cards

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/