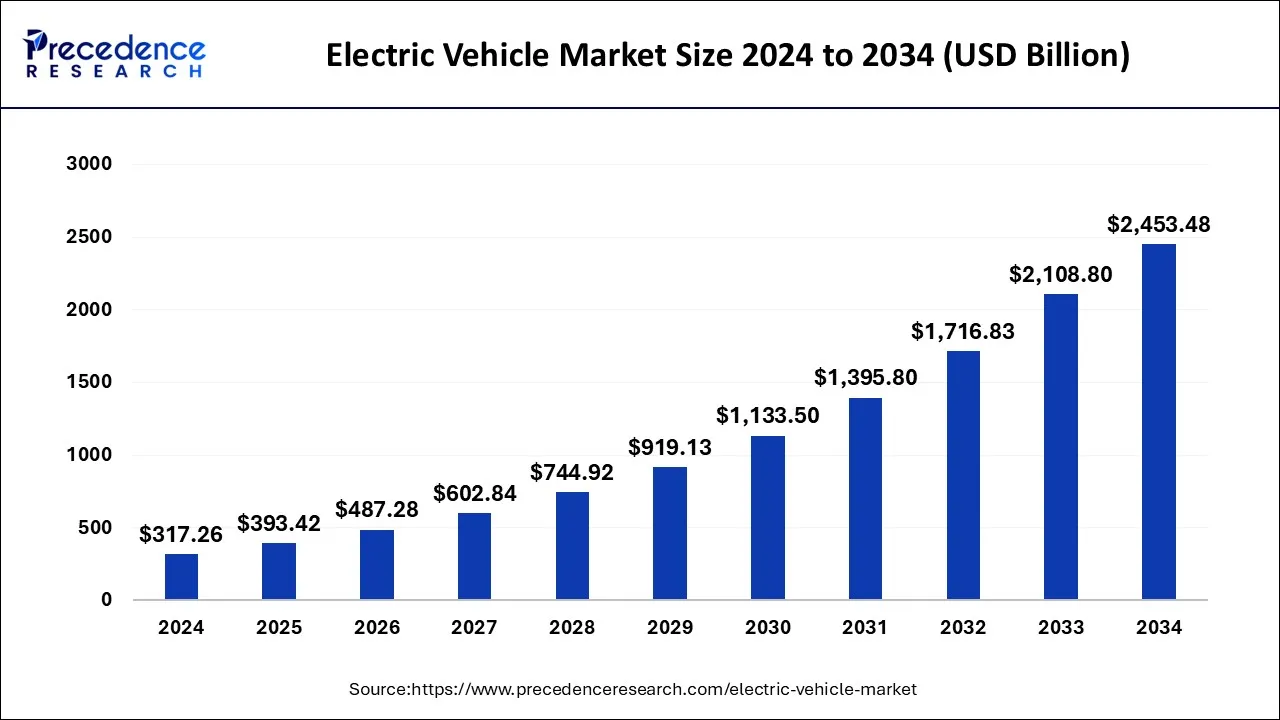

The electric vehicle market size was evaluated at USD 317.26 billion in 2024 and is predicted to attain around USD 2,453.48 billion by 2034 with a CAGR of 22.69%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1009

Market Key Takeaway

- Asia-Pacific maintained its leading position in the EV market with a 42.14% revenue share in 2024.

- The Asia-Pacific EV market was valued at USD 107.68 billion in 2024, showcasing strong regional growth.

- Battery Electric Vehicles (BEVs) dominated the market, contributing 67.7% of total revenue by propulsion type in 2024.

- The passenger car segment accounted for 62.4% of total revenue in 2024, making it the largest vehicle type category.

- Europe is set to achieve a 40% reduction in greenhouse gas emissions by 2040, with a target of net zero emissions by 2050.

- In 2021, Norway and Iceland saw 86% and 64% of newly registered cars being electric, respectively.

- The hybrid electric vehicle (HEV) segment is projected to grow to USD 301.67 billion by 2030, up from USD 77.58 billion in 2021.

- The plug-in hybrid EV (PHEV) market is expected to generate USD 385.62 billion in revenue between 2025 and 2034.

Electric Vehicle Market Overview

The electric vehicle (EV) market is growing rapidly, driven by technological advancements, government incentives, and increasing consumer demand for sustainable transportation. EVs, including battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs), are transforming the automotive industry by reducing reliance on fossil fuels and lowering carbon emissions. Automakers are investing in battery technology, charging infrastructure, and vehicle performance to accelerate EV adoption.

Market Drivers

Several factors are fueling the EV market’s expansion. Governments worldwide are implementing stricter emissions regulations and offering incentives to boost EV adoption. Falling battery costs have made EVs more competitive with traditional gasoline vehicles. Consumer interest in eco-friendly transportation is rising, and improvements in charging infrastructure are addressing range anxiety. Automakers are also introducing a wider variety of EV models to meet diverse consumer preferences.

Market Opportunities

The EV sector offers significant opportunities for growth and innovation. Advancements in battery technology, such as solid-state batteries, promise improved energy density and faster charging. The integration of smart and connected features, including autonomous driving and vehicle-to-grid (V2G) technology, is opening new possibilities. The expansion of renewable energy sources, such as solar-powered charging stations, is creating synergies between the EV and energy industries. Emerging markets also present vast growth potential as infrastructure improves and production costs decrease.

Market Challenges

Despite strong growth, the EV market faces several hurdles. The high initial cost of EVs remains a concern for many consumers, especially in developing regions. Charging infrastructure is still limited in some areas, slowing adoption. Battery production and the sourcing of key materials like lithium and cobalt pose supply chain and environmental challenges. Automakers also need to scale up EV production and transition from traditional internal combustion engine (ICE) vehicles. Addressing these challenges will require coordinated efforts across industries and governments.

Regional Insights

EV adoption varies by region. Asia-Pacific dominates the market, led by China’s strong government support and manufacturing capabilities. Japan and South Korea are also key players in battery technology and EV production. Europe is advancing rapidly due to strict emissions regulations and incentives, with Norway, Germany, and the Netherlands leading the shift. North America, particularly the U.S., is seeing increased EV adoption, driven by automakers like Tesla and government initiatives. Emerging markets in Latin America, the Middle East, and Africa are gradually investing in EV infrastructure, paving the way for future growth.

The EV market is on a strong upward trajectory. Overcoming challenges related to cost, infrastructure, and supply chains will be essential for continued expansion. Innovations in battery technology and connectivity will further strengthen EV adoption worldwide.

Electric Vehicle Market Companies

- Ampere Vehicles

- Benling India Energy and Technology Pvt Ltd

- BMW AG

- BYD Company Limited

- Chevrolet Motor Company

- Daimler AG

- Energica Motor Company S.p.A.

- Ford Motor Company

- General Motors

- Hero Electric

- Hyundai Motor Company

- Karma Automotive

- Kia Corporation

- Lucid Group, Inc.

- Mahindra Electric Mobility Limited

- NIO

- Nissan Motors Co., Ltd.

- Okinawa Autotech Pvt. Ltd.

- Rivain

- Tata Motors

- Tesla Inc.

- Toyota Motor Corporation

- Volkswagen AG

- WM Motor

- Xiaopeng Motors

Key Developments

- In January 2023, the UK government achieved its goal of converting over a quarter of all of its automobiles (25.5%) to ultra-low emission vehicles, and is now moving forward with decarbonizing its central car fleet (ULEV).

- In January 2023, MG unveiled new small electric car concept at the biennial Auto Expo in India.

- In January 2023, the UK government achieved its goal of converting over a quarter of all of its automobiles (25.5%) to ultra-low emission vehicles, and is now moving forward with decarbonizing its central car fleet (ULEV).

- In January 2023, MG unveiled new small electric car concept at the biennial Auto Expo in India.

- BMW will debut its new i4 electric vehicle in November 2021, with a range of 300-367 miles. In just four seconds, the car can reach 100 km/h. It has an automatic transmission and is equipped with linked car capabilities.

- In April 2021, the key player named Toyota introduced the new Mirai & LS models in the city japan which come with the technology of advanced driving assessment.

- In April 2021, the key player named BYD introduced four new electric vehicle models which were equipped with Blade batteries in Chongqing. The new vehicle models, Qin plus EV, E2 2021 Tang EV, and Song plus EV came with the advanced feature of battery safety.

- In April 2021, the key player named Volkswagen reviled the 7 seater ID.6 X and EV ID.6 Crozz manufactured along with SAIC and FAW in China. Furthermore, these vehicles be sold in China only. Also, it comprises of 2 versions of battery, as 77 kWh & 58 kWh and comes in four powertrain configurations.

- Tesla, Inc. declared the acquisition of Maxwell Technologies, Inc. in March 2019. The purchase was made with the goal of improving Tesla’s batteries and lowering overall costs in order to obtain a competitive edge in the market.

- The Nissan Motor Company has surpassed 180,000 consumers, which is the most significant milestone in the LEAF’s launch. The latest vehicle from this business is the Ariya, an electric crossover coupe.

Segments Covered in the Report

By Propulsion Type

- Hybrid Vehicles

- Pure Hybrid Vehicles

- Plug-in Hybrid Vehicles

- Battery Electric Vehicles

- Fuel Cell Electric Vehicles

By Components

- Battery Cells & Packs

- On-Board Charge

- Motor

- Reducer

- Fuel Stack

- Power Control Unit

- Battery Management System

- Fuel Processor

- Power Conditioner

- Air Compressor

- Humidifier

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- E-Scooters & Bikes

- Light Commercial Vehicles

- Others

By Vehicle Class

- Mid-priced

- Luxury

By Top Speed

- Less Than 100 MPH

- 100 to 125 MPH

- More Than 125 MPH

By Vehicle Drive

- Front-Wheel Drive

- Rear Wheel Drive

- All Wheel Drive

By EV Charging Point Type

- Normal Charging

- Super Charging

By V2G

- V2B or V2H

- V2G

- V2V

- V2X

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/