Table of Contents

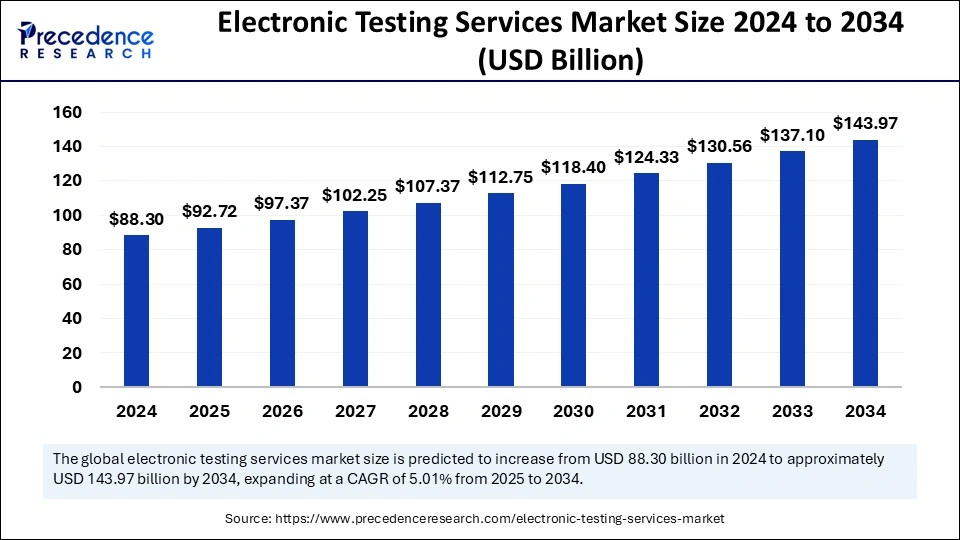

The global electronic testing services market size was valued at USD 88.30 billion in 2024 and is expected to Surpass around USD 143.97 billion by 2034, growing at a CAGR of 5.01 % from 2025 to 2034.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5764

Electronic Testing Services Market Key Points

-

Asia Pacific held the largest market share in 2024, leading the global market.

-

North America is projected to experience the highest CAGR during the forecast period, reflecting strong growth potential.

-

Among service types, motors and generator testing emerged as the dominant segment in 2024.

-

The transformer testing segment is anticipated to register a notable CAGR in the coming years.

-

By end use, data centers accounted for the largest market share in 2024.

-

The transmission and distribution stations segment is expected to grow significantly over the study period.

The Transformative Impact of AI on the Electronic Testing Services Market

The electronic testing services market is experiencing a transformation with the adoption of AI, which enhances testing speed, precision, and automation. AI-driven test equipment can autonomously analyze electronic components, reducing manual intervention and accelerating production cycles. With the help of deep learning and neural networks, AI can detect complex defects that traditional testing methods might miss, ensuring higher product reliability.

In addition to improving fault detection, AI enables predictive maintenance by analyzing historical test data to anticipate potential failures. This proactive approach minimizes unexpected breakdowns and enhances equipment longevity. The integration of AI with cloud-based testing solutions also facilitates remote diagnostics and real-time monitoring, allowing companies to optimize resources and reduce operational costs. AI’s influence on electronic testing services is expected to grow, making testing processes smarter and more efficient.

Market Overview

The electronic testing services market is experiencing significant growth due to the rising complexity of electronic devices and the increasing demand for quality assurance. With industries such as telecommunications, automotive, aerospace, and consumer electronics relying on high-performance components, the need for precise and efficient testing solutions is expanding. The integration of advanced technologies such as AI, machine learning, and IoT in testing services is further improving accuracy, reducing testing time, and enhancing reliability. As industries continue to innovate, the demand for comprehensive electronic testing services is expected to rise.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 143.97 Billion |

| Market Size in 2025 | USD 92.72 Billion |

| Market Size in 2024 | USD 88.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.01% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

The rapid advancements in electronic components and devices are one of the primary drivers of the market. The growing adoption of 5G technology, electric vehicles, and smart devices has increased the need for rigorous testing to ensure functionality and safety. Additionally, regulatory standards for electronic products are becoming more stringent, necessitating high-quality testing solutions. The demand for automated and AI-driven testing is also increasing as companies seek to reduce human errors and improve efficiency. The expansion of industrial automation and connected devices is further fueling market growth.

Market Opportunities

The emergence of AI and big data analytics presents new opportunities for electronic testing services. AI-driven predictive testing can identify potential failures before they occur, improving reliability and reducing downtime. The rising demand for wireless technology and IoT-enabled devices also opens new avenues for testing services, particularly in network security and performance testing. Additionally, the shift towards remote and cloud-based testing solutions allows companies to optimize their operations and enhance efficiency. The development of customized testing solutions for emerging technologies like quantum computing and nanotechnology is another promising opportunity.

Market Challenges

Despite its growth potential, the market faces several challenges, including high costs associated with advanced testing equipment and software. The rapid evolution of technology requires continuous updates in testing methodologies, making it difficult for service providers to keep up. Additionally, a shortage of skilled professionals with expertise in AI-driven and automated testing poses a challenge to market expansion. Cybersecurity threats also present risks, as electronic devices become more connected and vulnerable to cyberattacks, requiring enhanced security testing protocols.

Regional Outlook

North America leads the electronic testing services market due to strong technological advancements and the presence of major electronics manufacturers. Asia Pacific is expected to witness the fastest growth, driven by the rapid expansion of the semiconductor and consumer electronics industries, particularly in China, Japan, and South Korea. Europe is also experiencing steady growth, supported by advancements in automotive electronics and industrial automation. The Middle East and Latin America are gradually adopting advanced testing solutions as electronic manufacturing capabilities expand in these regions.

Recent Developments

- In February 2024, Rhode and Schwarz collaborated with SmartViser to develop a solution that complies with the newly presented EU regulation regarding the energy efficiency index (EEI) labeling on tablets and smartphones. A radio communication tester adopts end-to-end testing across every signaling use case. Smart Viser’s test automation application has been seamlessly integrated with t for precise results, which is compatible with iOS and Android platforms.

- In February 2024, Siemens Energy introduced a new predictive maintenance solution incorporating AI and IoT for electronic testing services, offering real-time monitoring and predictive diagnostics, particularly for critical electrical infrastructure.

- In May 2023, a new optoelectronic testing service will be launched by AIM Photonics. It is equipped with various sophisticated testing tools to test traditional electronic integrated circuits along with newly introduced photonic integrated circuits.

Electronic Testing Services Market Companies

- Schneider Electric

- Siemens AG

- Eaton Corporation plc

- General Electric Company

- ABB Inc

- Power Products & Solutions

- American Electrical Testing

- Haugland Group LLC

- Dekra

- TCS Electrical Co.

- Phase One Electric

- Intran

- GEM Electrical Services

Segments Covered in the Report

By Service Type

- Transformer Testing

- Circuit Breaker Testing

- Protection Testing

- Battery Testing

- Rotating Equipment Vibration Testing

- Motors/Generators Testing

- Thermographic Testing

By End Use

- Power Generation Station

- Transmission and Distribution Station

- Steel Plants

- Major Refineries

- Railways

- Data Centres

- Healthcare and Hospitality

- Commercial Establishment

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

- Latin America

Also Read: Semiconductor Chemicals Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/