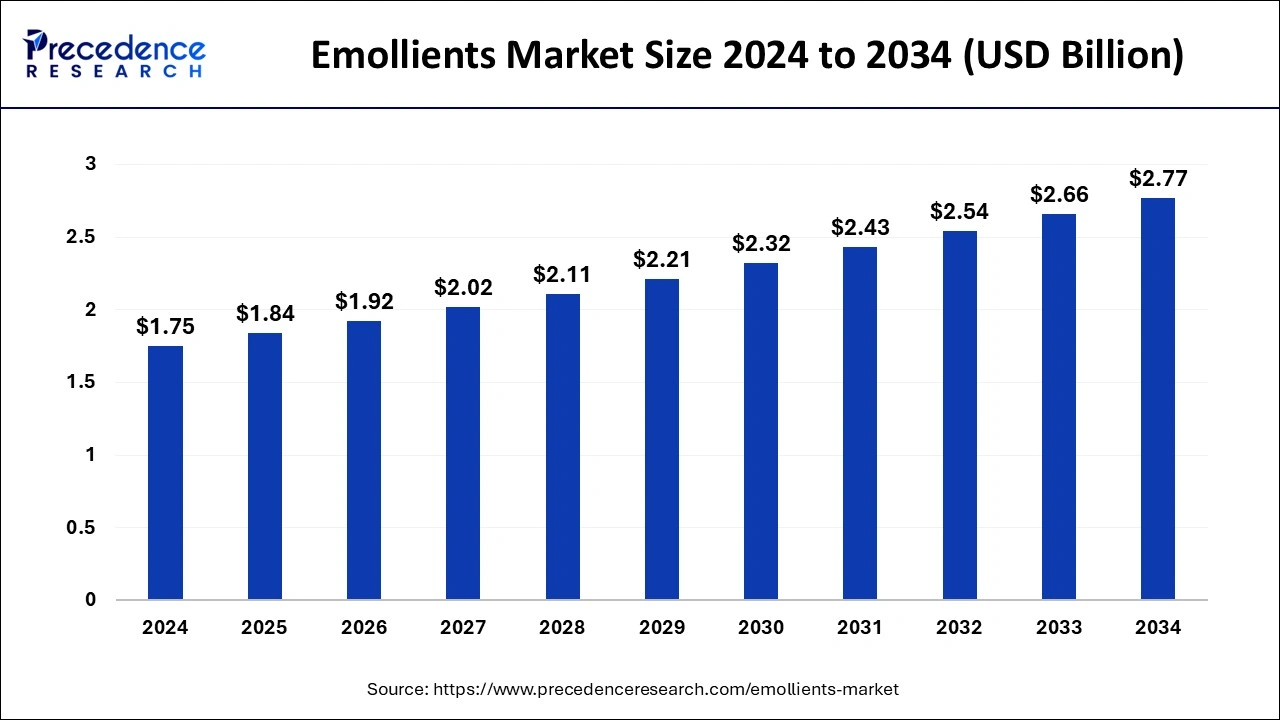

The global emollients market size was estimated at USD 1.68 billion in 2023 and is predicted to reach around USD 2.66 billion by 2033, growing at a CAGR of 4.73% from 2024 to 2033.

Key Points

- Asia Pacific led the market with the largest market share of 34% in 2023.

- North America is expected to experience rapid CAGR of 4.84% over the forecast period.

- By form, the liquid segment has contributed more than 70% of the market share in 2023.

- By form, the solid segment is anticipated to grow at the fastest rate over the forecast period.

- By application, the skin care segment has accounted the largest market share of 39% in 2023.

- By application, the hair care segment is expected to grow at the fastest rate during the projected period.

- By type, the easter segment dominated the market with the major market share of 41% in 2023.

- By type, the fatty acid segment is projected to experience the fastest growth during the forecast period.

The Emollients Market refers to the industry focused on the production and distribution of substances that soften and soothe the skin. Emollients are crucial components in various skincare products, including creams, lotions, and ointments. These substances work by forming a protective barrier on the skin’s surface, preventing moisture loss and enhancing hydration. The market encompasses a wide range of emollient products catering to different skin types and needs, including natural and synthetic variants.

Get a Sample: https://www.precedenceresearch.com/sample/4151

Growth Factors:

The Emollients Market is experiencing steady growth driven by increasing consumer awareness about skincare, rising disposable incomes, and growing demand for cosmetic products worldwide. Additionally, the rising prevalence of skin conditions such as eczema, psoriasis, and dry skin is fueling the demand for emollient-based solutions. Moreover, advancements in emollient formulations, such as those incorporating natural and organic ingredients, are further propelling market growth.

Region Insights:

The market for emollients exhibits significant regional variations, with developed regions like North America and Europe leading in terms of consumption and innovation. These regions boast a mature skincare market and a well-established cosmetic industry, driving the demand for premium emollient products. In contrast, emerging economies in Asia-Pacific and Latin America are witnessing rapid growth due to increasing urbanization, changing lifestyles, and a burgeoning middle-class population with higher disposable incomes.

Emollients Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 4.73% |

| Global Market Size in 2023 | USD 1.68 Billion |

| Global Market Size in 2024 | USD 1.75 Billion |

| Global Market Size by 2033 | USD 2.66 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Form, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Emollients Market Dynamics

Drivers:

Several factors are driving the Emollients Market’s expansion, including the growing emphasis on skincare routines, especially among the younger demographic, and the increasing adoption of emollient-rich products in the beauty and personal care industry. Furthermore, the rising prevalence of skin disorders and dermatological conditions globally is bolstering demand for therapeutic emollients prescribed by healthcare professionals.

Opportunities:

The Emollients Market presents numerous opportunities for growth and innovation, particularly in developing novel formulations tailored to specific skin concerns and demographics. Opportunities also abound in expanding market reach through e-commerce channels and strategic partnerships with retailers and distributors. Moreover, the rising demand for natural and sustainable emollients opens avenues for companies to capitalize on consumer preferences for eco-friendly skincare solutions.

Challenges:

Despite its growth prospects, the Emollients Market faces challenges such as regulatory hurdles concerning the safety and efficacy of ingredients, particularly in regions with stringent cosmetic regulations. Moreover, competition from substitute products and the presence of counterfeit or low-quality emollient products pose challenges to market players in maintaining brand reputation and consumer trust.

Read Also: Dental Digital X-Ray Market Size to Rake USD 13.17 Bn by 2033

Competitive Landscape:

Emollients Market Recent Developments

- In November 2023, Sonneborn, LLC, introduced plant derived SonneNatural NXG emollient. Reportedly, the new product improves the formation of lip care and personal care items owing to their sensory & firmness features.

- In June 2023, Oleon is concentrating on the enzymatic esterification of ingredient development. Radia 7199ACT, an emollient and texture enhancer, and Jolee 7749ACT, a fatty ester that is good for skin and hair, are two of their most recent releases.

- In March 2023, Clariant launched Plantasens Pro LM, a novel natural emollient, in response to consumers’ increasing interest in and understanding of skincare across the globe. The skin feels pampered, enriched, and opulent both during and after using this product.

- In April 2022, Seppic launched EMOGREEN™ HP 40, a new bio-based & sustainable emollient that is highly pure and sustainable.

- In November 2022, Givaudan launched Sensityl™, a cosmetic active ingredient that addresses the negative effects of stress on the skin and provides a soothing effect.

- In September 2022, BASF and L’Oréal announced a partnership to develop sustainable bio-based surfactants for personal care applications, aiming to reduce the environmental impact of formulations.

Emollients Market Companies

- BASF SE

- Clariant

- Eastman Chemical Company

- The Lubrizol Corporation

- Covestro AG

- Evonik Industries AG

- Hallstar

- Croda International PLC

- Ashland Inc.

- Sasol

- Lonza

- Stepan Company

- Oleon Health and Beauty

- Solvay

- Vantage Speciality Chemicals.

Segments Covered in the Report

By Type

- Esters

- Fatty Alcohols

- Fatty Acids

- Ethers

- Silicones

- Others

By Form

- Solid

- Liquid

By Application

- Skincare

- Hair Care

- Deodorants

- Oral Care

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/