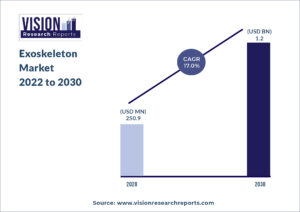

The global Exoskeleton market size was valued at USD 250.9 million in 2020, and is predicted to be worth around USD 1.2 billion by 2030, registering a CAGR of 17.0% during the forecast period 2022 to 2030.

Download Exclusive Sample of Report@ https://www.visionresearchreports.com/report/sample/39126

Table of Contents

Exoskeleton Market Growth Factors

Rapidly growing global geriatric population, increasing incidences of road accidents, rising prevalence of stroke is boosting the adoption of exoskeleton products and driving the market growth. As per National Safety Council data estimates in March 2021, 42,060 individuals have died in road accidents in 2020 and accounted for an increase of 8% as compared to 2019. Furthermore, the market is expected to witness the emergence of smarter & more competent exoskeletons through the integration of artificial intelligence and machine learning algorithms.

The mobile exoskeleton segment dominated in 2021 and is anticipated to grow lucratively over the forthcoming years owing to the emergence of innovative mobile exoskeletons for the disabled communities and geriatric population. Although, high costs and complications associated with mobile systems are expected to restrain the segment growth. The powered technology segment dominated in 2021 owing to the widespread adoption of powered exoskeletons for rehabilitation aid in patients suffering from spinal cord injuries.

Report Coverage

| Report Scope | Details |

| Market Size | US$ 1.2 billion by 2030 |

| Growth Rate | CAGR of 17.0% From 2022 to 2030 |

| Largest Market | North America |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Mobility, Technology, Extremity, End use |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Mentioned | Ekso Bionics; Hocoma; Lockheed Martin Corporation; Suit X (U.S. Bionics, Inc.); Rex Bionics Plc.; RB3D; ReWalk Robotics Ltd; Cyberdyne, Inc.; and ActiveLink (Panasonic Corporation) |

By Mobility Analysis

The mobile segment dominated the market for exoskeleton and accounted for the largest revenue share of 60.7% and largest volume share of 61.7%. The mobile segment is anticipated to register the fastest growth rate over the forthcoming years.

This significant market share and lucrative growth rate is attributable to the surge in demand for motor-equipped robots for aiding human body mechanics and rise in research and development activities.

Key participants are constantly introducing innovative solutions for various industries which support worker/user’s health, boost productivity, reduce fatigue, and minimize risks of serious injuries. The growth witnessed by stationary exoskeleton technologies is due to the growing usage of stationary system in rehabilitation centers.

By Technology Analysis

The powered technology segment dominated the market for exoskeleton and accounted for the largest revenue share of 74.7% and volume share of 67.6% owing to the rising implementation of powered exoskeleton solutions in several industries to enhance personal safety and boost productivity.

Non-powered or passive technology segment is anticipated to register the fastest growth rate over the forthcoming years owing to the growing number of innovative product launches. For instance, in December 2020, Hilti partnered with Ottobock SE to launch EXO-O1, a passive exoskeleton used by the construction industry.

By Extremity Analysis

The lower body segment dominated the market for exoskeleton and accounted for the largest revenue share 43.3% and volume share of 53.5% owing to the alarming rise of lower body disabilities and growing adoption rates of exoskeleton products by paralyzed and geriatric population for stability, mobility, and weight-bearing capabilities.

The upper body segment is anticipated to register the fastest growth rate over the forthcoming years owing to the benefits provided by exoskeleton products in upper extremities such as supporting disabled communities and rehabilitation aid in post-stroke, neurological, or musculoskeletal impairments.

By End-use Analysis

The healthcare segment dominated the market for exoskeleton and accounted for the largest revenue share of 51.3% and volume share of 51.8% owing to the rising incidence rate of Spinal Cord Injuries (SCIs), widespread adoption of these products and solutions in rehabilitation centers, and significant surge in treatment numbers are some of the key driving factors.

On the other hand, the industry segment is anticipated to register the fastest growth over the forthcoming years owing to the rising awareness levels towards the benefits associated with exoskeleton technologies in several industry applications and rapidly growing incidence rate of occupation-related injuries.

By Regional Analysis

North America dominated the market for exoskeleton and accounted for the largest revenue share of 47.0% and volume share of 28.4% owing to the growing prevalence of disabled individuals, rising expenditure on research activities, growing public and private support, increasing number of partnerships & collaborations amongst key participants, and availability of technologically advanced products.

Asia Pacific is anticipated to register the fastest growth rate over the forthcoming years owing to growing patient pool requiring rehabilitation support. Developing & advancing healthcare infrastructure, availability of government support and funding are driving the development and growth of the market for exoskeleton in Asia Pacific.

Read also @ Bone Grafts and Substitutes Market Size Hit US$ 3.96 billion by 2030

Major Key Players Covered in The Exoskeleton Market Report include

- Ekso Bionics

- Hocoma

- Lockheed Martin Corporation

- Suit X (U.S. Bionics, Inc.)

- Rex Bionics Plc.

- RB3D

- ReWalk Robotics Ltd

- Cyberdyne, Inc.

- ActiveLink (Panasonic Corporation)

Exoskeleton Market Segmentation

- By Mobility

- Mobile

- Fixed/Stationary

- By Technology

- Powered

- Non-powered

- By Extremity

- Upper Body

- Lower Body

- Full Body

- By End-use

- Healthcare

- Military

- Industry

- Regional

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Spain

- Italy

- France

- Russia

- Asia Pacific

- Japan

- China

- India

- Australia

- Singapore

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

- North America

Table of Contents

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Exoskeleton Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Extremity Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Exoskeleton Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Exoskeleton Market, By Mobility

7.1. Exoskeleton Market, by Mobility, 2021-2030

7.1.1. Mobile

7.1.1.1. Market Revenue and Forecast (2019-2030)

7.1.2. Fixed/Stationary

7.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 8. Global Exoskeleton Market, By Technology

8.1. Exoskeleton Market, by Technology, 2021-2030

8.1.1. Powered

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Non-powered

8.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Exoskeleton Market, By Extremity

9.1. Exoskeleton Market, by Extremity, 2021-2030

9.1.1. Upper Body

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Lower Body

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Full Body

9.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Exoskeleton Market, By End-use

10.1. Exoskeleton Market, by End-use, 2021-2030

10.1.1. Healthcare

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Military

10.1.2.1. Market Revenue and Forecast (2019-2030)

10.1.3. Industry

10.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Exoskeleton Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.1.2. Market Revenue and Forecast, by Technology (2019-2030)

11.1.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.1.4. Market Revenue and Forecast, by End-use (2019-2030)

11.1.5. U.S.

11.1.5.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.1.5.2. Market Revenue and Forecast, by Technology (2019-2030)

11.1.5.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.1.5.4. Market Revenue and Forecast, by End-use (2019-2030)

11.1.6. Rest of North America

11.1.6.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.1.6.2. Market Revenue and Forecast, by Technology (2019-2030)

11.1.6.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.1.6.4. Market Revenue and Forecast, by End-use (2019-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.2.2. Market Revenue and Forecast, by Technology (2019-2030)

11.2.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.2.4. Market Revenue and Forecast, by End-use (2019-2030)

11.2.5. UK

11.2.5.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.2.5.2. Market Revenue and Forecast, by Technology (2019-2030)

11.2.5.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.2.5.4. Market Revenue and Forecast, by End-use (2019-2030)

11.2.6. Germany

11.2.6.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.2.6.2. Market Revenue and Forecast, by Technology (2019-2030)

11.2.6.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.2.6.4. Market Revenue and Forecast, by End-use (2019-2030)

11.2.7. France

11.2.7.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.2.7.2. Market Revenue and Forecast, by Technology (2019-2030)

11.2.7.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.2.7.4. Market Revenue and Forecast, by End-use (2019-2030)

11.2.8. Rest of Europe

11.2.8.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.2.8.2. Market Revenue and Forecast, by Technology (2019-2030)

11.2.8.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.2.8.4. Market Revenue and Forecast, by End-use (2019-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.3.2. Market Revenue and Forecast, by Technology (2019-2030)

11.3.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.3.4. Market Revenue and Forecast, by End-use (2019-2030)

11.3.5. India

11.3.5.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.3.5.2. Market Revenue and Forecast, by Technology (2019-2030)

11.3.5.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.3.5.4. Market Revenue and Forecast, by End-use (2019-2030)

11.3.6. China

11.3.6.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.3.6.2. Market Revenue and Forecast, by Technology (2019-2030)

11.3.6.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.3.6.4. Market Revenue and Forecast, by End-use (2019-2030)

11.3.7. Japan

11.3.7.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.3.7.2. Market Revenue and Forecast, by Technology (2019-2030)

11.3.7.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.3.7.4. Market Revenue and Forecast, by End-use (2019-2030)

11.3.8. Rest of APAC

11.3.8.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.3.8.2. Market Revenue and Forecast, by Technology (2019-2030)

11.3.8.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.3.8.4. Market Revenue and Forecast, by End-use (2019-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.4.2. Market Revenue and Forecast, by Technology (2019-2030)

11.4.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.4.4. Market Revenue and Forecast, by End-use (2019-2030)

11.4.5. GCC

11.4.5.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.4.5.2. Market Revenue and Forecast, by Technology (2019-2030)

11.4.5.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.4.5.4. Market Revenue and Forecast, by End-use (2019-2030)

11.4.6. North Africa

11.4.6.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.4.6.2. Market Revenue and Forecast, by Technology (2019-2030)

11.4.6.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.4.6.4. Market Revenue and Forecast, by End-use (2019-2030)

11.4.7. South Africa

11.4.7.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.4.7.2. Market Revenue and Forecast, by Technology (2019-2030)

11.4.7.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.4.7.4. Market Revenue and Forecast, by End-use (2019-2030)

11.4.8. Rest of MEA

11.4.8.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.4.8.2. Market Revenue and Forecast, by Technology (2019-2030)

11.4.8.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.4.8.4. Market Revenue and Forecast, by End-use (2019-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.5.2. Market Revenue and Forecast, by Technology (2019-2030)

11.5.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.5.4. Market Revenue and Forecast, by End-use (2019-2030)

11.5.5. Brazil

11.5.5.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.5.5.2. Market Revenue and Forecast, by Technology (2019-2030)

11.5.5.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.5.5.4. Market Revenue and Forecast, by End-use (2019-2030)

11.5.6. Rest of LATAM

11.5.6.1. Market Revenue and Forecast, by Mobility (2019-2030)

11.5.6.2. Market Revenue and Forecast, by Technology (2019-2030)

11.5.6.3. Market Revenue and Forecast, by Extremity (2019-2030)

11.5.6.4. Market Revenue and Forecast, by End-use (2019-2030)

Chapter 12. Company Profiles

12.1. Ekso Bionics

12.1.1. Company Overview

12.1.2. Mobility Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Hocoma

12.2.1. Company Overview

12.2.2. Mobility Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Lockheed Martin Corporation

12.3.1. Company Overview

12.3.2. Mobility Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Suit X (U.S. Bionics, Inc.)

12.4.1. Company Overview

12.4.2. Mobility Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Rex Bionics Plc.

12.5.1. Company Overview

12.5.2. Mobility Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. RB3D

12.6.1. Company Overview

12.6.2. Mobility Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. ReWalk Robotics Ltd

12.7.1. Company Overview

12.7.2. Mobility Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Cyberdyne, Inc.

12.8.1. Company Overview

12.8.2. Mobility Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. ActiveLink (Panasonic Corporation)

12.9.1. Company Overview

12.9.2. Mobility Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Buy this Research Report study@ https://www.visionresearchreports.com/report/cart/39126

Contact Us:

Vision Research Reports

Call: +1 9197 992 333