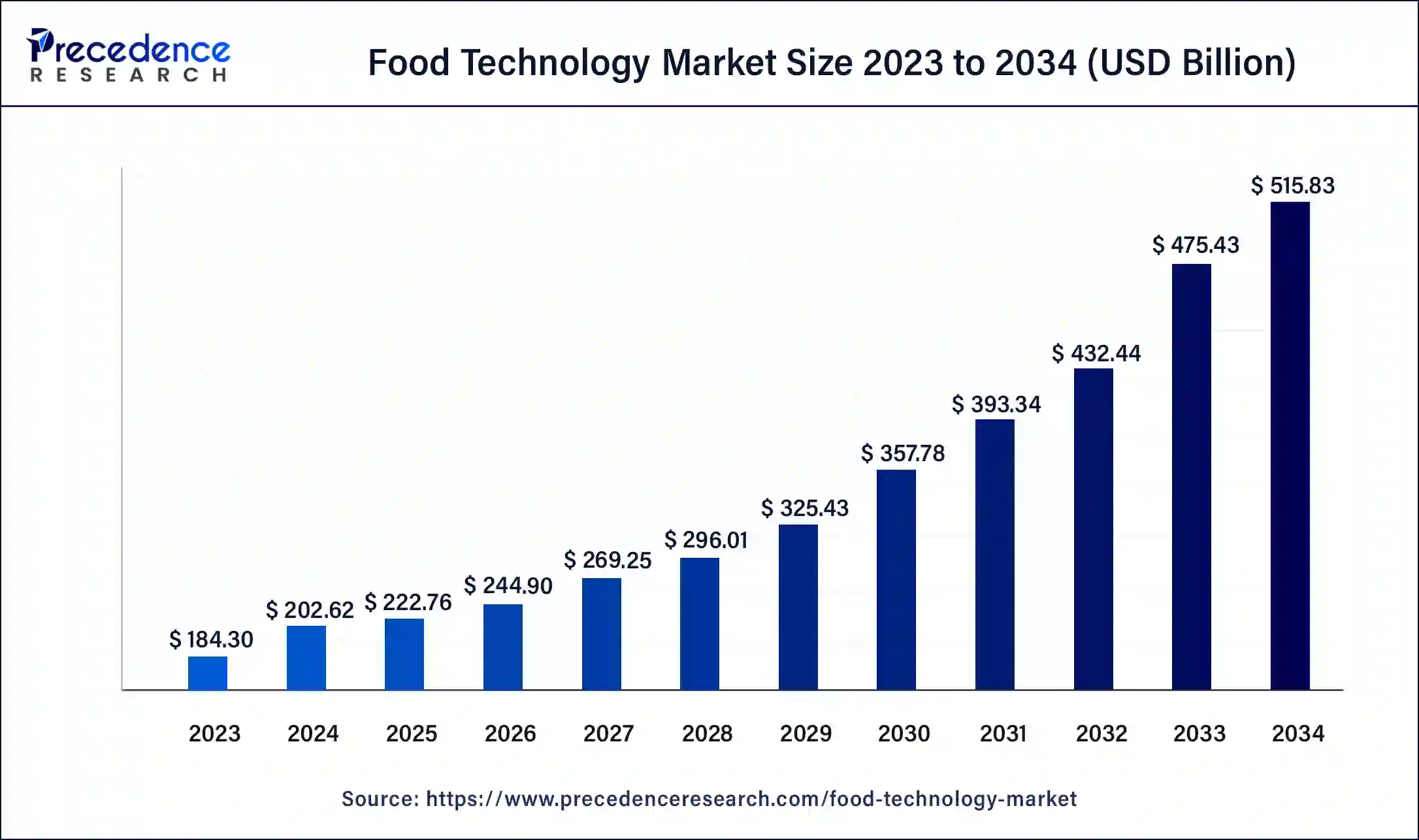

The global food technology market size was estimated at USD 184.30 billion in 2023 and is projected to attain around USD 475.43 billion by 2033, growing at a CAGR of 9.94% from 2024 to 2033.

Key Points

- Asia-Pacific has contributed more than 33% of market share in 2023.

- North America is estimated to expand the fastest CAGR between 2024 and 2033.

- By component, the hardware segment held the largest market share of 43% in 2023.

- By component, the software segment is anticipated to grow at a remarkable CAGR of 11.13% between 2024 and 2033.

- By industry, the fish, meat, and seafood segment has accounted over 20% of market share in 2023.

- By industry, the dairy products segment is expected to expand at the fastest CAGR over the projected period.

- By application, the food science management segment has recorded over 27% of market share in 2023.

- By application, the delivery segment is expected to expand at the fastest CAGR over the projected period.

The food technology market encompasses a broad spectrum of innovative solutions aimed at transforming various aspects of the food industry, ranging from production and processing to packaging and distribution. This market is witnessing significant growth driven by several factors, including changing consumer preferences, increasing demand for convenience foods, advancements in food preservation techniques, and a growing focus on sustainability and food safety. As the global population continues to expand and urbanize, the need for efficient food production and distribution systems becomes more pronounced, further fueling the growth of the food technology market.

Get a Sample: https://www.precedenceresearch.com/sample/4025

Food Technology Market Data and Statistics

- In April 2023, Aniai, Inc., a South Korea-based company specializing in robotic kitchen technology, unveiled the Alpha Grill, an innovative cooking robot tailored specifically for preparing burgers, leveraging automation and AI capabilities.

- The Good Food Institute reported that investments in plant-based meat, egg, and dairy companies reached a total of USD 2.1 billion in 2020, with Impossible Foods, a prominent player in the plant-based meat sector, securing over USD 1.9 billion in funding to date.

- According to McKinsey & Company’s data as of May 2021, DoorDash held a dominant position in various markets, including San Jose with 77% market share, Houston with 56%, Philadelphia with 51%, and San Antonio with 51%. Meanwhile, Uber Eats and Postmates jointly led in Los Angeles with a 50% market share and in New York City with 41%.

- In 2021, the USDA’s Economic Research Service (ERS) found that 10.2% of the entire U.S. population, equating to approximately 13.5 billion households, faced food insecurity.

- The World Bank noted that the United States has been among the pioneering nations in industrialization, experiencing significant urbanization rates over the past two centuries.

- The Food Safety Modernization Act (FSMA) in the United States and similar regulations worldwide have prompted companies to invest in technologies like blockchain and IoT for traceability and transparency.

- With approximately 1.3 billion tons of food wasted globally each year, according to the Food and Agriculture Organization (FAO), technologies like predictive analytics and cold chain management are being increasingly adopted to minimize waste along the supply chain.

Growth Factors:

One of the primary growth factors driving the food technology market is the rising demand for processed and packaged foods. Rapid urbanization, busy lifestyles, and changing dietary habits have led to a surge in the consumption of convenience foods, driving the need for advanced food processing technologies and packaging solutions. Additionally, increasing awareness regarding health and wellness among consumers has spurred the demand for functional foods and ingredients, driving innovation in food technology to meet these evolving preferences.

Another significant growth factor is the increasing adoption of automation and digitization in the food industry. Automation technologies such as robotics, artificial intelligence, and Internet of Things (IoT) are revolutionizing various aspects of food production, from farm to fork. These technologies enhance efficiency, reduce labor costs, improve product quality, and ensure compliance with food safety regulations, thereby driving the demand for food technology solutions.

Region Insights

The food technology market is geographically diverse, with significant growth opportunities across various regions. North America and Europe currently dominate the market, driven by their advanced food processing infrastructure, stringent food safety regulations, and robust R&D capabilities. These regions are witnessing increased investments in food technology startups and research institutions, fostering innovation and technological advancements.

Asia-Pacific is emerging as a lucrative market for food technology, fueled by rapid industrialization, urbanization, and changing consumer preferences. Countries like China, India, and Japan are experiencing a growing demand for processed and convenience foods, driving the adoption of food technology solutions. Moreover, governments in the region are investing in food safety initiatives and promoting the use of advanced technologies to modernize the food supply chain and ensure food security.

Food Technology Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9.94% |

| Global Market Size in 2023 | USD 184.30 Billion |

| Global Market Size by 2033 | USD 475.43 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Industry, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Food Technology Market Dynamics

Drivers:

Several key drivers are propelling the growth of the food technology market. One of the primary drivers is the increasing global population, which is putting pressure on the food industry to enhance productivity and efficiency to meet the growing demand for food. Food technology plays a crucial role in enabling sustainable and efficient food production, processing, and distribution to address this challenge.

Changing consumer preferences and dietary habits are also driving the adoption of food technology solutions. Consumers are seeking healthier, more convenient, and sustainable food options, prompting food companies to innovate and develop products that meet these evolving demands. Additionally, the growing emphasis on food safety and quality assurance is driving the adoption of technologies such as blockchain and traceability systems to ensure transparency and accountability across the food supply chain.

Opportunities:

The food technology market presents numerous opportunities for innovation and growth. With advancements in biotechnology and genetic engineering, there is potential to develop novel ingredients, flavors, and textures to create healthier and more sustainable food products. Furthermore, the integration of data analytics and machine learning enables food companies to gain valuable insights into consumer preferences, market trends, and supply chain dynamics, enabling them to make informed decisions and optimize their operations.

The rise of alternative proteins, such as plant-based and cell-cultured meats, presents a significant opportunity for food technology companies to cater to the growing demand for sustainable protein sources. Additionally, the increasing focus on reducing food waste and optimizing resource utilization creates opportunities for technologies that improve food preservation, storage, and distribution efficiency.

Challenges:

Despite the promising growth prospects, the food technology market faces several challenges. One of the major challenges is regulatory compliance and food safety concerns. As food technology evolves, regulatory frameworks may struggle to keep pace with rapid advancements, leading to uncertainties and compliance issues for food companies. Ensuring the safety and quality of novel food ingredients and production processes remains a priority to gain consumer trust and regulatory approval.

Another challenge is the high upfront costs associated with implementing advanced food technology solutions. Small and medium-sized food companies, in particular, may face financial constraints and technical barriers to adopting new technologies. Moreover, the complexity of integrating diverse technologies into existing food production systems and supply chains can pose implementation challenges and require significant investments in training and infrastructure.

Read Also: Data Center Power Management Market Size,Share, Report by 2033

Recent Developments

- In July 2023, FarMart, an advanced food supply network, introduced Saudabook, India’s inaugural technological solution for the food processing industry. This groundbreaking platform extended its ERP system, FarMartOS, to all food processors across India, to modernize the nation’s food sector and streamline supply chain processes intelligently.

- In March 2023, CUBIQ FOODS and Cargill, Incorporated, a U.S.-based company, revealed a collaboration to supply innovative fats for plant-based foods. Through this partnership, the companies sought to address the growing demand for healthier ingredients in the market.

Food Technology Market Companies

- Beyond Meat

- Impossible Foods

- Cargill, Incorporated

- Tyson Foods

- Nestlé

- ADM (Archer Daniels Midland Company)

- Kerry Group

- Ingredion

- Tyson Foods

- Danone

- Kraft Heinz

- Givaudan

- Conagra Brands

- The Kellogg Company

- Ingredion Incorporated

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Industry

- Fish, Meat, and Seafood

- Fruits and Vegetables

- Grain and Oil

- Dairy Products

- Beverages

- Bakery and Confectionery

- Others

By Application

- Food Science

- Kitchen & Restaurant Tech

- Delivery

- Supply Chain

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/