Table of Contents

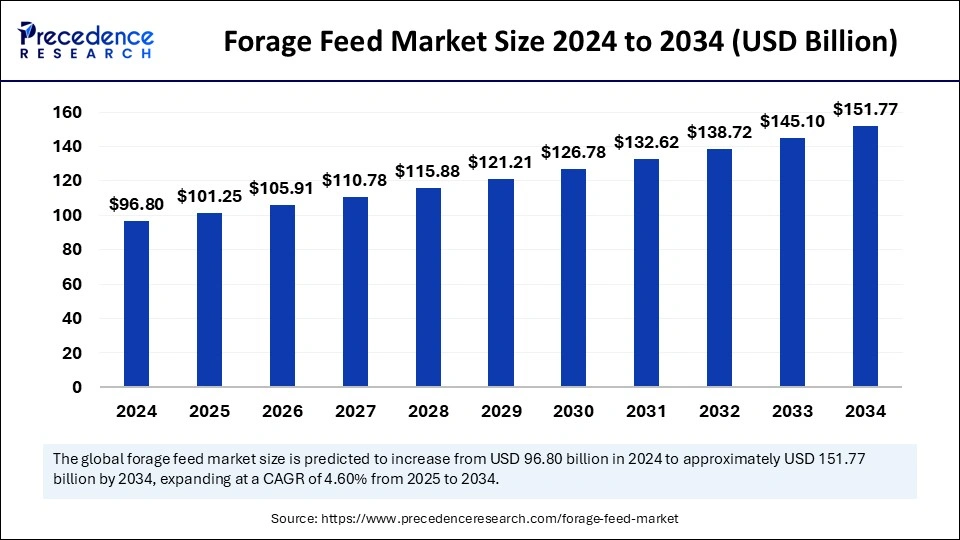

The global forage feed market size surpassed USD 96.80 billion in 2024 and is projected to surpass around USD 151.77 billion by 2034 with a CAGR 4.60% from 2025 to 2034.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5774

Forage Feed Market Key Highlights

-

North America led the forage feed market with the highest market share in 2024.

-

Asia Pacific is expected to grow at the fastest pace during the forecast period.

-

The stored forage segment dominated the market in 2024.

-

The fresh forage segment is projected to experience significant growth in the coming years.

-

The ruminants segment accounted for the largest market share in 2024.

-

The poultry segment is expected to expand notably during the forecast period.

How AI is Transforming the Forage Feed Market for Smarter Farming

AI is playing a transformative role in the forage feed market by optimizing farming practices, improving livestock nutrition, and enhancing supply chain efficiency. AI-powered predictive analytics enable farmers to assess soil quality, weather conditions, and crop health, allowing them to make data-driven decisions on forage cultivation.

Machine learning algorithms analyze past yield patterns and recommend the best harvesting times, ensuring maximum nutritional value in forage feed. Additionally, AI-integrated drones and sensors monitor field conditions in real time, detecting pests, diseases, and nutrient deficiencies, thereby reducing wastage and improving overall crop productivity.

AI also plays a crucial role in livestock management by analyzing feeding patterns, tracking animal health, and optimizing diets based on real-time data. Smart feeding systems use AI to balance forage nutrients, ensuring livestock receive optimal nutrition for growth and productivity.

In the supply chain, AI-driven logistics and inventory management systems help producers and distributors optimize storage, reduce spoilage, and forecast demand accurately. As AI technology advances, its integration into the forage feed market is expected to enhance efficiency, sustainability, and profitability for farmers and industry stakeholders.

Forage Feed Market Growth Factors

Increasing Livestock Production

The rising global demand for meat, dairy, and poultry products is driving the need for high-quality forage feed. Growing livestock populations, particularly in emerging economies, are increasing the demand for nutrient-rich feed to ensure better productivity and animal health.

Advancements in Agricultural Technology

Technological advancements, such as precision farming, automated feeding systems, and AI-driven analytics, are optimizing forage production and improving feed efficiency. These innovations help in better yield prediction, nutrient management, and enhanced sustainability.

Growing Awareness of Animal Nutrition

Farmers and livestock owners are increasingly prioritizing high-nutrition forage feed to improve animal health, productivity, and disease resistance. This has led to a shift towards fortified and high-protein forage varieties.

Expansion of Dairy and Meat Industry

The expansion of the global dairy and meat industries is fueling the demand for quality forage feed. Countries with growing urban populations and changing dietary habits are witnessing a surge in milk and meat consumption, driving forage feed requirements.

Government Support and Subsidies

Many governments are promoting sustainable livestock farming by providing financial support and subsidies for quality forage production. Policies favoring organic and nutrient-rich feed are further encouraging market growth.

Climate Change and Sustainability Initiatives

With climate change affecting traditional grazing patterns, there is an increasing focus on sustainable and high-yield forage crops. Drought-resistant and genetically modified forage varieties are gaining traction, ensuring a steady feed supply.

Rising Demand for Organic and Non-GMO Feed

Consumer preferences for organic dairy and meat products are pushing the demand for organic forage feed. Non-GMO feed options are gaining popularity, particularly in North America and Europe, where regulatory frameworks support organic livestock farming.

Forage Feed: An Overview

What is Forage Feed?

Forage feed refers to plant-based feed primarily used for livestock nutrition. It includes fresh or stored plant material such as grass, legumes, hay, and silage that provide essential nutrients to ruminants like cattle, sheep, and goats. Forage is a crucial component of animal diets, supplying fiber, protein, and energy while promoting digestion and overall health.

Types of Forage Feed

-

Fresh forage – Includes pasture grass, clover, and other green crops consumed directly by animals.

-

Stored forage – Includes hay (dried grass), silage (fermented forage), and haylage (semi-dried forage wrapped for preservation).

-

Crop residues – After-harvest remains of crops like wheat straw, maize stalks, and rice husks.

-

Specialty forages – High-protein forage crops like alfalfa and legumes are used for enhanced nutrition.

Importance of Forage Feed in Livestock Farming

-

Nutritional benefits: Provides essential nutrients such as fiber, protein, and vitamins for animal growth and milk/meat production.

-

Cost-effective: More affordable than processed animal feed, making it a sustainable option for farmers.

-

Environmental sustainability: Helps reduce reliance on grain-based feed, promoting eco-friendly livestock farming.

-

Improves animal digestion: High-fiber content supports digestive health in ruminants.

Factors Influencing Forage Feed Production

-

Climate and soil conditions: Temperature, rainfall, and soil fertility affect forage crop yields.

-

Agricultural practices: Irrigation, fertilization, and crop rotation impact forage quality and availability.

-

Livestock demand: Growing demand for dairy and meat products increases forage feed consumption.

-

Technology and innovations: AI-driven precision farming and improved storage techniques enhance efficiency.

Global Forage Feed Market Trends

-

Rising adoption of organic and non-GMO forage feed for sustainable livestock farming.

-

Increased focus on climate-resilient forage crops to counter changing weather conditions.

-

Expansion of precision agriculture technologies to optimize forage production.

-

Growing government initiatives and subsidies to support livestock farmers.

Key Forage Feed Producing Regions

-

North America: Advanced livestock farming practices and high demand for dairy and meat.

-

Asia Pacific: Rapidly growing meat and dairy consumption, especially in China and India.

-

Europe: Strong preference for organic and high-quality feed options.

-

Latin America and Africa: Emerging markets with increasing investments in sustainable animal farming.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 151.77 Billion |

| Market Size in 2025 | USD 101.25 Billion |

| Market Size in 2024 | USD 96.80 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.60% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Products, animal type, and Regions |

| Regions Covered | America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

The primary drivers of the forage feed market include the growing global demand for meat and dairy products. The rising awareness about animal nutrition and health has led to increased adoption of high-quality forage feed. Additionally, advancements in agricultural technology, such as precision farming and AI-based feed analysis, are helping farmers optimize feed efficiency, further fueling market growth.

Market Opportunities

The increasing trend toward organic and non-GMO animal feed presents significant opportunities for forage feed producers. Additionally, climate-resilient forage crops are gaining attention due to changing environmental conditions, providing new avenues for market expansion. The integration of smart farming solutions and government support for sustainable livestock farming also create promising opportunities for industry players.

Market Challenges

Despite positive growth, the market faces challenges such as fluctuating raw material costs and the impact of climate change on forage crop yield. Additionally, small-scale farmers often struggle with access to quality feed due to high production costs and limited supply chains. Ensuring affordability while maintaining quality remains a key challenge.

Regional Analysis

North America dominates the forage feed market, driven by large-scale livestock farming and advanced feed technologies. Asia Pacific is anticipated to witness the fastest growth due to rising dairy and meat consumption, particularly in China and India. Europe is also expanding, with a strong focus on organic and sustainable forage feed options. Latin America and Africa present emerging markets, supported by increasing livestock farming and agricultural developments.

Forage Feed Market Companies

- ADM Alliance Nutrition

- Triple Crown Nutrition

- Lucerne Farms

- Al Dahra ACX Global Inc.

- NWF Agriculture

- Standlee Premium Products, LLC

- Wilbur-Ellis Holdings Inc.

- Riverina Australia Pty Ltd.

- Chaffhaye

- Baileys Horse Feeds

Recent Developments

- In October 2024, Renovo Seed declared the addition of a new forage mix, OptiHarv. The mix includes several types of millets, peas, beans, barley, and brassicas to yield considerable amounts of baleage, haylage, and grazing matériel.

- In March 2023, PGG Wrightson Seeds announced the GT07 phalaris variety. Consumers value GT07 for its development through CSIRO’s breeding program because it demonstrates PGG Wrightson Seeds’ dedication to agricultural innovation and sustainability.

- In September 2023, MAS Seeds revealed a new forage mixture collection and specialized blends; they introduced their “MAS4 NUTRI” forage containing high levels of legumes for animal nutrition enhancement. The new launches come as a part of the company’s efforts to raise its agronomic offerings to farmers.

Segments Covered in the Report

By products

- Stored Forage

- Fresh Forage

- Other Products

By animal type

- Ruminants

- Poultry

- Swine

- Others

By region

- North America

- Asia Pacific

- Europe

- Latin America

Also Read: Polymer 3D Printing Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/