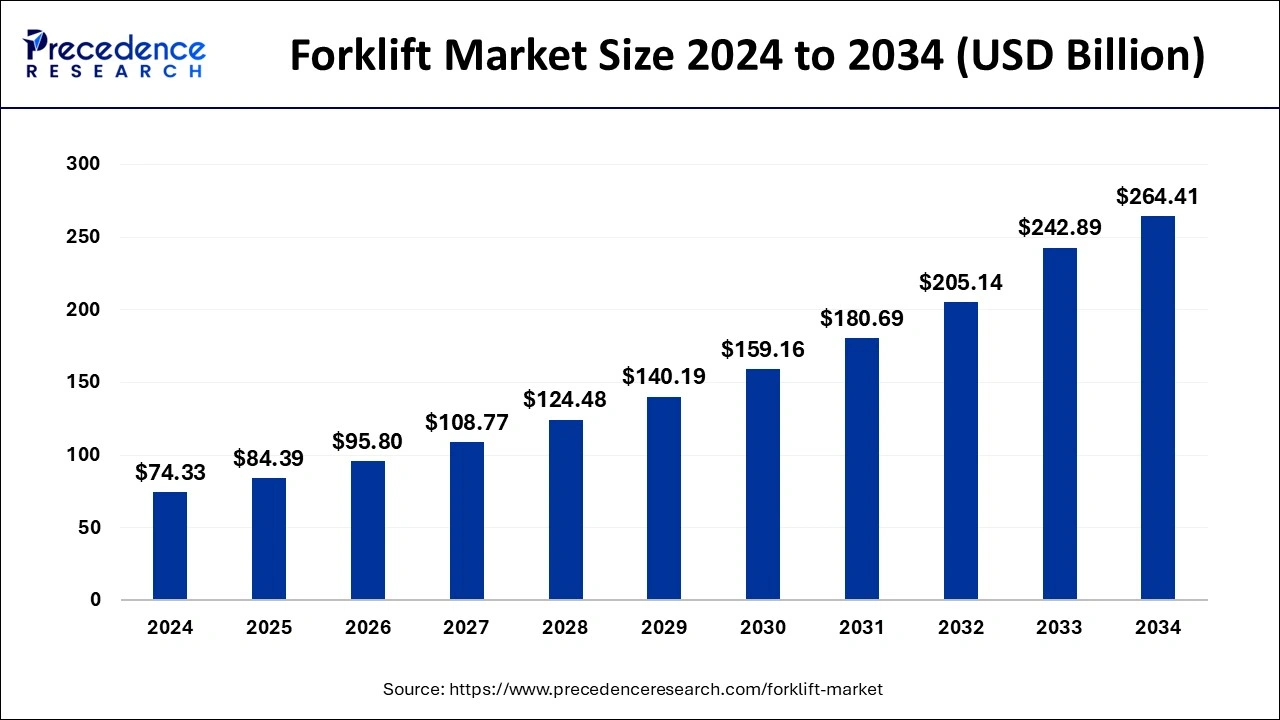

The global forklift market size was valued at USD 74.33 billion in 2024 and is projected to reach around USD 264.41 billion by 2034 with a CAGR of 13.53%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1032

Key Takeaways

- In 2024, the Asia-Pacific region led the global market with a 48% share.

- The class 3 category accounted for the highest market share of 44% in 2024.

- The electric power source segment dominated the market in 2024.

- The 5-15 ton load capacity category secured the largest market share in 2024.

- Among electric battery types, the lead-acid segment held a 67% share in 2024.

- The industrial end-use sector contributed over 25% of the market share in 2024.

AI Transforming the Forklift Market

Artificial intelligence is revolutionizing the forklift industry by enhancing automation, efficiency, and safety. AI-powered autonomous forklifts are reducing the need for manual operation, improving warehouse logistics, and minimizing human errors. Machine learning algorithms enable forklifts to optimize navigation, detect obstacles, and adapt to changing warehouse environments in real time.

AI-driven predictive maintenance is another game-changer, allowing fleet managers to monitor forklift performance and detect potential failures before they occur. This reduces downtime, lowers maintenance costs, and increases overall productivity. Additionally, AI integration with IoT and data analytics helps optimize fleet management, ensuring better route planning and fuel efficiency.

As AI technology advances, the forklift market is expected to see increased adoption of fully autonomous and semi-autonomous solutions, leading to safer, more efficient, and cost-effective material handling operations.

Market Drivers

Forklifts are increasingly in demand due to the expansion of logistics, construction, and warehousing sectors. The shift toward automation and the need for efficient material handling in industries such as automotive and food & beverage further drive market growth.

Opportunities

Innovations in battery technology and the emergence of autonomous forklifts offer lucrative opportunities for market expansion. Government incentives for electric vehicle adoption further encourage businesses to invest in sustainable forklift solutions.

Challenges

Market growth faces hurdles such as high operational costs and technical complexities in integrating advanced forklift technologies. Workforce shortages and the need for extensive operator training also add to the industry’s challenges.