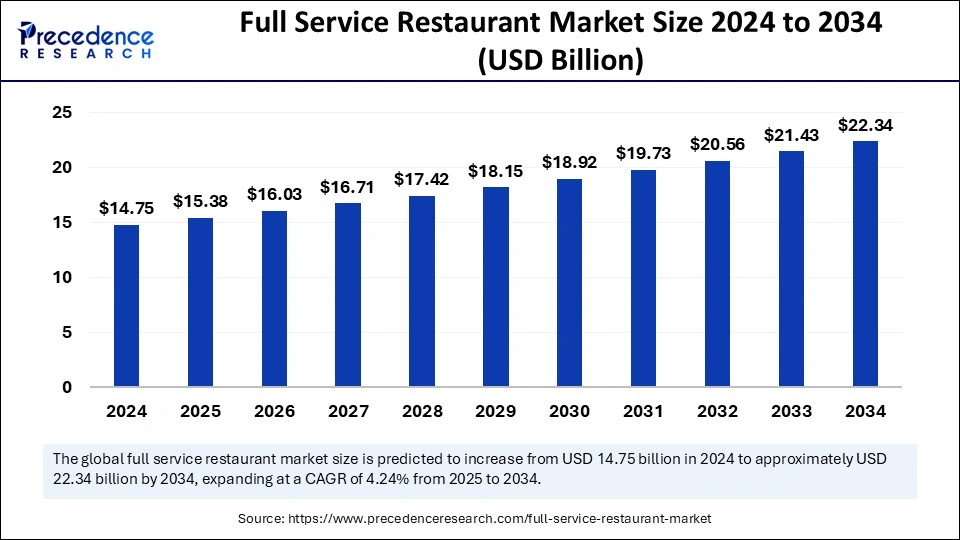

The global full service restaurant market size was valued at USD 14.75 billion in 2024 and is expected to achieve around USD 22.34 billion by 2034, growing at a CAGR of 4.24%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5818

Full Service Restaurant Market Key Takeaways

-

North America held the largest share of the global market at 31% in 2024.

-

Asia Pacific is projected to grow at the fastest pace during the forecast period.

-

The casual dining category led the market by restaurant type in 2024.

-

The family dining segment is expected to maintain a steady CAGR over the next few years.

-

Ethnic cuisine dominated the market by menu type in 2024.

-

Italian cuisine is anticipated to expand significantly in the forecast period.

-

Table service accounted for a major portion of the market by service type in 2024.

-

Delivery services are forecasted to register strong growth moving forward

The AI-Powered Evolution of Full-Service Restaurants

Artificial Intelligence is reshaping the full-service restaurant market by streamlining operations and enhancing customer experiences. AI-powered tools are used for tasks such as dynamic pricing, demand forecasting, inventory management, and optimizing staff scheduling.

By analyzing customer data and dining trends, AI helps restaurants make data-driven decisions that improve efficiency and profitability. AI-driven chatbots and virtual assistants are also being used to handle reservations, answer customer queries, and manage waitlists in real-time.

In the front-end experience, AI is transforming customer engagement through personalized marketing, tailored menu recommendations, and loyalty programs based on behavior and preferences. Facial recognition and voice-enabled ordering systems are also being tested to deliver more seamless dining experiences.

As restaurants embrace digital transformation, AI becomes an essential component in delivering consistent service, reducing operational costs, and adapting to changing consumer expectations in a competitive market.

Full Service Restaurant Market Growth Factors

1.Rising Disposable Income and Urbanization

As disposable incomes increase, particularly in emerging economies, more consumers are dining out, seeking diverse culinary experiences. Urbanization has led to lifestyle changes, with individuals and families opting for the convenience of dining out, boosting demand for full-service restaurants.

2. Evolving Consumer Preferences

Consumers are increasingly seeking experiential dining that offers more than just food. Full-service restaurants cater to this demand by providing unique ambiances, personalized services, and diverse menu options, enhancing the overall dining experience.

3. Technological Advancements

The integration of technology, such as online reservations, digital menus, and contactless payments, has streamlined operations and improved customer experiences. These innovations cater to tech-savvy consumers and enhance operational efficiency.

4. Health and Sustainability Trends

There’s a growing demand for healthier menu options and sustainable practices. Full-service restaurants are responding by offering organic ingredients, accommodating dietary restrictions, and sourcing locally, aligning with consumers’ health and environmental concerns.

5. Growth in Tourism

The expanding travel and tourism industry has increased the demand for unique dining experiences. Tourists often seek out local cuisines and authentic dining environments, which full-service restaurants are well-positioned to provide.

6. Expansion of Delivery and Takeout Services

The rise of online food ordering and delivery services has allowed full-service restaurants to reach a broader customer base. This expansion caters to consumers seeking convenience without compromising on quality

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 22.34 Billion |

| Market Size in 2025 | USD 15.38 Billion |

| Market Size in 2024 | USD 14.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.24% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Yeareny | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Restaurant Type, Menu Type, Service Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The primary drivers include rising disposable income, urbanization, and a growing middle-class population. Additionally, the cultural shift toward eating out, coupled with the influence of food-related media and social platforms, has boosted interest in trying different cuisines and dining styles. The adoption of digital technologies like table-side ordering and contactless payments also supports operational efficiency and customer satisfaction.

Opportunities

There is growing opportunity in integrating AI and data analytics for menu personalization and customer engagement. Expanding into smaller cities and emerging economies presents untapped potential. Additionally, the health-conscious and sustainable dining trends open doors for restaurants that focus on organic, locally sourced, and dietary-specific menu options.

Challenges

The industry faces several challenges including high operational costs, staffing shortages, and fluctuating ingredient prices. Customer loyalty can be difficult to maintain in a competitive landscape, and economic downturns or public health issues can significantly impact footfall and revenues.

Regional Insights

North America leads the global market with a substantial share, driven by a well-established dining culture and technological innovation in restaurant services. The Asia Pacific region is expected to grow at the fastest pace due to increasing urbanization, growing consumer spending, and the expanding tourism industry. Europe continues to maintain a strong presence with its diverse culinary landscape and emphasis on quality dining experiences.

Full Service Restaurant Market Companies

- Taco Bell Corp

- Yum! Brands, Inc.

- The McDonald’s Corporation

- Domino’s Pizza, Inc.

- Dunkin’ Brands Group, Inc.

- Panera Bread Company

- Darden Restaurants, Inc.

- Restaurant Brands International Inc.

- Chipotle Mexican Grill, Inc.

- Starbucks Corporation

- Wendy’s Company

- Subway Restaurants, LLc

- Texas Roadhouse, Inc.

- Outback Steakhouse, Inc.

Recent Developments

- In March 2025, the New Museum in New York, U.S., is undergoing renovation. A full-service restaurant is set to be opened inside the museum for the first time. This restaurant will integrate sustainable materials and practices in its menu and design.

- In January 2025, Slim Chickens officially opened its first full-service restaurant in Ann Arbor, Michigan.

- In November 2024, a ‘metroburb’ Bell Works in New Jersey got its first full-service restaurant. This restaurant, named Mabel, will serve European bar food.

- In October 2024, Punta Gorda Airport in Florida, U.S., announced that it is demanding dialects for a public full-service restaurant, bar, and even catering operation at the PGD Air Center. The authorities take this step to accommodate rising demand from employees, aviators, and local residents.

Segments Covered in the Report

By Restaurant Type

- Casual Dining

- Fine Dining

- Family Dining

- Quick Service Restaurants (QSRs)

By Menu Type

- Ethnic Cuisine

- American Cuisine

- Italian Cuisine

- Asian Cuisine

By Service Type

- Table Service

- Counter Service

- Buffet Service

- Delivery Service

By Region

- North America

- Europe

- Latin America

- Asia Pacific

- Middle East and Africa

Also Read: Customer Self-service Software Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/