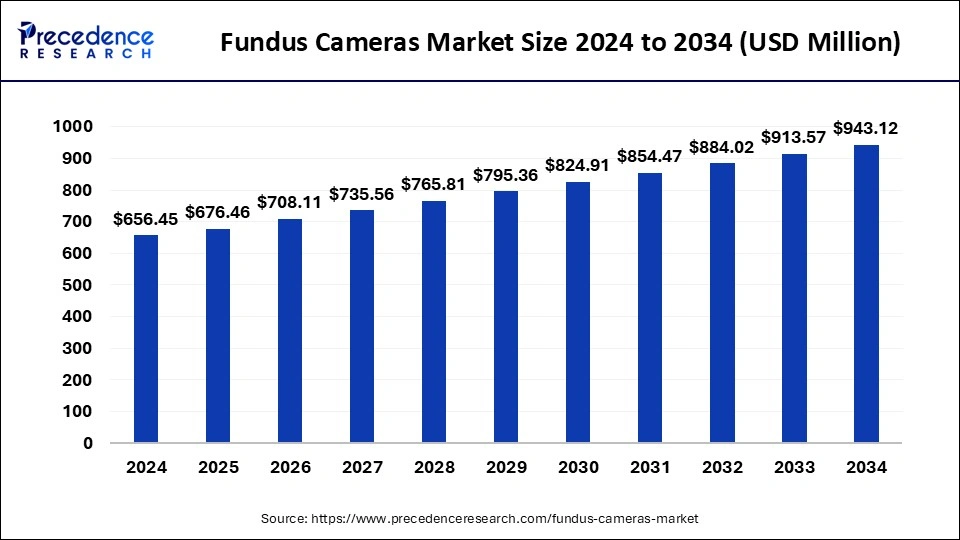

The global fundus cameras market size was estimated at USD 644.38 million in 2023 and is predicted to hit around USD 874.43 million by 2033, growing at a CAGR of 3.10% from 2024 to 2033.

Key Points

- North America dominated the fundus cameras market share of 42% in 2023.

- By product type, the non-mydriatic segment held the largest market share in 2023.

- By end use, the hospital segment captured the biggest revenue share in 2023.

The Fundus Cameras Market is a crucial segment within the broader medical imaging industry, dedicated to the diagnosis and management of various retinal diseases. Fundus cameras, also known as retinal cameras or ophthalmic cameras, capture detailed images of the fundus, including the retina, optic disc, and macula. These images aid in the detection and monitoring of conditions such as diabetic retinopathy, age-related macular degeneration, and glaucoma. The market for fundus cameras is driven by factors such as the increasing prevalence of retinal diseases, technological advancements in imaging modalities, and growing awareness about preventive healthcare.

Get a Sample: https://www.precedenceresearch.com/sample/3957

Growth Factors:

The Fundus Cameras Market is propelled by several growth factors, including the rising incidence of retinal diseases worldwide. Factors such as aging populations, lifestyle changes, and the increasing prevalence of diabetes contribute to the growing burden of retinal conditions, driving demand for diagnostic tools such as fundus cameras. Furthermore, technological advancements, including the development of digital imaging systems, high-resolution sensors, and image processing software, enhance the capabilities and efficiency of fundus cameras, leading to improved diagnosis and patient outcomes.

Moreover, the growing adoption of telemedicine and remote diagnostics presents opportunities for the expansion of the Fundus Cameras Market. Teleophthalmology programs leverage fundus cameras to capture retinal images remotely, enabling healthcare providers to diagnose and manage retinal diseases in underserved areas or remote communities. Additionally, initiatives aimed at raising awareness about the importance of regular eye examinations and early detection of retinal diseases contribute to market growth by increasing the demand for fundus imaging services.

Region Insghts

The Fundus Cameras Market exhibits regional variations influenced by factors such as healthcare infrastructure, prevalence of retinal diseases, and regulatory frameworks. North America and Europe represent mature markets for fundus cameras, characterized by well-established healthcare systems, high healthcare expenditure, and a strong focus on technological innovation. In these regions, favorable reimbursement policies and increasing investments in healthcare infrastructure drive the adoption of advanced imaging technologies, including fundus cameras.

Asia-Pacific emerges as a lucrative region for the Fundus Cameras Market, driven by factors such as the large population base, rising disposable incomes, and increasing awareness about eye health. Countries like China, India, and Japan witness significant demand for fundus cameras due to the high prevalence of diabetes and aging populations. Moreover, government initiatives aimed at improving access to healthcare services and reducing the burden of preventable blindness fuel market growth in the region.

Fundus Cameras Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 644.38 Million |

| Global Market Size by 2033 | USD 874.43 Million |

| U.S. Market Size in 2023 | USD 189.45 Million |

| U.S. Market Size by 2033 | USD 257.08 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Fundus Cameras Market Dynamics

Drivers:

Several drivers propel the growth of the Fundus Cameras Market, including the increasing prevalence of chronic diseases such as diabetes, which significantly elevates the risk of developing diabetic retinopathy. The growing aging population, particularly in developed regions, contributes to the rising incidence of age-related retinal conditions such as macular degeneration and glaucoma. Additionally, technological advancements in fundus camera systems, such as the integration of artificial intelligence for image analysis and interpretation, enhance diagnostic accuracy and efficiency, driving adoption among healthcare providers.

Furthermore, the growing emphasis on preventive healthcare and early disease detection fosters the demand for screening and diagnostic tools like fundus cameras. Healthcare organizations and governments worldwide are increasingly investing in programs aimed at promoting regular eye examinations and implementing telemedicine solutions for remote retinal screening. Moreover, the expanding applications of fundus cameras beyond traditional ophthalmic settings, such as in primary care clinics and teleophthalmology initiatives, broaden the market’s growth prospects.

Restraints:

Despite the market’s growth potential, certain restraints and challenges hinder the widespread adoption of fundus cameras. Cost constraints pose a significant barrier to adoption, particularly in resource-constrained healthcare settings where budgetary limitations restrict investment in advanced imaging equipment. Additionally, the complexity of operating and maintaining fundus camera systems may deter healthcare facilities from integrating these technologies into their practice, especially in regions with limited technical expertise and infrastructure.

Regulatory hurdles and reimbursement challenges also impact market growth, as the approval process for medical devices and diagnostic technologies varies across regions, leading to delays in market entry and adoption. Moreover, concerns regarding patient privacy and data security pose challenges for teleophthalmology programs, limiting the scalability and acceptance of remote retinal imaging solutions. Addressing these restraints requires collaboration between healthcare stakeholders, regulatory bodies, and technology providers to streamline market access and ensure affordability and accessibility of fundus camera solutions.

Opportunities:

Despite the challenges, the Fundus Cameras Market presents significant opportunities for growth and innovation. Technological advancements, including the miniaturization of imaging devices, the development of handheld and portable fundus cameras, and the integration of telemedicine capabilities, expand the market’s reach and accessibility. These innovations enable healthcare providers to perform retinal screening and diagnosis in diverse settings, including primary care clinics, mobile health units, and remote rural areas.

Furthermore, partnerships and collaborations between healthcare organizations, technology providers, and government agencies facilitate the implementation of teleophthalmology programs and population-based screening initiatives, driving market growth. Additionally, the growing focus on personalized medicine and precision healthcare creates opportunities for the development of advanced imaging modalities tailored to individual patient needs, enhancing diagnostic accuracy and treatment outcomes. By leveraging these opportunities and addressing key challenges, stakeholders can unlock the full potential of the Fundus Cameras Market, improving access to quality eye care and reducing the burden of preventable blindness worldwide.

Read Also: Atrial Fibrillation Devices Market Size to Attain USD 37.84 Bn by 2033

Recent Developments

- In January 2024, a label-free coded aperture snapshot spectral imaging fundus camera was introduced.

- In October 2022, on World Sight Day, Samsung pledged to screen 150,000 individuals in India for eye diseases using its EYELIKE™ Fundus Camera as part of the Galaxy Upcycling Program in partnership with local hospitals.

- In May 2022, Visionix and Right MFG announced a long-term strategic partnership.

Fundus Cameras Market Companies

- Carl Zeiss Meditec, Inc.

- Kowa Company Ltd.

- Optomed Oy (Ltd.)

- Optovue, Incorporated

- CenterVue SpA

- NIDEK Co., Ltd.

- Topcon Medical Systems, Inc.

- Clarity Medical Systems, Inc.

- Canon, Inc.

Segments Covered in the Report

By Product

- Mydriatic Fundus Cameras

- Tabletop

- Handheld

- Non-mydriatic Fundus Cameras

- Tabletop

- Handheld

- Hybrid Fundus Cameras

- ROP Fundus Cameras

By End-use

- Hospitals

- Ophthalmology Clinics

- Ophthalmic & Optometrist Offices

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/