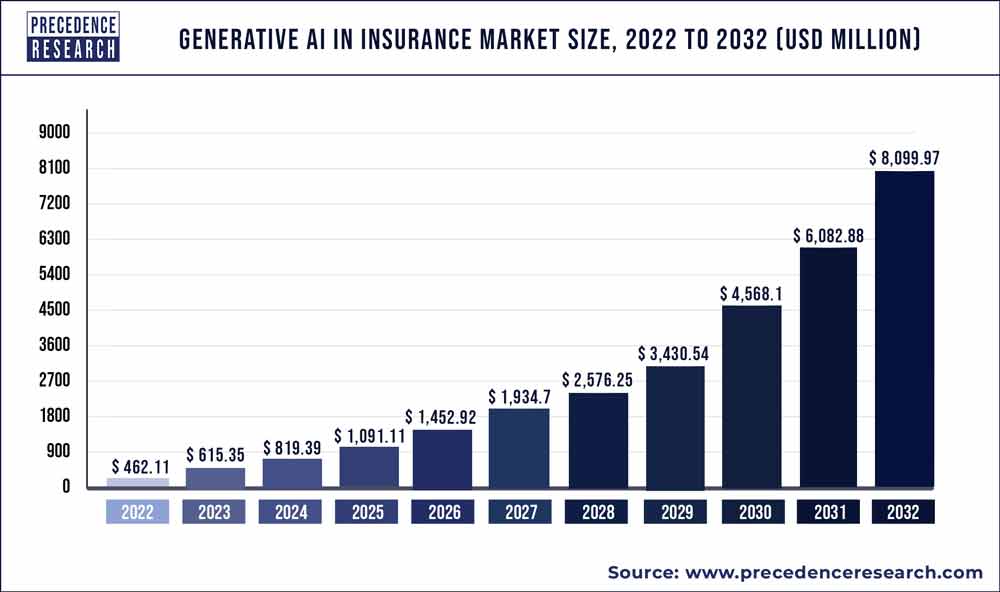

The global generative AI in insurance market size was estimated to be around US$ 462.11 million in 2022. It is projected to reach US$ 8,099.97 million by 2032, indicating a compound annual growth rate (CAGR) of 33.11% from 2023 to 2032.

Key Takeaways:

- North America dominated the market with the largest market share of 44% in 2022.

- Asia Pacific is expected to expand at the fastest CAGR from 2023 to 2032.

- By deployment, the cloud segment is expected to hold the largest share of the market during the forecast period.

- By technology, the machine learning segment dominated the market with the highest market share in 2022.

- The natural language processing segment is expected to grow at a significant rate during the predicted timeframe.

- By application, fraud detection and credit analysis segment dominated the market with the largest market share in 2022.

The market research report on the Generative AI in insurance market provides a comprehensive analysis of various key aspects. It includes the definition, classification, and application of Generative AI in insurance products. The report examines the development trends, competitive landscape, and industrial chain structure within the industry. Furthermore, it presents an overview of the industry, analyzes national policies and planning, and offers insights into the latest market dynamics and opportunities at a global level.

Get a Sample: https://www.precedenceresearch.com/sample/3115

Generative AI in Insurance Market Report Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 615.35 Million |

| Market Size by 2032 | USD 8,099.97 Million |

| Growth Rate from 2023 to 2032 | CAGR of 33.11% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Deployment, By Technology, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Generative AI in Telecom Market Size to Garner USD 4,883.78 Million by 2032

The report presents the volume and value-based market size for the base year 2022 and forecasts the market’s growth between 2023 and 2032. It estimates market numbers based on product form and application, providing size and forecast for each application segment in both global and regional markets.

Focusing on the global Generative AI in insurance market, the report highlights its status, future forecasts, growth opportunities, key market players, and key market regions such as the United States, Europe, and China. The study aims to present the development of the Generative AI in insurance market by considering factors like Year-on-Year (Y-o-Y) growth, in addition to Compound Annual Growth Rate (CAGR). This approach enables a better understanding of market certainty and the identification of lucrative opportunities.

Regarding production, the report investigates the capacity, production, value, ex-factory price, growth rate, and market share of major manufacturers, regions, and product types. On the consumption side, the report focuses on the regional consumption of Generative AI in insurance products across different countries and applications.

Buyers of the report gain access to verified market figures, including global market size in terms of revenue and volume. The report provides reliable estimations and calculations for global revenue and volume by product type from 2023 to 2032. It also includes accurate figures for production capacity and production by region during the same period.

The research includes product parameters, production processes, cost structures, and data classified by region, technology, and application. Furthermore, it conducts SWOT analysis and investment feasibility studies for new projects.

This in-depth research report offers valuable insights into the Generative AI in insurance market. It employs an objective and fair approach to analyze industry trends, supporting customer competition analysis, development planning, and investment decision-making. The project received support and assistance from technicians and marketing personnel across various links in the industry chain.

The competitive landscape section of the report provides detailed information on Generative AI in insurance market competitors. It includes company overviews, financials, revenue generation, market potential, research and development investments, new market initiatives, global presence, production sites, production capacities, strengths and weaknesses, product launches, product range, and application dominance. However, the data points provided only focus on the companies’ activities related to the Generative AI in insurance market.

Prominent players in the market are expected to face tough competition from new entrants. Key players are targeting acquisitions of startup companies to maintain their dominance. The report

Reasons to Purchase this Report:

- Comprehensive market segmentation analysis incorporating qualitative and quantitative research, considering the impact of economic and policy factors.

- In-depth regional and country-level analysis, examining the demand and supply dynamics that influence market growth.

- Market size in USD million and volume in million units provided for each segment and sub-segment.

- Detailed competitive landscape, including market share of major players, recent projects, and strategies implemented over the past five years.

- Comprehensive company profiles encompassing product offerings, key financial information, recent developments, SWOT analysis, and employed strategies by major market players.

Key Players

- Microsoft Corporation

- Amazon Web Services Inc.

- IBM Corporation

- Avaamo Inc

- Cape Analytics LLC

- MetLife

- Prudential Financial

- Wipro Limited

- ZhongAn

- Acko General Insurance

Generative AI in Insurance Market Segmentations

By Deployment

- Cloud-based

- On-premise

By Technology

- Machine Learning

- Natural Language Processing

By Application

- Fraud Detection and Credit Analysis

- Customer Profiling and Segmentation

- Product and Policy Design

- Underwriting and Claims Assessment

- Chatbots

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Generative AI in Insurance Market

5.1. COVID-19 Landscape: Generative AI in Insurance Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Generative AI in Insurance Market, By Deployment

8.1. Generative AI in Insurance Market, by Deployment, 2023-2032

8.1.1 Cloud-based

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. On-premise

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Generative AI in Insurance Market, By Technology

9.1. Generative AI in Insurance Market, by Technology, 2023-2032

9.1.1. Machine Learning

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Natural Language Processing

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Generative AI in Insurance Market, By Application

10.1. Generative AI in Insurance Market, by Application, 2023-2032

10.1.1. Fraud Detection and Credit Analysis

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Customer Profiling and Segmentation

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Product and Policy Design

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Underwriting and Claims Assessment

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Chatbots

10.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Generative AI in Insurance Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.1.2. Market Revenue and Forecast, by Technology (2020-2032)

11.1.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.2.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.3.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Deployment (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. Microsoft Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Amazon Web Services Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. IBM Corporation

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Avaamo Inc

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cape Analytics LLC

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. MetLife

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Prudential Financial

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Wipro Limited

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. ZhongAn

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Acko General Insurance

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com