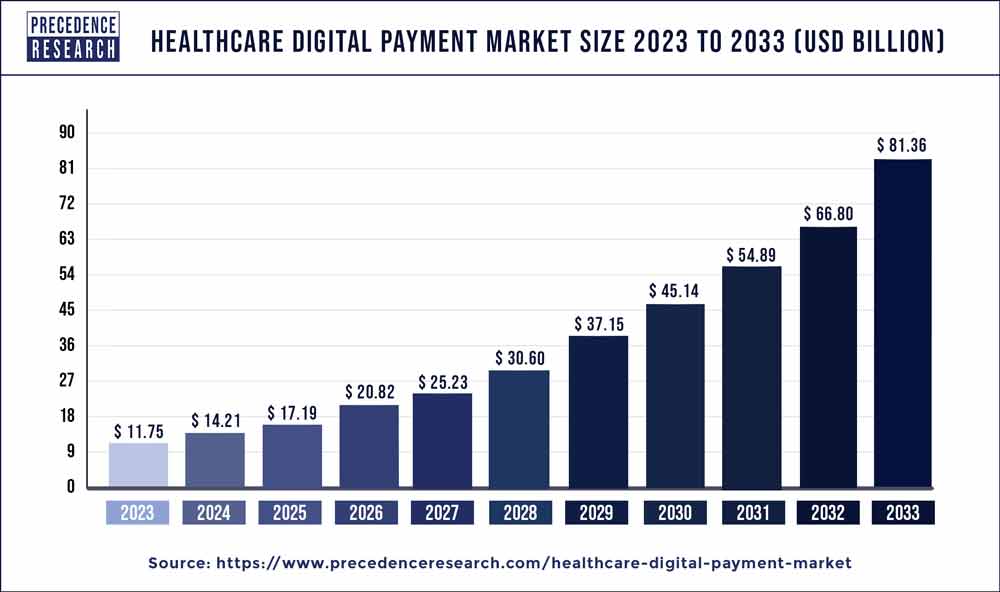

The global healthcare digital payment market size reached USD 11.75 billion in 2023 and is projected to hit around USD 81.36 billion by 2033, significant at a CAGR of 21.40% from 2024 to 2033.

Key Takeaways

- North America contributed 40% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By solution, the payment processing segment has held the largest market share of 23% in 2023.

- By solution, the payment gateway segment is anticipated to grow at a remarkable CAGR of 23.5% between 2024 and 2033.

- By deployment, the cloud segment generated over 53% of the market share in 2023.

- By deployment, the on-premise segment is expected to expand at the fastest CAGR over the projected period.

- By mode of payment, the bank cards segment generated over 34% of the market share in 2023.

- By mode of payment, the digital wallet segment is expected to expand at the fastest CAGR over the projected period.

The healthcare digital payment market has experienced significant growth in recent years, driven by the increasing adoption of digital payment solutions across the healthcare sector. As healthcare organizations strive to streamline their payment processes and improve efficiency, the demand for digital payment platforms has surged. These platforms offer a range of benefits, including faster payment processing, enhanced security, and greater convenience for both healthcare providers and patients.

Get a Sample: https://www.precedenceresearch.com/sample/3718

Several key growth factors have contributed to the expansion of the healthcare digital payment market. One primary factor is the growing emphasis on cost containment and revenue cycle management within the healthcare industry. Digital payment solutions enable healthcare providers to reduce administrative costs associated with traditional paper-based billing and payment methods. Additionally, the shift towards value-based care models has incentivized healthcare organizations to invest in technologies that improve operational efficiency and patient engagement, further driving the adoption of digital payment platforms.

Healthcare Digital Payment Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 21.40% |

| Global Market Size in 2023 | USD 11.75 Billion |

| Global Market Size by 2033 | USD 81.36 Billion |

| U.S. Market Size in 2023 | USD 3.29 Billion |

| U.S. Market Size by 2033 | USD 23.16 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Solution, By Deployment, and By Mode of Payment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: U.S. In Vitro Diagnostics Market Size to Cross USD 41.62 Bn By 2033

Opportunities

The healthcare digital payment market presents numerous opportunities for innovation and expansion. One such opportunity lies in the integration of digital payment solutions with electronic health record (EHR) systems and other healthcare IT platforms. By seamlessly integrating payment functionality into existing healthcare workflows, providers can streamline the payment process and enhance the overall patient experience. Furthermore, the proliferation of mobile technology presents opportunities to develop user-friendly payment apps that empower patients to manage their healthcare finances more effectively.

Challenges

Despite its growth potential, the healthcare digital payment market also faces several challenges. One significant challenge is ensuring compliance with regulatory requirements, particularly concerning patient privacy and data security. Healthcare organizations must navigate complex regulatory frameworks, such as the Health Insurance Portability and Accountability Act (HIPAA), to ensure the secure handling of sensitive patient information in digital payment transactions. Additionally, resistance to change among healthcare providers and patients may pose challenges to widespread adoption of digital payment solutions, highlighting the importance of education and training initiatives to promote acceptance and usage.

Reasons to Purchase this Report:

- Comprehensive market segmentation analysis incorporating qualitative and quantitative research, considering the impact of economic and policy factors.

- In-depth regional and country-level analysis, examining the demand and supply dynamics that influence market growth.

- Market size in USD million and volume in million units provided for each segment and sub-segment.

- Detailed competitive landscape, including market share of major players, recent projects, and strategies implemented over the past five years.

- Comprehensive company profiles encompassing product offerings, key financial information, recent developments, SWOT analysis, and employed strategies by major market players.

Healthcare Digital Payment Market Companies

- JPMorgan Chase & Co.

- InstaMed

- Zelis

- Rectangle Health

- PayPal Holdings, Inc.

- KKR (Kohlberg Kravis Roberts & Co.)

- HDFC Bank

- Crunchfish

- Mastercard

- Arab African International Bank (AAIB)

- Visa Inc.

- Cerner Corporation

- Fiserv, Inc.

- Allscripts Healthcare Solutions, Inc.

- Optum, Inc.

Segments Covered in the Report

By Solution

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security & Fraud Management

- Transaction Risk Management

- Others

By Deployment

- Cloud

- On-premise

By Mode of Payment

- Bank Cards

- Digital Wallets

- Net Banking

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Healthcare Digital Payment Market

5.1. COVID-19 Landscape: Healthcare Digital Payment Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Healthcare Digital Payment Market, By Solution

8.1. Healthcare Digital Payment Market, by Solution, 2024-2033

8.1.1 Application Program Interface

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Payment Gateway

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Payment Processing

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Payment Security & Fraud Management

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Transaction Risk Management

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Healthcare Digital Payment Market, By Deployment

9.1. Healthcare Digital Payment Market, by Deployment, 2024-2033

9.1.1. Cloud

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. On-premise

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Healthcare Digital Payment Market, By Mode of Payment

10.1. Healthcare Digital Payment Market, by Mode of Payment, 2024-2033

10.1.1. Bank Cards

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Digital Wallets

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Net Banking

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

hapter 11. Global Healthcare Digital Payment Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

Chapter 12. Company Profiles

12.1. JPMorgan Chase & Co.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. InstaMed

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Zelis

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Rectangle Health

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. PayPal Holdings, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. KKR (Kohlberg Kravis Roberts & Co.)

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. HDFC Bank

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Crunchfish

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Mastercard

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Arab African International Bank (AAIB)

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/