Table of Contents

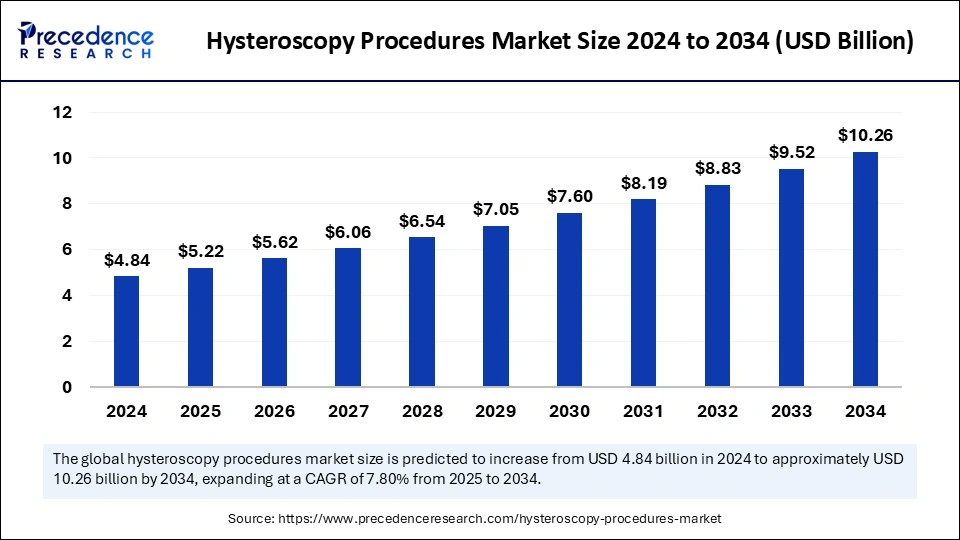

The global hysteroscopy procedures market size was valued at USD 4.84 billion in 2024 and is expected to reach around 10.26 billion by 2034, growing at a CAGR of 7.80% from 2025 to 2034.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/5731

Hysteroscopy Procedures Market Key Highlights

-

North America held the largest share of 39% in the hysteroscopy procedures market in 2024.

-

Asia Pacific is projected to grow at a CAGR of 8.5% over the forecast period.

-

By CPT codes, the 58558 CPT code segment led the market with a 36% share in 2024.

-

The 58562 CPT code segment is expected to experience significant growth in the coming years.

-

By end-use, hospitals accounted for the largest market share of 53% in 2024.

-

The ambulatory surgery centers segment is predicted to expand considerably during the forecast period.

Hysteroscopy Procedures: An Overview

What is Hysteroscopy?

Hysteroscopy is a minimally invasive procedure used to examine and treat conditions inside the uterus. It involves the use of a hysteroscope, a thin, lighted tube inserted through the cervix to provide a clear view of the uterine cavity. This procedure is commonly performed for both diagnostic and operative purposes.

Types of Hysteroscopy

-

Diagnostic Hysteroscopy

-

Used to diagnose uterine conditions such as abnormal bleeding, fibroids, polyps, and adhesions.

-

Often performed in an outpatient setting without anesthesia.

-

May be used in conjunction with other procedures like a biopsy or dilation and curettage (D&C).

-

-

Operative Hysteroscopy

-

Used to treat uterine abnormalities, such as removing fibroids, polyps, and adhesions or correcting uterine septum.

-

Special surgical instruments are inserted through the hysteroscope for precise treatment.

-

Often performed under local, regional, or general anesthesia.

-

Common Applications of Hysteroscopy

-

Investigation of abnormal uterine bleeding.

-

Diagnosis and removal of uterine fibroids and polyps.

-

Treatment of uterine septum, adhesions (Asherman’s Syndrome), or endometrial abnormalities.

-

Removal of retained products of conception after miscarriage or abortion.

-

Fertility evaluations and assisted reproductive technology procedures.

Advantages of Hysteroscopy

-

Minimally invasive: No incisions are required, leading to a quicker recovery.

-

Shorter hospital stay: Many procedures can be done in outpatient settings.

-

Lower risk of complications: Compared to open or laparoscopic surgeries.

-

Faster recovery time: Patients can often return to normal activities within a few days.

Risks and Complications

Although hysteroscopy is generally safe, potential risks include:

-

Uterine perforation (rare but possible).

-

Infection or bleeding.

-

Fluid overload due to excessive absorption of distension media.

-

Cramping or mild pain post-procedure.

Market Insights for Hysteroscopy Procedures

-

Increasing demand: Growing prevalence of gynecological disorders and advancements in hysteroscopic techniques are driving market growth.

-

Technological advancements: The introduction of 3D hysteroscopic visualization and AI-assisted diagnostics is improving procedural efficiency.

-

Rising awareness: Increased awareness about minimally invasive procedures is boosting adoption rates globally.

-

Regional trends: North America and Europe dominate the market, while Asia Pacific is expected to witness rapid growth due to improved healthcare infrastructure.

Role of AI in the Hysteroscopy Procedures Market

1. AI-Powered Diagnostic Accuracy

AI enhances diagnostic hysteroscopy by analyzing images and videos captured during the procedure. Machine learning algorithms assist in detecting uterine abnormalities such as fibroids, polyps, and endometrial hyperplasia with higher precision, reducing the chances of misdiagnosis.

2. Automated Image Analysis

AI-driven image recognition software can automatically analyze hysteroscopic images, highlight abnormalities, and assist gynecologists in identifying potential concerns faster. This reduces manual workload and enhances early detection of uterine conditions.

3. Predictive Analytics for Personalized Treatment

AI helps in predicting patient outcomes by analyzing medical history, previous procedures, and real-time hysteroscopic findings. This enables doctors to provide personalized treatment plans, improving overall patient care and reducing complications.

4. AI-Assisted Robotic Hysteroscopy

AI-powered robotic-assisted hysteroscopy enhances precision in complex procedures. Robotics combined with AI ensures steady movements, minimizes human error, and enables minimally invasive treatments with higher accuracy.

5. AI in Training and Simulation

AI-driven virtual reality (VR) and augmented reality (AR) training programs allow medical professionals to practice hysteroscopic procedures in a risk-free environment. AI-powered simulations help enhance surgical skills and decision-making.

6. Workflow Optimization and Automation

AI optimizes scheduling, documentation, and patient monitoring in hysteroscopy procedures. Automated workflow management systems improve efficiency in hospitals and ambulatory surgery centers, reducing waiting times and enhancing patient experience.

7. AI for Post-Procedure Monitoring and Follow-ups

AI-powered applications and chatbots provide continuous monitoring after hysteroscopy procedures. They assist in tracking patient symptoms, provide reminders for follow-ups, and alert doctors about potential complications.

8. Enhanced Data Integration and AI-Driven Insights

AI integrates hysteroscopic findings with electronic health records (EHRs) to provide comprehensive insights for better decision-making. AI-driven analytics can identify trends, helping in research and improving clinical protocols.

Future Impact of AI in Hysteroscopy Procedures Market

AI is expected to play a significant role in the future of hysteroscopy by enhancing early disease detection, improving surgical outcomes, and making procedures more accessible. As AI technology advances, the market is set to witness increased efficiency, reduced costs, and better patient care in gynecological procedures.

Hysteroscopy Procedures Market Overview

The hysteroscopy procedures market is witnessing steady expansion as the demand for minimally invasive gynecological surgeries grows. Hysteroscopy is widely used for diagnosing and treating uterine abnormalities, including endometrial polyps, adhesions, and fibroids. The increasing adoption of office-based hysteroscopy and the emergence of AI-powered diagnostic tools are transforming the industry. The shift toward outpatient procedures and advancements in hysteroscopic devices are key factors driving market growth.

Also Read: Automated Microbiology Market

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.26 Billion |

| Market Size in 2025 | USD 5.22 Billion |

| Market Size in 2024 | USD 4.84 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.80% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | CPT Codes, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

A rise in gynecological disorders and increasing awareness of early diagnosis are major drivers of the market. The trend toward minimally invasive procedures is encouraging the adoption of hysteroscopy over traditional surgical methods. Technological innovations, such as high-definition hysteroscopic cameras and AI-assisted image analysis, are improving the accuracy of diagnoses and treatments. The growing number of fertility clinics and assisted reproductive technology (ART) centers is further driving the market.

Market Opportunities

The market holds promising opportunities in the integration of robotic-assisted hysteroscopy and AI-driven diagnostic solutions. The expansion of hysteroscopy into outpatient settings and ambulatory surgical centers is increasing patient accessibility. Additionally, developing nations with improving healthcare infrastructure present a lucrative market for hysteroscopic device manufacturers. Investments in research and development for advanced hysteroscopy tools, such as flexible and single-use hysteroscopes, offer new growth prospects.

Market Challenges

Challenges in the market include the high costs of advanced hysteroscopic equipment and procedures, which can limit adoption in cost-sensitive regions. The need for highly skilled professionals to perform hysteroscopic procedures also poses a hurdle. Additionally, the potential risks of complications, such as uterine perforation and infections, create concerns among patients and healthcare providers.

Regional Insights

North America leads the market due to well-established healthcare systems, increased spending on women’s health, and widespread adoption of advanced medical technologies. Europe follows closely with strong government support for healthcare advancements and favorable reimbursement scenarios. The Asia-Pacific region is emerging as a key growth market, driven by increasing healthcare investments, rising awareness of gynecological health, and improving medical infrastructure. Latin America and the Middle East & Africa are witnessing gradual adoption, supported by efforts to enhance women’s healthcare services.

Hysteroscopy Procedures Market Companies

- Medtronic

- Stryker Corp.

- Hologic, Inc.

- KARL STORZ SE and Co. KG

- Medical Devices Business Services, Inc. (Ethicon, Inc.)

- Olympus Corp.

- Delmont Imaging

- B. Braun Melsungen AG

- Richard Wolf GmbH

- CooperCompanies

- Maxer Endoscopy GmbH

- Boston Scientific Corp.

- MedGyn Products, Inc.

- Lina Medical APS

- Luminelle

Recent Developments

- In April 2024, Nambour General Hospital unveiled its Outpatient Hysteroscopy Service, which provides hysteroscopies under local anesthetic in 1-2 hours duration, leading to reduced hospital stays from 6-14 hours previously and improved patient quality.

- In July 2023, GenWorks presented its mechanical hysteroscopic tissue removal system. This system employs a simple mechanical technique to remove intrauterine tissues.

- In May 2023, Olympus Corporation obtained FDA clearance for their EVIS X1 endoscopy system that they released with two matching gastrointestinal endoscopes as part of their innovative medical technology portfolio.

Segments Covered in the Report

By CPT Codes

- 58555

- 58558

- 58562

- 58340

- 58563

- 58565

- 58353

- 58561,74740

- Others

By End Use

- Hospitals

- Clinics

- Ambulatory Surgery Centers

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/