Table of Contents

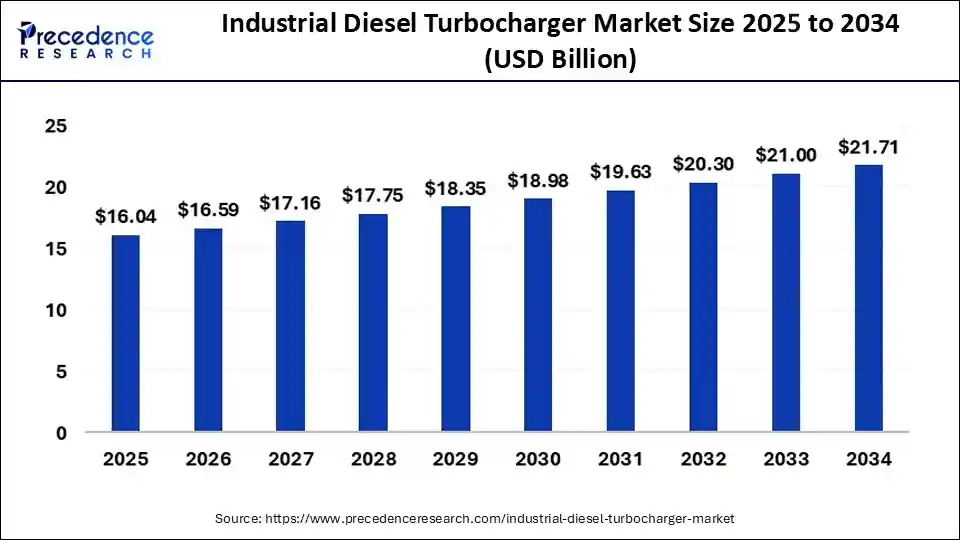

The global industrial diesel turbocharger market size was estimated at USD 15.51 billion in 2024 and is expected to achieve around USD 21.71 billion by 2034, growing at a CAGR of 3.42%.

Get Sample Copy of Report@https://www.precedenceresearch.com/sample/5717

Key Insights

- Asia Pacific held the largest share in the industrial diesel turbocharger market at 40% in 2024.

- North America is forecasted to experience robust growth during the upcoming years.

- Diesel engines led the global market in the engine type category in 2024.

- The internal combustion engine segment is expected to expand at a rapid pace.

- The OEM sales segment had the largest market share in 2024.

- Direct sales are projected to grow at the highest rate over the study period.

- Compressors dominated the market in the component type category in 2024.

- The turbine segment is anticipated to show strong growth over the coming years.

- The power generation sector emerged as the leading application segment in 2024.

- The marine application segment is expected to witness substantial expansion over the forecast period.

Industrial Diesel Turbocharger Market Growth Factors

Increasing Demand for Fuel Efficiency

As industries seek to improve energy efficiency and reduce operational costs, diesel turbochargers play a crucial role in enhancing engine performance by maximizing fuel combustion and reducing fuel consumption.

Rising Industrialization and Infrastructure Development

Rapid industrialization, particularly in emerging economies, has led to increased demand for heavy machinery and power generation equipment, boosting the need for diesel turbochargers in various industrial applications.

Expansion of the Automotive and Marine Sectors

The growing adoption of diesel engines in heavy-duty vehicles, ships, and marine vessels drives the demand for industrial turbochargers, improving engine efficiency and reducing emissions.

Stringent Emission Regulations

Governments and environmental agencies worldwide have implemented strict emission norms, compelling manufacturers to adopt advanced turbocharging technologies to reduce carbon footprints while maintaining engine performance.

Advancements in Turbocharger Technology

Continuous innovations in materials, aerodynamics, and electronic turbocharging solutions are improving the efficiency, durability, and performance of industrial diesel turbochargers, making them more attractive for end users.

Rising Adoption in Power Generation

Turbochargers are increasingly used in diesel-powered generators and backup power systems to enhance power output and efficiency, particularly in regions with unreliable electricity grids.

Growth in Renewable Energy Integration

As industries shift toward hybrid power solutions, diesel turbochargers are being integrated with renewable energy sources to create more efficient and reliable power generation systems.

Increasing Demand for High-Performance Engines

The need for high-power and compact engines in industrial applications, including construction, mining, and agriculture, is fueling the demand for advanced turbocharging systems.

Expansion of Aftermarket Services

With a growing number of diesel engines in operation, the aftermarket sector for turbocharger maintenance, repair, and replacement parts is expanding, contributing to market growth.

Growing Investments in Smart and Connected Turbochargers

The integration of IoT and AI in turbocharger systems allows for real-time monitoring, predictive maintenance, and optimized engine performance, driving adoption in industrial applications.

Market Overview

Industrial turbochargers are vital for enhancing engine performance and efficiency. They play a key role in meeting strict environmental regulations and addressing the growing demand for fuel-efficient diesel engines across various industries. Market leaders are focusing on developing intelligent solutions that optimize turbocharger performance, improve efficiency, and facilitate predictive maintenance.

Also Read: Off-Highway Electric Vehicle Market

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 21.71 Billion |

| Market Size in 2025 | USD 16.04 Billion |

| Market Size in 2024 | USD 15.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.42% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Engine Type, Component Type, application, Sales Channel and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

A key driver for the market is the rising need for fuel-efficient and high-performance diesel engines in industrial applications. Stricter government regulations on emissions are also pushing industries to adopt turbocharged engines to meet environmental standards. Additionally, the expansion of the construction and transportation sectors, particularly in developing economies, is fueling demand for high-efficiency diesel engines equipped with turbochargers.

Market Opportunities

There are growing opportunities in the development of advanced turbocharger technologies, such as variable geometry turbochargers (VGT) and electric turbochargers, which enhance fuel efficiency and performance. The increasing focus on renewable energy integration in industrial applications is also creating new avenues for turbocharger manufacturers to develop hybrid solutions. Emerging markets in Asia and Latin America present lucrative opportunities due to industrialization and infrastructure development.

Market Challenges

Despite growth, challenges such as high manufacturing costs and complex integration processes hinder widespread adoption. Fluctuating raw material prices and supply chain disruptions also pose risks to market stability. Additionally, the transition toward alternative power sources like electric and hydrogen-based engines could impact the long-term demand for diesel turbochargers.

Regional Outlook

Asia Pacific leads the market, driven by rapid industrialization and increasing investments in heavy industries in China, India, and Japan. North America is expected to witness steady growth due to advancements in emission-reduction technologies and the strong presence of key manufacturers. Meanwhile, Europe is focusing on sustainable solutions, driving research and development in turbocharging technologies to improve efficiency and meet strict environmental standards.

Industrial Diesel Turbocharger Market Companies

- Cummins

- Turbo Energy

- KTT

- Kangyue

- BorgWarner

- K turbocharger

- Weichai Power

- Mitsubishi Heavy Industries

- IHI Corporation

- MHI Turbocharger

- Honeywell

- General Electric

Latest Announcement by Market Leaders

- In March 2025, COLUMBUS, Ind. global power and technology leader Cummins Inc. announced an update to the legendary B-Series engine platform, unveiling the new Cummins B7.2 diesel engine at NTEA Work Truck Week in Indianapolis, IN.”The B7.2 brings the latest technology and advancements to one of our most proven platforms.

- In October 2024, Engine manufacturer General Electric announced that its LM2500 marine engines had been chosen to power the Indian Navy’s Next Generation Missile Vessels (NGMV) being built by Cochin Shipyard Limited. Additionally, GE Aerospace will be supplying its composite base and enclosure, and full complement of gas turbine auxiliary systems, GE said in a statement.

Recent Developments

- In September 2024, A Cummins-powered Ram had on display a 2700 HP triple-turbo setup in a high-performance demo accompanied by a slow explosion that underlined the immense capabilities of industrial diesel turbochargers. It gave credence to the awesome capacity and efficiency of today’s turbocharging systems- much more so for that designed by Cummins.

- In May 2023, Mitsubishi Heavy Industries (MHI) introduced MGS3100R, a turbocharger for high efficiency in the diesel engine. It marked a monumental technological advancement in turbochargers in increasing fuel efficiency and further cutting industrial emission levels.

In February 2023, BorgWarner announced the acquisition of Delphi Technologies’ turbocharger business. The acquisition will strengthen BorgWarner’s position in the global turbocharger market and expand its product portfolio.

Segments Covered in the Report

By Engine Type

- Internal Combustion Engine

- Diesel Engine

- Natural Gas Engine

- Dual Fuel Engine

- Heavy Fuel Engine

By Component Type

- Bearing Systems

- Compressor

- Turbine

- Wastegate

- Actuators

By Application

- Marine

- Power Generation

- Construction Equipment

- Mining

- Agricultural Equipment

By Sales Channel

- Direct Sales

- Distributor Sales

- Online Sales

- OEM Sales

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/