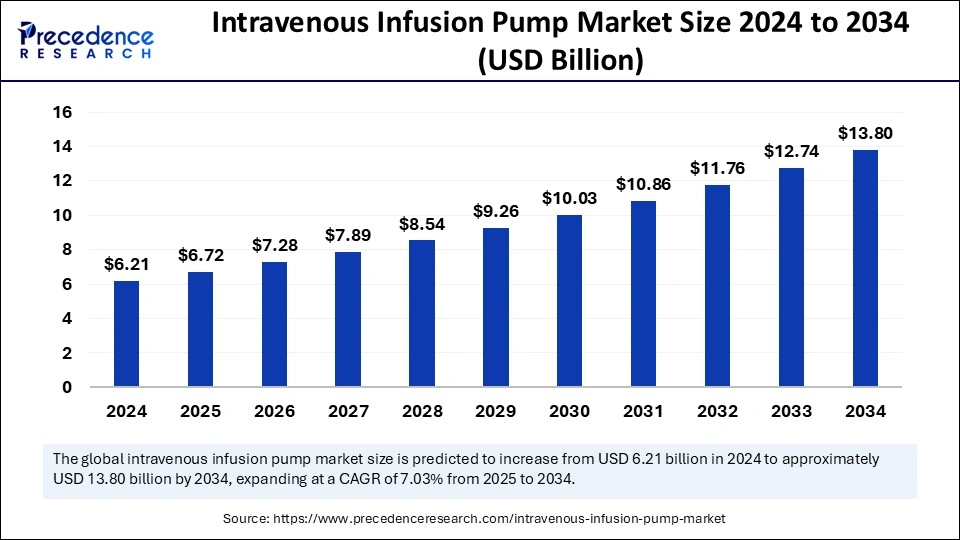

The global intravenous infusion pump market size is estimated to reach around USD 13.80 billion by 2034 increasing from USD 6.21 billion in 2024, with a CAGR of 7.03%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5820

Intravenous Infusion Pump Market Key Points

-

North America held the largest share of the global market in 2024, accounting for 50%.

-

The Asia Pacific region is set to experience the fastest growth, with a CAGR of 8.84% from 2025 to 2034.

-

Europe has been steadily gaining momentum in recent years.

-

In 2024, the volumetric infusion pump segment dominated the market with a 19% share.

-

The ambulatory infusion pump segment is expected to see significant growth in the coming years.

-

Pediatrics/neonatology had the largest market share of 27% in 2024 by disease indication.

-

Chemotherapy is projected to grow notably over the forecast period.

-

The hospitals segment led the market in 2024 by end-use.

-

Homecare settings are expected to grow at a significant rate between 2025 and 2034.

AI Revolutionizing the Intravenous Infusion Pump Market: Enhancing Safety, Efficiency, and Personalization

AI is transforming the Intravenous (IV) Infusion Pump Market by significantly improving safety, efficiency, and personalization in patient care. AI-powered pumps can detect anomalies in infusion rates, adjust settings automatically based on real-time patient data, and predict potential issues like blockages, reducing human error and enhancing patient safety.

These smart systems streamline workflows by automating tasks such as programming infusion rates and enabling remote monitoring, making it easier for healthcare providers to manage multiple patients efficiently, especially in telemedicine and homecare settings. Additionally, AI’s ability to optimize infusion protocols based on individual patient data allows for more personalized treatment and better outcomes.

Moreover, AI contributes to predictive maintenance, helping healthcare facilities avoid downtime by predicting when pumps need servicing. While AI-driven infusion pumps may have higher initial costs, they ultimately lead to cost savings by reducing errors, minimizing manual intervention, and improving patient outcomes. AI also helps healthcare providers comply with regulatory standards by automating documentation and providing valuable data insights.

As AI technology continues to evolve, its role in the IV infusion pump market is expected to grow, driving further advancements in smart healthcare systems and leading to more autonomous, efficient, and cost-effective patient care.

Intravenous Infusion Pump Market Growth Factors

1. Rising Prevalence of Chronic Diseases

The growing prevalence of chronic diseases such as cancer, diabetes, cardiovascular disorders, and kidney diseases is a significant driver for the IV infusion pump market. These conditions often require regular administration of intravenous medications, fluids, or nutrition, increasing the demand for efficient, accurate, and reliable infusion pumps.

2. Aging Population

The global aging population is another crucial factor contributing to market growth. As people age, they are more prone to conditions that require continuous intravenous therapy. Older patients often require complex infusion treatments, and this demographic trend is fueling the demand for infusion pumps in hospitals and homecare settings.

3. Technological Advancements

Continuous innovations in IV infusion pump technology, such as the integration of AI, smart sensors, and wireless connectivity, are driving market growth. These advancements improve the functionality, safety, and ease of use of infusion pumps, making them more attractive to healthcare providers. AI-driven pumps that optimize infusion rates based on real-time patient data are becoming increasingly popular.

4. Increasing Surgical Procedures

As the number of surgical procedures worldwide rises, the need for accurate and controlled drug delivery systems is also growing. Infusion pumps are integral during and after surgeries for pain management, anesthesia administration, and fluid balance, boosting their demand in operating rooms and recovery units.

5. Homecare and Ambulatory Infusion Therapies

The growing trend toward homecare and ambulatory infusion therapies is another factor driving market growth. Patients receiving treatments like chemotherapy, parenteral nutrition, and pain management at home require portable and user-friendly infusion pumps. The demand for homecare infusion pumps is increasing due to the convenience, reduced hospital visits, and lower healthcare costs associated with home treatment.

6. Focus on Patient Safety

The increasing emphasis on patient safety in healthcare environments is driving the demand for infusion pumps. Smart infusion pumps with features such as dose error reduction, alarms, and precise flow control are in high demand, as they help minimize the risk of medication errors and adverse events.

7. Growing Healthcare Infrastructure in Emerging Markets

Emerging economies, particularly in Asia Pacific and Latin America, are investing heavily in healthcare infrastructure. As healthcare systems in these regions improve and expand, there is an increasing need for advanced medical equipment like IV infusion pumps to meet the growing demand for intravenous therapies in hospitals, clinics, and outpatient settings.

8. Regulatory Support and Reimbursement Policies

Governments and regulatory bodies are increasingly implementing supportive reimbursement policies and regulations that facilitate the adoption of advanced medical technologies, including infusion pumps. This is especially evident in developed markets where insurance coverage for infusion pump therapies is improving, encouraging the widespread use of these devices.

9. Rising Demand for Precision Medicine

The trend toward precision medicine, where treatment is tailored based on individual patient needs, is pushing the demand for advanced infusion pumps that can deliver customized drug dosages and therapies with high accuracy. This is especially relevant in oncology, pediatrics, and pain management, where precise medication administration is critical.

10. Increased Awareness of Infusion Pump Benefits

Growing awareness among healthcare professionals and patients about the benefits of infusion pumps—such as their ability to provide controlled and consistent medication delivery—has further fueled the adoption of these devices. Educational campaigns and training programs have also contributed to a better understanding of infusion pump technology in both clinical and homecare settings.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.80 Billion |

| Market Size in 2025 | USD 6.72 Billion |

| Market Size in 2024 | USD 6.21 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.03% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Disease Indication and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The primary drivers for the IV infusion pump market include the growing prevalence of chronic diseases, which requires frequent administration of medications via intravenous routes. The aging population is also a significant factor, as elderly patients often require ongoing medical treatment, including infusion therapies. Furthermore, the rapid advancements in technology, including the introduction of smart infusion pumps with AI capabilities and real-time monitoring, have bolstered market growth by improving patient safety and treatment accuracy.

Opportunities

The market holds promising opportunities, especially in the expanding homecare and ambulatory care settings, where more patients are receiving treatments outside traditional healthcare facilities. The growing adoption of portable and user-friendly infusion pumps is creating new avenues for growth. Emerging economies in regions like Asia Pacific are also witnessing a surge in demand for advanced infusion pumps, presenting a significant opportunity for manufacturers. Additionally, innovations like wireless infusion pumps and predictive analytics for maintenance are expected to shape the future of the market.

Challenges

One of the challenges facing the intravenous infusion pump market is the high cost of advanced systems, which could be prohibitive for healthcare providers in emerging markets. Moreover, there are safety concerns related to device malfunction and product recalls, which can undermine trust in these devices. Regulatory hurdles, along with the complexity of integrating new technologies into existing healthcare systems, pose additional challenges. The lack of trained healthcare professionals to manage advanced infusion pumps can also hinder market adoption.

Regional Insights

North America leads the market due to the presence of well-established healthcare systems, high demand for infusion therapies, and continuous technological advancements. Europe follows with a significant share, driven by the aging population and robust healthcare infrastructure. The Asia Pacific region is poised for the fastest growth, with increasing healthcare investments, rising awareness of advanced medical technologies, and a large population base, especially in countries like China and India.

Intravenous Infusion Pump Market Companies

- Arcomed

- B. Braun Melsungen AG

- Baxter

- BD

- Boston Scientific Corporation

- CODAN Companies

- Fresenius Kabi AG

- ICU Medical, Inc. (Smiths Medical)

- IRadimed Corporation

- Micrel Medical Devices SA

- Moog Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Terumo Corporation

Leaders Announcements

- On November 12, 2024, ICU Medical and Otsuka Pharmaceutical Factory announced a joint venture to enhance IV solutions manufacturing and innovation in North America, strengthening supply chain resilience and advancing medical device development.

- In January 2024, Lemer Pax, a global radiation protection leader, partnered with ICU Medical to distribute the Plum 360 infusion pump in France’s nuclear medicine sector, aiming to expand sales across the European market.

Recent Developments

- On January 31, 2025, UCB announced that the CHMP had issued a positive opinion for two new administration methods of RYSTIGGO® (rozanolixizumab) for generalized myasthenia gravis (gMG) in the EU. Patients can now self-administer the treatment via an infusion (syringe pump) or a manual push syringe after training from a healthcare professional.

Segments Covered in the Report

By Product Type

- Volumetric Infusion Pumps

- Insulin Infusion Pumps

- Syringe Infusion Pumps

- Enteral Infusion Pumps

- Ambulatory Infusion Pumps

- Patient Controlled Analgesia (PCA)

- Implantable Infusion Pumps

- Others

By Disease Indication

- Chemotherapy

- Diabetes

- Gastroenterology

- Analgesia/Pain Management

- Pediatrics/Neonatology

- Hematology

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Also Read: Surgical Sponge Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/